Find Help

More Items From Ergsy search

-

Can I get a loan to cover funeral costs?

Relevance: 100%

-

What financial help is available for funeral costs?

Relevance: 77%

-

Funeral Costs - Where to get help? - Community Legal Education

Relevance: 70%

-

What is the average cost of a funeral in the UK?

Relevance: 69%

-

What support is available for funeral costs in the UK?

Relevance: 69%

-

What costs are usually associated with a funeral?

Relevance: 66%

-

Are there any charities that can help with funeral costs?

Relevance: 66%

-

How much does a funeral typically cost in the UK?

Relevance: 65%

-

Does life insurance cover funeral costs?

Relevance: 64%

-

What financial support is available for funeral expenses?

Relevance: 57%

-

Who is eligible for a Funeral Expenses Payment?

Relevance: 55%

-

How to arrange a funeral in the UK

Relevance: 51%

-

Planning for your funeral

Relevance: 51%

-

What is a pre-paid funeral plan?

Relevance: 50%

-

How do I apply for a Funeral Expenses Payment?

Relevance: 49%

-

Can I arrange a funeral service myself without a funeral director?

Relevance: 49%

-

How do I choose a funeral director?

Relevance: 49%

-

What is a public health funeral?

Relevance: 48%

-

Can funeral directors offer payment plans?

Relevance: 47%

-

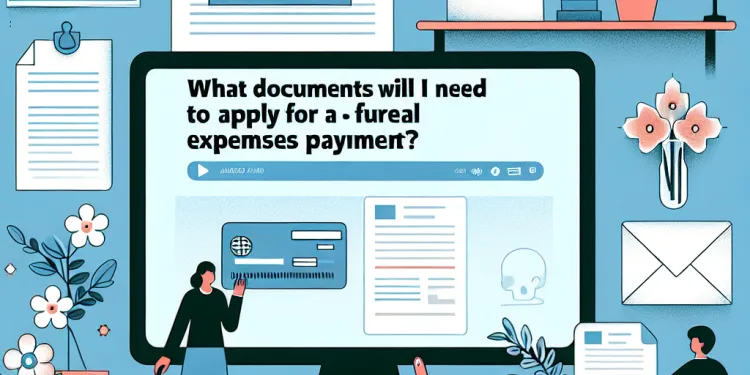

What documents will I need to apply for a Funeral Expenses Payment?

Relevance: 46%

-

How much can I receive from the Funeral Expenses Payment?

Relevance: 46%

-

What is a green or eco-friendly funeral?

Relevance: 44%

-

What is the role of a funeral director in a traditional burial?

Relevance: 43%

-

What is loan rehabilitation?

Relevance: 43%

-

Can I use crowdfunding to raise money for funeral expenses?

Relevance: 43%

-

What Do You Want for Your Own Funeral? | Personal Funeral Wishes Explored

Relevance: 42%

-

How much does a traditional ground burial cost in the UK?

Relevance: 42%

-

Can my loan repayment terms be renegotiated?

Relevance: 42%

-

What are the different types of funerals available?

Relevance: 41%

-

Can I have a funeral service at home?

Relevance: 41%

-

Planning Your Funeral in Advance? | Expert Tips from Celebrants

Relevance: 41%

-

Can switching banks offer better loan options?

Relevance: 41%

-

How do I notify people about the funeral?

Relevance: 41%

-

How does loan consolidation help with repayment?

Relevance: 41%

-

What happens to my loans if I go back to school?

Relevance: 41%

-

What is direct cremation and how much does it cost in the UK?

Relevance: 41%

-

What is the first step in arranging a funeral in the UK?

Relevance: 40%

-

Do I need to have a wake or reception after the funeral?

Relevance: 40%

-

Can switching banks offer better loan options?

Relevance: 40%

-

Are there regulations on transporting the body before the funeral?

Relevance: 40%

Can I Get a Loan to Cover Funeral Costs?

Managing the financial aspects of a funeral can be overwhelming, as costs can quickly add up. In the United Kingdom, a variety of options are available to help families manage these expenses, one of which is taking out a personal loan.

Understanding Funeral Loans

Funeral loans are specifically designed to cover the costs associated with a funeral. These loans can be an immediate way to access funds, helping to alleviate the financial burden during a challenging emotional time. The amount you can borrow depends on the lender’s policies and your creditworthiness, covering costs such as coffin expenses, flowers, transport, and burial or cremation fees.

Types of Loans Available

If a specific funeral loan is not available, personal loans are a viable alternative. Personal loans are offered by banks, credit unions, and online lenders, and can be used for any purpose, including covering funeral expenses. Moreover, some lenders offer short-term loans, also known as payday loans, that can be used for urgent needs, although they typically come with higher interest rates and shorter repayment terms.

Eligibility and Application Process

To be eligible for a loan, you might need to demonstrate your ability to repay it, typically evidenced by a steady income and a good credit score. The application process usually involves filling out a form with your personal, financial information, and supporting documents. In some cases, a visit to the bank may be necessary to finalise the application.

Government Support and Alternatives

In addition to loans, it’s worth exploring if you qualify for government assistance. The UK government offers the Funeral Expenses Payment for individuals receiving certain benefits, which can help cover some funeral costs. Additionally, checking if the deceased had a funeral plan, insurance, or savings set aside can provide further financial support.

Conclusion

Negotiating funeral costs can be stressful, yet financial assistance is available in the form of loans or government support in the UK. It’s essential to carefully consider the best option for your financial situation, potentially consulting a financial adviser for guidance. Comparing different loan offers and understanding the repayment terms can aid in making a more informed decision during this difficult time.

Can I Get a Loan to Cover Funeral Costs?

Funerals can be expensive, and paying for them can be hard. In the UK, there are ways to help families pay for funerals, like getting a personal loan.

Understanding Funeral Loans

Funeral loans are special loans to help pay for a funeral. These loans give you money quickly, so you don't have to worry as much. The amount you can borrow depends on the lender and your credit. You can use the loan for things like the coffin, flowers, transport, and burial or cremation fees.

Types of Loans Available

If you can't get a funeral loan, you can still get a personal loan. Personal loans come from banks, credit unions, and online lenders. You can use them for funerals. Some lenders also offer short-term loans, but these can be more expensive because of higher interest rates and quick repayment times.

Eligibility and Application Process

To get a loan, you might need to show you can pay it back. This usually means having a steady income and a good credit history. To apply, you fill out a form with your details and give some documents. Sometimes, you might need to visit the bank to finish your application.

Government Support and Alternatives

Besides loans, you can see if you can get help from the government. In the UK, there's the Funeral Expenses Payment for people getting certain benefits, which helps pay for funerals. You should also check if the person who passed away had a funeral plan, insurance, or savings to help with costs.

Conclusion

Paying for funerals can be stressful, but there are ways to get help, like loans or government support in the UK. Make sure to pick the best option for your situation. Talking to a financial adviser might be a good idea. Look at different loan offers and understand how to pay them back before deciding.

Frequently Asked Questions

Can I get a loan to cover funeral costs in the UK?

Yes, you can apply for a funeral loan in the UK to help cover the costs of a funeral service.

What types of loans are available for funeral costs?

There are personal loans and specialised funeral loans available to cover funeral expenses in the UK.

What is the average cost of a funeral in the UK?

The average cost of a funeral in the UK can range from £3,000 to £5,000 depending on the type of service.

Do I need good credit to get a funeral loan?

Having good credit can help, but there are lenders who offer loans to those with less-than-perfect credit.

How can I apply for a funeral loan?

You can apply for a funeral loan online or through a bank or credit union that offers such products.

What information do I need to provide when applying for a funeral loan?

Typically, you'll need to provide personal identification, proof of income, and details of the funeral expenses.

Can I use a personal loan for funeral expenses?

Yes, personal loans can be used to cover funeral expenses if they are not specifically designated as funeral loans.

Are there any grants available to help with funeral costs?

Yes, the UK government offers a Funeral Expenses Payment to those on certain benefits to help cover costs.

What is a Funeral Expenses Payment?

A Funeral Expenses Payment is a contribution from the UK government to help pay for funeral costs for those eligible.

How do I qualify for a Funeral Expenses Payment?

Eligibility depends on financial circumstances and whether you are receiving certain benefits in the UK.

Do funeral homes offer any payment plans?

Some funeral homes in the UK may offer payment plans or financing options to help spread out the cost.

What should I look for in a funeral loan lender?

Look for reputable lenders with clear terms, competitive interest rates, and good customer reviews.

Is it possible to use a credit card to pay for funeral costs?

Yes, if you have sufficient credit available, you can use a credit card to pay for funeral expenses.

What are the risks of taking out a loan for funeral expenses?

The risks include accruing interest, increasing debt levels, and potential financial strain if repayments are not affordable.

Can life insurance be used to cover funeral costs?

Yes, life insurance benefits can often be used to pay for funeral expenses, depending on the policy terms.

Can I borrow money to help pay for a funeral in the UK?

If you need money to help pay for a funeral, you might be able to borrow it. This is called a loan.

Sometimes, people do not have enough money saved for a funeral. In these cases, a loan can help.

It is important to know that you will need to pay the loan back later. If you have trouble reading or understanding about loans, you can ask someone you trust for help.

Yes, you can ask for a loan in the UK to help pay for a funeral.

What loans can help pay for a funeral?

When someone dies, it can cost money for the funeral.

Here are some loans that can help:

- Personal Loan: You borrow from a bank and pay it back slowly.

- Funeral Loan: This is just for funerals, from some banks or places.

- Credit Card: You pay with a card and pay back later. Be careful with extra costs.

- Family Loan: Someone in your family might lend you money.

There are ways to get help:

- Ask a friend or helper to read with you.

- Use a calculator for keeping track of money.

- Talk to a bank worker to explain things.

You can use a personal loan or a special funeral loan to help pay for a funeral in the UK.

How much does a funeral cost in the UK?

Funerals can be expensive. In the UK, a funeral usually costs a lot of money. Ask an adult to help you find out more about costs. You can also use online tools to compare prices.

In the UK, having a funeral can cost between £3,000 and £5,000. The price depends on the kind of service you choose.

Can I get a funeral loan if my credit is not good?

Having good credit is helpful. But, some lenders give loans to people with not-so-good credit too.

How do I get money for a funeral?

1. Talk to your bank or a loan company. They can help you get a loan.

2. You will need some papers like your ID and a paper that shows how much money you earn.

3. Ask family or friends if they can help you fill out forms.

4. Use a computer or ask someone to help you go online to look for loans.

5. There are phone apps that can help you fill out forms.

You can ask for a loan to pay for a funeral. You can do this online or at a bank or a credit union that offers these loans.

What do I need to tell the bank to get money for a funeral?

You will usually need to show who you are, prove how much money you earn, and give information about the funeral costs.

Can I borrow money to pay for a funeral?

Yes, you can borrow money to help pay for a funeral. This is called a personal loan. A personal loan is money you borrow from a bank or another lender. You have to pay this money back later, usually with interest, which is extra money you have to pay for borrowing.

Here are some steps to help you:

- Talk to a bank or someone who gives loans. Ask them about personal loans for funerals.

- Make a plan for how you will pay back the money. This plan is called a budget.

- Ask a friend or family member to help you understand the loan. They can help you with any hard words.

- Use a calculator to help you see how much money you will pay back each month.

Remember to ask for help if you need it. You can talk to a family member, friend, or a bank worker. They can explain things to you in a simple way.

Yes, you can use a personal loan to pay for a funeral. The loan does not have to be special for funerals.

Can I get any money to help pay for a funeral?

You might be able to get some money to help pay for a funeral. This money is called a 'grant'.

Here are some tips to help you:

- Ask someone you trust to help you fill out forms.

- Look for help online or ask at places like your local library or community center.

- Use simple lists to keep track of what you need to do.

The UK government can give money to help pay for a funeral. This is called a Funeral Expenses Payment. You can get this help if you receive certain benefits.

What is a Funeral Expenses Payment?

A Funeral Expenses Payment is money to help pay for a funeral.

You can use this money to pay for things like:

- The person’s coffin

- Flowers for the funeral

- Travel to the funeral

Here are some tips that might help you:

- Ask someone you trust to help you read and understand letters

- Use a computer or phone to read information out loud

- Draw or write notes to help you remember

A Funeral Expenses Payment is money from the UK government. It helps pay for funeral costs if you can get it.

Who can get help to pay for a funeral?

You can get help depending on how much money you have and if you get certain help or benefits from the UK government.

Can you pay for a funeral bit by bit?

You might be able to pay for a funeral a little at a time. Some funeral homes let you do this. It can make it easier to pay.

Ask the funeral home if they have payment plans. This means you can pay small amounts over time.

Some funeral homes in the UK can help you pay by letting you pay a bit at a time. They offer plans to spread the cost out.

What should I check when picking someone for a funeral loan?

Here is how to choose a good lender (a person or bank that gives you money):

- See if they explain everything clearly.

- Check how much money you will have to pay back.

- Ask if there are any extra charges.

- Find out if they can be reached easily if you have questions.

- Look to see what other people say about them.

To make things easier, bring a friend or family member to help ask questions.

Using a calculator can help see if you can pay back the loan.

Find lenders you can trust. They should have clear rules, fair interest rates, and good reviews from other customers.

Can you use a credit card to pay for a funeral?

Yes, you can use a credit card to pay for a funeral.

If you use a credit card, make sure you can pay it back later. This can help you avoid extra money fees.

If you need help, ask someone you trust. They can help you make a plan to pay for the funeral.

Yes, you can use a credit card to pay for a funeral if you have enough credit.

What can happen if you borrow money to pay for a funeral?

Sometimes families need help to pay for a funeral. They might borrow money, which is called a loan.

But borrowing money can be tricky. Here are some things to think about:

- You have to pay the money back.

- You might have to pay extra money, called interest.

- If you can't pay it back, it can cause problems.

If you find reading hard, you can ask someone to help you understand.

You can also use a calculator to see how much you have to pay back in total.

The risks are:

- Interest can add up over time.

- Debt can grow bigger.

- You might struggle if you can't afford the payments.

You can use tools like budget planners or ask someone to help you understand your money. These can help you stay on track.

Can you use life insurance to pay for a funeral?

Life insurance money can help pay for a funeral. This can make things easier for family and friends.

Helpful tools: You can use a calculator to see the costs. You might also like to have a friend or family member help you.

Yes, money from life insurance can be used to pay for a funeral. This depends on the rules of the insurance plan.

Useful Links

This website offers general information and is not a substitute for professional advice.

Always seek guidance from qualified professionals.

If you have any medical concerns or need urgent help, contact a healthcare professional or emergency services immediately.

Some of this content was generated with AI assistance. We’ve done our best to keep it accurate, helpful, and human-friendly.

- Ergsy carfully checks the information in the videos we provide here.

- Videos shown by Youtube after a video has completed, have NOT been reviewed by ERGSY.

- To view, click the arrow in centre of video.

- Most of the videos you find here will have subtitles and/or closed captions available.

- You may need to turn these on, and choose your preferred language.

- Go to the video you'd like to watch.

- If closed captions (CC) are available, settings will be visible on the bottom right of the video player.

- To turn on Captions, click settings .

- To turn off Captions, click settings again.

More Items From Ergsy search

-

Can I get a loan to cover funeral costs?

Relevance: 100%

-

What financial help is available for funeral costs?

Relevance: 77%

-

Funeral Costs - Where to get help? - Community Legal Education

Relevance: 70%

-

What is the average cost of a funeral in the UK?

Relevance: 69%

-

What support is available for funeral costs in the UK?

Relevance: 69%

-

What costs are usually associated with a funeral?

Relevance: 66%

-

Are there any charities that can help with funeral costs?

Relevance: 66%

-

How much does a funeral typically cost in the UK?

Relevance: 65%

-

Does life insurance cover funeral costs?

Relevance: 64%

-

What financial support is available for funeral expenses?

Relevance: 57%

-

Who is eligible for a Funeral Expenses Payment?

Relevance: 55%

-

How to arrange a funeral in the UK

Relevance: 51%

-

Planning for your funeral

Relevance: 51%

-

What is a pre-paid funeral plan?

Relevance: 50%

-

How do I apply for a Funeral Expenses Payment?

Relevance: 49%

-

Can I arrange a funeral service myself without a funeral director?

Relevance: 49%

-

How do I choose a funeral director?

Relevance: 49%

-

What is a public health funeral?

Relevance: 48%

-

Can funeral directors offer payment plans?

Relevance: 47%

-

What documents will I need to apply for a Funeral Expenses Payment?

Relevance: 46%

-

How much can I receive from the Funeral Expenses Payment?

Relevance: 46%

-

What is a green or eco-friendly funeral?

Relevance: 44%

-

What is the role of a funeral director in a traditional burial?

Relevance: 43%

-

What is loan rehabilitation?

Relevance: 43%

-

Can I use crowdfunding to raise money for funeral expenses?

Relevance: 43%

-

What Do You Want for Your Own Funeral? | Personal Funeral Wishes Explored

Relevance: 42%

-

How much does a traditional ground burial cost in the UK?

Relevance: 42%

-

Can my loan repayment terms be renegotiated?

Relevance: 42%

-

What are the different types of funerals available?

Relevance: 41%

-

Can I have a funeral service at home?

Relevance: 41%

-

Planning Your Funeral in Advance? | Expert Tips from Celebrants

Relevance: 41%

-

Can switching banks offer better loan options?

Relevance: 41%

-

How do I notify people about the funeral?

Relevance: 41%

-

How does loan consolidation help with repayment?

Relevance: 41%

-

What happens to my loans if I go back to school?

Relevance: 41%

-

What is direct cremation and how much does it cost in the UK?

Relevance: 41%

-

What is the first step in arranging a funeral in the UK?

Relevance: 40%

-

Do I need to have a wake or reception after the funeral?

Relevance: 40%

-

Can switching banks offer better loan options?

Relevance: 40%

-

Are there regulations on transporting the body before the funeral?

Relevance: 40%