Find Help

More Items From Ergsy search

-

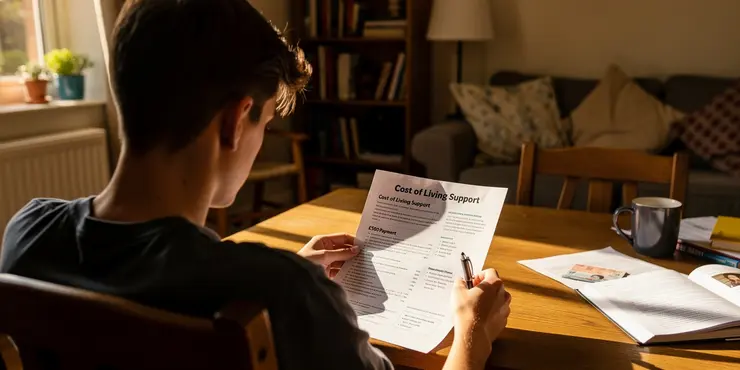

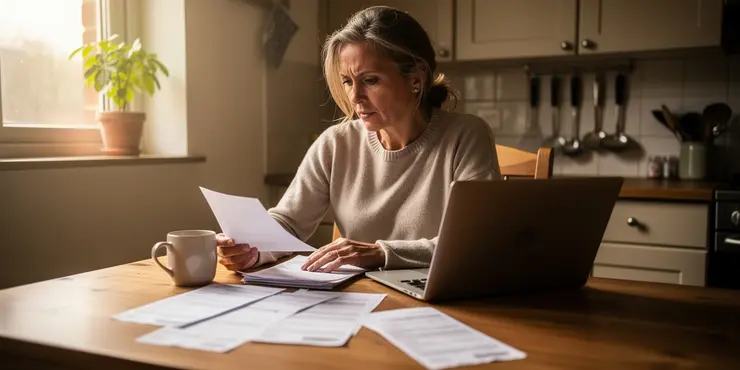

Rising Cost of Living: How Families Can Cope

Relevance: 100%

-

How Rising Living Costs Are Impacting Family Wellbeing

Relevance: 78%

-

Navigating the UK Cost of Living Crisis: Tips for Families

Relevance: 75%

-

Understanding the Impact of Rising Living Costs on Family Welfare

Relevance: 74%

-

Impact of Rising Living Costs on Family Health

Relevance: 74%

-

Financial Support for Families Amid Rising Cost of Living

Relevance: 64%

-

Impact of Cost of Living on UK Communities

Relevance: 62%

-

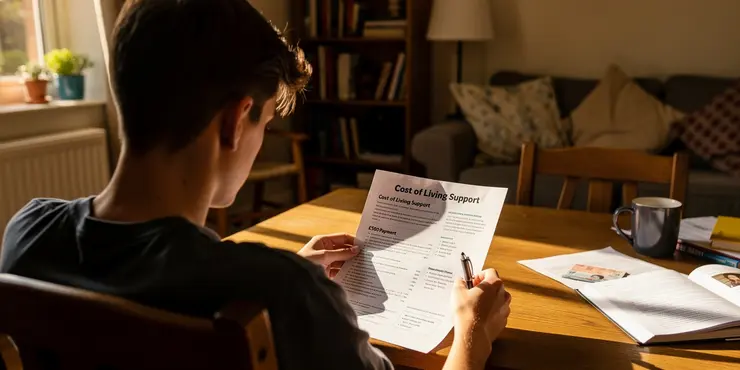

Is the £500 cost of living payment taxable?

Relevance: 61%

-

What is the £500 cost of living payment?

Relevance: 58%

-

What is the £500 cost of living payment?

Relevance: 58%

-

Is the £500 cost of living payment taxable?

Relevance: 57%

-

Is there a deadline to apply for the £500 cost of living payment?

Relevance: 57%

-

When will I receive the £500 cost of living payment?

Relevance: 56%

-

How do I apply for the £500 cost of living payment?

Relevance: 55%

-

Is the £500 cost of living payment a one-time payment?

Relevance: 54%

-

Mental Health Impact of Cost of Living Crisis and Support Resources

Relevance: 53%

-

Is the £500 cost of living payment a one-time payment?

Relevance: 52%

-

Can students receive the £500 cost of living payment?

Relevance: 52%

-

Addressing the Cost of Living Crisis: Community Support and Resources

Relevance: 52%

-

Will the £500 cost of living payment affect my benefits?

Relevance: 51%

-

Are students eligible for the £500 cost of living payment?

Relevance: 51%

-

Addressing the Rising Cost of Living: Community Support and Resources

Relevance: 51%

-

Are pensioners eligible for the £500 cost of living payment?

Relevance: 51%

-

Where can I find more information about the £500 cost of living payment?

Relevance: 50%

-

Charities Warn of Food Insecurity Amidst Rising Cost of Living

Relevance: 50%

-

how do I get the £500 cost of living payment before March deadline?

Relevance: 49%

-

Are there any fees to apply for the £500 cost of living payment?

Relevance: 49%

-

How can I apply for the £500 cost of living payment?

Relevance: 48%

-

Impact of Rising Energy Costs on Family Budgets

Relevance: 48%

-

Who is eligible to receive the £500 cost of living payment?

Relevance: 48%

-

Do I need to pay tax on the £500 cost of living payment?

Relevance: 47%

-

Can I receive this payment alongside other cost of living payments?

Relevance: 47%

-

Inflation Hits New High: How Shoppers Are Coping

Relevance: 45%

-

Can mature students apply for the £500 cost of living payment?

Relevance: 45%

-

Where can I find more information about the £500 cost of living payment?

Relevance: 45%

-

Essential Tips for Mental Health and Well-Being Amidst Rising Living Costs

Relevance: 44%

-

How can students apply for the £500 cost of living payment?

Relevance: 44%

-

What is the cost of living in a care home?

Relevance: 43%

-

What Household & Cost‑of‑Living Support grants may be available to me?

Relevance: 41%

-

New Government Benefits for Low-Income Families

Relevance: 39%

Rising Cost of Living: How Families Can Cope

Understanding the Rising Cost of Living

The cost of living in the United Kingdom has been on a consistent rise, affecting families nationwide. This increase is seen in essential areas such as housing, food, utilities, and transport, placing greater financial pressure on households. Understanding the components contributing to the rising costs can help families make informed decisions and plan better for the future.

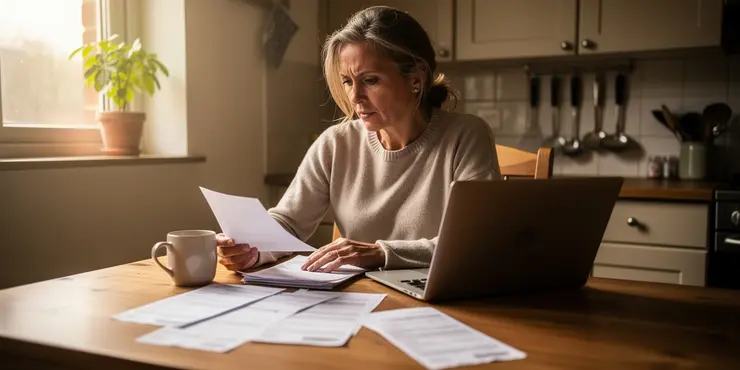

Budgeting Effectively

One of the most crucial strategies for coping with the rising cost of living is effective budgeting. Families should start by tracking their income and expenses meticulously. Creating a detailed budget allows for a clear overview of where money is being spent and highlights areas where savings can be made. Utilizing free budgeting tools or apps can also streamline the process and ensure that financial goals are met more easily.

Reducing Non-Essential Spending

Curbing non-essential spending is another practical approach. Dining out, entertainment subscriptions, and impulse purchases contribute significantly to monthly expenses. Families can benefit from evaluating what is truly essential and cutting back on luxuries. Engaging in cost-effective activities, such as home-cooking or free local events, can also help maintain a balanced lifestyle while saving money.

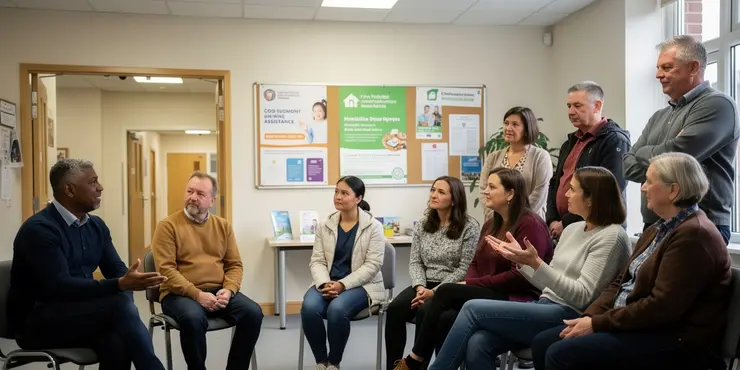

Exploring Government and Community Support

There are various forms of support available to UK families facing financial strain. Government assistance programs, such as Universal Credit, Child Benefit, and housing benefits, can provide much-needed relief. Additionally, community resources like food banks, local charities, and financial counseling services can offer support. Making use of these resources can provide a financial cushion during challenging times.

Energy Efficiency and Cost Savings

The cost of utilities is a significant concern for many families. Adopting energy-efficient practices can lead to substantial savings. Simple changes, such as using LED light bulbs, insulating homes, and opting for energy-efficient appliances, can reduce electricity and gas bills. Many energy companies also offer grants and assistance programs to help lower-income households improve efficiency and reduce costs.

Supplementing Income

Increasing household income can also mitigate the impact of rising living costs. This could involve taking on part-time work, freelancing, or even starting a small home-based business. For those with professional skills, platforms offering freelance work or gig economy jobs may provide additional income streams to support the family budget.

Making Long-Term Financial Plans

While immediate measures can provide relief, making long-term financial plans is essential. Investing in education, training, or starting a savings plan can provide financial stability for the future. Engaging with a financial advisor might also offer personalized strategies for managing finances more effectively.

Building a Supportive Community

Finally, building a supportive community can make a significant difference. Sharing resources, knowledge, and support with family, friends, and neighbors can help navigate financial challenges collectively. Community groups and online forums can also offer valuable advice and support networks for those looking to manage their expenses more effectively.

Conclusion

The rising cost of living is a substantial challenge for many families in the UK. However, with careful planning, strategic budgeting, and making use of available resources and support systems, families can cope more effectively and work towards financial stability.

Rising Cost of Living: How Families Can Cope

Understanding the Rising Cost of Living

The cost of living in the UK is going up. This means things like houses, food, and transport cost more money. It can be hard for families. By knowing why things cost more, families can plan better and make good choices.

Budgeting Effectively

Making a budget is very important. A budget helps you see how much money you have and what you spend it on. Write down how much you earn and what you buy. This way, you can see where you might save money. There are free tools and apps to help you make a budget. They can make it easier to reach your money goals.

Reducing Non-Essential Spending

Spend less on things you do not really need. Eating out, streaming services, and buying things you don't need can cost a lot. Ask yourself what you truly need and try to cut down on extras. You can still have fun by cooking at home or going to free events nearby.

Exploring Government and Community Support

The government has programs to help families with money troubles. Programs like Universal Credit and Child Benefit can help. There are also community services like food banks and charities. Using these can give you extra help when you need it.

Energy Efficiency and Cost Savings

Utility bills can be high, but saving energy can help. Use LED lights, insulate your home, and get efficient appliances to save money. Some energy companies offer help to make homes more energy-efficient, especially for families with low income.

Supplementing Income

Making more money can also help. You could find a part-time job or freelance work. Some people start small businesses at home. If you have special skills, you can earn money online. This extra money can help you cover costs.

Making Long-Term Financial Plans

Thinking about the future is important too. You can save money or learn new skills to get a better job. Talking to a financial advisor can also help. They can give you personal advice on how to use your money better.

Building a Supportive Community

Having support from others helps a lot. You can share things or ideas with family and friends. Join community groups or online forums. These can offer advice and support when managing your money.

Conclusion

The rising cost of living is hard for families in the UK. But, with planning, budgeting, and using support systems, families can manage better and aim for a stable financial future.

Frequently Asked Questions

What are the main factors contributing to the rising cost of living in the UK?

Factors include inflation, increased energy prices, higher housing costs, and global supply chain disruptions.

How can families reduce their energy bills?

Families can reduce energy bills by using energy-efficient appliances, improving home insulation, and adopting habits like turning off lights and appliances when not in use.

Are there any government programs to help with the cost of living?

Yes, the UK government offers various programs such as Universal Credit, Housing Benefit, and the Warm Home Discount to assist families with living costs.

Can budgeting help manage rising living costs?

Absolutely. Creating and sticking to a budget helps families track their spending, prioritize essential expenses, and save money.

How can families save on grocery bills?

Families can save on groceries by meal planning, buying in bulk, using discount vouchers, and choosing supermarket own-brand products.

What advice is there for managing debt amid rising living costs?

Prioritize paying off high-interest debt first, seek advice from debt charities like Citizens Advice, and consider consolidating debts to lower interest rates.

What financial tools can help manage expenses?

Financial tools like budgeting apps, expense trackers, and using savings accounts with high interest rates can aid in managing expenses.

How can families benefit from bulk buying and stocking up?

Bulk buying often offers lower per-unit prices, and stocking up on non-perishable items during sales can lead to overall savings.

What are the benefits of using public transportation over owning a car?

Public transportation can be more cost-effective than owning a car, avoiding expenses like fuel, insurance, parking, and maintenance.

Is investing in renewable energy an option for reducing household costs?

Yes, investing in renewable energy sources like solar panels can reduce long-term energy costs and potentially provide government incentives.

How can families benefit from government housing schemes?

Government housing schemes like Help to Buy and Shared Ownership can make buying a home more affordable and accessible for families.

What should families consider when purchasing insurance during times of high living costs?

Families should compare policies to ensure they get the best value, consider bundling policies, and review coverage to avoid paying for unnecessary extras.

How can families make use of community resources to reduce expenses?

Families can utilize community resources like food banks, community centers, and local support groups for assistance with food, clothing, and other needs.

Are there ways to save on childcare costs?

Utilize government schemes like Tax-Free Childcare, seek out local childcare grants, and consider sharing childcare responsibilities with other parents.

What are some long-term strategies for coping with rising living costs?

Long-term strategies include continuous budgeting, investing in education and skills for better job prospects, regularly reviewing and adjusting expenses, and building an emergency savings fund.

What makes the cost of living go up in the UK?

Why are things getting more expensive in the UK? Here are some reasons:

- Prices go up: Things like food and clothes cost more money.

- More people want things: If lots of people want to buy something, it can make the price higher.

- Money changes: Sometimes the value of money goes up or down, which can change prices.

- Weather changes: If there's bad weather, it can damage crops or goods, making them cost more.

If reading is hard, try using tools that can read out loud or help you understand words better.

Things like prices going up, energy costing more, houses being more expensive, and problems getting things from other countries are reasons.

How can families save money on energy bills?

Here are some ways families can save money on energy:

- Turn off lights when leaving a room. This saves electricity.

- Use energy-saving light bulbs. They use less power.

- Unplug chargers when not in use. They use power even if nothing is charging.

- Keep doors and windows closed when the heat or air conditioning is on. This keeps warm or cool air inside.

- Use thick curtains to keep heat inside during winter.

- Fix leaky taps. This can save on water heating costs.

Families can also try setting a budget for energy spending and use apps to track energy use. Ask for help from utility companies; sometimes, they can offer advice or discounts.

Families can save money on energy bills by doing a few simple things:

- Use appliances that save energy.

- Make sure the house is well-insulated to keep warm air in.

- Turn off lights and appliances when you are not using them.

Try using stickers and reminders to help remember to turn things off.

Does the government have programs to help with living costs?

Yes, the government has programs that can help with living costs. These programs can give you money or other kinds of help.

Here are a few things you could do:

- Look online at the government's website to find programs that can help you.

- Ask a family member, friend, or support worker to help you find out more.

- Use simple tools like a computer or tablet to search for help.

If you need help reading or understanding, ask someone you trust to explain it to you.

Yes, the UK government has programs to help families with money. These include Universal Credit, Housing Benefit, and the Warm Home Discount. These programs help with costs like rent, bills, and other living expenses.

Tools like text-to-speech apps can read this text aloud. Highlighting tools can make it easier to focus on one sentence or word at a time.

Can planning a budget help with higher living costs?

Yes, a budget is a helpful tool. It helps families know where their money goes, pay for important things first, and save money.

How can families save money on groceries?

Here are some easy ways to spend less on food:

- Make a List: Write down what you need before shopping. Stick to the list!

- Look for Sales: Check for discounts or sales in the store.

- Buy in Bulk: Get large packs of items you use often. They cost less over time.

- Cook at Home: It's cheaper to make meals at home than to eat out.

- Plan Meals: Think about what you will eat each day. This helps avoid waste.

You can use pictures or apps on your phone to help remember your list. Shopping with someone else can also help you stay on track.

Families can save money on food by doing these things:

- Plan meals ahead of time.

- Buy big packs of food.

- Use coupons to get discounts.

- Buy store-brand products because they are often cheaper.

It can also help to make a shopping list before going to the store. This way, you only buy what you need.

How can I handle debt when everything is getting more expensive?

Pay off the loans that cost you the most money first. You can ask for help from groups like Citizens Advice. They can help with money problems. Think about putting all your loans together. This might make it cheaper to pay them back.

What money tools can help you handle spending?

Here are some simple ways to manage your money:

- Budgeting App: This is a phone or computer app that helps you track how much money you have and what you spend.

- Spending Plan: Make a list of your income and expenses. Plan where your money will go each month.

- Saving Goals: Set small goals to save a little money every week or month.

- Use Cash: Pay with cash instead of cards to help stay within your spending limit.

These tools can help you understand and control your spending better. You can ask someone you trust for help if you have questions.

Money tools can help you manage your spending. You can use apps to make a budget and see where you spend money. It’s also a good idea to use a savings account that gives you more money back for saving.

How can families save money by buying in bulk and storing food?

Buying in bulk means getting a lot of something at once. It is usually cheaper. Here is how families can save money and keep food fresh:

- Save Money: Buying more at once often costs less per item. This means you pay less in the long run.

- Fewer Trips: You don't have to go to the store as often. This saves time and travel money.

- Be Prepared: You will have extra food at home. This is helpful if you can't get to the store.

- Avoid Food Waste: Make sure to store food properly. Use the oldest food first.

Here are some tools and tips that can help:

- Storage Containers: Use boxes and jars that keep food fresh.

- Labels: Write dates on foods to use them in order.

- Meal Planning: Plan your meals to use what you have.

Buying in large amounts usually costs less for each item. Buying things that don't go bad when they are on sale can save you money.

Why is it good to use buses and trains instead of having a car?

Taking buses and trains can be cheaper than having a car. You don't have to pay for things like gas, insurance, parking, or repairs.

Can using clean energy help save money at home?

Using clean energy like solar or wind can help you save money on your bills. When you make your own power, you might pay less for electricity.

Here are some tips if you want to learn more:

- Look for videos or apps that explain clean energy.

- Ask a friend or family member to help you understand.

- Visit a local library for books on clean energy.

Yes, using energy from the sun with solar panels can make your bills cheaper over time. You might also get help from the government for doing this.

How do government housing plans help families?

Government housing plans like Help to Buy and Shared Ownership can help families buy homes. These plans make it cheaper and easier to get a house.

What should families think about when buying insurance when things cost a lot?

Buying insurance can be important. Here are some things families might think about:

- Look at what you really need: Think about what your family needs the most.

- Set a budget: Decide how much money you can spend on insurance each month.

- Compare different plans: Look at different insurance plans to find the best deal.

- Ask for help: If you find it hard to understand, ask someone you trust or a financial advisor to help you.

Tools that can help:

- Online comparison tools: Use websites that show different plans and prices.

- Budgeting apps: Keep track of your money to see what you can afford.

It is important for families to look at different insurance plans. This helps them find the best one for their money. They can also think about getting more than one plan from the same company. This might save them money. Families should check what the plans cover to make sure they are not paying for things they don't need.

How can families use local help to save money?

Families can find help in their community to spend less money. Here are some tips:

- Visit the local library. Libraries have free books, internet, and activities.

- Check out local parks. Parks are free and great for playing or having a picnic.

- Look for community centers. They often have free or cheap classes and events.

- Join a food co-op or community garden. These can help you get food for less money.

- Find local support groups. They can give advice and share resources.

Using these local resources can help families save money and have fun too!

Families can get help from places in their community. They can go to food banks to get food. Community centers can also help. There are local groups where people come together to give clothes and help with other things families need.

How can I spend less money on childcare?

Use government help, like Tax-Free Childcare. Look for local grants to help pay for childcare. Think about sharing childcare duties with other parents.

How can we deal with costs going up for a long time?

Here are some tips to help manage money:

- Make a plan for how to spend your money. This is called budgeting.

- Learn new things and skills to get a better job.

- Look at what you spend and see if you can spend less.

- Save some money for emergencies, like if your car breaks down.

Some tools that might help are:

- A simple app to track spending.

- Asking someone who knows about money for advice.

- Watching videos or reading easy books on saving money.

Useful Links

This website offers general information and is not a substitute for professional advice.

Always seek guidance from qualified professionals.

If you have any medical concerns or need urgent help, contact a healthcare professional or emergency services immediately.

Some of this content was generated with AI assistance. We’ve done our best to keep it accurate, helpful, and human-friendly.

- Ergsy carfully checks the information in the videos we provide here.

- Videos shown by Youtube after a video has completed, have NOT been reviewed by ERGSY.

- To view, click the arrow in centre of video.

- Most of the videos you find here will have subtitles and/or closed captions available.

- You may need to turn these on, and choose your preferred language.

- Go to the video you'd like to watch.

- If closed captions (CC) are available, settings will be visible on the bottom right of the video player.

- To turn on Captions, click settings .

- To turn off Captions, click settings again.

More Items From Ergsy search

-

Rising Cost of Living: How Families Can Cope

Relevance: 100%

-

How Rising Living Costs Are Impacting Family Wellbeing

Relevance: 78%

-

Navigating the UK Cost of Living Crisis: Tips for Families

Relevance: 75%

-

Understanding the Impact of Rising Living Costs on Family Welfare

Relevance: 74%

-

Impact of Rising Living Costs on Family Health

Relevance: 74%

-

Financial Support for Families Amid Rising Cost of Living

Relevance: 64%

-

Impact of Cost of Living on UK Communities

Relevance: 62%

-

Is the £500 cost of living payment taxable?

Relevance: 61%

-

What is the £500 cost of living payment?

Relevance: 58%

-

What is the £500 cost of living payment?

Relevance: 58%

-

Is the £500 cost of living payment taxable?

Relevance: 57%

-

Is there a deadline to apply for the £500 cost of living payment?

Relevance: 57%

-

When will I receive the £500 cost of living payment?

Relevance: 56%

-

How do I apply for the £500 cost of living payment?

Relevance: 55%

-

Is the £500 cost of living payment a one-time payment?

Relevance: 54%

-

Mental Health Impact of Cost of Living Crisis and Support Resources

Relevance: 53%

-

Is the £500 cost of living payment a one-time payment?

Relevance: 52%

-

Can students receive the £500 cost of living payment?

Relevance: 52%

-

Addressing the Cost of Living Crisis: Community Support and Resources

Relevance: 52%

-

Will the £500 cost of living payment affect my benefits?

Relevance: 51%

-

Are students eligible for the £500 cost of living payment?

Relevance: 51%

-

Addressing the Rising Cost of Living: Community Support and Resources

Relevance: 51%

-

Are pensioners eligible for the £500 cost of living payment?

Relevance: 51%

-

Where can I find more information about the £500 cost of living payment?

Relevance: 50%

-

Charities Warn of Food Insecurity Amidst Rising Cost of Living

Relevance: 50%

-

how do I get the £500 cost of living payment before March deadline?

Relevance: 49%

-

Are there any fees to apply for the £500 cost of living payment?

Relevance: 49%

-

How can I apply for the £500 cost of living payment?

Relevance: 48%

-

Impact of Rising Energy Costs on Family Budgets

Relevance: 48%

-

Who is eligible to receive the £500 cost of living payment?

Relevance: 48%

-

Do I need to pay tax on the £500 cost of living payment?

Relevance: 47%

-

Can I receive this payment alongside other cost of living payments?

Relevance: 47%

-

Inflation Hits New High: How Shoppers Are Coping

Relevance: 45%

-

Can mature students apply for the £500 cost of living payment?

Relevance: 45%

-

Where can I find more information about the £500 cost of living payment?

Relevance: 45%

-

Essential Tips for Mental Health and Well-Being Amidst Rising Living Costs

Relevance: 44%

-

How can students apply for the £500 cost of living payment?

Relevance: 44%

-

What is the cost of living in a care home?

Relevance: 43%

-

What Household & Cost‑of‑Living Support grants may be available to me?

Relevance: 41%

-

New Government Benefits for Low-Income Families

Relevance: 39%