Important Information On Using This Service

- Ergsy carefully checks the information in the videos we provide here.

- Videos shown by YouTube after a video has completed have NOT been reviewed by ERGSY.

- To view, click the arrow in the center of the video.

Using Subtitles and Closed Captions

- Most of the videos you find here will have subtitles and/or closed captions available.

- You may need to turn these on and choose your preferred language.

Turn Captions On or Off

- Go to the video you'd like to watch.

- If closed captions (CC) are available, settings will be visible on the bottom right of the video player.

- To turn on captions, click settings.

- To turn off captions, click settings again.

Find A Professional

Videos from Ergsy search

More Videos of Interestdiagnosis

Related Videosdiagnosis

What Happens When Pensions Go Bust in the UK

Understanding Pension System Collapse

When we talk about pensions going bust, it's a scenario where a pension fund becomes unable to meet its financial obligations to its members. This can occur due to mismanagement, poor investment performance, or sudden economic downturns. In the UK, pensions can be either public, such as the State Pension, or private, including workplace and personal pensions. A collapse in the pension system can have far-reaching consequences on individuals’ financial stability and the broader economy.

Impact on Retirees

If a pension fund collapses, current retirees who rely heavily on their pension income may face significant financial challenges. Many pensioners could see their expected income reduced, which might lead to difficulties in covering living expenses, medical costs, or housing. This can severely affect their quality of life and create a sudden reliance on state benefits as a temporary cushion. The social safety nets, however, may not fully compensate for the loss, potentially stretching government resources even thinner.

Effect on Future Pensioners

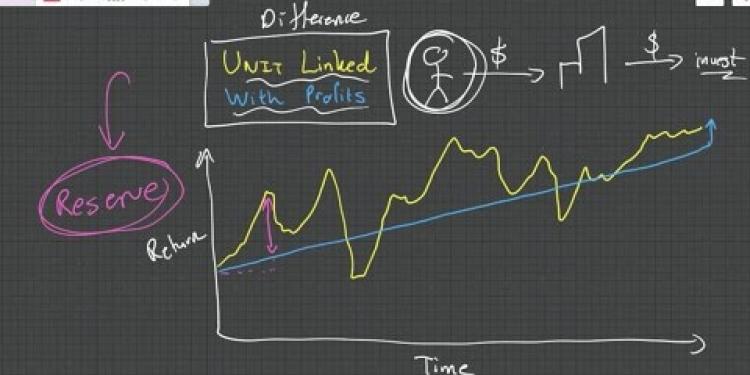

For those not yet retired, a pension collapse can mean uncertainty about future income. Workers who are building their pension pots may find that their projected retirement savings diminish, which could alter their retirement plans significantly. This uncertainty might prompt individuals to increase personal savings or seek alternative investments, placing additional strain on personal resources and financial planning. It could also shake confidence in pension schemes as a whole, impacting future participation rates.

Government and Regulatory Response

In the event of a pension system collapse, the UK government and regulatory bodies typically intervene to mitigate the situation. The Pension Protection Fund (PPF), for instance, provides a safety net for members of defined benefit pension schemes. However, the protection is capped and does not always cover 100% of the expected pension. Additionally, regulators may strengthen oversight, introducing stricter rules on pension fund management to prevent similar occurrences. These actions, while helpful, may not be able to fully restore lost pension values, but they are crucial in maintaining trust in the system.

Long-term Consequences

The long-term consequences of pension fund collapses can be severe. They may lead to increased poverty rates among the elderly and heighten inequality, as wealth isn’t evenly distributed to begin with. Battered trust in pension schemes can lead to less engagement with retirement saving plans. Moreover, it can place additional burdens on younger generations, who may have to support older family members financially. This complex interplay highlights the importance of robust pension management and the need for diversified retirement planning.

Frequently Asked Questions

What happens when a pension fund goes bust in the UK?

If a pension fund goes bust in the UK, the Pension Protection Fund (PPF) steps in to protect members of defined benefit pension schemes. The PPF pays compensation to members, although it may not be the full amount originally promised by the pension scheme.

What is the Pension Protection Fund?

The Pension Protection Fund (PPF) is a UK government-established fund that provides compensation to members of eligible defined benefit pension schemes whose employers become insolvent and cannot fulfill their pension obligations.

Who is eligible for compensation from the PPF?

Members of defined benefit pension schemes are eligible for compensation from the PPF if their employer becomes insolvent and the pension scheme cannot meet its obligations.

How does the PPF determine the amount of compensation?

The PPF pays 100% compensation to those who have reached their pension age, while those below pension age typically receive 90% of their pension benefits, subject to a cap.

Are defined contribution pensions protected if the provider goes bust?

Defined contribution pensions are usually not covered by the PPF. However, they are protected under the Financial Services Compensation Scheme (FSCS) up to certain limits if the provider collapses.

What is the impact on pensioners if a pension system collapses?

If a pension system collapses, pensioners may face reduced benefits, delayed payments, and increased uncertainty around their financial security. The PPF can mitigate the impact for defined benefit schemes.

Why do pension funds go bust?

Pension funds may go bust due to factors such as poor investment performance, insufficient contributions, demographic changes, or the insolvency of sponsoring employers.

Can pension scheme members influence how their pension is managed?

Members typically have limited direct influence over how their defined benefit pension is managed, but in defined contribution schemes, they may have some choice over investment options.

What is a defined benefit pension scheme?

A defined benefit pension scheme promises a specified monthly benefit at retirement, often based on salary and years of service, and is generally employer-funded.

What is a defined contribution pension scheme?

A defined contribution pension scheme is a retirement plan where contributions are made to an individual account for each member, and benefits depend on the contributions made and the investment performance of the fund.

How does insolvency impact pension funds?

When a company becomes insolvent, it may no longer be able to contribute to its pension scheme, potentially leading to a shortfall in the fund and triggering intervention by the PPF for defined benefit schemes.

Can pensioners lose all their money if a pension provider fails?

It is unlikely that pensioners will lose all their money if a pension provider fails due to protective measures like the PPF and FSCS. However, they may receive reduced benefits.

What can pension fund members do if their fund is at risk of failing?

Members should stay informed about their pension scheme's funding status and seek advice from financial advisors if they have concerns about their fund's stability.

What role does government regulation play in protecting pensions?

Government regulation imposes funding requirements, investment rules, and oversight mechanisms to ensure pensions are managed responsibly and to offer protection via entities like the PPF.

How can individuals protect their retirement savings?

Individuals can protect their retirement savings by diversifying their investments, regularly reviewing their pension performance, and considering additional savings routes such as ISAs or personal pension plans.

Useful Links

More Videos of Interestdiagnosis

Related Videosdiagnosis

Have you found an error, or do you have a link or some information you would like to share? Please let us know using the form below.

- Ergsy carfully checks the information in the videos we provide here.

- Videos shown by Youtube after a video has completed, have NOT been reviewed by ERGSY.

- To view, click the arrow in centre of video.

- Most of the videos you find here will have subtitles and/or closed captions available.

- You may need to turn these on, and choose your preferred language.

- Go to the video you'd like to watch.

- If closed captions (CC) are available, settings will be visible on the bottom right of the video player.

- To turn on Captions, click settings .

- To turn off Captions, click settings again.