Find Help

More Items From Ergsy search

-

What should I do if I suspect an error in my Council Tax billing?

Relevance: 100%

-

Where can I get a copy of my Council Tax bill?

Relevance: 76%

-

Does overpayment affect my Council Tax band?

Relevance: 65%

-

Are refunds for overpaid Council Tax taxable?

Relevance: 63%

-

How do can I find out if I have overpaid my UK Council Tax?

Relevance: 62%

-

Can an inheritance tax bill be challenged or appealed?

Relevance: 55%

-

Is there a time limit for claiming a refund on overpaid Council Tax?

Relevance: 54%

-

Will my council send a refund check if I overpay?

Relevance: 53%

-

Citizens Advice Bureau Sees Spike in Queries Related to Council Tax Benefits

Relevance: 50%

-

Can I access my Council Tax payment history online?

Relevance: 50%

-

How does council tax relate to wealth in the UK?

Relevance: 49%

-

How do I pay my tax bill?

Relevance: 46%

-

How do I calculate my tax bill?

Relevance: 46%

-

How can I dispute a Council Tax charge?

Relevance: 44%

-

Is it possible to reduce the Inheritance Tax bill?

Relevance: 42%

-

How is the Inheritance Tax bill calculated?

Relevance: 42%

-

What if I can’t pay my tax bill on time?

Relevance: 42%

-

What should I do if I made an error on my CGT report?

Relevance: 41%

-

How do I know if I have overpaid my Council Tax?

Relevance: 39%

-

What should I do if my energy bill is unexpectedly high?

Relevance: 35%

-

Where can I get help in managing my household bills?

Relevance: 34%

-

What details are needed to check for overpayments through my council?

Relevance: 32%

-

Can seniors receive help with their energy bills?

Relevance: 32%

-

What should drivers do if there are errors in their digital license data?

Relevance: 31%

-

Local Councils Struggle with Increasing Demand for Welfare Support

Relevance: 31%

-

How does billing for live-in care work?

Relevance: 30%

-

What if I owe more than £30,000 in Self Assessment tax?

Relevance: 30%

-

Is my healthcare provider obligated to correct errors in my medical records?

Relevance: 30%

-

I received a tax refund letter, but I haven’t overpaid any tax. What should I do?

Relevance: 30%

-

What if I make a mistake on my tax return?

Relevance: 30%

-

What factors influence the rise and fall of energy bills in the UK?

Relevance: 30%

-

Can I amend my tax return after submitting it?

Relevance: 29%

-

I received a refund but think I owe tax instead. What should I do?

Relevance: 28%

-

My first Self Assessment tax return

Relevance: 28%

-

Are there government programs that help with utility bills?

Relevance: 28%

-

Can I file my taxes online if I'm self-employed?

Relevance: 28%

-

UK Government Announces New Energy Bill Support Amid Rising Costs

Relevance: 28%

-

Are there apps that help manage and reduce household bills?

Relevance: 27%

-

Can I amend an online tax return?

Relevance: 27%

-

Why are council burial fees going up nearly 50% in the UK?

Relevance: 27%

Understanding Your Council Tax Bill

Council Tax is a mandatory payment collected by local councils in the UK to fund local services such as education, waste management, and policing. Occasionally, discrepancies or errors can occur in your Council Tax bill, leading to overpayment or underpayment. Understanding your bill is the first step in identifying these errors.

Review Your Bill Carefully

Start by reviewing your Council Tax bill thoroughly. Check the property valuation band, the Council Tax reduction or exemption status, and ensure that all personal details are correct. Errors can sometimes occur due to incorrect property band allocation or incorrect application of discounts or exemptions.

Contact Your Local Council

If you identify a potential error, the next step is to contact your local council. Councils usually have dedicated customer service teams to handle billing inquiries. It's often helpful to provide them with all relevant details, including your account number and specific details about the suspected error. You can usually find contact information on the council's official website.

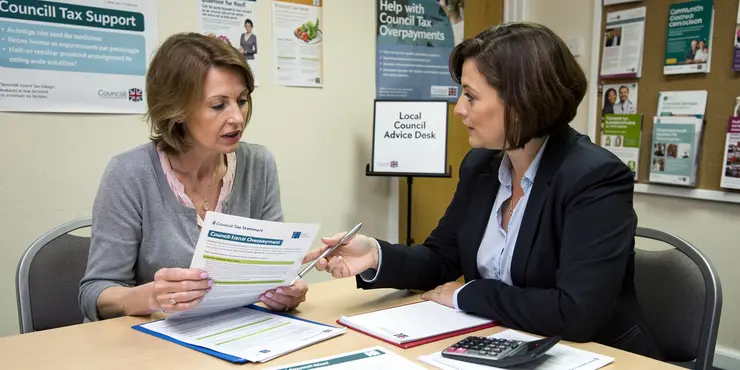

Submit a Formal Challenge

If an informal inquiry doesn’t resolve the issue, you might need to submit a formal challenge. This involves a written explanation of the perceived error and any supporting evidence. Councils have specific procedures for handling such challenges, and it's important to follow their guidelines closely. Keep copies of all correspondence for your records.

Understanding Council Tax Bands

Errors in property banding can lead to incorrect billing amounts. In England and Scotland, homes are allocated to bands based on their estimated market value as of 1 April 1991, and 1993 in Wales. If you believe your property has been incorrectly banded, you can contact the Valuation Office Agency (VOA) in England and Wales, or the Scottish Assessors Association in Scotland, to request a re-evaluation.

Check for Discounts and Exemptions

Ensure that any applicable discounts or exemptions are correctly applied. Students, single occupants, and individuals with disabilities, among others, may qualify for reductions. Verify that these are reflected on your bill. If not, you may need to provide additional documentation to support your eligibility.

What if Your Challenge Is Unsuccessful?

If after contacting the council and submitting a formal challenge your issue remains unresolved, you can escalate the matter. Contact the Local Government and Social Care Ombudsman in England or the Public Services Ombudsman in Wales and Scotland for further assistance. They can investigate complaints about mishandling of the case by the local council.

Preventing Future Errors

To prevent future billing errors, keep your personal information up to date and notify your council promptly of any changes in circumstances, such as moving homes or changes in occupancy. Regularly review your bills upon receipt to ensure correctness.

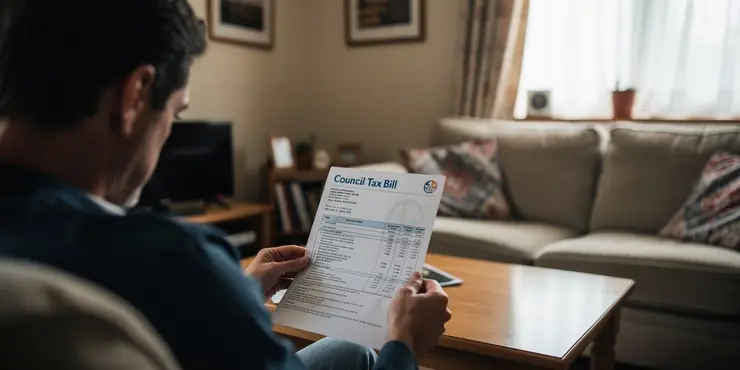

Understanding Your Council Tax Bill

Council Tax is money you need to pay to the local council. It helps pay for things like schools, trash collection, and the police. Sometimes, mistakes happen in your Council Tax bill, and you might pay too much or too little. Knowing how to read your bill can help you spot these mistakes.

Review Your Bill Carefully

Look at your Council Tax bill closely. Check the property band, any discounts, and make sure your personal details are right. Mistakes can happen if your house is put in the wrong band or if discounts are not applied.

Contact Your Local Council

If you think there is a mistake, talk to your local council. They have people who can help with billing questions. Give them your account number and details about the mistake. You can find their contact information on the council's website.

Submit a Formal Challenge

If talking to them doesn't fix the problem, you might need to write a letter explaining the mistake. Include any evidence you have. Follow the council's rules for submitting challenges. Keep copies of everything you send.

Understanding Council Tax Bands

Houses are put in bands based on how much they were worth in the past. This can affect your bill. If you think your home is in the wrong band, contact the Valuation Office Agency in England and Wales, or the Scottish Assessors Association in Scotland, to ask for a check.

Check for Discounts and Exemptions

Make sure any discounts you qualify for are on your bill. People like students, single people living alone, or those with disabilities might get a reduction. If these are not on your bill, you might need to give extra papers to prove you qualify.

What if Your Challenge Is Unsuccessful?

If you’ve tried to fix the mistake and it’s still there, you can ask for more help. In England, you can talk to the Local Government and Social Care Ombudsman. In Wales and Scotland, contact the Public Services Ombudsman. They can help if the council doesn’t sort things out properly.

Preventing Future Errors

To stop mistakes from happening again, keep your personal information current. If you move or there are changes, tell the council quickly. Always check your bills carefully when you get them.

Frequently Asked Questions

What should I do if I suspect an error in my Council Tax bill?

First, closely review the details on your Council Tax bill for any discrepancies. Then, contact your local council directly to raise the issue and provide them with all relevant information.

How can I check for errors on my Council Tax bill?

Carefully read through your bill and compare it against previous bills or any recent changes in your circumstances that you have reported to the council.

Who should I contact regarding a potential Council Tax billing error?

You should contact the billing department of your local council. Their contact information will be on your Council Tax bill.

What information will I need when reporting an error?

Have your Council Tax bill reference number, details of the error, and any supporting documents ready when you contact your council.

Can I dispute a Council Tax bill error online?

Many local councils offer online services to dispute Council Tax bill errors. Check your council's website for more information.

How long does it take to resolve a Council Tax billing error?

Resolution times can vary, but your council should provide a timeline once you report the issue.

Will I be charged for incorrect Council Tax amounts?

If an error is confirmed, your council should adjust your account. Let them know as soon as possible to avoid any overcharges.

Is there a deadline to report Council Tax errors?

There isn't a strict deadline, but it’s best to report errors as soon as you notice them to prevent additional charges or complications.

What should I do if I disagree with the council’s resolution?

If you disagree, you can ask for a formal review or take your complaint to the Valuation Tribunal Service.

Can a billing error affect my credit report?

Normally, Council Tax is not reported to credit agencies. However, unresolved issues leading to arrears could indirectly affect your credit if enforced through the courts.

Should I make payments while my dispute is being resolved?

Continue making payments based on the correct amount you believe is due to prevent being in arrears.

What proof will the council need to investigate the error?

Proof can vary based on the error. Council calculations, correspondence letters, and any related documentation can be useful.

Can my bill be wrong due to incorrect property banding?

Yes, incorrect property banding can lead to errors. Contact the Valuation Office Agency if you think your band is wrong.

Are Council Tax errors common?

Errors are not very common but can occur. Always review your bills carefully to catch any mistakes promptly.

How can I track the status of my dispute?

Ask for a case or reference number when you report the error. Use this when following up with the council.

Can I claim a refund for overpayments due to a billing error?

Yes, if overpayments are due to a confirmed error, your council should refund the excess amount.

Will my direct debit payments be adjusted after an error resolution?

Yes, the council should adjust your direct debit details to reflect the correct amount once the error is resolved.

Is there a way to avoid future Council Tax billing errors?

Ensure the council has your up-to-date information and notify them of any changes to your household or property promptly.

Can I talk to someone in person about my billing issues?

Yes, some local councils may offer in-person appointments at their offices. Check with your local council for available options.

What happens if I don't pay the disputed amount?

Not paying could result in arrears, but continue payments based on the correct calculation as you see it and alert the council of the dispute.

What if I think there's a mistake on my Council Tax bill?

If you think your Council Tax bill is wrong, you should:

- Check the details: Look at all the information on the bill to see if something is incorrect.

- Contact the council: Call or email your local council. Tell them what you think is wrong.

- Ask for help: If you find it difficult to understand the bill, ask a friend or family member to help you.

- Use technology: You can use apps or tools that read text out loud or help explain it better.

First, look carefully at your Council Tax bill. Check if anything is wrong. If you find a problem, talk to your local council. Tell them what is wrong and give them all the information they need.

How can I find mistakes on my Council Tax bill?

Do you want to know how to see if your Council Tax bill is right? Here is what you can do:

- Look at your bill. Check if your name, address, and amount to pay are correct.

- Use a calculator to add up the numbers. Make sure the total is right.

- If you are unsure, ask someone you trust to help you check.

- You can use online tools to help you understand your bill. Try looking for guides or videos that explain Council Tax bills.

If you find a mistake, call your local council. They will help fix it.

Look at your bill closely. Check it against your old bills. Also, think about any changes you've told the council about. Make sure everything matches up.

Who do I talk to if there's a mistake with my Council Tax bill?

You should get in touch with the billing office in your local council. You can find their phone number and email on your Council Tax bill.

What do I need to know to tell someone about a mistake?

When you tell someone about a mistake, you need to have some information. Here is what you should know:

- What the mistake is. Try to say it clearly.

- When the mistake happened. What time and date was it?

- Where the mistake happened. Tell if it was on a computer, phone, or somewhere else.

- How the mistake makes things wrong. What problems is it causing?

You can use tools to help you remember:

- Take a picture or screenshot of the mistake.

- Write down notes so you don't forget details.

When you talk to the council, have these things ready:

- Your Council Tax bill number

- Information about the mistake

- Any papers that can help show the mistake

These will make it easier to fix the problem.

Can I fix a mistake on my Council Tax bill online?

Lots of local councils can help you online if your Council Tax bill is wrong. Look at your council's website to find out more.

How long does it take to fix a mistake on your Council Tax bill?

If there's a mistake on your Council Tax bill, the Council will help fix it.

It can take a few weeks to sort out.

Here are some things you can do:

- Check your bill to make sure you understand the mistake.

- Call or email the Council to tell them about the mistake.

- Write down the date you contacted them and what they said.

If you need help, you can ask a friend or family member.

You can also use a tool like a calendar to track how long it takes to fix the mistake.

Fixing the problem can take different amounts of time. After you tell your council about the issue, they should tell you how long it will take to fix it.

Do I have to pay the wrong Council Tax amount?

If there is a mistake, the council should fix it. Tell them right away so you don’t pay too much.

When do I need to tell the Council about Council Tax mistakes?

If you find a mistake on your Council Tax, tell the Council quickly. Don't wait too long. Ask someone for help if you need it.

There is no exact time limit. But it is good to tell someone about mistakes as soon as you see them. This helps stop more problems or extra costs.

What can I do if I don't agree with the council's decision?

If you don't agree with what the council decided, here are things you can do:

- Talk to someone you trust about why you don't agree.

- Ask the council to explain their decision in easy words.

- You can write a letter to the council to say why you think they are wrong.

- You might ask for a meeting to talk more about it.

It can also help to use other tools:

- You might find helpful information on the council's website.

- Look for people or groups that help with council problems.

If you don't agree, you can ask someone to look at it again. You can also talk to the Valuation Tribunal Service if you have a complaint.

Can a billing mistake hurt my credit report?

Yes, if there is a mistake in a bill, it can make your credit report look bad. This is because the wrong information might say you owe money.

Here are some tips to help you:

- Read your bills carefully to spot mistakes.

- Ask someone to help you if it gets confusing.

- You can tell the company if there's a mistake, and they can fix it.

Usually, the Council Tax is not shared with credit companies. But, if you do not pay, it can go to court and this might hurt your credit score.

Should I keep paying while my problem is being fixed?

Keep paying the right amount of money that you think you owe so you don't fall behind.

What do you need to show the council to look into the mistake?

Proof can be different depending on the mistake. Things like calculations from the council, letters they have sent, and any other important papers can help.

Can my bill be wrong because of a mistake in my property band?

Yes, if your property is in the wrong band, it can cause mistakes. If you think your band is wrong, you should tell the Valuation Office Agency.

Do Council Tax mistakes happen a lot?

Yes, sometimes mistakes happen with Council Tax.

If you think there's a mistake, you can ask for help.

You can use tools like:

- A friend or family member to talk to the council for you

- Calculator to check the numbers

- Online guides to understand your bill better

Mistakes can happen, but not often. Always check your bills carefully to find any errors quickly.

How can I check my dispute?

When you tell the council about a mistake, ask for a special number. This is the case number. Use this number when you talk to the council again.

Can I get money back if I paid too much because of a mistake in my bill?

Yes, if you paid too much because of a mistake, your council should give you the extra money back.

Will my direct debit payments change after fixing a mistake?

Yes, the council will change your direct debit details to make sure the right amount is taken out after they fix the mistake.

How can I stop mistakes on my Council Tax bill in the future?

Make sure you tell the council about any changes to who lives in your home or if something changes about your home. It is important to do this quickly.

Can I speak to someone face-to-face about my bill problems?

If you are having trouble with your bill and want to talk to someone, you can ask to meet with a helper in person. This means you can talk to them face-to-face and get help.

If talking is hard, you can use tools like a planner to write down your questions first. This can help you remember what to say. A friend or family member can also come with you to help.

Yes, some local councils might let you visit and talk to someone at their offices. Ask your local council to find out more.

What happens if I don't pay the money I owe?

If you don't pay, you might end up owing money. Keep paying what you think is the right amount. Tell the council that you do not agree with what they are asking.

Useful Links

This website offers general information and is not a substitute for professional advice.

Always seek guidance from qualified professionals.

If you have any medical concerns or need urgent help, contact a healthcare professional or emergency services immediately.

Some of this content was generated with AI assistance. We’ve done our best to keep it accurate, helpful, and human-friendly.

- Ergsy carfully checks the information in the videos we provide here.

- Videos shown by Youtube after a video has completed, have NOT been reviewed by ERGSY.

- To view, click the arrow in centre of video.

- Most of the videos you find here will have subtitles and/or closed captions available.

- You may need to turn these on, and choose your preferred language.

- Go to the video you'd like to watch.

- If closed captions (CC) are available, settings will be visible on the bottom right of the video player.

- To turn on Captions, click settings .

- To turn off Captions, click settings again.

More Items From Ergsy search

-

What should I do if I suspect an error in my Council Tax billing?

Relevance: 100%

-

Where can I get a copy of my Council Tax bill?

Relevance: 76%

-

Does overpayment affect my Council Tax band?

Relevance: 65%

-

Are refunds for overpaid Council Tax taxable?

Relevance: 63%

-

How do can I find out if I have overpaid my UK Council Tax?

Relevance: 62%

-

Can an inheritance tax bill be challenged or appealed?

Relevance: 55%

-

Is there a time limit for claiming a refund on overpaid Council Tax?

Relevance: 54%

-

Will my council send a refund check if I overpay?

Relevance: 53%

-

Citizens Advice Bureau Sees Spike in Queries Related to Council Tax Benefits

Relevance: 50%

-

Can I access my Council Tax payment history online?

Relevance: 50%

-

How does council tax relate to wealth in the UK?

Relevance: 49%

-

How do I pay my tax bill?

Relevance: 46%

-

How do I calculate my tax bill?

Relevance: 46%

-

How can I dispute a Council Tax charge?

Relevance: 44%

-

Is it possible to reduce the Inheritance Tax bill?

Relevance: 42%

-

How is the Inheritance Tax bill calculated?

Relevance: 42%

-

What if I can’t pay my tax bill on time?

Relevance: 42%

-

What should I do if I made an error on my CGT report?

Relevance: 41%

-

How do I know if I have overpaid my Council Tax?

Relevance: 39%

-

What should I do if my energy bill is unexpectedly high?

Relevance: 35%

-

Where can I get help in managing my household bills?

Relevance: 34%

-

What details are needed to check for overpayments through my council?

Relevance: 32%

-

Can seniors receive help with their energy bills?

Relevance: 32%

-

What should drivers do if there are errors in their digital license data?

Relevance: 31%

-

Local Councils Struggle with Increasing Demand for Welfare Support

Relevance: 31%

-

How does billing for live-in care work?

Relevance: 30%

-

What if I owe more than £30,000 in Self Assessment tax?

Relevance: 30%

-

Is my healthcare provider obligated to correct errors in my medical records?

Relevance: 30%

-

I received a tax refund letter, but I haven’t overpaid any tax. What should I do?

Relevance: 30%

-

What if I make a mistake on my tax return?

Relevance: 30%

-

What factors influence the rise and fall of energy bills in the UK?

Relevance: 30%

-

Can I amend my tax return after submitting it?

Relevance: 29%

-

I received a refund but think I owe tax instead. What should I do?

Relevance: 28%

-

My first Self Assessment tax return

Relevance: 28%

-

Are there government programs that help with utility bills?

Relevance: 28%

-

Can I file my taxes online if I'm self-employed?

Relevance: 28%

-

UK Government Announces New Energy Bill Support Amid Rising Costs

Relevance: 28%

-

Are there apps that help manage and reduce household bills?

Relevance: 27%

-

Can I amend an online tax return?

Relevance: 27%

-

Why are council burial fees going up nearly 50% in the UK?

Relevance: 27%