Find Help

More Items From Ergsy search

-

Are refunds for overpaid Council Tax taxable?

Relevance: 100%

-

Is there a time limit for claiming a refund on overpaid Council Tax?

Relevance: 71%

-

Is the tax refund amount taxable?

Relevance: 65%

-

How do can I find out if I have overpaid my UK Council Tax?

Relevance: 59%

-

Will my council send a refund check if I overpay?

Relevance: 51%

-

HMRC Tax Refund letters

Relevance: 46%

-

Does overpayment affect my Council Tax band?

Relevance: 45%

-

I received a tax refund letter, but I haven’t overpaid any tax. What should I do?

Relevance: 44%

-

How is the tax refund amount calculated?

Relevance: 44%

-

How do I know if I have overpaid my Council Tax?

Relevance: 42%

-

Why did I receive a tax refund letter from HMRC?

Relevance: 41%

-

What is an HMRC tax refund letter?

Relevance: 39%

-

How do I claim my tax refund from HMRC?

Relevance: 35%

-

What happens if I do not claim my tax refund?

Relevance: 35%

-

Can my tax refund be applied to my future tax obligations?

Relevance: 34%

-

I received a refund but think I owe tax instead. What should I do?

Relevance: 33%

-

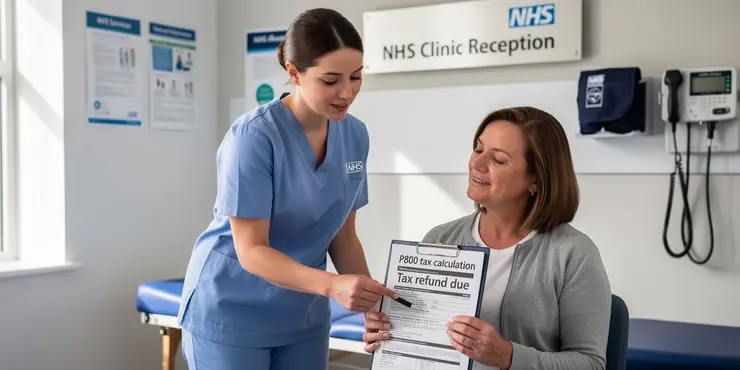

What is a P800 form and how does it relate to my tax refund?

Relevance: 33%

-

Are these grants taxable?

Relevance: 33%

-

How long does it take to receive a tax refund from HMRC?

Relevance: 32%

-

How does council tax relate to wealth in the UK?

Relevance: 31%

-

What should I do if I suspect an error in my Council Tax billing?

Relevance: 30%

-

Are firefighter pension benefits taxable?

Relevance: 30%

-

Where can I get a copy of my Council Tax bill?

Relevance: 30%

-

Can I access my Council Tax payment history online?

Relevance: 29%

-

Is the Winter Fuel Payment taxable?

Relevance: 29%

-

Do I need to keep my tax refund letter for future reference?

Relevance: 28%

-

Citizens Advice Bureau Sees Spike in Queries Related to Council Tax Benefits

Relevance: 28%

-

Is the £500 cost of living payment taxable?

Relevance: 28%

-

Can Inheritance Tax be claimed back?

Relevance: 28%

-

Can I receive my tax refund directly into my bank account?

Relevance: 28%

-

Do online tax services help maximize my refund?

Relevance: 27%

-

Will HMRC contact me via phone or email regarding my tax refund?

Relevance: 27%

-

How can I verify that my tax refund letter is genuine?

Relevance: 26%

-

Can Stamp Duty be refunded in the UK?

Relevance: 26%

-

Is the £500 cost of living payment taxable?

Relevance: 26%

-

What happens to a deceased’s Income Tax if they were employed?

Relevance: 25%

-

How can I dispute a Council Tax charge?

Relevance: 25%

-

Are the refunds part of a regulatory action?

Relevance: 24%

-

What if I've moved since the tax year ended?

Relevance: 22%

-

Can I amend an online tax return?

Relevance: 22%

Understanding Council Tax in the UK

In the United Kingdom, Council Tax is a local taxation system used by local authorities to fund communal services such as waste collection, road maintenance, and local educational services. This tax is typically charged on residential properties, and the amount levied depends on the property's valuation band, which is determined by factors such as size, location, and market value. Households are usually required to pay Council Tax monthly, and it forms a significant part of local government revenue.

Overpayment of Council Tax

There are instances where individuals or households may overpay their Council Tax. Overpayments can occur for various reasons, such as changes in occupancy, property reassessment, or errors in billing calculations. When local authorities receive payments that exceed the actual amount due, the excess amount paid is classified as an overpayment. In such cases, residents have the right to request a refund for the overpaid amount from their local Council.

Refunds for Overpaid Council Tax

When taxpayers have overpaid their Council Tax, they can contact their local authority to request a refund. It's common for local councils to automatically issue a refund once the overpayment is recognized during end-of-year adjustments; however, in some cases, taxpayers may need to initiate the refund process. The procedure generally involves a straightforward application, which can often be completed online, showing proof of overpayment and detailing the reasons for the discrepancy.

Are Refunds for Overpaid Council Tax Taxable?

One of the key questions individuals often have is whether a refund received for overpaid Council Tax is considered taxable income. According to the UK tax authorities and current prevailing tax laws, refunds for overpaid Council Tax are not taxable. Council Tax itself is a local tax, and any refund related to it is simply a return of the taxpayer's own money. It does not constitute income or profit. Therefore, there is no tax liability associated strictly with the receipt of these refunds.

Important Considerations

While Council Tax refunds are not taxable, taxpayers should keep records of all transactions related to the overpayment and subsequent refund for their financial records. This documentation aids in ensuring transparency and accuracy in financial matters. Additionally, if overpayments were inadvertently recorded as business expenses in accounting books, adjustments might be needed to reflect the refund correctly without impacting taxable business income.

Conclusion

The UK's tax framework allows taxpayers to retrieve overpaid Council Tax without the worry of incurring additional tax liabilities on the refunded amount. As always, individuals and businesses are advised to maintain proper records and consult with tax professionals if there are complexities regarding tax obligations or bookkeeping practices. Understanding the nuances of local taxes and their impact on personal or business finances is crucial for compliance and long-term fiscal management.

Understanding Council Tax in the UK

In the UK, people pay a tax called Council Tax. This money helps pay for things in your community, like collecting rubbish, fixing roads, and schools. You pay this tax if you live in a house. The amount you pay depends on how big your house is, where it is, and how much it is worth. Most people pay Council Tax every month, and it is important because it helps the local council get money to do their work.

Paying Too Much Council Tax

Sometimes people pay more Council Tax than they should. This can happen if something changes, like if someone moves out of your house or if there's a mistake in the bill. If you pay too much, it’s called an overpayment. You can ask your local council to give this extra money back to you.

Getting Your Money Back

If you paid too much Council Tax, you can ask your local council for a refund. Often, they will notice the mistake and give your money back at the end of the year. But, sometimes you might need to ask for it. You can usually do this online by filling out a simple form and showing why you paid too much.

Is the Council Tax Refund Taxable?

Many people ask if they will have to pay tax on money they get back from overpaying Council Tax. The good news is, you do not have to pay tax on this refund. Council Tax is a local tax, and getting your money back is not like earning more money. It’s just your own money coming back to you.

Things to Remember

Even though you don't pay tax on a Council Tax refund, you should still keep all the paperwork. It helps keep everything clear with your money. Also, if you wrote down the overpayment as a business expense, make sure to change it when you get your refund so it doesn’t mess up your business finances.

Conclusion

In the UK, if you pay too much Council Tax, you can get your money back without worrying about paying extra tax on it. Remember to keep good records and ask for help from a tax expert if your money matters get confusing. Knowing how to handle local taxes helps you manage your money better over time.

Frequently Asked Questions

What is a refund for overpaid Council Tax?

A refund for overpaid Council Tax occurs when a taxpayer has paid more than what was owed for their Council Tax bill, and the overpayment is returned to them by the local authority.

Are refunds for overpaid Council Tax considered income?

No, refunds for overpaid Council Tax are not considered income. They are simply a return of an overpayment that you initially made to the local authority.

Do I need to report a Council Tax refund on my tax return?

No, you do not need to report a Council Tax refund on your tax return, as it is not taxable income.

Is a refund for overpaid Council Tax taxable?

No, a refund for overpaid Council Tax is not taxable.

Why isn’t a refund for overpaid Council Tax taxable?

A refund for overpaid Council Tax is not taxable because it is not considered new income; it is simply the repayment of money that was overpaid.

How will I receive my Council Tax refund?

Typically, a Council Tax refund can be issued via bank transfer, cheque, or credited back to your Council Tax account, depending on the local authority's policies.

Is there any paperwork required when I receive a Council Tax refund?

Usually, no significant paperwork is required to receive a Council Tax refund, but you may need to confirm your payment details with your local council.

Will receiving a refund affect any benefits I receive?

A refund for overpaid Council Tax generally should not affect any benefits you receive, but it’s best to confirm with your benefits advisor.

Can I use my Council Tax refund to pay future bills?

Yes, some councils allow you to apply your refund towards future Council Tax bills.

How long does it take to process a Council Tax refund?

The processing time for a Council Tax refund can vary but typically takes a few weeks. Check with your local authority for specifics.

Do I need to apply for a Council Tax refund if I have overpaid?

In most cases, you will need to contact your local council to request a refund, as they may not automatically issue one.

Can I get a refund for overpaid Council Tax if I move house?

Yes, if you have overpaid your Council Tax before moving, you can request a refund. Be sure to inform your local council of your move.

What should I do if I haven't received my Council Tax refund?

If you haven't received your refund, contact your local council to inquire about the status of your refund request.

Are there any fees associated with a Council Tax refund?

No, there should be no fees associated with receiving a refund for overpaid Council Tax.

Can my local council refuse to give a refund for overpaid Council Tax?

Typically, councils will not refuse a legitimate request for a refund of overpaid Council Tax. If they refuse, request an explanation and escalate if necessary.

Is it possible to donate my Council Tax refund to a local charity?

Yes, in some cases, councils offer the option to donate your refund to a local charity. Contact your council to find out if this option is available.

Will I be notified when my Council Tax refund is issued?

Most councils will notify you when a refund has been processed and issued, either by post or email.

Do I have to provide proof of overpayment to get a refund?

You may need to provide proof of payment or overpayment if the council has no record, but usually, they should have a record of accounts.

Will I have to pay tax on interest from the Council Tax refund?

Interest on a Council Tax refund is rare, but if provided, any interest earned may be considered taxable income. Confirm with your local council.

How is a Council Tax refund calculated?

A Council Tax refund is calculated based on the excess amount paid over the actual amount owed, after any applicable discounts or adjustments.

What is a refund for too much Council Tax paid?

Sometimes, people pay too much money on their Council Tax. When this happens, the extra money is called an "overpayment." The Council gives this money back to the person. This is called a "refund."

Is money back from paying too much Council Tax counted as income?

No, getting money back from paying too much Council Tax is not income. It's just money that you paid extra and the council is giving it back to you.

Do I have to tell anyone about a Council Tax refund on my tax form?

No, you don't have to tell the tax office about getting a Council Tax refund. It's not money you need to pay tax on.

Do I need to pay tax on a Council Tax refund?

No, you don't have to pay tax on a refund for paying too much Council Tax.

Why don't you pay tax on a Council Tax refund?

You won't pay tax on a Council Tax refund. This is because it's your own money given back. You paid too much before, and they are returning it to you. You don’t earn this refund, so it’s not income.

Tip: If you need help, use a calculator to check your payments or ask someone you trust for support.

Getting money back from paying too much Council Tax is not taxed. This is because it is just returning money you paid too much of before. It is not new money you are earning.

How do I get my Council Tax money back?

Usually, you can get your Council Tax money back in a few ways. The council might put it in your bank account, send you a cheque, or add it back to your Council Tax account. It depends on what the council likes to do.

If you need help with reading, you can ask a friend to read it with you. You can also use tools that read out loud or apps that help you understand words. It’s always okay to ask for support!

Do I need to fill out any forms when I get a Council Tax refund?

Most of the time, you don't need to do much paperwork to get a Council Tax refund. But you might need to check with your local council to make sure they have the right payment information.

If I get money back, will it change my benefits?

If you paid too much Council Tax and get money back, it usually won't change the help you get with benefits. But it's a good idea to ask your benefits advisor to be sure.

Can I use my Council Tax refund to pay my future bills?

Yes, you can sometimes use your Council Tax refund to pay for future bills. Check with your local council to make sure.

If it's hard to understand, ask someone for help, like a family member or friend.

You can also use tools that read text aloud to you or make fonts bigger and easier to read. These tools can help you understand better.

Yes, some councils let you use your refund to pay future Council Tax bills.

How long will it take to get my Council Tax money back?

Getting your Council Tax refund might take some time. It usually takes a few weeks. You can ask your local council for more details.

Here are some things that might help you:

- Ask someone for help to make a call to the council.

- Write down any questions you have before you call.

- Use big, clear writing when taking notes.

Can I get my money back if I paid too much Council Tax?

You will need to ask your local council to give you your money back. They might not do it by themselves.

Can I get money back if I paid too much Council Tax and I move?

If you paid too much Council Tax before you moved, you can ask for some money back. Make sure you tell your local council that you moved.

What to do if you didn't get your Council Tax money back

If you have not got your money back, talk to your local council. Ask them what is happening with your refund.

Do you have to pay any money to get a Council Tax refund?

No, you should not have to pay any money to get a refund if you paid too much Council Tax.

Can my local council say no to giving back extra money I paid for Council Tax?

If you think you paid too much Council Tax, you can ask your council to give the extra money back.

But sometimes the council might say no. This can happen if they believe you don't need a refund.

If you find this hard, you can ask someone to help, like a friend or a family member.

There are tools that can read the words out loud for you. You can also ask someone to explain this to you.

Most of the time, if you paid too much Council Tax, the council will give you the extra money back. If they say no, ask them why. If you still think they're wrong, ask someone else for help.

Can I give my Council Tax refund to a local charity?

If you get a refund on your Council Tax, you can choose to give it to a local charity. Here are some steps and tools to help:

- Contact your local council and ask how to donate your refund.

- Find out which local charities you can help.

- Ask someone to help you make the donation if you need support.

Remember, giving to charity is a kind way to help others. You can make a difference!

Yes, sometimes you can give your refund money to a local charity. Contact your council to see if you can do this.

Will I get a message when my Council Tax money is sent back?

Most councils will tell you when they give you a refund. They will send a letter to your home or an email to let you know.

Do I need to show proof to get money back if I paid too much?

If you paid too much money and want it back, you might need to show something that proves you paid extra.

It can be helpful to keep receipts or bank statements to show what you paid.

If you need help, ask a friend or use a calculator to check your payments.

If the council doesn’t know that you paid or paid too much, you might need to show proof. But usually, the council should know what you have paid.

Do I need to pay tax on money from the Council Tax refund?

It is not common to get interest on a Council Tax refund, but sometimes you might. If you do, this extra money might be taxed. Check with your local council to be sure.

How do you work out a Council Tax refund?

If you paid too much Council Tax, you can get some money back. This is called a refund.

Here is how it works:

- They look at how much Council Tax you paid.

- They check if you paid more than you needed to.

- If you paid too much, they give you money back.

If you need help, you can:

- Ask someone you trust to help you.

- Use online tools that make numbers easier to understand.

You might get some Council Tax money back if you paid too much. This happens when you paid more than you needed to, after getting any discounts or changes to your bill.

Useful Links

This website offers general information and is not a substitute for professional advice.

Always seek guidance from qualified professionals.

If you have any medical concerns or need urgent help, contact a healthcare professional or emergency services immediately.

Some of this content was generated with AI assistance. We’ve done our best to keep it accurate, helpful, and human-friendly.

- Ergsy carfully checks the information in the videos we provide here.

- Videos shown by Youtube after a video has completed, have NOT been reviewed by ERGSY.

- To view, click the arrow in centre of video.

- Most of the videos you find here will have subtitles and/or closed captions available.

- You may need to turn these on, and choose your preferred language.

- Go to the video you'd like to watch.

- If closed captions (CC) are available, settings will be visible on the bottom right of the video player.

- To turn on Captions, click settings .

- To turn off Captions, click settings again.

More Items From Ergsy search

-

Are refunds for overpaid Council Tax taxable?

Relevance: 100%

-

Is there a time limit for claiming a refund on overpaid Council Tax?

Relevance: 71%

-

Is the tax refund amount taxable?

Relevance: 65%

-

How do can I find out if I have overpaid my UK Council Tax?

Relevance: 59%

-

Will my council send a refund check if I overpay?

Relevance: 51%

-

HMRC Tax Refund letters

Relevance: 46%

-

Does overpayment affect my Council Tax band?

Relevance: 45%

-

I received a tax refund letter, but I haven’t overpaid any tax. What should I do?

Relevance: 44%

-

How is the tax refund amount calculated?

Relevance: 44%

-

How do I know if I have overpaid my Council Tax?

Relevance: 42%

-

Why did I receive a tax refund letter from HMRC?

Relevance: 41%

-

What is an HMRC tax refund letter?

Relevance: 39%

-

How do I claim my tax refund from HMRC?

Relevance: 35%

-

What happens if I do not claim my tax refund?

Relevance: 35%

-

Can my tax refund be applied to my future tax obligations?

Relevance: 34%

-

I received a refund but think I owe tax instead. What should I do?

Relevance: 33%

-

What is a P800 form and how does it relate to my tax refund?

Relevance: 33%

-

Are these grants taxable?

Relevance: 33%

-

How long does it take to receive a tax refund from HMRC?

Relevance: 32%

-

How does council tax relate to wealth in the UK?

Relevance: 31%

-

What should I do if I suspect an error in my Council Tax billing?

Relevance: 30%

-

Are firefighter pension benefits taxable?

Relevance: 30%

-

Where can I get a copy of my Council Tax bill?

Relevance: 30%

-

Can I access my Council Tax payment history online?

Relevance: 29%

-

Is the Winter Fuel Payment taxable?

Relevance: 29%

-

Do I need to keep my tax refund letter for future reference?

Relevance: 28%

-

Citizens Advice Bureau Sees Spike in Queries Related to Council Tax Benefits

Relevance: 28%

-

Is the £500 cost of living payment taxable?

Relevance: 28%

-

Can Inheritance Tax be claimed back?

Relevance: 28%

-

Can I receive my tax refund directly into my bank account?

Relevance: 28%

-

Do online tax services help maximize my refund?

Relevance: 27%

-

Will HMRC contact me via phone or email regarding my tax refund?

Relevance: 27%

-

How can I verify that my tax refund letter is genuine?

Relevance: 26%

-

Can Stamp Duty be refunded in the UK?

Relevance: 26%

-

Is the £500 cost of living payment taxable?

Relevance: 26%

-

What happens to a deceased’s Income Tax if they were employed?

Relevance: 25%

-

How can I dispute a Council Tax charge?

Relevance: 25%

-

Are the refunds part of a regulatory action?

Relevance: 24%

-

What if I've moved since the tax year ended?

Relevance: 22%

-

Can I amend an online tax return?

Relevance: 22%