Find Help

More Items From Ergsy search

-

Navigating Post-Divorce Finances Amidst Economic Challenges

Relevance: 100%

-

Rise in Food Bank Usage Amid Economic Challenges

Relevance: 37%

-

Can a finance broker be liable for mis-selling car finance?

Relevance: 29%

-

Can a wealth tax impact economic behavior?

Relevance: 29%

-

Could a wealth tax affect economic growth in the UK?

Relevance: 29%

-

What are the challenges of implementing a wealth tax?

Relevance: 28%

-

Why is understanding the terms of car finance important?

Relevance: 28%

-

What constitutes economic abuse under the Domestic Abuse Act 2021?

Relevance: 26%

-

Support Services for Mental Health Amid Economic Uncertainty

Relevance: 26%

-

First Time Buyer Buy to Let Finance Options. Lending Criteria on Mortgage and Bridging Finance

Relevance: 26%

-

Can I claim compensation if I was mis-sold car finance?

Relevance: 26%

-

How can I check if I was mis-sold car finance?

Relevance: 26%

-

What is the time limit for making a complaint about mis-sold car finance?

Relevance: 25%

-

What does it mean to be mis-sold car finance?

Relevance: 25%

-

Submitted Addressing Social Inequalities: Initiatives and Challenges in the UK

Relevance: 25%

-

First Time Buyer Buy to Let Finance Options. Lending Criteria on Mortgage and Bridging Finance

Relevance: 25%

-

Are all car finance products potentially subject to mis-selling?

Relevance: 25%

-

Can I modify a car I'm leasing or financing?

Relevance: 25%

-

How can I find out if I was mis-sold car finance?

Relevance: 24%

-

How does leasing compare financially to financing a car?

Relevance: 24%

-

How do economic conditions influence interest rate changes?

Relevance: 24%

-

What are common signs of being mis-sold car finance?

Relevance: 24%

-

What challenges have been encountered with the social media ban?

Relevance: 24%

-

Can mis-sold car finance affect my credit score?

Relevance: 24%

-

Why is it challenging to fix water leaks in the UK?

Relevance: 24%

-

Understanding Your Rights: Legal Support for Families During Economic Turbulence

Relevance: 24%

-

What documents do I need to assess if I was mis-sold car finance?

Relevance: 23%

-

What should I look for in my car finance agreement?

Relevance: 22%

-

How does interest rate affect my car finance agreement?

Relevance: 22%

-

Is financing available for a facelift?

Relevance: 22%

-

What should I do if my complaint about mis-sold car finance is rejected?

Relevance: 22%

-

Bridging Finance Dangers - Tips on common problems, risks and lending rules in the UK

Relevance: 21%

-

What challenges do water companies face in maintaining infrastructure?

Relevance: 20%

-

How long does the mis-sold car finance complaints process take?

Relevance: 20%

-

Can I make a complaint if I was mis-sold car finance?

Relevance: 20%

-

Can an inheritance tax bill be challenged or appealed?

Relevance: 20%

-

Current Challenges in Youth Mental Health Services

Relevance: 19%

-

Divorce - How To Rebuild Your Life After Losing Everything

Relevance: 19%

-

What economic impact do screw worms have?

Relevance: 19%

-

What are the common challenges faced by primary care support workers?

Relevance: 19%

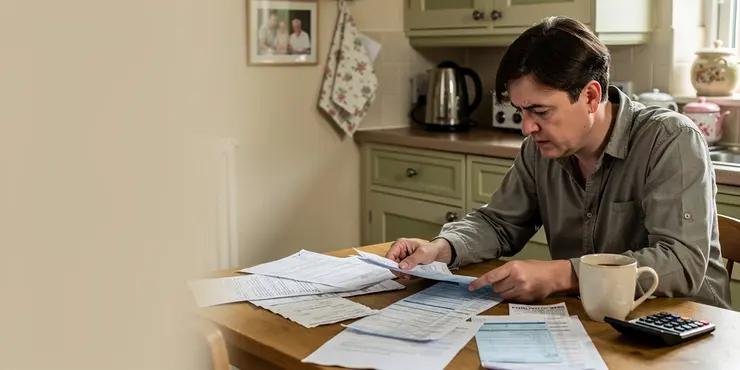

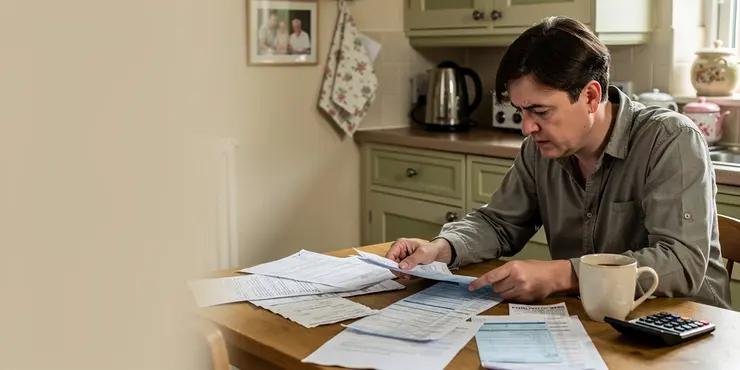

Navigating Post-Divorce Finances Amidst Economic Challenges

Assessing Your New Financial Situation

Post-divorce finances can seem daunting, especially amidst economic challenges. The first step is to assess your current financial situation. Create a comprehensive list of your incomes, including wages, benefits, and any support/alimony payments. Similarly, tabulate all your expenses, from essential bills like mortgage or rent, utilities, and groceries to discretionary spending. This detailed overview will help you understand your financial standing and identify areas for adjustment.

Budgeting and Managing Expenses

Budgeting is crucial in maintaining financial stability post-divorce. With an accurate budget, you can prioritize essential expenditures and limit non-essential spending. Utilize budgeting tools and apps that cater to the UK market, such as Yolt or Money Dashboard. These can provide real-time tracking and insights into your spending habits, helping you stay on top of your finances. Regularly review and adjust your budget to reflect any changes in your financial situation or economic conditions.

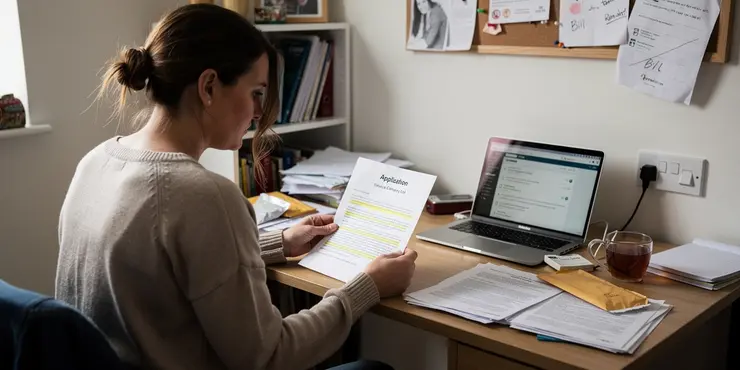

Rebuilding Credit

Post-divorce, your credit rating might need attention, especially if the separation led to unsettled debts or financial disputes. Start by checking your credit report through UK agencies like Experian, Equifax, or TransUnion. Identify any discrepancies or issues and work on resolving them. Make consistent, on-time payments to rebuild your credit score, and avoid taking on new debt unless absolutely necessary. Consider using a credit-builder card to slowly improve your rating.

Seeking Professional Financial Advice

Navigating finances after a divorce can be complex, and seeking professional help can make the process smoother. Engage with financial advisors who specialize in post-divorce financial planning. They can provide tailored advice, help in restructuring debts, and guide you on investment opportunities suitable to your new circumstances. Also, consider reaching out to charities and organizations in the UK like Citizens Advice, which offer free financial advice and support for those in need.

Planning for the Future

Amidst economic challenges, it’s essential to think long-term when planning your post-divorce finances. Re-evaluate your financial goals, including saving for retirement, children’s education, and personal growth. Open or contribute to savings and investment accounts that align with your revised goals. Building an emergency fund is also vital to cushion against economic uncertainties. Aim to save at least three to six months’ worth of expenses to ensure you are prepared for any unforeseen financial challenges.

Understanding Money After Divorce When Things Are Tough

Looking at Your Money Now

When you get divorced, money can be confusing, especially if the economy is not doing well. First, check how much money you have now. Make a list of all the money you get. This can be from your job, any benefits, or support payments like alimony. Do the same for all the money you spend, like on rent or your mortgage, your bills, and groceries. Look also at money you spend on other things. This will help you see how much money you have and where you can save.

Making a Budget and Spending Wisely

It’s important to make a budget to keep your money safe after a divorce. A budget helps you know what you need to spend money on and what you can save on. Try using easy tools or apps like Yolt or Money Dashboard. These apps are for people in the UK and can help you see how you spend your money. Check your budget often and change it if things change.

Building Your Credit Again

After a divorce, your credit might need some fixing, especially if there were money problems before. Look at your credit report from places like Experian, Equifax, or TransUnion in the UK. Fix any mistakes you find. Pay your bills on time to help your credit score. Don’t borrow more money unless you really need to. A credit-builder card can help make your credit better slowly.

Getting Help from Money Experts

Dealing with money after a divorce can be hard. A financial advisor who knows about divorce money problems can help you. They can give advice on fixing debts and how to invest your money now. You can also talk to charities or groups like Citizens Advice for free help with money.

Thinking About the Future

Even when times are tough, plan for the future. Think about what you want for retirement, your kids’ education, and your own goals. Add money to savings and investments that match what you want. Make sure you have an emergency fund to help if things go wrong. Try to save enough money for at least three to six months of your expenses. This will help you be ready for unexpected money problems.

Frequently Asked Questions

How should I approach budgeting post-divorce?

Post-divorce budgeting involves assessing your income and expenses, prioritizing essential costs, and setting realistic financial goals. Tracking your expenditure and adjusting your budget accordingly is crucial.

What are the best steps to rebuild credit after a divorce?

To rebuild credit, ensure timely payments of all debts, maintain a low credit utilisation ratio, and regularly check your credit report for errors. Consider obtaining a secured credit card to help re-establish credit.

How should I handle joint debts post-divorce?

Joint debts should be addressed through any legal agreements made during the divorce. It’s advisable to transfer joint debts to individual accounts where possible to avoid future disputes.

What financial protections should I put in place after a divorce?

Consider updating your will, changing beneficiaries on insurance policies and retirement accounts, and establishing separate bank accounts. Also, review and update any powers of attorney.

Can I claim benefits as a single person after divorce?

Yes, you may be eligible for benefits such as Universal Credit or Housing Benefit. It is essential to check with the UK Government’s benefits calculators to see what you can claim.

How do I split pension assets during a divorce?

Pensions can be split in several ways including pension sharing orders, pension offsetting, or earmarking orders. It’s advisable to seek legal and financial advice to understand the implications of each method.

What should I consider when planning for future financial stability?

Focus on building an emergency fund, investing in long-term savings plans like ISAs, and diversifying your income streams. Regularly review your financial goals and adjust your plans as needed.

How can I manage childcare costs post-divorce?

Review all available childcare benefits and tax credits. Creating a shared parenting plan with structured financial agreements can help in managing costs effectively.

What is the impact of divorce on my taxes?

Divorce can affect your tax status and benefits. Ensure you understand the implications on personal allowances, capital gains tax (CGT), and any potential tax reliefs available.

How should I handle asset division during economic challenges?

During economic challenges, asset division should include a thorough evaluation of current market values and potential future worth. Legal and financial advice will be crucial to make informed decisions.

Can mediation help with financial disputes in a divorce?

Yes, mediation can be a cost-effective way to resolve financial disputes. It allows both parties to negotiate in a structured environment, often leading to more amicable solutions.

How do I deal with the financial implications of selling a jointly-owned property?

Selling a jointly-owned property involves agreeing on the sale price, splitting any remaining mortgage, and dividing the sale proceeds. Consider the market conditions and potential capital gains tax implications.

Is it beneficial to hire a financial advisor post-divorce?

A financial advisor can provide valuable insights and help you create a detailed financial plan, manage investments, and ensure you are on track towards achieving long-term financial stability.

How can I secure spousal maintenance or child support?

Spousal maintenance and child support can be secured through legal agreements during divorce proceedings. The amount and duration depend on individual circumstances and legal guidelines.

What should I consider about insurance post-divorce?

Review and update all insurance policies including life, health, home, and auto. Ensure you have adequate coverage and consider any changes in your beneficiaries.

How do I manage my money after a divorce?

After a divorce, it is important to make a plan for your money. Look at how much money you have coming in and how much you are spending. You need to pay for the most important things first. Set goals that you can reach with your money. Keep track of what you spend and change your plan if you need to.

How can I fix my credit after a divorce?

A divorce can make your credit score go down. Here are some simple steps to help make it better:

1. Check your credit report: Look at your credit report to see what is there. You can get it for free from some websites.

2. Pay your bills on time: Make sure to pay all your bills when they are due. This will help your credit score go up.

3. Make a budget: Write down all the money you get and spend. This will help you know what you can afford.

4. Use credit cards carefully: If you have a credit card, try not to use too much of it. Only buy what you can pay back.

5. Talk to a financial advisor: If you need more help, someone who knows about money can give you advice.

Using a tool like a smartphone app to track your spending can also help you manage your money better.

To fix your credit:

- Always pay your bills on time.

- Try not to use too much of your credit limit.

- Check your credit report often to see if there are mistakes.

- Think about getting a secured credit card to help build your credit again.

Here are some ideas to help you:

- Use a calendar or phone reminders to remember bill payment dates.

- Write down how much of your credit you use to make sure it’s low.

- If you see mistakes on your report, ask someone to help you fix them.

- Talk to a bank or credit union about getting a secured credit card.

What should I do about money we owe together after a divorce?

When you get a divorce, you need to talk about any debts you both owe. Try to split these debts fairly. It's a good idea to put each debt under one person's name. This can stop arguments later on.

What money plans should I make after a divorce?

When people get a divorce, they might need to make new plans for their money. Here are some things you can do:

- Budget: Make a list of how much money you earn and spend. This helps you know where your money goes.

- Savings: Try to save some money for emergencies. This is important in case something unexpected happens.

- Insurance: Check if you need to change your health or life insurance. This keeps you safe if you get sick or if you need help later on.

- Bank Accounts: Make sure your bank accounts are in your name. This way, you are in control of your money.

Ask a trusted friend or a money expert if you need help. They can help you make the best choices for your money.

Think about making changes to your will. You can choose new people to get your life insurance money or money from retirement accounts. It’s a good idea to have your own bank accounts. Also, look at any forms where you gave someone the power to make decisions for you, and make sure they are up to date.

Can I get help with money after a divorce?

If you are divorced and live alone, you might wonder if you can get money help from the government.

Here’s what you can do:

- Look at websites that tell you about benefits.

- Ask someone at a local advice center for help.

- Use an online benefits calculator to see what you can claim.

If you find it hard to read or understand, it’s okay to ask a friend or family member for help!

Yes, you might get money help. This can be Universal Credit or Housing Benefit. It is important to check with the UK Government's benefit calculators to see what you can ask for.

How do I share pension money when getting a divorce?

When you and your partner decide to get a divorce, you need to share the money in your pension. A pension is money saved for when you are older and stop working. Sharing a pension can be hard, so here are some steps you can take to make it easier.

1. Find out how much money. First, you need to know how much pension money you both have. You can ask your pension provider for a statement. This shows how much money is in your pension.

2. Talk to a professional. It is a good idea to talk to someone who knows about pensions. This can be a lawyer or a financial advisor. They can help you understand what to do.

3. Agree on how to share. You and your partner need to decide how to split the pension money. Sometimes you can share it equally. Other times you might agree on a different way.

4. Use the right court papers. You might need to go to court to make the pension split official. The court will tell you the correct papers to fill in.

5. Think about future money. When you split the pension, think about how much money you will need when you are older.

Tools that can help:

- A calculator for working out amounts.

- A friend or family member to talk things through.

If you find any words hard to understand, ask someone to explain them to you.

You can split a pension in a few ways: by sharing it, offsetting it, or earmarking it. It's a good idea to talk to a lawyer or a money expert. They can help you understand what each way means.

What should I think about for money in the future?

Here are some simple steps:

- Think about how much money you need each week.

- Save a little money regularly if you can.

- Make a list of things you need to buy and their costs.

- Use a calendar to plan when bills are due.

- Talk to someone you trust about money.

Tools to help you:

- Use a piggy bank or savings app for saving money.

- Try a budgeting app to track your spending.

- Use a calculator to understand your money better.

Save some money for emergencies. Put some money into savings plans that last a long time, like ISAs. Try to find different ways to earn money. Check your money goals often and change your plans if you need to.

How can I pay for childcare after a divorce?

Divorce can make money tight. If you need to pay for childcare, here are some simple tips to help:

- Make a budget. Write down how much money you have and how much you need to spend.

- Ask for help. See if family or friends can watch your child sometimes.

- Look for childcare programs or discounts in your area.

- Check if you can get help from the government.

Talking to a money expert can also be a good idea. They can help you plan and find the right support.

Look at all the help you can get for childcare. This includes any money you can get back or save on taxes. Make a plan with the other parent about how you will both help with money and taking care of the kids. This can make it easier to handle costs.

How does getting a divorce change my taxes?

When you get divorced, it can change your taxes and the benefits you get. Make sure you know how it affects things like personal allowances, capital gains tax (CGT), and any tax help you can get.

If reading is hard, you can:

- Use a ruler or your finger to keep your place when reading.

- Ask someone to explain words you don’t understand.

- Listen to audiobooks or use text-to-speech tools to hear the information.

- Break reading into small bits, and take breaks often.

What should I do with my things when money is tight?

When times are tough with money, it is important to share things like houses, cars, or businesses fairly. To do this, we need to find out how much they are worth now and what they might be worth later. Talking to a lawyer or money expert can help us make smart choices.

Can talking things out help with money problems in a divorce?

When people get divorced, they might argue about money. Talking to each other with the help of a special person, called a mediator, can help. The mediator listens to both sides and helps them find a solution. It's a calmer way to solve money problems instead of going to court.

Mediators are trained to help people be fair and kind to each other. They help everyone have their turn to talk and listen.

If reading is hard, you can:

- Ask someone you trust to read it with you.

- Use a colored overlay to make reading easier.

- Try listening to an audiobook version if you have one.

Yes, mediation is a good way to solve money problems. It doesn't cost too much. Mediation helps people talk and agree on things nicely.

What should I do about money when selling a home owned with someone else?

Selling a home with another person can be tricky with money. Here's how to make it easier:

- Talk Together: Sit with the person you own the home with. Agree on how to split the money from selling the home.

- Get Help: Talk to a money expert. They can explain big money words and help you understand what to do.

- Make it Clear: Write down what you both agree to do with the money. This helps stop arguments later.

- Use a Calculator: There are online tools to help you see how much money you might get. Ask an adult to help you use these.

It’s important to talk, get advice, and write things down so everyone understands what will happen with the money.

When you want to sell a house you own with someone else, you both need to agree on a few things.

First, agree on how much money you want to sell the house for.

Next, if you still owe the bank money for the house, decide how to pay it off together.

Then, decide how to share the money you get from selling the house.

Think about whether it's a good time to sell and whether you might have to pay extra taxes.

Should you get help with money after a divorce?

A financial advisor helps you with money. They can give advice on saving, spending, and planning for the future.

If you have been through a divorce, you might find it hard to manage money on your own. A financial advisor can help you make a good plan.

Here are some tips to help:

- Write down what you spend and save.

- Set small goals for your money.

- Ask someone you trust for advice.

- Use online tools or apps to track your money.

A money helper can give you good advice. They can help you make a money plan, take care of your savings, and make sure you have enough money in the future.

How can I get money for me or my children after a separation?

When parents divorce, they might need to agree on money help for one parent and for the kids. This is called spousal maintenance and child support.

How much money and for how long depends on personal situations and legal rules.

Things to Think About Insurance After a Divorce

Check and change your insurance. This includes life, health, home, and car insurance. Make sure you have enough cover. Think about who will get benefits if something happens to you.

Useful Links

This website offers general information and is not a substitute for professional advice.

Always seek guidance from qualified professionals.

If you have any medical concerns or need urgent help, contact a healthcare professional or emergency services immediately.

Some of this content was generated with AI assistance. We’ve done our best to keep it accurate, helpful, and human-friendly.

- Ergsy carfully checks the information in the videos we provide here.

- Videos shown by Youtube after a video has completed, have NOT been reviewed by ERGSY.

- To view, click the arrow in centre of video.

- Most of the videos you find here will have subtitles and/or closed captions available.

- You may need to turn these on, and choose your preferred language.

- Go to the video you'd like to watch.

- If closed captions (CC) are available, settings will be visible on the bottom right of the video player.

- To turn on Captions, click settings .

- To turn off Captions, click settings again.

More Items From Ergsy search

-

Navigating Post-Divorce Finances Amidst Economic Challenges

Relevance: 100%

-

Rise in Food Bank Usage Amid Economic Challenges

Relevance: 37%

-

Can a finance broker be liable for mis-selling car finance?

Relevance: 29%

-

Can a wealth tax impact economic behavior?

Relevance: 29%

-

Could a wealth tax affect economic growth in the UK?

Relevance: 29%

-

What are the challenges of implementing a wealth tax?

Relevance: 28%

-

Why is understanding the terms of car finance important?

Relevance: 28%

-

What constitutes economic abuse under the Domestic Abuse Act 2021?

Relevance: 26%

-

Support Services for Mental Health Amid Economic Uncertainty

Relevance: 26%

-

First Time Buyer Buy to Let Finance Options. Lending Criteria on Mortgage and Bridging Finance

Relevance: 26%

-

Can I claim compensation if I was mis-sold car finance?

Relevance: 26%

-

How can I check if I was mis-sold car finance?

Relevance: 26%

-

What is the time limit for making a complaint about mis-sold car finance?

Relevance: 25%

-

What does it mean to be mis-sold car finance?

Relevance: 25%

-

Submitted Addressing Social Inequalities: Initiatives and Challenges in the UK

Relevance: 25%

-

First Time Buyer Buy to Let Finance Options. Lending Criteria on Mortgage and Bridging Finance

Relevance: 25%

-

Are all car finance products potentially subject to mis-selling?

Relevance: 25%

-

Can I modify a car I'm leasing or financing?

Relevance: 25%

-

How can I find out if I was mis-sold car finance?

Relevance: 24%

-

How does leasing compare financially to financing a car?

Relevance: 24%

-

How do economic conditions influence interest rate changes?

Relevance: 24%

-

What are common signs of being mis-sold car finance?

Relevance: 24%

-

What challenges have been encountered with the social media ban?

Relevance: 24%

-

Can mis-sold car finance affect my credit score?

Relevance: 24%

-

Why is it challenging to fix water leaks in the UK?

Relevance: 24%

-

Understanding Your Rights: Legal Support for Families During Economic Turbulence

Relevance: 24%

-

What documents do I need to assess if I was mis-sold car finance?

Relevance: 23%

-

What should I look for in my car finance agreement?

Relevance: 22%

-

How does interest rate affect my car finance agreement?

Relevance: 22%

-

Is financing available for a facelift?

Relevance: 22%

-

What should I do if my complaint about mis-sold car finance is rejected?

Relevance: 22%

-

Bridging Finance Dangers - Tips on common problems, risks and lending rules in the UK

Relevance: 21%

-

What challenges do water companies face in maintaining infrastructure?

Relevance: 20%

-

How long does the mis-sold car finance complaints process take?

Relevance: 20%

-

Can I make a complaint if I was mis-sold car finance?

Relevance: 20%

-

Can an inheritance tax bill be challenged or appealed?

Relevance: 20%

-

Current Challenges in Youth Mental Health Services

Relevance: 19%

-

Divorce - How To Rebuild Your Life After Losing Everything

Relevance: 19%

-

What economic impact do screw worms have?

Relevance: 19%

-

What are the common challenges faced by primary care support workers?

Relevance: 19%