Find Help

More Items From Ergsy search

-

Impact of Rising Energy Prices on Household Budgets

Relevance: 100%

-

Impact of Rising Energy Costs on Family Budgets

Relevance: 74%

-

Energy Prices Set to Rise: How to Keep Your Bills Down

Relevance: 54%

-

Why was the energy price cap introduced?

Relevance: 50%

-

Does the energy price cap apply to all energy tariffs?

Relevance: 47%

-

What is the UK's energy price cap?

Relevance: 46%

-

Understanding the Impact of Rising Living Costs on Family Welfare

Relevance: 46%

-

What is the Energy Price Cap in the UK?

Relevance: 46%

-

What is the energy price cap?

Relevance: 44%

-

When was the energy price cap introduced?

Relevance: 44%

-

Have energy prices in the UK historically fluctuated?

Relevance: 44%

-

Does the energy price cap guarantee my total bill?

Relevance: 44%

-

UK Government Announces New Energy Bill Support Amid Rising Costs

Relevance: 43%

-

How often is the energy price cap reviewed?

Relevance: 43%

-

Are energy prices regulated in the UK?

Relevance: 43%

-

How does global energy demand affect UK energy prices?

Relevance: 42%

-

How does the energy price cap affect green energy tariffs?

Relevance: 41%

-

What factors influence changes to the energy price cap?

Relevance: 41%

-

What factors influence the rise and fall of energy bills in the UK?

Relevance: 41%

-

Can the energy price cap go down as well as up?

Relevance: 41%

-

How Rising Living Costs Are Impacting Family Wellbeing

Relevance: 41%

-

How can government intervention affect energy prices?

Relevance: 40%

-

Does the energy price cap apply to prepayment meters?

Relevance: 40%

-

How does the energy price cap affect my energy bills?

Relevance: 40%

-

Is the energy price cap being reviewed due to market changes?

Relevance: 40%

-

Is the energy price cap the same for everyone?

Relevance: 39%

-

Can fixed-rate tariffs offer better price stability compared to variable tariffs?

Relevance: 39%

-

How is the energy price cap calculated?

Relevance: 39%

-

Addressing the Rising Cost of Living: Community Support and Resources

Relevance: 39%

-

Do energy suppliers offer discounts on electricity prices?

Relevance: 39%

-

Are there apps that help manage and reduce household bills?

Relevance: 38%

-

Where can I find more information about the energy price cap?

Relevance: 38%

-

What role do renewable energy sources play in energy pricing?

Relevance: 38%

-

Rising Cost of Living: How Families Can Cope

Relevance: 38%

-

Where can I get budgeting advice to manage my household expenses better?

Relevance: 38%

-

What factors influence the difference in electricity prices among UK energy companies?

Relevance: 37%

-

How can I compare prices among different energy suppliers?

Relevance: 37%

-

Rising Property Prices Fuel Concerns Over First-Time Buyer Accessibility

Relevance: 36%

-

Can energy suppliers charge less than the price cap?

Relevance: 36%

-

How often do energy companies review their electricity prices?

Relevance: 35%

Impact of Rising Energy Prices on Household Budgets

Introduction

The United Kingdom, like many other parts of the world, has experienced a significant increase in energy prices in recent years. This rise has far-reaching effects on household budgets, affecting everything from daily living costs to long-term financial planning. Understanding the implications and potential strategies to mitigate these impacts is essential for households across the country.

Increase in Monthly Expenditures

One of the most immediate impacts of rising energy prices is the increase in monthly household expenditures. Families are now spending a larger portion of their income on utilities such as electricity, gas, and heating. This leaves less disposable income for other essentials such as food, education, and healthcare. The situation is particularly dire for lower-income households, who already allocate a higher percentage of their earnings to energy costs.

Impact on Savings and Investments

As energy costs consume a larger share of household budgets, the ability to save money or invest for the future is compromised. Many families are finding it difficult to maintain their savings for emergencies, education, or retirement. This lack of financial resilience can lead to greater economic instability and uncertainty, affecting long-term financial security.

Quality of Life and Health

Rising energy prices can also negatively impact the quality of life and health of UK residents. Higher energy bills may force some households to ration their energy use, leading to inadequately heated homes during the winter months. This can result in increased health issues, particularly for vulnerable groups such as the elderly and children. Additionally, the psychological stress of managing tighter budgets can contribute to mental health issues.

Strategies for Mitigating Impact

Households can adopt several strategies to mitigate the impact of rising energy prices. Energy efficiency measures, such as installing insulation, energy-efficient windows, and using energy-saving appliances, can reduce overall energy consumption. Additionally, exploring alternative energy sources like solar panels can help decrease reliance on traditional energy suppliers. Households should also regularly review their energy tariffs to ensure they are on the most cost-effective plan available.

Conclusion

The impact of rising energy prices on household budgets in the UK is multifaceted, affecting not only financial stability but also quality of life and health. While the challenges posed by increasing energy costs are significant, proactive measures can help mitigate these impacts. Through energy efficiency improvements and strategic financial planning, households can better manage their budgets and safeguard their financial and physical well-being.

Impact of Rising Energy Prices on Household Budgets

Introduction

In the United Kingdom, energy prices have gone up a lot. This makes it harder for families to keep up with their budgets. When energy costs more, it affects what people can buy every day and save for the future. It is important for families to know how this can affect them and what they can do to make things easier.

Increase in Monthly Expenditures

When energy prices rise, families spend more money on gas, electricity, and heating. This means they have less money to spend on other important things, like food and healthcare. Families with less money are having an even harder time because they already spend a lot on energy.

Impact on Savings and Investments

As energy takes up more of the budget, it gets harder for families to save money. People find it difficult to set aside money for emergencies, school, or retirement. Without savings, families can feel less secure about their future, which can make them worry more about money.

Quality of Life and Health

High energy prices can also make life harder. Some families might not use enough energy to heat their homes because of the cost. This can lead to cold houses and make people sick, especially older people and children. Worrying about money can also make you feel stressed and unhappy.

Strategies for Mitigating Impact

Families can try different ways to save money on energy. They can make their homes use energy better by putting in things like insulation and energy-efficient appliances. Solar panels are another way to get energy without paying so much. It also helps to check energy deals often to find cheaper plans.

Conclusion

Rising energy prices in the UK affect family budgets, health, and happiness. But there are things families can do to help. By saving energy and planning money well, families can handle these changes better and feel more secure.

Frequently Asked Questions

How do rising energy prices affect household budgets?

Rising energy prices can lead to higher utility bills, forcing households to allocate more of their budget to cover these costs, potentially reducing the amount of disposable income available for other expenses.

What are some ways to reduce energy consumption at home?

Some ways to reduce energy consumption include using energy-efficient appliances, turning off lights and electronics when not in use, insulating your home, and installing a smart thermostat to better manage heating and cooling.

Are there government programs available to help with energy costs?

Yes, the UK government offers programs such as the Warm Home Discount, Winter Fuel Payment, and Cold Weather Payment to assist eligible households with energy costs.

How can insulating my home help with rising energy prices?

Insulating your home can improve energy efficiency by reducing heat loss in the winter and keeping your home cooler in the summer, potentially lowering your energy bills.

What is a smart thermostat and how can it save me money?

A smart thermostat allows you to control your heating and cooling systems remotely via a smartphone app and can learn your schedule to optimize energy use, potentially reducing energy consumption and lowering your bills.

How can I find out if I'm eligible for energy assistance programs?

Eligibility for energy assistance programs typically depends on factors such as income, age, and specific needs. You can check the UK government website or contact local authorities for more information on eligibility requirements.

What impact do rising energy prices have on low-income households?

Rising energy prices can disproportionately affect low-income households, as they may spend a higher percentage of their income on energy costs, making it more difficult to cover other essential expenses.

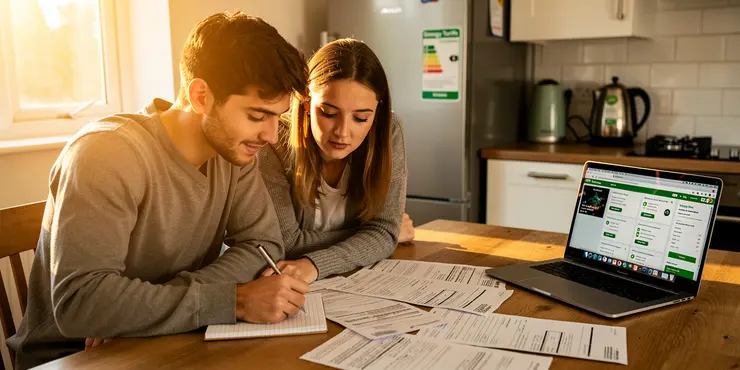

Can switching energy suppliers help reduce my energy bills?

Yes, switching to a different energy supplier with better rates or tariff plans can potentially lower your energy bills. It's important to compare different offers and consider factors like exit fees and contract terms.

What resources are available for learning about energy-saving practices?

Resources for learning about energy-saving practices include government websites, energy supplier websites, and organizations like the Energy Saving Trust, which offer tips and guidance on improving energy efficiency at home.

How can I make my household appliances more energy-efficient?

To make your appliances more energy-efficient, consider buying models with high energy ratings, using them efficiently by following manufacturer guidelines, and performing regular maintenance to ensure they operate optimally.

What are the benefits of using energy-efficient light bulbs?

Energy-efficient light bulbs, such as LED or CFL bulbs, use less electricity and last longer than traditional incandescent bulbs, which can result in lower energy bills and reduced replacement costs.

How do energy prices affect the cost of goods and services?

Higher energy prices can increase production and transportation costs for goods and services, which businesses may pass on to consumers in the form of higher prices, impacting household budgets.

Could renewable energy sources help mitigate rising energy prices?

Investing in renewable energy sources like solar or wind can help reduce dependency on fossil fuels, which can potentially stabilize or lower energy prices over time and provide more predictable energy costs.

What steps can I take to better manage my energy bills?

To manage your energy bills, you can monitor your energy usage, implement energy-saving measures, consider switching suppliers, and take advantage of any available assistance programs to help with costs.

Can installing solar panels reduce my energy costs?

Installing solar panels can reduce your reliance on grid electricity, potentially lowering your energy bills. While the initial investment can be significant, many households see long-term savings and benefits.

What happens to family budgets when energy prices go up?

When energy prices rise, it costs more money to use electricity, gas, and heating.

This means families might have less money to spend on other things they need or want.

It's important to look for ways to save energy at home and ask for help if needed.

When energy prices go up, it costs more to pay for things like electricity and gas. This means people have to spend more of their money on these bills. They might have less money to spend on other things they want or need.

How can you use less energy at home?

Here are some easy ways to save energy:

- Use appliances that save energy. They are often called "energy-efficient."

- Turn off lights when you leave a room.

- Turn off TVs and other electronics when you are not using them.

- Keep your home warm in the winter and cool in the summer by adding insulation.

- Get a smart thermostat. It helps control your home’s heating and cooling.

To remember these tips, you can use sticky notes as reminders, or set alarms on your phone or tablet.

Can the government help us pay for energy?

Yes, there are programs that can help. These programs can give money or support to pay for things like electricity and gas. You can ask someone to help you find these programs. Calling a friend, family member, or a support worker can be a good idea. You can also search online or check with your local government office.

The UK government has programs to help people pay for energy. They are:

- **Warm Home Discount**

This helps you get money off your electricity bill.

- **Winter Fuel Payment**

This gives extra money to help pay for heating in winter.

- **Cold Weather Payment**

This gives you money when it gets very cold.

If you need help, ask someone you trust or use a computer to find more information online.

How can insulating my home help me save money on energy?

Putting insulation in your home can help you use less energy. It keeps your house warm in winter and cool in summer. This might help you pay less for energy bills.

What is a smart thermostat and how can it save me money?

A smart thermostat is a tool in your home that controls the temperature. It can make sure your house is not too hot or too cold. You use it to keep your home comfy.

A smart thermostat can help you save money. It learns when you are home or away. It can turn the heat or cool air down when you are not there. This means you use less energy, and your bills are lower.

To help understand better, you could try using videos or talking to someone who knows about gadgets. Reading with a friend or a family member can help too.

A smart thermostat is a special device. It helps you control your heating and cooling at home. You can use a phone to change the temperature. It also learns when you like to have your home warmer or cooler. This can save energy and lower your bills.

How can I check if I can get help with my energy bills?

1. **Ask for Help:** You can ask someone at a community center or call a local help line. They can check if you can get help.

2. **Look Online:** Go to websites about energy help. They will have information about programs.

3. **Talk to Your Energy Company:** Call the company that sends your energy bills. They might have special plans to help you.

4. **Use a Support Tool:** There are apps and tools online that can check if you can get help.

If you need help reading, ask a friend or use a tool that reads out loud to you.

To get help paying for energy, it usually depends on how much money you earn, how old you are, and what you need. You can look on the UK government website or ask your local council to find out if you can get this help.

How do higher energy prices affect families with little money?

When energy prices go up, it can be hard for families with less money. They might use more of their money to pay for energy, like heating and electricity. This means they have less money for other important things they need.

Can changing energy companies help me save money on bills?

Yes, changing to a different energy company might save you money.

If your energy bills are too high, you can look at other energy companies.

Use a price comparison website to check prices from different companies.

Ask someone you trust to help you if you need it.

This might help you find a cheaper energy company.

Yes, changing to a new energy company with cheaper prices can help you spend less on energy bills. It’s good to look at different options and think about things like exit fees and how long the contract lasts.

Here are some tips to help:

- Use a price comparison website to find the best deals.

- Ask a friend or family member for help if you find it tricky.

- Look for easy-to-read contract terms.

What can help me learn about saving energy?

You can find booklets and websites that talk about saving energy. Try watching videos for easy tips. There are also mobile apps that help you save energy at home. Ask a family member or friend to help you. You can also talk to a teacher or visit the library for more information.

You can learn how to save energy in your home by visiting special websites. These websites are run by the government, energy companies, and groups like the Energy Saving Trust. They have lots of helpful tips on how to use less energy.

How can I save energy with home machines?

To use less energy with your appliances, try these tips:

- Buy appliances that save energy. Look for high energy ratings.

- Use appliances the way the instructions say. This helps them work better.

- Keep them clean and check them often so they work well.

Why are energy-saving light bulbs good to use?

Energy-saving light bulbs are a smart choice for your home. They use less electricity, which means lower energy bills. These bulbs last longer, so you won't need to change them as often. They are also good for the planet because they help reduce pollution. Using these bulbs is an easy way to save money and help the environment.

If you need help understanding, you can:

- Ask someone to explain it to you.

- Use pictures to see how energy-saving bulbs work.

- Watch a video about energy-saving light bulbs.

Some light bulbs save energy. These bulbs are called LED or CFL bulbs. They use less electricity and last longer. This means you pay less for electricity and do not have to buy new bulbs as often.

Using these tools can help you understand better:

- Picture books about electricity

- Videos that explain how light bulbs work

- Talking with someone who knows about light bulbs

How do energy prices change what we pay for things?

Energy prices can change a lot. When energy costs more, it can make everything cost more. This includes things we buy and use every day, like food, clothes, and services.

Here is how it works:

- Makers use energy: Factories need energy to make things. If energy is expensive, it costs more to make stuff.

- Moving stuff needs energy: Trucks and ships use fuel to move things from place to place. If fuel costs more, moving stuff costs more too.

- Shops and services: Stores and other services use energy to keep lights on and machines running. High energy prices mean their costs go up.

Because of these reasons, when energy prices go up, we might pay more for things we buy.

Here are some tips that can help:

- Use graphs or pictures to show how energy prices affect costs.

- Break ideas into small, easy pieces.

- Ask someone you trust to explain tough parts.

When energy prices go up, it costs more to make things and move them around. This means businesses might charge more money for the things we buy. This can make it harder for families to manage their money.

Tips to help:

- Make a budget - a simple plan for your money.

- Use money apps to track what you spend.

- Shop smart - look for sales and discounts.

Can renewable energy help lower energy prices?

Using energy that we can renew, like solar or wind power, might help make energy less expensive.

These energy sources do not run out and are free to use, which could help keep prices from going up.

Here are some ways to learn more:

- Watch videos about where energy comes from, like solar or wind.

- Use pictures and diagrams to understand how renewable energy works.

- Talk to an adult or teacher if you have questions about energy.

Using renewable energy like solar panels and wind turbines is a good idea. It can help us use less oil, gas, and coal. This means our energy prices might not change much and could even get cheaper over time. Plus, it can help us know what to expect with our energy costs.

How can I make my energy bills lower?

To help with your energy bills, you can do a few things:

- Watch how much energy you use. Try to use less.

- Try to save energy. Turn off lights when you leave a room.

- You can look at other energy suppliers. Sometimes they are cheaper.

- See if there are programs that can help with your bill costs.

Will putting up solar panels save me money on energy?

Putting solar panels on your house can help you use the sun to make power. This can make your energy bills smaller. Here are some easy points to help:

- Solar panels use the sun to make power.

- This power can run things in your home.

- If you use less power from the power company, you pay less money.

To learn more, you can:

- Ask someone who knows about solar panels.

- Watch videos or read books for kids about solar panels.

When you put solar panels on your house, you can use less electricity from the power company. This might make your energy bills go down. At first, it can cost a lot of money to get solar panels, but many people save money over time and enjoy other benefits.

Useful Links

This website offers general information and is not a substitute for professional advice.

Always seek guidance from qualified professionals.

If you have any medical concerns or need urgent help, contact a healthcare professional or emergency services immediately.

Some of this content was generated with AI assistance. We’ve done our best to keep it accurate, helpful, and human-friendly.

- Ergsy carfully checks the information in the videos we provide here.

- Videos shown by Youtube after a video has completed, have NOT been reviewed by ERGSY.

- To view, click the arrow in centre of video.

- Most of the videos you find here will have subtitles and/or closed captions available.

- You may need to turn these on, and choose your preferred language.

- Go to the video you'd like to watch.

- If closed captions (CC) are available, settings will be visible on the bottom right of the video player.

- To turn on Captions, click settings .

- To turn off Captions, click settings again.

More Items From Ergsy search

-

Impact of Rising Energy Prices on Household Budgets

Relevance: 100%

-

Impact of Rising Energy Costs on Family Budgets

Relevance: 74%

-

Energy Prices Set to Rise: How to Keep Your Bills Down

Relevance: 54%

-

Why was the energy price cap introduced?

Relevance: 50%

-

Does the energy price cap apply to all energy tariffs?

Relevance: 47%

-

What is the UK's energy price cap?

Relevance: 46%

-

Understanding the Impact of Rising Living Costs on Family Welfare

Relevance: 46%

-

What is the Energy Price Cap in the UK?

Relevance: 46%

-

What is the energy price cap?

Relevance: 44%

-

When was the energy price cap introduced?

Relevance: 44%

-

Have energy prices in the UK historically fluctuated?

Relevance: 44%

-

Does the energy price cap guarantee my total bill?

Relevance: 44%

-

UK Government Announces New Energy Bill Support Amid Rising Costs

Relevance: 43%

-

How often is the energy price cap reviewed?

Relevance: 43%

-

Are energy prices regulated in the UK?

Relevance: 43%

-

How does global energy demand affect UK energy prices?

Relevance: 42%

-

How does the energy price cap affect green energy tariffs?

Relevance: 41%

-

What factors influence changes to the energy price cap?

Relevance: 41%

-

What factors influence the rise and fall of energy bills in the UK?

Relevance: 41%

-

Can the energy price cap go down as well as up?

Relevance: 41%

-

How Rising Living Costs Are Impacting Family Wellbeing

Relevance: 41%

-

How can government intervention affect energy prices?

Relevance: 40%

-

Does the energy price cap apply to prepayment meters?

Relevance: 40%

-

How does the energy price cap affect my energy bills?

Relevance: 40%

-

Is the energy price cap being reviewed due to market changes?

Relevance: 40%

-

Is the energy price cap the same for everyone?

Relevance: 39%

-

Can fixed-rate tariffs offer better price stability compared to variable tariffs?

Relevance: 39%

-

How is the energy price cap calculated?

Relevance: 39%

-

Addressing the Rising Cost of Living: Community Support and Resources

Relevance: 39%

-

Do energy suppliers offer discounts on electricity prices?

Relevance: 39%

-

Are there apps that help manage and reduce household bills?

Relevance: 38%

-

Where can I find more information about the energy price cap?

Relevance: 38%

-

What role do renewable energy sources play in energy pricing?

Relevance: 38%

-

Rising Cost of Living: How Families Can Cope

Relevance: 38%

-

Where can I get budgeting advice to manage my household expenses better?

Relevance: 38%

-

What factors influence the difference in electricity prices among UK energy companies?

Relevance: 37%

-

How can I compare prices among different energy suppliers?

Relevance: 37%

-

Rising Property Prices Fuel Concerns Over First-Time Buyer Accessibility

Relevance: 36%

-

Can energy suppliers charge less than the price cap?

Relevance: 36%

-

How often do energy companies review their electricity prices?

Relevance: 35%