Find Help

More Items From Ergsy search

-

UNDERSTANDING YOUR STUDENT LOAN: A GUIDE FOR ENGLISH STUDENTS STARTING AN UNDERGRADUATE COURSE 2023

Relevance: 100%

-

Is bankruptcy an option for student loan discharge?

Relevance: 47%

-

Student Finance: Should I pay more? | Plan 1 & Plan 2 | SF Explained

Relevance: 46%

-

What happens if I default on my student loan?

Relevance: 46%

-

Can interest rates on student loans be reduced?

Relevance: 45%

-

Can I negotiate a settlement for my student loan?

Relevance: 45%

-

Are there implications for student loan repayments with 2026 changes?

Relevance: 45%

-

What happens if i can not afford to repay my student loan?

Relevance: 45%

-

Can my wages be garnished for unpaid student loans?

Relevance: 43%

-

Can I get my student loans forgiven if I can't repay them?

Relevance: 42%

-

Is there an income threshold for students to qualify for the payment?

Relevance: 41%

-

What criteria must be met for students to receive the payment?

Relevance: 41%

-

How does missing student loan payments affect my credit score?

Relevance: 41%

-

What funding options are available for nursing students in the UK?

Relevance: 41%

-

Is documentation of student status required for the payment?

Relevance: 39%

-

What should I do if I can't afford to repay my student loan?

Relevance: 39%

-

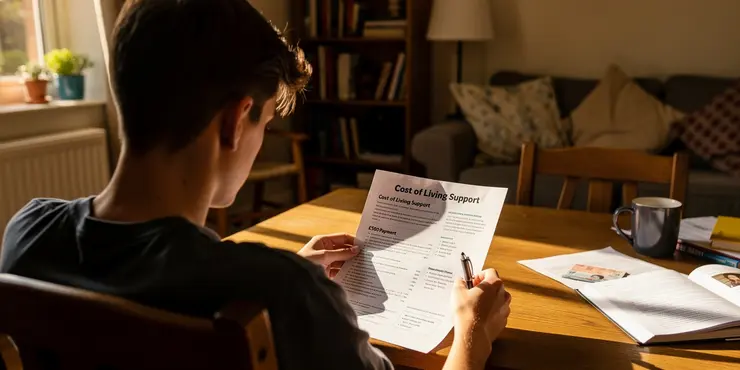

Can students apply for Cost-of-Living support?

Relevance: 36%

-

Can part-time students apply for the £500 payment?

Relevance: 36%

-

Are students eligible for the £500 cost of living payment?

Relevance: 34%

-

What is the process for applying to a nursing degree course?

Relevance: 34%

-

What happens to my loans if I go back to school?

Relevance: 33%

-

Do international students need the meningitis vaccine?

Relevance: 33%

-

Will students receive the payment directly into their bank accounts?

Relevance: 33%

-

Do international students qualify for the £500 payment?

Relevance: 32%

-

How can teachers support students with ADHD?

Relevance: 32%

-

Are students required to pay for a TV license?

Relevance: 31%

-

Can students receive the £500 cost of living payment?

Relevance: 31%

-

Can mature students apply for the £500 cost of living payment?

Relevance: 31%

-

Are school meals free for all students in the UK?

Relevance: 30%

-

How can students apply for the £500 cost of living payment?

Relevance: 30%

-

Should college students get the meningitis vaccine?

Relevance: 30%

-

Can I get a job with the National Trust if I am a student?

Relevance: 29%

-

Can students receive the payment if they are already receiving other scholarships?

Relevance: 29%

-

What is the deadline for students to apply for the £500 payment?

Relevance: 28%

-

Do students need to provide proof of expenses to receive the payment?

Relevance: 27%

-

What is loan rehabilitation?

Relevance: 27%

-

How does the payment affect students' financial aid packages?

Relevance: 27%

-

What should students do if their application for the payment is denied?

Relevance: 27%

-

Can first aid courses be applied for college credit?

Relevance: 25%

-

Will interest accrue during deferment?

Relevance: 25%

Understanding Your Student Loan: A Guide for English Students Starting an Undergraduate Course 2023

Eligibility Criteria

To apply for a Student Loan in England, students must meet certain eligibility requirements. Candidates should be enrolled in a recognized undergraduate course and be a UK citizen, have settled status, or meet residency requirements. It’s crucial to check the updated criteria on the government’s official website to ensure eligibility.Tuition Fee Loans

Tuition Fee Loans cover the cost of your course, up to £9,250 per year for public universities or colleges. They are paid directly to your institution. This means you won't need to pay any tuition upfront. The loan is available irrespective of household income, ensuring all eligible students have access to higher education.Maintenance Loans

Maintenance Loans help with living expenses such as accommodation, food, and travel. The amount you can borrow depends on several factors: household income, whether you are living at home, and whether you are studying in London. As of 2023, students not living with their parents can receive up to £9,978, while those studying in London can get up to £13,022.How to Apply

Applying for a Student Loan is straightforward and is done through Student Finance England. Applications can be completed online, and you’ll need to provide relevant documents like identification and income evidence. Ensure you apply early to avoid delays in funding.Repayment Terms

Repayment of your Student Loan begins the April after you graduate or leave your course, but only if your income exceeds the repayment threshold. In 2023, the threshold is £27,295 a year. You will repay 9% of your income above this amount. If your earnings drop below the threshold, repayments pause.Interest Rates

Interest on your Student Loan is based on the Retail Price Index (RPI) plus a variable rate dependent on your income. While studying, the interest is RPI + 3%. After graduating, those earning below £27,295 will incur RPI interest, while those earning above will have RPI + up to 3%.Additional Support

Additional financial support is available for students with dependents, disabilities, or other special circumstances. Grants, bursaries, and scholarships can also complement your student loan and do not require repayment. Explore your university's financial aid office for more options.Conclusion

Understanding the intricacies of Student Loans is pivotal for a worry-free university experience. By knowing your eligibility, understanding the types of loans, and the repayment terms, you can better manage your finances and focus on your studies. Always keep updated with the latest information from Student Finance England.Understanding Your Student Loan: A Guide for English Students Starting an Undergraduate Course 2023

Introduction to Student Loans

Starting university is an exciting time, but it often comes with financial challenges. Understanding your student loan options can help alleviate some of your worries. For students in the United Kingdom, the government offers tuition fee loans and maintenance loans to support your undergraduate studies.

Types of Student Loans

Tuition Fee Loan: This loan covers the full cost of your course fees, up to £9,250 per year. It is paid directly to your university or college.

Maintenance Loan: This loan helps with living costs, such as accommodation, food, and travel. The amount you receive depends on your household income, where you study, and whether you live at home or away.

Eligibility Criteria

To qualify for a student loan, you must be a UK or EU national, or have 'settled status,' and you've lived in the UK for at least three years before the start of your course. You must also be studying for your first higher education qualification.

Application Process

Apply online via the Student Finance England website. The application process involves providing details about your course, your family's income, and your national identity. It's advisable to apply early to ensure your finances are in place for the start of the academic year.

Repayment Terms

You only start repaying your student loan from the April after you graduate and earn above a certain threshold, currently £27,295 per year. Repayments are automatically deducted from your salary at a rate of 9% on income above this threshold.

Interest Rates

Interest is applied to your loan from the day you receive the first payment. The interest rate is based on the Retail Price Index (RPI) plus up to 3%, depending on your income.

Conclusion

Navigating student loans can be daunting, but understanding the basics can make the process smoother. These loans are designed to make higher education accessible and to be manageable to repay once you are earning a steady income.

Understanding Your Student Loan: A Simple Guide for English Students Starting University in 2023

Can You Get a Student Loan?

To get a Student Loan in England, students need to meet some rules. You must be in a recognized university course and be a UK citizen, have settled status, or meet certain living requirements. Always check the latest rules on the government website to see if you can get a loan.Loans for Course Fees

Tuition Fee Loans pay for your course. They can cover up to £9,250 per year for public universities or colleges. This money goes straight to your school, so you do not pay upfront. You can get this loan no matter how much your family earns. This makes sure everyone can go to university.Loans for Living Costs

Maintenance Loans help pay for things like rent, food, and travel. How much you get depends on your family’s income, if you live at home, or if you are studying in London. In 2023, living away from home gets you up to £9,978. Studying in London can get you up to £13,022.How to Get a Loan

Getting a Student Loan is easy. You apply through Student Finance England online. You will need important papers like ID and proof of income. Apply early so you get your money on time.Paying Back Your Loan

You start to pay back your Student Loan in April after you finish or leave your course, but only if you earn enough money. In 2023, you start paying back when you earn more than £27,295 a year. You pay 9% of what you earn over this amount. If you earn less, you stop paying.Interest on Your Loan

Interest is the extra money added to your loan. While you study, it's Retail Price Index (RPI) + 3%. After you finish, if you earn less than £27,295, it’s just RPI. If you earn more, it’s RPI + up to 3%.Extra Help

You can get more help if you have children, disabilities, or special needs. Grants, bursaries, and scholarships are other ways to get money and you do not have to pay these back. Ask your university's finance office for more choices.Finish

Knowing all about Student Loans is important to enjoy university without money worries. Understand if you can get a loan, the types of loans, and how to pay back your loan. Always check the latest news from Student Finance England to stay informed.Understanding Your Student Loan: A Guide for English Students Starting an Undergraduate Course 2023

Introduction to Student Loans

Going to university is exciting, but it can also cost a lot of money. Student loans can help with these costs. In the UK, the government gives two main types of loans: tuition fee loans and maintenance loans. These help you pay for your studies.

Types of Student Loans

Tuition Fee Loan: This loan pays for your course fees, up to £9,250 each year. The money goes straight to your university or college.

Maintenance Loan: This loan helps you with living expenses, like where you live, food, and travel costs. How much you get depends on your family's income, where your university is, and if you live at home or not.

Eligibility Criteria

To get a loan, you must be from the UK or EU, or have 'settled status'. You need to have lived in the UK for at least three years before your course starts. It must be your first time doing a degree.

Application Process

Apply online at the Student Finance England website. You need to give details like your course, your family's income, and who you are. It's a good idea to apply early, so your money is sorted before your course begins.

Repayment Terms

You only pay back your loan from the April after you finish your course. You start paying when you earn above £27,295 a year. The payments come out of your pay automatically, and it’s 9% of anything you earn over that amount.

Interest Rates

Interest is added to your loan from when you get the first payment. The rate depends on the Retail Price Index (RPI) and can be up to 3%, based on what you earn.

Conclusion

Understanding student loans can be confusing, but knowing the basics helps. These loans are there to make studying easier to afford. You pay them back once you have a steady job and income.

Frequently Asked Questions

What types of student loans are available for undergraduate students in the UK?

Undergraduate students in the UK can apply for Tuition Fee Loans, Maintenance Loans, and, in certain circumstances, other financial support such as grants or bursaries.

Who is eligible for a student loan in the UK?

Eligibility typically requires that you be a UK resident, starting your first undergraduate degree, and studying at a recognised institution. Specific criteria may apply for EU nationals and other international students.

How do I apply for a student loan?

Applications can be made online through Student Finance England. You'll need to provide details about your course, your household income, and evidence of your identity.

What is the submission deadline for student loan applications?

The deadline to apply for a student loan is typically 9 months after the start of the academic year.

How much can I borrow for tuition fees?

The Tuition Fee Loan covers the full cost of your course fees, up to £9,250 per year for courses at publicly-funded institutions.

What is the Maintenance Loan and how much can I get?

Maintenance Loans are designed to help with living costs. The amount you can borrow depends on your household income, where you live, and whether you live at home or independently.

When do I start repaying my student loan?

Repayments start in the April after you graduate or leave your course, but only if you're earning above the repayment threshold.

What is the current repayment threshold?

As of 2023, the repayment threshold is £27,295 per year, £2,274 a month, or £524 a week before tax.

How is the repayment amount calculated?

You’ll repay 9% of your income above the repayment threshold. The amount you repay depends on how much you earn, not how much you borrowed.

Are there any interest charges on student loans?

Yes, interest is charged from the day you receive your first payment until your loan is repaid in full or cancelled. The rate depends on the Retail Price Index (RPI) and other factors.

Can my student loan be written off?

Yes, your loan will be written off after 30 years from the April you were first due to repay, or if you become permanently disabled and unable to work.

Can I make voluntary repayments?

Yes, you can make voluntary repayments at any time without penalty.

What happens if I can't pay back my loan?

If your income is below the threshold, you won't have to make repayments. After 30 years, any remaining loan amount will be written off.

How do student loans affect my credit score?

Student loans do not appear on your credit report and don’t directly affect your credit score. However, lenders may consider your repayments when assessing your affordability for other forms of credit.

What should I do if my circumstances change?

You must inform Student Finance England if your personal or academic circumstances change, such as changing your course, institution, or if your household income changes significantly.

What is a student loan?

A student loan is financial support provided by the UK government to help cover the cost of tuition fees and living expenses for students pursuing higher education.

Who is eligible for a student loan?

Eligibility for a student loan in the UK generally depends on factors like your course, your age, your nationality or residency status, and whether you've studied a higher education course before.

How do I apply for a student loan?

You can apply for a student loan online through the Student Finance England website or by completing a paper application form.

What types of student loans are available?

There are two main types of student loans: Tuition Fee Loans and Maintenance Loans. Tuition Fee Loans cover the cost of your course fees, while Maintenance Loans help with living costs.

How much can I borrow for tuition fees?

For 2023, you can borrow up to £9,250 per year to cover tuition fees if you are studying at a publicly funded university.

How much can I borrow for living costs?

The amount you can borrow for living costs varies based on factors such as your household income, where you study, and whether you live at home. For the 2023/24 academic year, it ranges from £3,775 to £9,978 per year.

Do I need a guarantor for a student loan?

No, you do not need a guarantor to apply for a student loan through Student Finance England.

When do I start repaying my student loan?

You start repaying your student loan in the April after you finish or leave your course, but only if your income is over the repayment threshold.

What is the repayment threshold for student loans?

For the 2023/24 tax year, the repayment threshold is £27,295 per year, £2,274 per month, or £524 per week before tax and other deductions.

How are student loan repayments calculated?

Repayments are calculated as 9% of any income you earn over the repayment threshold.

Is there interest on student loans?

Yes, interest is charged on student loans. The rate is based on the Retail Price Index (RPI) and varies depending on your income and circumstances.

Can I make extra repayments or pay off my student loan early?

Yes, you can make extra repayments or pay off your student loan early without any penalties.

What happens if I go abroad after my studies?

If you move abroad, you will still need to make repayments based on your income and the country you are living in. You must inform the Student Loans Company of your move.

What if I can’t afford my repayments?

If your income falls below the repayment threshold, your repayments will stop until your income goes above the threshold again.

How long will it take to repay my loan?

The time it takes to repay your loan varies depending on your income and the amount borrowed. Any outstanding loan is usually written off 30 years after you become eligible to repay.

What student loans can students in the UK get?

If you are a student in the UK, there are two main types of loans you can apply for:

1. Tuition Fee Loan: This loan helps pay for your course fees. The money goes straight to your college or university.

2. Maintenance Loan: This loan helps with living costs, like rent and food. The money goes to your bank account.

You can use a website reader or ask someone to help you if you find the words hard to read.

Students going to college in the UK can get help to pay for their studies. They can ask for:

- Money to pay for classes called Tuition Fee Loans.

- Money to help with living costs called Maintenance Loans.

- Sometimes, other money help like grants or bursaries.

If it feels hard to understand, try using tools that read the text out loud or ask someone you trust to explain it to you.

Who can get a student loan in the UK?

If you want money to help study in the UK, you might get a student loan. Here is who can get one:

- Going to college or university: You should be planning to study at a college or university.

- Age: Most people can get a loan if they are 18 or older.

- Living in the UK: You should live in the UK, or be from the UK, or have lived in the UK for a while.

- First degree: It's good for people who haven't been to college or university before.

It’s a good idea to ask for help from a family member or teacher if you don’t understand.

You can also use apps that read text out loud or show words with pictures to help.

To be eligible, you usually need to live in the UK and start your first degree at a recognised school. There might be different rules for students from the EU and other countries.

How can I get a student loan?

Here is a simple way to understand how to get money for school:

- Find the student loan website for your country.

- Read about the loans offered.

- Make a list of what you need to apply. This could be ID, school info, and more.

- Fill out the form online. Ask someone for help if you need it.

- Submit your form and wait for a reply.

If you have trouble reading, try using screen readers or asking a friend or family member to help you.

You can apply online at Student Finance England. You need to tell them about your course, how much money your family makes, and who you are, like showing them your ID.

When is the last day to apply for a student loan?

You can apply for a student loan up to 9 months after your school year starts.

How much money can I get for school fees?

You might get money to help pay for school. This money is called a "loan."

The loan is to help you pay for school fees. The school fees are what you pay to go to school.

You can use online tools or ask someone to help you find out how much money you can borrow.

The Tuition Fee Loan pays for all your course fees. It can cover up to £9,250 each year if you study at a school that gets money from the government.

What is a Maintenance Loan and how much money can I get?

A Maintenance Loan is money you can borrow to help pay for your living costs while at university or college. This money can help with things like rent, food, and travel.

The amount of money you can get depends on different things, like where you live and study and how much your family earns.

Here are some tips to help you understand better:

- Ask a teacher or adult to help you read tricky words.

- Use tools like text-to-speech to listen to the information.

- Write down any questions you have so you can ask someone for help.

Maintenance Loans give you money to help with living costs. The amount you can get depends on how much money your family makes, where you live, and if you live at home or on your own.

Here are some tips to help understand:

- Ask someone to read with you.

- Use a ruler or finger to follow the words.

- Pause and think about what each sentence means.

When do I start paying back my student loan?

You start paying back your student loan after you finish your course. You need to earn a certain amount of money first.

Here are some tips to help you:

- Use a calendar or reminder app to keep track of dates.

- Ask someone you trust to help you understand payments.

- Use online tools like loan calculators to see how much you owe.

You start paying back your loan in April after you finish school or leave your course. But you only pay if you earn more than a certain amount of money.

What is the repayment threshold now?

In 2023, you start paying back when you earn £27,295 a year. This is the same as £2,274 each month or £524 each week before tax.

How do we figure out how much you pay back?

You will pay back 9% of what you earn over a certain amount. How much you pay back depends on how much you earn, not on how much money you borrowed.

Do you have to pay extra money on student loans?

When you borrow money for school, sometimes you need to pay back more than you borrowed. This extra money is called "interest." It's like a fee for borrowing money.

If you have a student loan, find out if there is any extra money you need to pay back. Ask someone who knows about loans, like a teacher or a parent, to help you understand.

There are also online tools that can help explain student loans and interest.

You start paying extra money called interest when you get your first loan money. You stop paying this extra money when your loan is all paid or cancelled. The extra money depends on something called the Retail Price Index (RPI) and other things.

If you find it hard to understand, you can use tools like text-to-speech to have it read aloud. Highlighting the text can help you focus too.

Can my student loan go away?

If you have a student loan, you might wonder if you still have to pay it back. Sometimes, loans can be cancelled or "written off," which means you don't have to pay them anymore.

Here are some things to know:

- Your loan might go away after a certain number of years. Check how many years it takes before this can happen.

- If you don't earn much money, you might not have to pay. Keep track of how much you earn each year.

- In some cases, loans can be cancelled due to special reasons like health issues.

It's good to talk to someone who knows about money, like a financial advisor, if you have questions. They can help explain things in a way that makes sense to you.

Your loan will be forgiven after 30 years from the April you first had to start paying it back. It can also be forgiven if you become disabled and can't work anymore.

Can I choose to pay extra money back?

Yes, you can pay extra money back anytime. You won't get in trouble for it.

What if I can't pay back my loan?

If you can't pay back your loan, tell the bank or company right away.

Ask them if you can pay a little bit at a time.

You can also ask someone you trust for help.

Using a calendar can help you remember when to pay.

If you don't earn a lot of money, you won't have to pay back the loan. After 30 years, if you still owe any money, it will go away.

How do student loans affect my credit score?

Do you have a student loan? This is when you borrow money to pay for school.

Paying back a student loan can change your credit score. A credit score is a number that shows if you pay back money on time.

If you pay the loan back on time, your credit score can go up. This is good because it means you are good at paying money back.

If you miss a payment, your credit score can go down. This is not good because it means you have trouble paying money back.

Here is what you can do:

- Set a reminder to pay your loan on time.

- Ask someone you trust to help you with money.

- Use a calendar to keep track of payments.

Getting help with money can make it easier to pay back your loan on time.

Student loans do not show up on your credit report. They do not change your credit score. But lenders might still look at how you pay back your student loans when they decide if you can afford other loans.

If reading is tricky, you can try listening to the text with a text-to-speech tool or use apps with easy-to-read formats.

What should I do if my life changes?

If things in your life are different, don't worry. Tell someone who can help. You can:

- Talk to a family member or friend. They can give you support.

- Contact a support worker or counselor. They have good advice.

- Write down your feelings. This makes things easier to understand.

It's okay to ask for help. You are not alone.

You need to tell Student Finance England if your situation changes. This means if you change your study course, change schools, or if your family's money changes a lot.

What is a student loan?

A student loan is money that you borrow to help pay for school or college. You can use it for things like classes, books, and living costs.

You have to pay back the student loan later. You start paying it back when you finish school and get a job. There may be extra money, called interest, that you pay back, too.

It's important to understand how much you will pay back before taking a student loan. Talk to a teacher or someone you trust to help you learn more.

When reading about student loans, you can use tools like a dictionary to help understand hard words. You can also ask someone to read with you and explain it.

A student loan is money the UK government gives to help students pay for school and living costs while they study at university or college.

Who can get a student loan?

You might get a student loan if:

- You are 18 or older.

- You are going to college or university.

- You are a citizen of the country.

If you find it hard to read, try these tips:

- Use a ruler or your finger to help follow along.

- Read out loud to yourself.

- Ask someone to read with you.

In the UK, whether you can get a student loan depends on a few things. It depends on what course you are taking, how old you are, where you are from or where you live, and if you have done a university course before.

If you find it hard to read, you can use tools like text-to-speech apps that read the text out loud. You can also try using colored overlays or adjust the size of the text to make it easier to see.

How can I ask for a student loan?

You can ask for a student loan by going to the Student Finance England website. You can also fill out a paper form to apply.

What kinds of student loans can you get?

Here are some helpful tips:

- Use pictures or drawings to explain ideas.

- Try reading with a friend or family member.

- Ask a teacher or helper for advice.

There are two big kinds of student loans: Tuition Fee Loans and Maintenance Loans. Tuition Fee Loans pay for your school fees, and Maintenance Loans help you with living costs like food and rent.

How much money can I get for school fees?

If you go to a public university in 2023, you can borrow up to £9,250 each year to pay for your course.

How much money can I get for living?

Here is some useful help:

- Use a calculator on a money website.

- Ask someone at your school or work to explain it.

- Look for easy videos online that talk about money help.

How much money you can get for living costs depends on a few things. These include how much money your family earns, where you go to school, and if you live at home with your parents.

For the school year 2023/24, you can get between £3,775 and £9,978 each year.

If you need help understanding or have trouble reading, you can use tools like text-to-speech software, which can read text out loud to you. You can also ask someone else to go through it with you for better understanding.

Do I need someone to help me get a student loan?

If you are getting a student loan, sometimes you need someone to promise to pay if you can't. This person is called a guarantor.

Here are some tips to help you:

- Ask a family member if they can be your guarantor.

- Talk to the loan company to see if you really need one.

- Use a calculator to see how much money you need.

These steps can make it easier to understand.

No, you don't need someone to promise to pay if you can't when you ask for a student loan from Student Finance England.

When do I start paying back my student loan?

You start paying back your student loan when you have a job and earn enough money. This happens after you finish studying.

Here are some tools to help you:

- Use a calendar to note important dates.

- Ask someone for help if you need it.

- Use a calculator to work out how much you will pay.

You will begin to pay back your student loan in April after you finish or leave your course. You only pay if you make more money than a certain amount.

When do I start paying back my student loan?

In the 2023/24 tax year, you start paying back when you earn more than:

- £27,295 a year,

- £2,274 a month, or

- £524 a week.

This is before any tax or other payments come out.

Try using tools like a calculator to help with numbers. You can also ask someone for help if you need it.

How do you pay back a student loan?

If you have a student loan, you pay the money back a little at a time. This is called a "repayment."

You pay back a part of the money if you earn more than a certain amount each year. The amount you pay depends on how much money you make.

If you need help, you can:

- Ask a teacher or a family member to explain.

- Use online tools that help with numbers, like a calculator.

You pay back 9% of any money you make over the set amount.

Do you have to pay extra money on student loans?

When you borrow money for school, you might have to pay back more than you borrowed. This extra money is called interest. It's like a fee for borrowing money.

To help understand student loans, you can:

- Use a calculator to see how much you will pay back in total.

- Ask someone you trust to explain it with simple words.

- Look for videos or pictures online that explain student loans.

Yes, you have to pay extra money called interest on student loans. The extra money is based on the Retail Price Index (RPI). How much extra you pay can change depending on how much money you make and your personal situation.

If you need help understanding this, you can ask someone you trust to explain it to you, like a teacher or a family member. You can also use tools like pictures or videos that explain how loans work.

Can I pay more money to my student loan or pay it off early?

Yes, you can pay more money to your student loan. This helps you finish paying it faster.

Here are some tools that can help you:

- Use a calculator to see how much extra money you can pay.

- Set reminders to make extra payments.

Yes, you can pay extra money or finish paying your student loan early. There are no penalties for doing this.

What will happen if I travel to another country after my studies?

If you go to live in another country, you still have to pay back your student loan. How much you pay depends on how much money you make and where you live. You must tell the Student Loans Company when you move.

What if I can't pay my money back?

If you earn less than a certain amount of money, you will not have to make payments. You will only start paying again if you earn more.

How long will it take to pay back my loan?

A loan is money you borrow and need to pay back. How long will it take you to pay it all back?

Here are some tips to help you:

- Use a calculator to see how much you can pay each month.

- Ask a friend or family member to help you understand.

- Look at how much money you get each month.

How long it takes to pay back your loan depends on how much money you earn and how much you borrowed. If you still owe money after 30 years, the loan is usually cancelled.

Useful Links

This website offers general information and is not a substitute for professional advice.

Always seek guidance from qualified professionals.

If you have any medical concerns or need urgent help, contact a healthcare professional or emergency services immediately.

Some of this content was generated with AI assistance. We’ve done our best to keep it accurate, helpful, and human-friendly.

- Ergsy carfully checks the information in the videos we provide here.

- Videos shown by Youtube after a video has completed, have NOT been reviewed by ERGSY.

- To view, click the arrow in centre of video.

- Most of the videos you find here will have subtitles and/or closed captions available.

- You may need to turn these on, and choose your preferred language.

- Go to the video you'd like to watch.

- If closed captions (CC) are available, settings will be visible on the bottom right of the video player.

- To turn on Captions, click settings .

- To turn off Captions, click settings again.

More Items From Ergsy search

-

UNDERSTANDING YOUR STUDENT LOAN: A GUIDE FOR ENGLISH STUDENTS STARTING AN UNDERGRADUATE COURSE 2023

Relevance: 100%

-

Is bankruptcy an option for student loan discharge?

Relevance: 47%

-

Student Finance: Should I pay more? | Plan 1 & Plan 2 | SF Explained

Relevance: 46%

-

What happens if I default on my student loan?

Relevance: 46%

-

Can interest rates on student loans be reduced?

Relevance: 45%

-

Can I negotiate a settlement for my student loan?

Relevance: 45%

-

Are there implications for student loan repayments with 2026 changes?

Relevance: 45%

-

What happens if i can not afford to repay my student loan?

Relevance: 45%

-

Can my wages be garnished for unpaid student loans?

Relevance: 43%

-

Can I get my student loans forgiven if I can't repay them?

Relevance: 42%

-

Is there an income threshold for students to qualify for the payment?

Relevance: 41%

-

What criteria must be met for students to receive the payment?

Relevance: 41%

-

How does missing student loan payments affect my credit score?

Relevance: 41%

-

What funding options are available for nursing students in the UK?

Relevance: 41%

-

Is documentation of student status required for the payment?

Relevance: 39%

-

What should I do if I can't afford to repay my student loan?

Relevance: 39%

-

Can students apply for Cost-of-Living support?

Relevance: 36%

-

Can part-time students apply for the £500 payment?

Relevance: 36%

-

Are students eligible for the £500 cost of living payment?

Relevance: 34%

-

What is the process for applying to a nursing degree course?

Relevance: 34%

-

What happens to my loans if I go back to school?

Relevance: 33%

-

Do international students need the meningitis vaccine?

Relevance: 33%

-

Will students receive the payment directly into their bank accounts?

Relevance: 33%

-

Do international students qualify for the £500 payment?

Relevance: 32%

-

How can teachers support students with ADHD?

Relevance: 32%

-

Are students required to pay for a TV license?

Relevance: 31%

-

Can students receive the £500 cost of living payment?

Relevance: 31%

-

Can mature students apply for the £500 cost of living payment?

Relevance: 31%

-

Are school meals free for all students in the UK?

Relevance: 30%

-

How can students apply for the £500 cost of living payment?

Relevance: 30%

-

Should college students get the meningitis vaccine?

Relevance: 30%

-

Can I get a job with the National Trust if I am a student?

Relevance: 29%

-

Can students receive the payment if they are already receiving other scholarships?

Relevance: 29%

-

What is the deadline for students to apply for the £500 payment?

Relevance: 28%

-

Do students need to provide proof of expenses to receive the payment?

Relevance: 27%

-

What is loan rehabilitation?

Relevance: 27%

-

How does the payment affect students' financial aid packages?

Relevance: 27%

-

What should students do if their application for the payment is denied?

Relevance: 27%

-

Can first aid courses be applied for college credit?

Relevance: 25%

-

Will interest accrue during deferment?

Relevance: 25%