Find Help

More Items From Ergsy search

-

Is there a time limit for claiming a refund on overpaid Council Tax?

Relevance: 100%

-

Are refunds for overpaid Council Tax taxable?

Relevance: 73%

-

How do can I find out if I have overpaid my UK Council Tax?

Relevance: 55%

-

What happens if I do not claim my tax refund?

Relevance: 50%

-

Will my council send a refund check if I overpay?

Relevance: 50%

-

How do I claim my tax refund from HMRC?

Relevance: 46%

-

HMRC Tax Refund letters

Relevance: 44%

-

I received a tax refund letter, but I haven’t overpaid any tax. What should I do?

Relevance: 43%

-

Does overpayment affect my Council Tax band?

Relevance: 43%

-

Can Inheritance Tax be claimed back?

Relevance: 42%

-

Why did I receive a tax refund letter from HMRC?

Relevance: 42%

-

Is the tax refund amount taxable?

Relevance: 40%

-

What is an HMRC tax refund letter?

Relevance: 40%

-

How do I know if I have overpaid my Council Tax?

Relevance: 38%

-

How is the tax refund amount calculated?

Relevance: 38%

-

How long does it take to receive a tax refund from HMRC?

Relevance: 34%

-

What information do I need to provide to claim my refund?

Relevance: 32%

-

What is a P800 form and how does it relate to my tax refund?

Relevance: 32%

-

Can my tax refund be applied to my future tax obligations?

Relevance: 32%

-

Can Stamp Duty be refunded in the UK?

Relevance: 31%

-

I received a refund but think I owe tax instead. What should I do?

Relevance: 31%

-

Are there any fees to claim money back?

Relevance: 30%

-

What should I do if I suspect an error in my Council Tax billing?

Relevance: 29%

-

Where can I get a copy of my Council Tax bill?

Relevance: 29%

-

Will HMRC contact me via phone or email regarding my tax refund?

Relevance: 28%

-

How does council tax relate to wealth in the UK?

Relevance: 28%

-

Citizens Advice Bureau Sees Spike in Queries Related to Council Tax Benefits

Relevance: 28%

-

Three-year limit for child sexual abuse claims to be removed

Relevance: 27%

-

Can I receive my tax refund directly into my bank account?

Relevance: 27%

-

Do online tax services help maximize my refund?

Relevance: 27%

-

Can I access my Council Tax payment history online?

Relevance: 27%

-

Is there a limit to how many EV grants I can claim?

Relevance: 27%

-

Do I need to keep my tax refund letter for future reference?

Relevance: 26%

-

What happens to a deceased’s Income Tax if they were employed?

Relevance: 26%

-

How can I verify that my tax refund letter is genuine?

Relevance: 26%

-

Higher Income Tax - How to Claim Pension Tax Relief | Extra 20% Boost

Relevance: 26%

-

How can I dispute a Council Tax charge?

Relevance: 26%

-

What is the time limit for making a complaint about mis-sold car finance?

Relevance: 24%

-

What happens if Inheritance Tax is not paid on time?

Relevance: 24%

-

Can I amend an online tax return?

Relevance: 24%

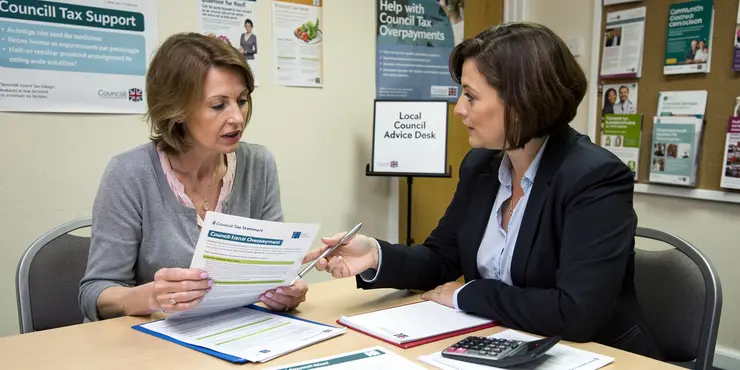

Understanding Council Tax Overpayment

Council Tax is a system of local taxation collected by local authorities in the United Kingdom. It is based on the estimated value of a property and the number of people living in it. Occasionally, households may overpay their Council Tax, which can happen due to changes in circumstances, such as changes in the number of residents, adjustments in Council Tax banding, or simply an administrative error. Understanding your rights regarding overpaid Council Tax, including how to claim a refund, is important.

Time Limits for Claiming a Refund

If you have overpaid your Council Tax, you are entitled to request a refund from your local council. However, there are time limits within which you must make your claim. In general, there is a six-year limitation period for claiming refunds on overpaid Council Tax, starting from the date of the initial overpayment. This is in line with the standard statutory time limit for reclaiming money under the Limitation Act 1980.

The six-year rule means that if you realize you have overpaid your Council Tax, you should contact your local council promptly to initiate the refund process. Waiting too long could result in the inability to reclaim some of the overpaid amounts if the overpayment happened beyond the six-year window.

How to Claim a Refund

To claim a refund for an overpayment, you will need to contact your local council's Council Tax department. Most councils allow you to apply for a refund online through their website, though you can also contact them via phone or in writing. You will typically need to provide account details, including your Council Tax account number, and evidence of any changes in circumstances that justify the overpayment.

Once your claim is submitted, the council will review your account details and the circumstances of the overpayment. If they confirm the overpayment, they will process a refund. The time taken to receive a refund may vary depending on the council's procedures and workload, but they should keep you informed of the progress.

Exceptions and Considerations

While the six-year limit is standard, there can be exceptions. For example, if there is evidence of a mistake made by the council, or if a tribunal finds in your favor for a refund beyond the typical limitation period, it might be possible to reclaim older overpayments. Tenants should also consider that if they move into a property and discover that the previous tenant overpaid, they might still be entitled to claim a refund on the overpaid amount.

In any case, it is always advisable to address any Council Tax issues as soon as they are discovered to ensure the best chance of refund and to avoid further complications.

Understanding Council Tax Overpayment

Council Tax is money people pay to local councils in the UK. It helps pay for local services. The amount is based on how much your home is worth and how many people live there. Sometimes, families pay too much by mistake. This might happen if the number of people in the home changes or if there is a mistake in billing. Knowing how to get your money back if you overpay is important.

Time Limits for Claiming a Refund

If you pay too much Council Tax, you can ask for the extra money back from the council. But you have to do this within six years of overpaying. This means you should check your payments and ask for a refund quickly. If you wait too long, you might not get all your money back.

How to Claim a Refund

To get a refund, you need to contact your local council's Council Tax department. You can usually do this online on their website, call them, or write a letter. You will need to give them your account number and explain why you paid too much.

After you ask for a refund, the council will check your records. If they see there was an overpayment, they will give you a refund. Getting your money back might take some time, but the council will let you know how it's going.

Exceptions and Considerations

There are some special cases where the six-year rule doesn't apply. If the council made a mistake, or a tribunal decides you should get a refund after six years, you might be able to get your money back. Also, if you move into a new home and find out the last person paid too much, you might get a refund for that too.

It's a good idea to deal with any Council Tax problems as soon as you find them. This gives you the best chance to get your money back and avoid more issues.

Frequently Asked Questions

How long do I have to claim a refund for overpaid Council Tax?

The time limit to claim a refund can vary depending on your local council's policies. It's best to contact your council directly to find out the specific time limit.

What happens if I miss the deadline for claiming a refund on overpaid Council Tax?

If you miss the deadline, you may forfeit your right to a refund. Contact your local council to see if there are any exceptions or appeals processes.

Can I request a refund for overpaid Council Tax from previous years?

It's possible to request a refund for previous years, but the ability to do so will depend on your council's policies and any applicable time limits.

Is there a standard time limit across all councils for claiming Council Tax refunds?

No, there is no standard time limit across all councils. Each local council sets its own rules and time limits for refunds.

How can I find out the time limit for claiming a Council Tax refund in my area?

The best way to find out is to contact your local council directly or visit their website for specific information.

What documentation do I need to claim a refund for overpaid Council Tax?

You may need to provide proof of payment, identification, and details of the overpayment. Check with your local council for exact requirements.

Can I claim a refund on overpaid Council Tax if I have moved house?

Yes, you can still claim a refund even if you have moved, but you may need to provide your previous address details to your council.

What is the first step to take if I think I overpaid my Council Tax?

Contact your local council's billing department to verify your account and discuss the refund process.

Will my refund request be denied if I don't act within a certain timeframe?

Yes, if you don't submit your request within the council's specified time frame, your request could be denied.

Do different types of properties have different time limits for refund claims on Council Tax?

No, the time limit typically applies regardless of property type, but it's always best to check with your council.

If the overpayment was the council's fault, can I still face a time limit for refund claims?

Yes, time limits may still apply, but the council may be more flexible in cases where the overpayment was their error.

Is there a time limit for claiming a refund if I overpaid online?

Yes, the time limit applies regardless of how the payment was made. Check with your council for specifics.

How does direct debit affect the process of claiming a refund for overpaid Council Tax?

If overpayments occurred via direct debit, you might need to update your payment details, but the refund process is similar.

Can I appeal if my refund request is denied due to missing the deadline?

You may be able to appeal a denial, but it will depend on your local council's policies.

How long does it take to receive a refund once my claim is approved?

The time it takes to process a refund varies by council, but they should be able to provide a timeframe once your claim is approved.

Does the time limit for refund claims apply to both businesses and individuals?

Yes, typically the time limit applies to both, but policies may differ for business properties.

Can someone else claim a refund on my behalf if I've overpaid my Council Tax?

Usually, someone can claim on your behalf if they have the necessary authorization and documentation.

Are there any fees associated with claiming a refund for overpaid Council Tax?

Generally, there are no fees for claiming a refund, but check with your local council for any specific charges.

What should I do if my local council has no clear information about refund time limits?

Contact your council directly for guidance, or check any available citizen advice resources.

Can I claim a refund for overpaid Council Tax if I am currently in arrears?

Yes, you can claim a refund for overpaid Council Tax, but any arrears might be deducted from your refund.

When can I ask for my money back if I paid too much Council Tax?

How long you have to ask for your money back can be different in each place. The best thing to do is to call or talk to your local council to find out how much time you have.

What if I am late asking for my Council Tax money back?

If you do not ask for your money back before the deadline, you might not get it. Try to ask as soon as you can.

For help, you can:

- Ask someone you trust for help.

- Use a calendar or phone reminder to keep track of important dates.

- Contact the Council Tax office for guidance.

If you miss the deadline, you might lose your chance to get your money back. Talk to your local council to find out if there are any special rules or ways to ask for help.

Can I ask for my money back if I paid too much Council Tax before?

If you paid too much Council Tax in the past, you might be able to get your money back.

Here’s how to make it easier:

- Check your old bills to see how much you paid.

- Contact your Council Tax office and ask for help.

- You can also ask someone you trust to help you.

You might be able to ask for your money back for past years. This depends on what your council says you can do and if there are any time limits for asking.

Does everyone have the same time to ask for Council Tax money back?

No, there is no set time limit that is the same everywhere. Each local council makes its own rules about refunds and how long you have to ask for one.

If you find it hard to read, you can ask someone to read with you. You could also use a tool that reads text out loud or helps you understand better.

How do I know how long I have to ask for my Council Tax money back?

The best way to find out is to talk to your local council. You can also go to their website to get the right information.

What papers do I need to get my extra Council Tax money back?

If you paid too much Council Tax and want it back, you need to have some papers ready. These papers show that you paid too much and help you get your money back.

Here are some things that can help:

- Your Council Tax bill.

- A receipt or bank statement showing you paid.

- Any letters from the council about your payments.

- Your own notes about how much you have paid.

If you need help, you can ask someone at the council office. You can also use a computer or magnifying glass to see the words better or listen to audio books if available.

You might need to show you have paid. You will also need to show who you are and tell them about the extra money you paid. Ask your local council what you need to bring.

Can I get money back if I paid too much Council Tax and moved to a new house?

If you think you have paid too much Council Tax and moved to a new house, you might be able to get some money back.

Here is what you can do:

- Check your Council Tax bill to see if you paid too much.

- Call or visit your local council to ask for help.

- You can also ask a friend or family to help you understand what to do.

If you need help reading or understanding forms, you can:

- Use a ruler or card to keep track of lines when reading documents.

- Ask someone to read with you.

- Use apps or tools that read text aloud.

Yes, you can still get your money back if you have moved. You might need to tell your old address to the council.

What should I do first if I paid too much Council Tax?

Ask your local council for help with your bill. They can check your account and tell you how to get your money back.

Could I lose my refund if I wait too long?

Yes, if you don't send your request on time, the council might say no.

Can different property types have different time limits to ask for a Council Tax refund?

No, the time limit is usually the same for all property types. But, it is a good idea to check with your council to be sure.

If the council made a mistake and paid you too much, is there a time limit to ask for your money back?

Yes, there might still be time limits, but the council could be more flexible if the overpayment was their mistake.

Can I get my money back if I paid too much online? Is there a time limit?

Yes, the time limit is the same no matter how you paid. Ask your council to find out more details.

How do you get your money back if you paid too much Council Tax with direct debit?

If you paid too much Council Tax, you can get a refund.

If you use direct debit, the Council might give the refund straight to your bank account.

You can call or ask someone at the Council for help.

You might need to fill out a form to get your money back. You can ask for help with this too.

If you paid too much money because of direct debit, you might need to change your payment details. But getting your money back works the same way.

Can I ask again if my refund request was turned down because I was late?

If your refund request was denied because you missed the deadline, you might still be able to ask again. Here are some steps you can take:

- Check the rules: Look at the company's refund policy to see if you can appeal.

- Write a letter: Write a simple letter explaining why you missed the deadline. Be polite and clear.

- Ask for help: You can ask a friend or family member to help you with the letter.

- Practice talking: If you need to call, practice what you want to say beforehand.

These tips can help you if you want to ask again for your refund.

You might be able to ask for a change if you get a "no" answer. This depends on the rules where you live.

When will I get my money back after my claim is okayed?

How long it takes to get your money back can be different for each council. But, once they say yes to your refund, they should tell you how long it will take.

Do businesses and people have the same time to ask for their money back?

Yes, usually there is a time limit for both. But rules can be different for business places.

Can Another Person Get My Money Back if I Paid Too Much Council Tax?

If you paid too much Council Tax, you might want someone else to help get your money back. Make sure this person is someone you trust.

You might need to give them a letter saying they can do this for you.

If you need help with writing or understanding, ask a friend or use a computer to help you read.

Usually, someone can help you make a claim if they have the right permission and papers.

Do you have to pay money to get a Council Tax refund?

Usually, you don't have to pay any money to get a refund. But, it's a good idea to ask your local council if there are any charges.

What can I do if my council doesn't tell me how long I have to get a refund?

If your local council does not give clear information about how long you have to ask for a refund, you can try these steps:

1. **Ask for Help**: Call or visit the council's office. Ask them to explain the refund rules. You can also check their website.

2. **Look Online**: Sometimes, other websites or people might know and can share information. Try searching online for advice.

3. **Contact a Support Group**: There are groups that can help you understand your rights. They can tell you more about getting refunds.

4. **Write a Letter or Email**: Send a letter or email to the council asking for the refund rules. Make sure to keep a copy.

5. **Ask Someone You Trust**: A friend, family member, or teacher might help you understand or find the information.

Try using tools that read the text out loud or apps that change words into simpler ones. These can make information easier to understand.

You can ask your local council for help. You can also look at citizen advice services for more information.

Can I get my money back if I paid too much Council Tax, but still owe some?

Here is how you can do it:

- Check how much you owe.

- Find out if you paid too much before.

- Contact your local council.

- Ask if you can get money back.

- You might have to pay what you owe first.

Need help? Ask someone you trust or use some tools to help you. You can try:

- Talking to a friend or family member.

- Using a calculator to check your payments.

- Reading guides or asking for easy read information from the council.

Yes, you can get money back if you paid too much Council Tax. But if you owe any money, it might be taken from your refund.

Useful Links

This website offers general information and is not a substitute for professional advice.

Always seek guidance from qualified professionals.

If you have any medical concerns or need urgent help, contact a healthcare professional or emergency services immediately.

Some of this content was generated with AI assistance. We’ve done our best to keep it accurate, helpful, and human-friendly.

- Ergsy carfully checks the information in the videos we provide here.

- Videos shown by Youtube after a video has completed, have NOT been reviewed by ERGSY.

- To view, click the arrow in centre of video.

- Most of the videos you find here will have subtitles and/or closed captions available.

- You may need to turn these on, and choose your preferred language.

- Go to the video you'd like to watch.

- If closed captions (CC) are available, settings will be visible on the bottom right of the video player.

- To turn on Captions, click settings .

- To turn off Captions, click settings again.

More Items From Ergsy search

-

Is there a time limit for claiming a refund on overpaid Council Tax?

Relevance: 100%

-

Are refunds for overpaid Council Tax taxable?

Relevance: 73%

-

How do can I find out if I have overpaid my UK Council Tax?

Relevance: 55%

-

What happens if I do not claim my tax refund?

Relevance: 50%

-

Will my council send a refund check if I overpay?

Relevance: 50%

-

How do I claim my tax refund from HMRC?

Relevance: 46%

-

HMRC Tax Refund letters

Relevance: 44%

-

I received a tax refund letter, but I haven’t overpaid any tax. What should I do?

Relevance: 43%

-

Does overpayment affect my Council Tax band?

Relevance: 43%

-

Can Inheritance Tax be claimed back?

Relevance: 42%

-

Why did I receive a tax refund letter from HMRC?

Relevance: 42%

-

Is the tax refund amount taxable?

Relevance: 40%

-

What is an HMRC tax refund letter?

Relevance: 40%

-

How do I know if I have overpaid my Council Tax?

Relevance: 38%

-

How is the tax refund amount calculated?

Relevance: 38%

-

How long does it take to receive a tax refund from HMRC?

Relevance: 34%

-

What information do I need to provide to claim my refund?

Relevance: 32%

-

What is a P800 form and how does it relate to my tax refund?

Relevance: 32%

-

Can my tax refund be applied to my future tax obligations?

Relevance: 32%

-

Can Stamp Duty be refunded in the UK?

Relevance: 31%

-

I received a refund but think I owe tax instead. What should I do?

Relevance: 31%

-

Are there any fees to claim money back?

Relevance: 30%

-

What should I do if I suspect an error in my Council Tax billing?

Relevance: 29%

-

Where can I get a copy of my Council Tax bill?

Relevance: 29%

-

Will HMRC contact me via phone or email regarding my tax refund?

Relevance: 28%

-

How does council tax relate to wealth in the UK?

Relevance: 28%

-

Citizens Advice Bureau Sees Spike in Queries Related to Council Tax Benefits

Relevance: 28%

-

Three-year limit for child sexual abuse claims to be removed

Relevance: 27%

-

Can I receive my tax refund directly into my bank account?

Relevance: 27%

-

Do online tax services help maximize my refund?

Relevance: 27%

-

Can I access my Council Tax payment history online?

Relevance: 27%

-

Is there a limit to how many EV grants I can claim?

Relevance: 27%

-

Do I need to keep my tax refund letter for future reference?

Relevance: 26%

-

What happens to a deceased’s Income Tax if they were employed?

Relevance: 26%

-

How can I verify that my tax refund letter is genuine?

Relevance: 26%

-

Higher Income Tax - How to Claim Pension Tax Relief | Extra 20% Boost

Relevance: 26%

-

How can I dispute a Council Tax charge?

Relevance: 26%

-

What is the time limit for making a complaint about mis-sold car finance?

Relevance: 24%

-

What happens if Inheritance Tax is not paid on time?

Relevance: 24%

-

Can I amend an online tax return?

Relevance: 24%