Find Help

More Items From Ergsy search

-

What information do I need to set up a Time to Pay arrangement online?

Relevance: 100%

-

How to set up a Time to Pay arrangement online for Self Assessment

Relevance: 99%

-

What if I'm not comfortable applying online for a Time to Pay arrangement?

Relevance: 93%

-

How can I apply for a Time to Pay arrangement online for Self Assessment?

Relevance: 93%

-

Time to Pay arrangement for Self Assessment?

Relevance: 90%

-

What is a Time to Pay arrangement for Self Assessment?

Relevance: 87%

-

Is there a penalty for setting up a Time to Pay arrangement?

Relevance: 82%

-

Who is eligible for a Time to Pay arrangement for Self Assessment?

Relevance: 82%

-

Is there any interest charged on a Time to Pay arrangement?

Relevance: 80%

-

How will I know if my Time to Pay arrangement is approved?

Relevance: 77%

-

How long does it take to set up a Time to Pay arrangement online?

Relevance: 75%

-

Can a Time to Pay arrangement affect my credit score?

Relevance: 75%

-

How long can I spread my payments under a Time to Pay arrangement?

Relevance: 74%

-

Can I include previous year's tax debt in a new Time to Pay arrangement?

Relevance: 73%

-

Can I cancel a Time to Pay arrangement once it’s set up?

Relevance: 73%

-

What happens if I miss a payment under a Time to Pay arrangement?

Relevance: 72%

-

What if I can’t pay my tax bill on time?

Relevance: 53%

-

Is there a penalty for setting up a Time to Pay arrangement?

Relevance: 47%

-

Can I check the waiting time for a specific procedure online?

Relevance: 43%

-

What happens if I miss a payment under a Time to Pay arrangement?

Relevance: 41%

-

Can a Time to Pay arrangement affect my credit score?

Relevance: 41%

-

How do I pay my tax bill?

Relevance: 39%

-

When can I set up a Time to Pay arrangement for Self Assessment?

Relevance: 39%

-

Can online patient forums provide reliable information on waiting times?

Relevance: 38%

-

www.DebtMadeSimple.co.uk - Trust Deeds, Debt Arrangement Schemes, and Bankruptcy Services

Relevance: 38%

-

Do I need to provide financial evidence to HMRC for the arrangement?

Relevance: 37%

-

Can I file my taxes online if I'm self-employed?

Relevance: 36%

-

What is the first step in arranging a funeral in the UK?

Relevance: 35%

-

How can I pay for a TV license?

Relevance: 35%

-

How to arrange a funeral in the UK

Relevance: 35%

-

Can I arrange a funeral service myself without a funeral director?

Relevance: 35%

-

When is the deadline to file taxes online?

Relevance: 35%

-

What is an online tax return?

Relevance: 34%

-

Are students required to pay for a TV license?

Relevance: 34%

-

What is redundancy pay and who is eligible for it?

Relevance: 34%

-

Why does my online case status show 'case received' for a long time?

Relevance: 34%

-

How do I pay the Capital Gains Tax after reporting the property disposal?

Relevance: 33%

-

Boost your Take Home Pay | Salary Sacrifice Explained UK

Relevance: 33%

-

How do I pay Stamp Duty in the UK?

Relevance: 33%

-

How much notice do I need to give to arrange a survey?

Relevance: 33%

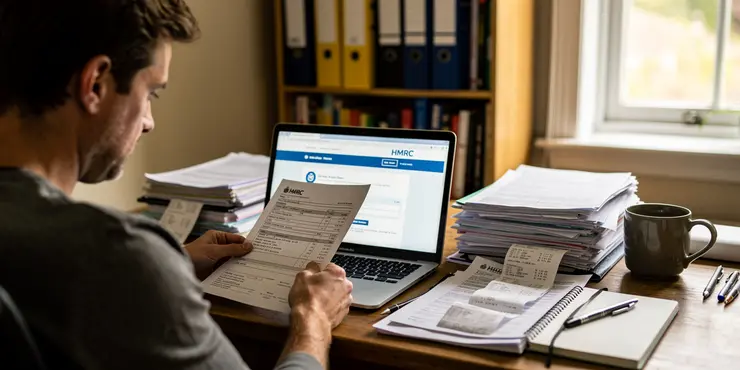

Understanding Time to Pay Arrangements

If you're facing difficulties in paying your tax bill on time, HMRC offers a solution known as Time to Pay arrangements. This allows you to spread the cost of your tax liabilities over a longer period. Understanding the necessary information beforehand can make the online setup process smoother.

Setting up a Time to Pay arrangement can usually be done online for tax debts up to £30,000. It's important to gather all required details before starting the process to avoid any interruptions.

Essential Personal Information

To set up a Time to Pay arrangement, you will need your personal details. Make sure you have your name, address, and National Insurance number at hand. These are crucial for verifying your identity with HMRC.

You will also need your Unique Taxpayer Reference (UTR) if you are a self-assessment taxpayer. This number is typically found on previous tax returns or official correspondence from HMRC.

Your Income and Expenditure Details

Gather all necessary information about your current financial situation. Be ready to provide details of your monthly income, including wages, benefits, or other sources. This information helps HMRC assess your ability to pay.

Additionally, listing your monthly outgoings is crucial. This should include rent or mortgage payments, utilities, groceries, and other essential expenses. Accurate details will assist in negotiating a suitable repayment plan.

Bank Account Information

Prepare your bank account details, as payments will be set up directly from this account. This should include the sort code, account number, and name of the account holder. Having this information ready ensures quick and efficient setup of the Direct Debit payment method.

It's also advisable to check the balance and any upcoming transactions in your account to ensure sufficient funds are available for the agreed payment schedule.

Details of the Tax Debt

You'll need specific information about the amount you owe. Ensure you have the latest tax calculation or bill from HMRC showing the debt amount. Familiarize yourself with the due date and any penalties or interest that may apply.

If you have multiple tax liabilities, be prepared to provide a breakdown of these amounts. Knowing the exact figures helps tailor the payment arrangement to your particular needs.

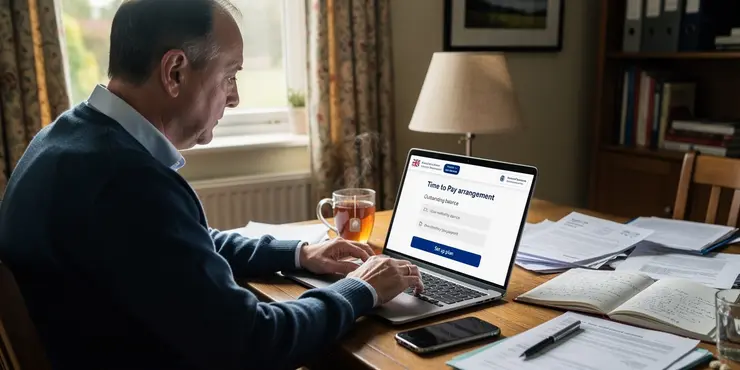

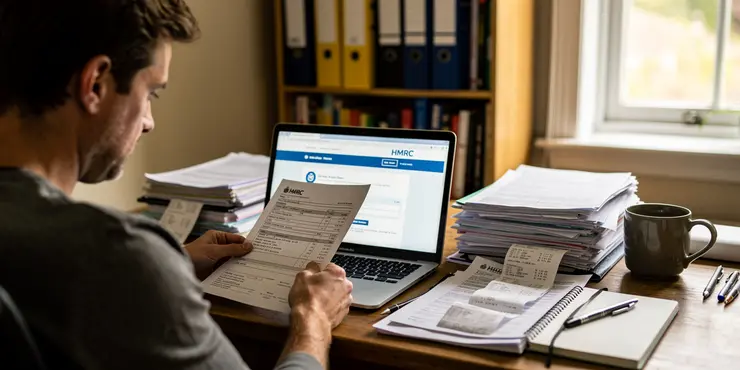

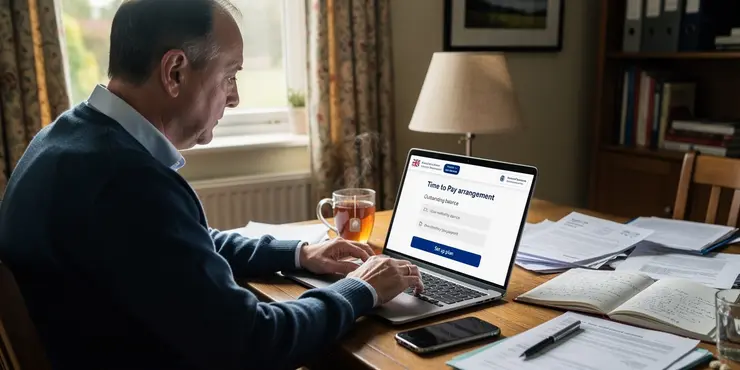

Setting Up the Arrangement Online

Once you have all the necessary information, you can proceed to set up the arrangement online through the HMRC portal. The platform will guide you through the process with clear instructions.

If you're unsure at any point, HMRC offers resources and helplines to assist you. Ensuring you have all your information prepared beforehand will streamline the setup process and help manage your payments effectively.

Frequently Asked Questions

What is a Time to Pay arrangement?

A Time to Pay arrangement is an agreement with tax authorities to spread out the payment of taxes owed over a period of time.

Who is eligible for a Time to Pay arrangement?

Eligibility depends on individual circumstances, including the amount owed and the ability to make payments over time.

What personal information do I need to set up a Time to Pay arrangement online?

You will need your tax identification number, contact details, and sometimes additional identification documents for verification.

Do I need my tax return information to apply for a Time to Pay arrangement?

Yes, details of your most recent tax return and any outstanding tax amounts are typically required.

Is there a minimum amount I must owe to set up a Time to Pay arrangement online?

This depends on the tax authority's policies, but generally, there may be a minimum debt amount required for online arrangements.

How do I calculate the payments needed for a Time to Pay arrangement?

Use an online payment calculator provided by the tax authority or seek guidance based on your financial situation.

What documentation will I need to provide when applying online?

You may need to provide income statements, bank statements, or evidence of other financial commitments.

Are there any fees associated with setting up a Time to Pay arrangement?

Some tax authorities may charge a setup fee or interest on the outstanding amount.

Can I set up a Time to Pay arrangement if I'm self-employed?

Yes, self-employed individuals can often set up arrangements, but they may need additional documentation proving their income.

How long does it take to set up a Time to Pay arrangement online?

The process can vary, but often you can set it up within an hour if you have all necessary information and documents ready.

Can I include multiple tax debts in a single Time to Pay arrangement?

Yes, you can often consolidate multiple debts into one arrangement, depending on the tax authority’s rules.

What if I can't afford the monthly payments suggested?

You should contact your tax authority to discuss alternative arrangements based on your financial situation.

Can I apply for a Time to Pay arrangement online if I have previously defaulted on payments?

This depends on the policies of the tax authority, but previous defaults may affect your eligibility.

Will setting up a Time to Pay arrangement affect my credit score?

Typically, tax authorities do not report payment plans to credit bureaus, but you should confirm with them directly.

What happens if I miss a payment in my Time to Pay arrangement?

You should contact the tax authority immediately to discuss options; missed payments can lead to the arrangement being revoked.

Do interest and penalties stop accruing once I set up a Time to Pay arrangement?

Not always; interest might still accrue, but penalties often stop once an arrangement is in place.

Can I make extra payments on my Time to Pay arrangement?

Yes, most arrangements allow for additional payments to be made, which can reduce the term of the arrangement.

How can I make payments once the arrangement is set up?

Payments can typically be made via direct debit, online banking, or through the tax authority’s online portal.

How do I update my contact information during an ongoing arrangement?

You usually need to log into your account on the tax authority’s website and update your contact details.

Can I cancel a Time to Pay arrangement if my financial situation improves?

Yes, you can generally cancel the arrangement by notifying the tax authority and fulfilling any remaining balance in full.

Useful Links

This website offers general information and is not a substitute for professional advice.

Always seek guidance from qualified professionals.

If you have any medical concerns or need urgent help, contact a healthcare professional or emergency services immediately.

Some of this content was generated with AI assistance. We’ve done our best to keep it accurate, helpful, and human-friendly.

- Ergsy carfully checks the information in the videos we provide here.

- Videos shown by Youtube after a video has completed, have NOT been reviewed by ERGSY.

- To view, click the arrow in centre of video.

- Most of the videos you find here will have subtitles and/or closed captions available.

- You may need to turn these on, and choose your preferred language.

- Go to the video you'd like to watch.

- If closed captions (CC) are available, settings will be visible on the bottom right of the video player.

- To turn on Captions, click settings .

- To turn off Captions, click settings again.

More Items From Ergsy search

-

What information do I need to set up a Time to Pay arrangement online?

Relevance: 100%

-

How to set up a Time to Pay arrangement online for Self Assessment

Relevance: 99%

-

What if I'm not comfortable applying online for a Time to Pay arrangement?

Relevance: 93%

-

How can I apply for a Time to Pay arrangement online for Self Assessment?

Relevance: 93%

-

Time to Pay arrangement for Self Assessment?

Relevance: 90%

-

What is a Time to Pay arrangement for Self Assessment?

Relevance: 87%

-

Is there a penalty for setting up a Time to Pay arrangement?

Relevance: 82%

-

Who is eligible for a Time to Pay arrangement for Self Assessment?

Relevance: 82%

-

Is there any interest charged on a Time to Pay arrangement?

Relevance: 80%

-

How will I know if my Time to Pay arrangement is approved?

Relevance: 77%

-

How long does it take to set up a Time to Pay arrangement online?

Relevance: 75%

-

Can a Time to Pay arrangement affect my credit score?

Relevance: 75%

-

How long can I spread my payments under a Time to Pay arrangement?

Relevance: 74%

-

Can I include previous year's tax debt in a new Time to Pay arrangement?

Relevance: 73%

-

Can I cancel a Time to Pay arrangement once it’s set up?

Relevance: 73%

-

What happens if I miss a payment under a Time to Pay arrangement?

Relevance: 72%

-

What if I can’t pay my tax bill on time?

Relevance: 53%

-

Is there a penalty for setting up a Time to Pay arrangement?

Relevance: 47%

-

Can I check the waiting time for a specific procedure online?

Relevance: 43%

-

What happens if I miss a payment under a Time to Pay arrangement?

Relevance: 41%

-

Can a Time to Pay arrangement affect my credit score?

Relevance: 41%

-

How do I pay my tax bill?

Relevance: 39%

-

When can I set up a Time to Pay arrangement for Self Assessment?

Relevance: 39%

-

Can online patient forums provide reliable information on waiting times?

Relevance: 38%

-

www.DebtMadeSimple.co.uk - Trust Deeds, Debt Arrangement Schemes, and Bankruptcy Services

Relevance: 38%

-

Do I need to provide financial evidence to HMRC for the arrangement?

Relevance: 37%

-

Can I file my taxes online if I'm self-employed?

Relevance: 36%

-

What is the first step in arranging a funeral in the UK?

Relevance: 35%

-

How can I pay for a TV license?

Relevance: 35%

-

How to arrange a funeral in the UK

Relevance: 35%

-

Can I arrange a funeral service myself without a funeral director?

Relevance: 35%

-

When is the deadline to file taxes online?

Relevance: 35%

-

What is an online tax return?

Relevance: 34%

-

Are students required to pay for a TV license?

Relevance: 34%

-

What is redundancy pay and who is eligible for it?

Relevance: 34%

-

Why does my online case status show 'case received' for a long time?

Relevance: 34%

-

How do I pay the Capital Gains Tax after reporting the property disposal?

Relevance: 33%

-

Boost your Take Home Pay | Salary Sacrifice Explained UK

Relevance: 33%

-

How do I pay Stamp Duty in the UK?

Relevance: 33%

-

How much notice do I need to give to arrange a survey?

Relevance: 33%