Find Help

More Items From Ergsy search

-

Who is eligible for a Time to Pay arrangement for Self Assessment?

Relevance: 100%

-

What is a Time to Pay arrangement for Self Assessment?

Relevance: 98%

-

Time to Pay arrangement for Self Assessment?

Relevance: 96%

-

How to set up a Time to Pay arrangement online for Self Assessment

Relevance: 93%

-

How can I apply for a Time to Pay arrangement online for Self Assessment?

Relevance: 86%

-

What is a Self Assessment tax return?

Relevance: 60%

-

Is there a penalty for setting up a Time to Pay arrangement?

Relevance: 59%

-

How do I register for Self Assessment?

Relevance: 59%

-

My first Self Assessment tax return

Relevance: 59%

-

Is there any interest charged on a Time to Pay arrangement?

Relevance: 58%

-

What if I owe more than £30,000 in Self Assessment tax?

Relevance: 57%

-

Can I get help from HMRC with my Self Assessment?

Relevance: 56%

-

Can a Time to Pay arrangement affect my credit score?

Relevance: 56%

-

Who needs to file a Self Assessment tax return?

Relevance: 55%

-

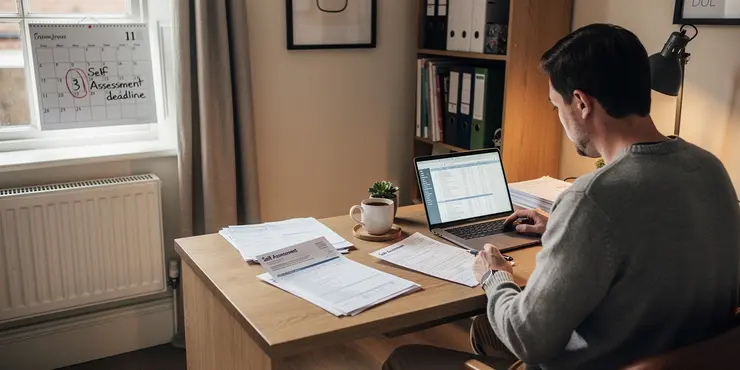

What happens if I miss the Self Assessment deadline?

Relevance: 55%

-

How do I complete my Self Assessment tax return?

Relevance: 54%

-

How long can I spread my payments under a Time to Pay arrangement?

Relevance: 53%

-

How will I know if my Time to Pay arrangement is approved?

Relevance: 52%

-

What happens if I miss a payment under a Time to Pay arrangement?

Relevance: 52%

-

Can I cancel a Time to Pay arrangement once it’s set up?

Relevance: 52%

-

When is the deadline for submitting my Self Assessment tax return?

Relevance: 52%

-

What if I'm not comfortable applying online for a Time to Pay arrangement?

Relevance: 51%

-

Can I include previous year's tax debt in a new Time to Pay arrangement?

Relevance: 51%

-

What information do I need to set up a Time to Pay arrangement online?

Relevance: 50%

-

Do I need an accountant to file a Self Assessment tax return?

Relevance: 50%

-

When can I set up a Time to Pay arrangement for Self Assessment?

Relevance: 49%

-

What records should I keep for my Self Assessment?

Relevance: 48%

-

What information do I need to complete my Self Assessment tax return?

Relevance: 41%

-

What expenses can I claim on my Self Assessment?

Relevance: 39%

-

How long does it take to set up a Time to Pay arrangement online?

Relevance: 38%

-

What if I can’t pay my tax bill on time?

Relevance: 35%

-

Is there a penalty for setting up a Time to Pay arrangement?

Relevance: 34%

-

What happens if I miss a payment under a Time to Pay arrangement?

Relevance: 30%

-

Can a Time to Pay arrangement affect my credit score?

Relevance: 30%

-

Self Harm

Relevance: 29%

-

Do I need to provide financial evidence to HMRC for the arrangement?

Relevance: 27%

-

Suicide and Self Harm Prevention Strategy 2023-28

Relevance: 26%

-

Self Harm

Relevance: 26%

-

www.DebtMadeSimple.co.uk - Trust Deeds, Debt Arrangement Schemes, and Bankruptcy Services

Relevance: 25%

-

How to arrange a funeral in the UK

Relevance: 25%

Understanding the Time to Pay Arrangement

The Time to Pay arrangement is a scheme offered by HM Revenue and Customs (HMRC) to help taxpayers spread their tax payments over a more manageable timeline.

This option is particularly helpful for Self Assessment taxpayers who are facing financial difficulties and unable to pay their tax bill in full by the deadline.

It's important to note that interest will still be charged on the outstanding amounts, but penalties could be avoided with timely communication and agreement with HMRC.

Eligibility for a Time to Pay Arrangement

Before applying, ensure you are eligible for a Time to Pay arrangement. Typically, you should owe less than £30,000 to qualify for setting it up online.

If you owe more than £30,000, or require more than 12 months to pay, it might be necessary to contact HMRC directly to discuss your options.

Ensure all your previous tax returns are submitted and up to date, as this is usually a requirement for applying.

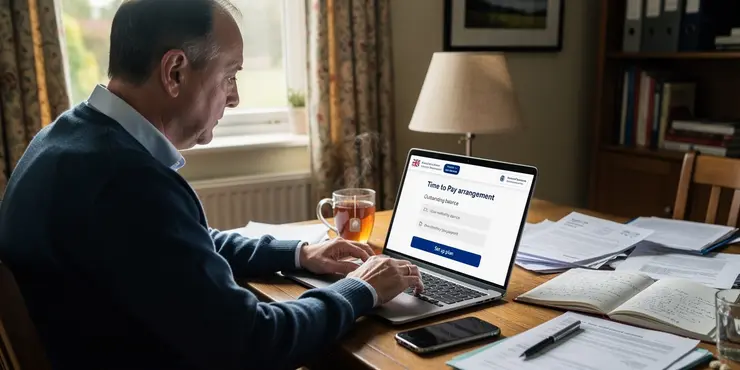

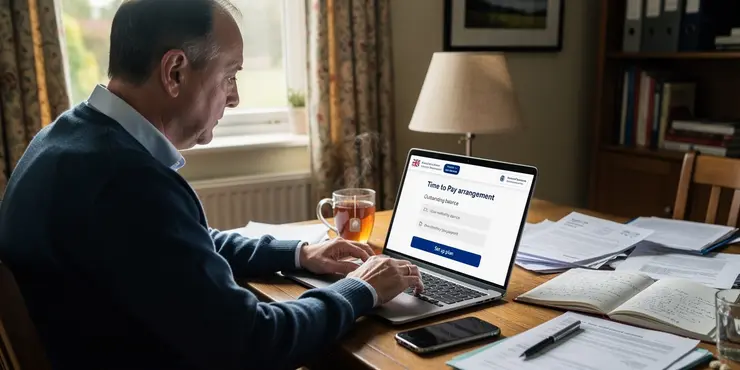

Applying for a Time to Pay Arrangement Online

You can apply for a Time to Pay arrangement online via the GOV.UK website. First, log in to your HMRC online account using your Government Gateway user ID and password.

Navigate to the Self Assessment section of your account. Look for the option to set up a payment plan or manage payments and debts.

Follow the prompts to apply for a payment plan. You'll need to provide details about your income and expenses to help HMRC assess your ability to pay.

Steps to Complete the Online Application

Once you have located the payment plan option, you will be guided through the process step by step. Answer all questions about your financial situation honestly.

Enter the amount you can afford to pay each month. HMRC may suggest a plan, but you'll have the chance to propose a different amount based on your circumstances.

After submitting your application, HMRC will review the proposal to ensure it is reasonable. They will contact you if further information or adjustments are required.

Conclusion and Next Steps

After a successful application, ensure you adhere to the payment schedule to avoid further penalties or interest charges.

Keep your contact information up to date in your HMRC account, as they may need to communicate with you regarding your arrangement.

If your financial situation changes, reach out to HMRC as soon as possible to adjust your payment plan and avoid complications.

Frequently Asked Questions

What is a Time to Pay arrangement?

A Time to Pay arrangement is an agreement with HMRC to pay your Self Assessment tax bill in installments if you're unable to pay the full amount by the due date.

How can I apply for a Time to Pay arrangement online?

You can apply for a Time to Pay arrangement online through your personal tax account on the HMRC website if you meet the eligibility criteria.

Am I eligible to apply for a Time to Pay arrangement online?

You may be eligible if your Self Assessment tax bill is between £32 and £30,000, it's no more than 60 days after the payment deadline, and you are unable to pay in full.

What information do I need to apply for a Time to Pay arrangement online?

You’ll need your Government Gateway user ID and password and details of your bank account from which to make payments.

Can I apply for a Time to Pay arrangement online if I'm late with my payment?

You can apply online if it's no more than 60 days after the payment deadline.

What happens if I don't meet the online eligibility criteria?

If you don't meet the online criteria, you might still be able to arrange a plan by calling HMRC directly to discuss your situation.

How long does it take to receive a decision on my application?

If you apply online and are eligible, you will typically receive a decision immediately or shortly after submission.

Can I choose how much to pay each month?

During the application, you can propose the amount and duration, subject to HMRC approval.

What if I miss a payment under the Time to Pay arrangement?

Missing a payment can lead to the cancellation of the arrangement and potential penalties. It's important to contact HMRC if you anticipate difficulties in making a payment.

Can I apply for a Time to Pay arrangement for previous years' tax bills?

The online application is for the current year's tax bill. For previous years, you may need to contact HMRC directly to discuss options.

Will I be charged interest on my Time to Pay arrangement?

Yes, HMRC will charge interest on the outstanding amount until it is fully paid.

How will I know if my Time to Pay arrangement application was successful?

HMRC will confirm the arrangement details online or by email if your application is successful.

How do I access my HMRC online personal tax account?

You can access your account by logging into the HMRC website using your Government Gateway credentials.

Can I change the payment terms of my Time to Pay arrangement once it's set up?

You may be able to change the terms by contacting HMRC, but changes are subject to their approval.

What happens if I complete my payments ahead of schedule?

Completing payments early will simply end the arrangement sooner without any penalties.

What if I can't pay the agreed installments in my Time to Pay arrangement?

Contact HMRC as soon as possible to discuss your situation and explore other payment options.

Can an agent apply for a Time to Pay arrangement on my behalf?

Yes, an authorized agent with access to your HMRC online account can apply for you.

What documents do I need to keep after applying?

Keep records of the arrangement agreement, payment schedule, and any correspondence with HMRC.

Is the Time to Pay arrangement available for all types of taxes?

The online self-service is for Self Assessment, but Time to Pay options may be available for other taxes by contacting HMRC.

Where can I find more information about Time to Pay arrangements?

Visit the official HMRC website or contact their helpline for detailed guidance.

Useful Links

This website offers general information and is not a substitute for professional advice.

Always seek guidance from qualified professionals.

If you have any medical concerns or need urgent help, contact a healthcare professional or emergency services immediately.

Some of this content was generated with AI assistance. We’ve done our best to keep it accurate, helpful, and human-friendly.

- Ergsy carfully checks the information in the videos we provide here.

- Videos shown by Youtube after a video has completed, have NOT been reviewed by ERGSY.

- To view, click the arrow in centre of video.

- Most of the videos you find here will have subtitles and/or closed captions available.

- You may need to turn these on, and choose your preferred language.

- Go to the video you'd like to watch.

- If closed captions (CC) are available, settings will be visible on the bottom right of the video player.

- To turn on Captions, click settings .

- To turn off Captions, click settings again.

More Items From Ergsy search

-

Who is eligible for a Time to Pay arrangement for Self Assessment?

Relevance: 100%

-

What is a Time to Pay arrangement for Self Assessment?

Relevance: 98%

-

Time to Pay arrangement for Self Assessment?

Relevance: 96%

-

How to set up a Time to Pay arrangement online for Self Assessment

Relevance: 93%

-

How can I apply for a Time to Pay arrangement online for Self Assessment?

Relevance: 86%

-

What is a Self Assessment tax return?

Relevance: 60%

-

Is there a penalty for setting up a Time to Pay arrangement?

Relevance: 59%

-

How do I register for Self Assessment?

Relevance: 59%

-

My first Self Assessment tax return

Relevance: 59%

-

Is there any interest charged on a Time to Pay arrangement?

Relevance: 58%

-

What if I owe more than £30,000 in Self Assessment tax?

Relevance: 57%

-

Can I get help from HMRC with my Self Assessment?

Relevance: 56%

-

Can a Time to Pay arrangement affect my credit score?

Relevance: 56%

-

Who needs to file a Self Assessment tax return?

Relevance: 55%

-

What happens if I miss the Self Assessment deadline?

Relevance: 55%

-

How do I complete my Self Assessment tax return?

Relevance: 54%

-

How long can I spread my payments under a Time to Pay arrangement?

Relevance: 53%

-

How will I know if my Time to Pay arrangement is approved?

Relevance: 52%

-

What happens if I miss a payment under a Time to Pay arrangement?

Relevance: 52%

-

Can I cancel a Time to Pay arrangement once it’s set up?

Relevance: 52%

-

When is the deadline for submitting my Self Assessment tax return?

Relevance: 52%

-

What if I'm not comfortable applying online for a Time to Pay arrangement?

Relevance: 51%

-

Can I include previous year's tax debt in a new Time to Pay arrangement?

Relevance: 51%

-

What information do I need to set up a Time to Pay arrangement online?

Relevance: 50%

-

Do I need an accountant to file a Self Assessment tax return?

Relevance: 50%

-

When can I set up a Time to Pay arrangement for Self Assessment?

Relevance: 49%

-

What records should I keep for my Self Assessment?

Relevance: 48%

-

What information do I need to complete my Self Assessment tax return?

Relevance: 41%

-

What expenses can I claim on my Self Assessment?

Relevance: 39%

-

How long does it take to set up a Time to Pay arrangement online?

Relevance: 38%

-

What if I can’t pay my tax bill on time?

Relevance: 35%

-

Is there a penalty for setting up a Time to Pay arrangement?

Relevance: 34%

-

What happens if I miss a payment under a Time to Pay arrangement?

Relevance: 30%

-

Can a Time to Pay arrangement affect my credit score?

Relevance: 30%

-

Self Harm

Relevance: 29%

-

Do I need to provide financial evidence to HMRC for the arrangement?

Relevance: 27%

-

Suicide and Self Harm Prevention Strategy 2023-28

Relevance: 26%

-

Self Harm

Relevance: 26%

-

www.DebtMadeSimple.co.uk - Trust Deeds, Debt Arrangement Schemes, and Bankruptcy Services

Relevance: 25%

-

How to arrange a funeral in the UK

Relevance: 25%