Find Help

More Items From Ergsy search

-

Does overpayment affect my Council Tax band?

Relevance: 100%

-

Will my council send a refund check if I overpay?

Relevance: 69%

-

Are refunds for overpaid Council Tax taxable?

Relevance: 62%

-

How do can I find out if I have overpaid my UK Council Tax?

Relevance: 58%

-

What should I do if I suspect an error in my Council Tax billing?

Relevance: 57%

-

Is there a time limit for claiming a refund on overpaid Council Tax?

Relevance: 57%

-

How does council tax relate to wealth in the UK?

Relevance: 55%

-

What details are needed to check for overpayments through my council?

Relevance: 54%

-

What is the nil rate band in Inheritance Tax?

Relevance: 46%

-

Are there any planned changes to tax bands for April 2026?

Relevance: 45%

-

How do I know if I have overpaid my Council Tax?

Relevance: 42%

-

Where can I get a copy of my Council Tax bill?

Relevance: 40%

-

Can I access my Council Tax payment history online?

Relevance: 40%

-

How can I dispute a Council Tax charge?

Relevance: 40%

-

Citizens Advice Bureau Sees Spike in Queries Related to Council Tax Benefits

Relevance: 38%

-

What should I do if I discover an overpayment?

Relevance: 38%

-

Are there any automated notifications for overpayments?

Relevance: 37%

-

What is the residence nil rate band?

Relevance: 36%

-

Mortgage Overpayment and Flexible Features Explained

Relevance: 36%

-

What could cause an overpayment in Council Tax?

Relevance: 35%

-

Can overpayments occur due to discounts or exemptions?

Relevance: 35%

-

What information do I need to check for overpayments?

Relevance: 35%

-

Can moving homes cause a Council Tax overpayment?

Relevance: 33%

-

Could my payment plan affect how overpayments are handled?

Relevance: 33%

-

Can Inheritance Tax be claimed back?

Relevance: 30%

-

Are there tax-free thresholds for inheritance tax?

Relevance: 29%

-

What is the best way to ensure I don't overpay again in the future?

Relevance: 29%

-

Are there any exemptions from inheritance tax?

Relevance: 29%

-

How is the Inheritance Tax bill calculated?

Relevance: 29%

-

What is the residence nil-rate band?

Relevance: 28%

-

How is inheritance tax calculated?

Relevance: 28%

-

What is inheritance tax in the UK?

Relevance: 28%

-

Are there any exemptions or reliefs available for Inheritance Tax?

Relevance: 28%

-

When is inheritance tax due to be paid?

Relevance: 28%

-

What is an HMRC tax refund letter?

Relevance: 27%

-

HMRC Tax Refund letters

Relevance: 27%

-

Is it possible to reduce the Inheritance Tax bill?

Relevance: 27%

-

Local Councils Struggle with Increasing Demand for Welfare Support

Relevance: 26%

-

What are HMRC Income Tax Changes in April 2026?

Relevance: 26%

-

Why did I receive a tax refund letter from HMRC?

Relevance: 26%

Understanding Council Tax Bands

In the UK, Council Tax is a local taxation system used to fund local government services. Properties are assigned a Council Tax band between A and H, based on their estimated value in April 1991. The band determines the amount of Council Tax payable. It's important to understand how factors like overpayments can affect your Council Tax band, if at all.

Overpayment of Council Tax

Overpayment occurs when you pay more Council Tax than you owe for your assigned band. This situation can arise due to changes in household composition, benefits entitlements, or administrative errors. It's essential to monitor your payments and ensure they align with the amount due for your Council Tax band to avoid overpayment.

Does Overpayment Affect Your Council Tax Band?

Overpayment of Council Tax itself does not affect your Council Tax band. The band is determined by the property's value as of 1991, and changes in payments have no bearing on this assessment. The valuation office agency is responsible for assigning bands, and these do not fluctuate based on payment history. Overpayment simply means you have paid more than required for the current band, and typically results in a credit to your account.

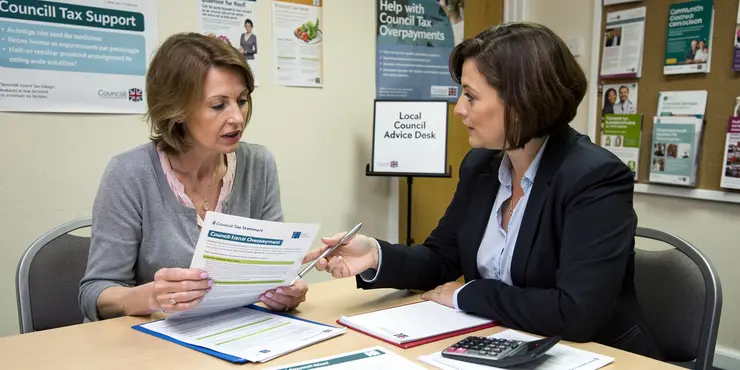

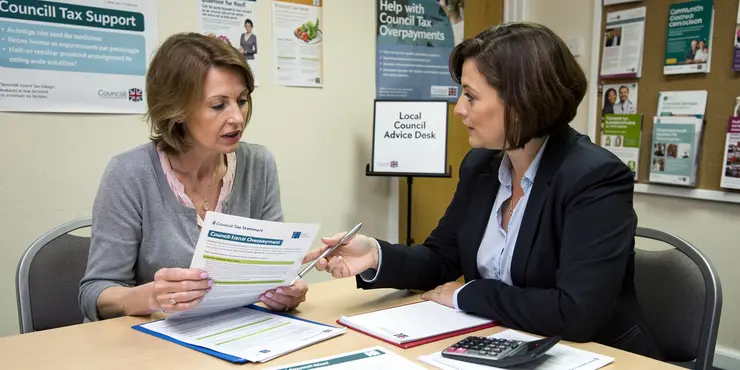

Refunds and Adjustments

If you find that you’ve overpaid your Council Tax, you can request a refund from your local council. Councils have specific procedures for dealing with overpayments, which often involve verifying your payment history and current entitlements. In most cases, if an overpayment is confirmed, the council will either refund the extra amount or apply a credit to your account, reducing future payments.

Challenging Your Council Tax Band

While overpayment doesn’t affect your band directly, you might find it worth challenging your band if you believe it's incorrect. To do so, you must contact the Valuation Office Agency (VOA) and provide evidence supporting your claim. Successful challenges can potentially lower your band and reduce future payments. Only factors related to the property or changes in the local area affecting property value are typically considered valid grounds for re-evaluation.

Maintaining Accurate Payments

To prevent overpayments, maintain accurate records of your Council Tax bills and payments. Ensure you’re aware of any benefits or discounts you’re entitled to, such as the single person discount, which can reduce your bill by 25%. Automatic payment methods like direct debits can help streamline the process and reduce the likelihood of overpaying.

Conclusion

Overpayment of Council Tax does not affect your Council Tax band, which is determined by property value as of 1991. However, staying informed about your payments and regularly reviewing your bills can help ensure you pay the correct amount. If you believe your band is incorrect, you can contact the VOA to request a reassessment, potentially resulting in reduced payments. Managing Council Tax efficiently helps avoid overpayments and supports effective personal finance management.

Understanding Council Tax Bands

In the UK, we pay a tax called Council Tax to help local services. Every home has a Council Tax band between A and H. This is based on how much the home was worth in 1991. The band tells us how much Council Tax we need to pay.

Overpayment of Council Tax

Sometimes, people pay more Council Tax than they need to. This is called overpayment. This can happen if the number of people in a home changes, if you get certain benefits, or if mistakes are made. It’s important to keep track of what you pay to avoid paying too much.

Does Overpayment Affect Your Council Tax Band?

Paying too much Council Tax does not change your band. The band is based on how much your home was worth in 1991. Your payment history doesn’t change this. If you overpay, you will have a credit in your account.

Refunds and Adjustments

If you pay too much, you can ask your local council for a refund. The council will check your payments. If you have paid too much, they will give you the extra money back or reduce future payments.

Challenging Your Council Tax Band

If you think your band is wrong, you can try to change it. You need to contact the Valuation Office Agency (VOA) and show why you think the band is wrong. If they agree, your band might go down, and you will pay less.

Maintaining Accurate Payments

To avoid paying too much, keep a record of your Council Tax bills. Check if you can get discounts, like a single person discount that takes 25% off your bill. Using direct debits to pay can also help you avoid overpayment.

Conclusion

Paying too much Council Tax doesn’t change your band, which is decided by how much your home was worth in 1991. Check your payments often to make sure you pay the right amount. If your band seems wrong, contact the VOA. Managing your Council Tax well helps you handle your money better.

Frequently Asked Questions

What is a Council Tax band?

A Council Tax band is a category assigned to a property based on its value, which determines how much Council Tax is charged.

Can overpayment of Council Tax affect my Council Tax band?

No, overpayment of Council Tax does not affect your Council Tax band. Bands are based on property values, not payment history.

What should I do if I've overpaid my Council Tax?

If you've overpaid, you should contact your local council to discuss a refund or adjusting future payments.

How is my Council Tax band determined?

Council Tax bands are determined by the value of your property as of April 1, 1991, in England and Scotland.

Can I request a revaluation of my property for Council Tax purposes?

Yes, you can request a revaluation if you believe your property is in the wrong band, but overpayment does not constitute a valid reason for revaluation.

Will a refund for overpayment change my Council Tax band?

No, receiving a refund does not affect your Council Tax band.

Does changing my payment plan affect my Council Tax band?

No, changing your payment plan does not alter your Council Tax band.

How can I pay my Council Tax?

Council Tax can be paid online, via direct debit, by phone, or in person at your local council.

If I inherit a property, will the Council Tax band change?

Inheriting a property does not automatically change its Council Tax band.

Are there any exemptions that might affect my Council Tax band?

Certain exemptions and discounts might apply to your Council Tax bill, but they do not change the band.

Can adjustments be made to my Council Tax bill without changing the band?

Yes, discounts, exemptions, or benefits can adjust your bill without affecting your band.

What happens if I underpay my Council Tax?

Underpayment might result in penalties or additional fees, but it does not change your Council Tax band.

Can property improvements affect my Council Tax band?

Yes, significant improvements might affect your band if the property is sold or revalued.

Will overpayment speed up the band reconsideration process?

Overpayment does not influence how quickly a band might be reassessed.

How can I find out my property’s Council Tax band?

You can find out your Council Tax band by checking your council's website or contacting them directly.

Can an error in billing affect my Council Tax band?

An error in billing does not affect your band, but it should be corrected to ensure accurate charges.

Why doesn't overpayment affect my Council Tax band?

Overpayment is a financial matter, while bands are based on property assessments and valuations.

Can switching to online payment affect my Council Tax band?

Switching to online payment methods does not impact your band.

Who assesses the value of a property for Council Tax banding?

In England, for example, the Valuation Office Agency assesses property values for tax banding.

What factors might lead to a revision of my Council Tax band?

Factors include property alterations, inaccuracies, or changes in the property's use or status.

What is a Council Tax band?

A Council Tax band is a letter, like A, B, C, or D. These letters show how much tax you need to pay for your home.

Each home is put in a group, or 'band', based on how much it was worth in the past.

Use tools like text-to-speech to help read tricky words.

A Council Tax band is a group that your home is put into based on how much it is worth. This group helps decide how much Council Tax you have to pay.

If you find this hard to read, you can ask someone to help you understand, use a text-to-speech tool to listen, or try breaking it down into smaller parts.

Will paying too much Council Tax change my Council Tax band?

No, paying too much Council Tax does not change your Council Tax band. Your band is decided by how much your home is worth, not by how much you pay.

What to Do if You Paid Too Much Council Tax

If you think you paid too much Council Tax, don't worry. Here’s how you can fix it:

- Check your payment. Make sure it is more than what you owe.

- Contact your local council. They can help you find out more.

- Ask for a refund. The council might give you the extra money back.

Tools and Tips:

- Use a calculator to check your payments.

- Ask a friend or family member to help you call the council.

- Write down important things the council tells you.

If you paid too much money, talk to your local council. They can help you get your money back or change what you pay next time.

How does my Council Tax band get decided?

Your Council Tax band is a letter like A, B, or C. It tells how much you pay for your house.

The band is decided by:

- The value of your house: How much your house cost at a certain time (like in 1991).

- Where you live: Different places can have different bands for houses.

If you want help, you can:

- Ask a family member or friend to explain.

- Use a computer to find more information online.

Council Tax bands are groups that tell us how much tax you need to pay for your home. The groups are chosen by looking at what your home was worth on April 1, 1991. This is in England and Scotland.

Can I ask for my home to be checked again for Council Tax?

If you think your Council Tax is wrong, you can ask for your home to be checked again.

Here is how you can ask for a check:

- Write a letter to the Council Tax office.

- Explain why you want your home checked again.

Tools that can help you:

- Ask someone to help you write the letter.

- Use a computer to type your letter.

- Call the Council Tax office for advice.

You can ask for a band change if you think your home is in the wrong group. But paying too much is not a reason for changing the group.

- Use simple language when asking for a change.

- Get help from an adult or friend if you need it.

- Use a dictionary or online tools if you don't understand some words.

Will getting money back change my Council Tax band?

If you paid too much Council Tax, you might get some money back. But this will not change your Council Tax band. Your band stays the same.

If you need help, you can ask someone at your Council office. You can also use tools like a calculator or ask a friend to help you understand.

No, getting money back does not change your Council Tax band.

Will changing how I pay change my Council Tax band?

If you change the way you pay your Council Tax, it does not change your Council Tax band.

Your Council Tax band is set by the government. It does not change if you pay differently.

For help with payments, you can:

- Use a calculator to plan your money.

- Ask someone you trust for advice with your bills.

No, changing how you pay does not change your Council Tax band.

How can I pay my Council Tax?

You have to pay Council Tax every month. Here are some easy ways to pay:

- Direct Debit: You can ask the bank to send the money for you every month.

- Online: Go to the Council website and pay there.

- Phone: Call the Council and pay with your bank card.

- Post Office: Take your bill to the Post Office and pay there.

If you need help, ask someone you trust or call the Council for support. Use a calendar or phone reminder to help you remember to pay on time.

You can pay Council Tax in different ways. You can pay online, set up a direct debit, use the phone, or go to your local council office.

If I get a house from someone, will the Council Tax change?

If you get a house from someone, it doesn't change the house's Council Tax group right away.

Can anything change my Council Tax band?

Your Council Tax band might be different if some special rules apply. Here are some helpful ways to understand:

Simple Words: Use short and clear sentences.

Pictures: Look for images or diagrams to help explain.

Ask for Help: A family member or friend can read with you.

These steps make it easier to find out about Council Tax bands.

Sometimes, you can pay less Council Tax. These are called exemptions and discounts. They won't change your tax band's letter, but they can make your bill smaller.

Can my Council Tax bill be changed without changing the band?

You might be able to pay less Council Tax without changing your band. Here are some ways to help:

- Discounts: You can ask if you can get a discount. This means you pay less money. For example, if you live alone, you may get a discount.

- Exemptions: Some people don’t have to pay Council Tax. Check if you can be exempt.

- Support: Ask for Council Tax support. This can help you if you have a low income.

If you need help, you can:

- Call your local council for advice.

- Look at your council's website.

- Speak to a support worker if you have one.

Yes, there are special discounts and benefits that can lower your bill. They don’t change your group or category.

What happens if I do not pay all my Council Tax?

If you do not pay the full amount of your Council Tax, here is what could happen:

- The Council might send you a reminder letter.

- They might ask you to pay the rest of the money.

- If you still don't pay, they might take more serious steps.

To make it easier to pay:

- Speak to someone at the Council. They can help you understand.

- You might be able to set up a payment plan.

- Using a calendar or phone reminders can help you remember to pay on time.

If you pay too little, you might have to pay extra money, but your Council Tax band stays the same.

Can fixing up my home change my Council Tax band?

Yes, big changes might change your band if you sell the house or if it is looked at for its new value.

If I pay too much, will it make the band reconsideration faster?

Paying too much does not make the band get checked faster.

How can I find out my property's Council Tax band?

To know your home's Council Tax band, follow these steps:

- Go to the official government website.

- Look for 'Council Tax band'.

- Enter your home address or postcode.

- You will see your Tax band.

Ask a friend or family member for help if you need it. You can also use a computer or smartphone to complete these steps.

You can find out what your Council Tax band is by looking at your council's website. You can also call them and ask.

Can a mistake in my bill change my Council Tax band?

A mistake in your bill does not change your band, but it should be fixed so the charges are right.

Why does paying too much not change my Council Tax band?

When you pay too much Council Tax, it does not change the band for your home. The band is set by the value of your home. Paying extra money does not change this value.

If you need help understanding or paying your Council Tax, you can:

- Talk to someone at the council office

- Use an online calculator to see if you can get a discount

- Ask a family member or friend to read it with you

Overpayment is about money. Bands are about how much a property is worth.

Will paying online change my Council Tax group?

Changing to paying online does not change your group.

Who decides how much a house is worth for Council Tax bands?

In England, there is a group called the Valuation Office Agency. They look at how much houses and buildings are worth for taxes.

What could change my Council Tax group?

Sometimes your house can be put in a different tax group. Here are some reasons why this might happen:

- You made your house bigger, like adding another room.

- The old tax group was wrong from the start.

- Houses like yours are paying different tax now.

If you're unsure, you can ask someone for help or use special tools online.

Reasons might be changes to the building, mistakes, or if the way the building is used has changed.

Useful Links

This website offers general information and is not a substitute for professional advice.

Always seek guidance from qualified professionals.

If you have any medical concerns or need urgent help, contact a healthcare professional or emergency services immediately.

Some of this content was generated with AI assistance. We’ve done our best to keep it accurate, helpful, and human-friendly.

- Ergsy carfully checks the information in the videos we provide here.

- Videos shown by Youtube after a video has completed, have NOT been reviewed by ERGSY.

- To view, click the arrow in centre of video.

- Most of the videos you find here will have subtitles and/or closed captions available.

- You may need to turn these on, and choose your preferred language.

- Go to the video you'd like to watch.

- If closed captions (CC) are available, settings will be visible on the bottom right of the video player.

- To turn on Captions, click settings .

- To turn off Captions, click settings again.

More Items From Ergsy search

-

Does overpayment affect my Council Tax band?

Relevance: 100%

-

Will my council send a refund check if I overpay?

Relevance: 69%

-

Are refunds for overpaid Council Tax taxable?

Relevance: 62%

-

How do can I find out if I have overpaid my UK Council Tax?

Relevance: 58%

-

What should I do if I suspect an error in my Council Tax billing?

Relevance: 57%

-

Is there a time limit for claiming a refund on overpaid Council Tax?

Relevance: 57%

-

How does council tax relate to wealth in the UK?

Relevance: 55%

-

What details are needed to check for overpayments through my council?

Relevance: 54%

-

What is the nil rate band in Inheritance Tax?

Relevance: 46%

-

Are there any planned changes to tax bands for April 2026?

Relevance: 45%

-

How do I know if I have overpaid my Council Tax?

Relevance: 42%

-

Where can I get a copy of my Council Tax bill?

Relevance: 40%

-

Can I access my Council Tax payment history online?

Relevance: 40%

-

How can I dispute a Council Tax charge?

Relevance: 40%

-

Citizens Advice Bureau Sees Spike in Queries Related to Council Tax Benefits

Relevance: 38%

-

What should I do if I discover an overpayment?

Relevance: 38%

-

Are there any automated notifications for overpayments?

Relevance: 37%

-

What is the residence nil rate band?

Relevance: 36%

-

Mortgage Overpayment and Flexible Features Explained

Relevance: 36%

-

What could cause an overpayment in Council Tax?

Relevance: 35%

-

Can overpayments occur due to discounts or exemptions?

Relevance: 35%

-

What information do I need to check for overpayments?

Relevance: 35%

-

Can moving homes cause a Council Tax overpayment?

Relevance: 33%

-

Could my payment plan affect how overpayments are handled?

Relevance: 33%

-

Can Inheritance Tax be claimed back?

Relevance: 30%

-

Are there tax-free thresholds for inheritance tax?

Relevance: 29%

-

What is the best way to ensure I don't overpay again in the future?

Relevance: 29%

-

Are there any exemptions from inheritance tax?

Relevance: 29%

-

How is the Inheritance Tax bill calculated?

Relevance: 29%

-

What is the residence nil-rate band?

Relevance: 28%

-

How is inheritance tax calculated?

Relevance: 28%

-

What is inheritance tax in the UK?

Relevance: 28%

-

Are there any exemptions or reliefs available for Inheritance Tax?

Relevance: 28%

-

When is inheritance tax due to be paid?

Relevance: 28%

-

What is an HMRC tax refund letter?

Relevance: 27%

-

HMRC Tax Refund letters

Relevance: 27%

-

Is it possible to reduce the Inheritance Tax bill?

Relevance: 27%

-

Local Councils Struggle with Increasing Demand for Welfare Support

Relevance: 26%

-

What are HMRC Income Tax Changes in April 2026?

Relevance: 26%

-

Why did I receive a tax refund letter from HMRC?

Relevance: 26%