Find Help

More Items From Ergsy search

-

What is a Self Assessment tax return?

Relevance: 100%

-

My first Self Assessment tax return

Relevance: 92%

-

Who needs to file a Self Assessment tax return?

Relevance: 92%

-

How do I complete my Self Assessment tax return?

Relevance: 89%

-

When is the deadline for submitting my Self Assessment tax return?

Relevance: 88%

-

Do I need an accountant to file a Self Assessment tax return?

Relevance: 88%

-

What information do I need to complete my Self Assessment tax return?

Relevance: 76%

-

How do I register for Self Assessment?

Relevance: 69%

-

What happens if I miss the Self Assessment deadline?

Relevance: 67%

-

Can I get help from HMRC with my Self Assessment?

Relevance: 67%

-

What if I owe more than £30,000 in Self Assessment tax?

Relevance: 65%

-

What records should I keep for my Self Assessment?

Relevance: 63%

-

Who is eligible for a Time to Pay arrangement for Self Assessment?

Relevance: 60%

-

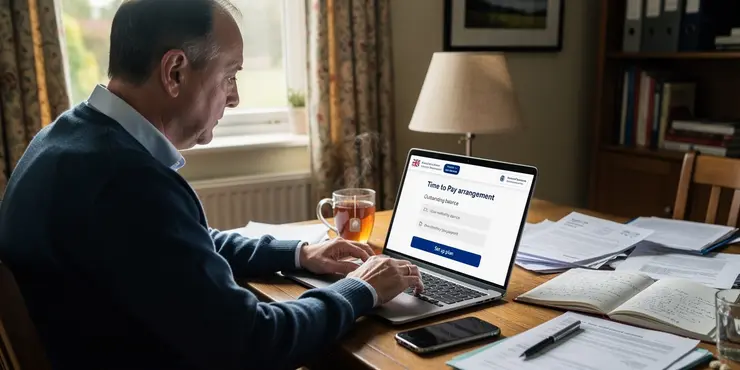

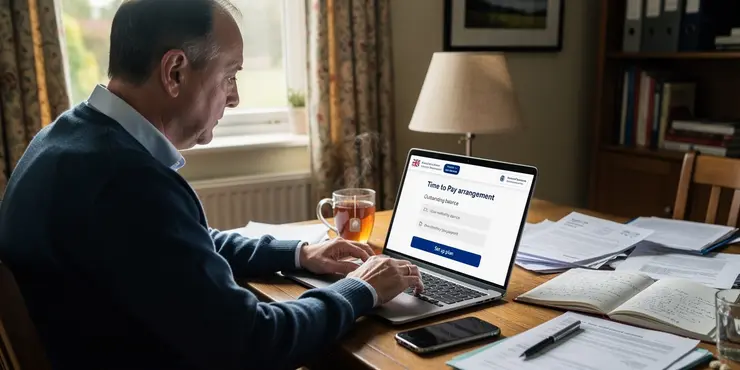

How to set up a Time to Pay arrangement online for Self Assessment

Relevance: 57%

-

What is a Time to Pay arrangement for Self Assessment?

Relevance: 54%

-

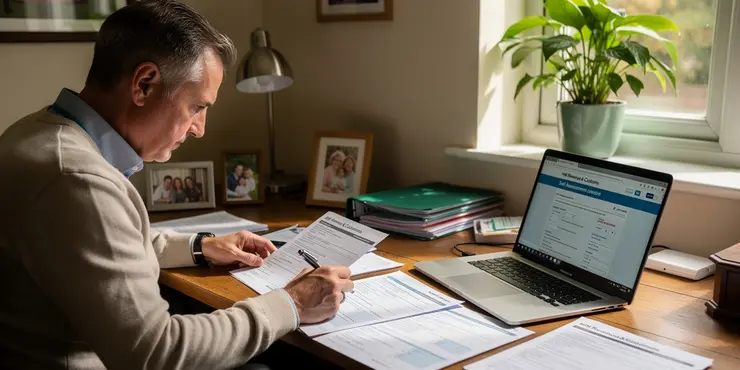

Starting your online tax return

Relevance: 52%

-

How can I check the status of my online tax return?

Relevance: 50%

-

Can I amend an online tax return?

Relevance: 50%

-

Is it necessary to complete a final tax return for the deceased?

Relevance: 48%

-

How can I apply for a Time to Pay arrangement online for Self Assessment?

Relevance: 47%

-

Time to Pay arrangement for Self Assessment?

Relevance: 46%

-

Who needs to file a Self Assessment tax return?

Relevance: 45%

-

What is an online tax return?

Relevance: 45%

-

Do I need to report the Winter Fuel Payment on my tax return?

Relevance: 42%

-

What expenses can I claim on my Self Assessment?

Relevance: 42%

-

What if I make a mistake on my tax return?

Relevance: 41%

-

Can I amend my tax return after submitting it?

Relevance: 40%

-

What should I do if I made a mistake on my tax return?

Relevance: 39%

-

What happens after I file my tax return online?

Relevance: 39%

-

Do I need to print and mail my online tax return?

Relevance: 38%

-

What information do I need to complete my Self Assessment tax return?

Relevance: 38%

-

Do I need to declare my ISA income on my tax return?

Relevance: 37%

-

How do I file VAT returns?

Relevance: 32%

-

How do I start filing my taxes online?

Relevance: 32%

-

How long does it take to receive a tax refund from HMRC?

Relevance: 32%

-

What if I owe more than £30,000 in Self Assessment tax?

Relevance: 31%

-

What is a P800 form and how does it relate to my tax refund?

Relevance: 29%

-

What is input tax and output tax?

Relevance: 29%

-

Self Harm

Relevance: 29%

-

How do I report a property disposal to the tax authorities?

Relevance: 29%

Personal Details

Your Self Assessment tax return requires specific personal information.

Ensure you have your National Insurance number ready.

You'll also need your Unique Taxpayer Reference (UTR), a ten-digit number.

This UTR can be found on letters from HMRC.

Income Information

Declare all sources of income throughout the tax year.

If you're employed, you'll need your P60 or P45 forms.

For self-employed individuals, details of your business income are necessary.

Also, include any additional income such as dividends or pensions.

Expenses and Deductions

If you are self-employed, you can claim business expenses.

Gather receipts and records of any business costs incurred.

You can deduct expenses like office supplies and travel costs.

These deductions can reduce your taxable income.

Savings and Investment Income

Include interest earned from UK banks or building societies.

Declare any dividends received from investments or shares.

Provide information on tax-exempt savings like ISAs where relevant.

Overview any capital gains from the sale of assets.

Foreign Income

If you earn income from abroad, this must be declared.

Provide details about any foreign pensions or investments.

It is critical to report this to avoid penalties.

Tax Reliefs and Allowances

Assess your eligibility for any tax reliefs.

This includes things like gift aid and pension contributions.

These reliefs can significantly affect your tax owed.

Accurate records will ensure you claim the right amounts.

Payments and Liabilities

Consider any taxes already paid such as PAYE.

Review any payments on account made during the year.

This helps in accurately calculating your final liability.

Settle any overdue amounts to avoid interest charges.

Summary

Completing your tax return requires thorough preparation.

Organize all necessary documents before starting the process.

This ensures accuracy and minimizes errors.

Filing early can also help prevent last-minute stress.

Frequently Asked Questions

What is a Self Assessment tax return?

A Self Assessment tax return is a system used by HM Revenue and Customs (HMRC) to collect Income Tax from individuals and businesses with income that is not taxed at source.

What personal information is required for a Self Assessment tax return?

You need your National Insurance number, Unique Taxpayer Reference (UTR), and your personal details such as your name, address, and date of birth.

What financial records do I need for my Self Assessment?

You will need records of all your income, expenses, invoices, bank statements, and any other financial documents for the tax year.

How do I report income from employment in a Self Assessment?

You need to provide your P60, P11D, or details from your payslips which show your income and tax deducted during the year.

What information is needed to report self-employment income?

You need a record of your self-employment income and expenses, as well as any accounting records, invoices, and receipts.

What information do I need for rental income?

You need details of all rental income, expenses, and any other relevant documents related to the property you are renting out.

How do I report dividend income?

You need details of all dividends received, including the names of companies and the amounts paid.

What should I include about savings and investments?

You need details of any interest received and details of your savings accounts and investment portfolios.

Do I need to report foreign income?

Yes, you must report any foreign income, including details of any tax paid abroad.

What information is needed for capital gains?

You need details of any assets sold or disposed of, including purchase and sale prices, dates, and any associated costs.

What are allowable expenses?

Allowable expenses are business costs you can deduct from your income to lower your taxable profit. They include things like office costs, travel expenses, and staff salaries.

How do I report pension contributions?

You need details of all contributions made to personal and occupational pension schemes, including any tax relief received.

What documentation is needed for charitable donations?

You need receipts, or proof of the donations you have made if you claim Gift Aid on donations.

What should I do if I'm missing documents?

You should try to obtain copies from the issuer, estimate figures if possible, and keep notes of how you calculated them.

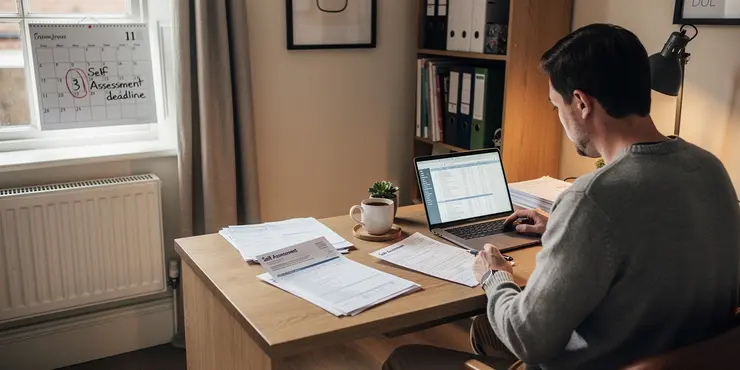

When is the deadline for filing a Self Assessment tax return?

The deadline for online tax returns is 31 January following the end of the tax year, and the deadline for paper returns is 31 October.

Can I use software to file my Self Assessment?

Yes, HMRC supports various third-party software that can help you file your Self Assessment online.

What should I do if I make a mistake on my tax return?

You can amend your return within 12 months of the original deadline by logging into your account and making the necessary changes.

Is there a penalty for late submission?

Yes, there are penalties for late submission, starting with an initial £100 if your tax return is up to 3 months late.

What is HMRC’s contact information for help with Self Assessment?

You can contact HMRC by phone or visit their website for help with filing your tax return and for any other queries.

How can I keep track of my tax return progress?

You can track the progress of your tax return and correspondence with HMRC through your online HMRC account.

Useful Links

This website offers general information and is not a substitute for professional advice.

Always seek guidance from qualified professionals.

If you have any medical concerns or need urgent help, contact a healthcare professional or emergency services immediately.

Some of this content was generated with AI assistance. We’ve done our best to keep it accurate, helpful, and human-friendly.

- Ergsy carfully checks the information in the videos we provide here.

- Videos shown by Youtube after a video has completed, have NOT been reviewed by ERGSY.

- To view, click the arrow in centre of video.

- Most of the videos you find here will have subtitles and/or closed captions available.

- You may need to turn these on, and choose your preferred language.

- Go to the video you'd like to watch.

- If closed captions (CC) are available, settings will be visible on the bottom right of the video player.

- To turn on Captions, click settings .

- To turn off Captions, click settings again.

More Items From Ergsy search

-

What is a Self Assessment tax return?

Relevance: 100%

-

My first Self Assessment tax return

Relevance: 92%

-

Who needs to file a Self Assessment tax return?

Relevance: 92%

-

How do I complete my Self Assessment tax return?

Relevance: 89%

-

When is the deadline for submitting my Self Assessment tax return?

Relevance: 88%

-

Do I need an accountant to file a Self Assessment tax return?

Relevance: 88%

-

What information do I need to complete my Self Assessment tax return?

Relevance: 76%

-

How do I register for Self Assessment?

Relevance: 69%

-

What happens if I miss the Self Assessment deadline?

Relevance: 67%

-

Can I get help from HMRC with my Self Assessment?

Relevance: 67%

-

What if I owe more than £30,000 in Self Assessment tax?

Relevance: 65%

-

What records should I keep for my Self Assessment?

Relevance: 63%

-

Who is eligible for a Time to Pay arrangement for Self Assessment?

Relevance: 60%

-

How to set up a Time to Pay arrangement online for Self Assessment

Relevance: 57%

-

What is a Time to Pay arrangement for Self Assessment?

Relevance: 54%

-

Starting your online tax return

Relevance: 52%

-

How can I check the status of my online tax return?

Relevance: 50%

-

Can I amend an online tax return?

Relevance: 50%

-

Is it necessary to complete a final tax return for the deceased?

Relevance: 48%

-

How can I apply for a Time to Pay arrangement online for Self Assessment?

Relevance: 47%

-

Time to Pay arrangement for Self Assessment?

Relevance: 46%

-

Who needs to file a Self Assessment tax return?

Relevance: 45%

-

What is an online tax return?

Relevance: 45%

-

Do I need to report the Winter Fuel Payment on my tax return?

Relevance: 42%

-

What expenses can I claim on my Self Assessment?

Relevance: 42%

-

What if I make a mistake on my tax return?

Relevance: 41%

-

Can I amend my tax return after submitting it?

Relevance: 40%

-

What should I do if I made a mistake on my tax return?

Relevance: 39%

-

What happens after I file my tax return online?

Relevance: 39%

-

Do I need to print and mail my online tax return?

Relevance: 38%

-

What information do I need to complete my Self Assessment tax return?

Relevance: 38%

-

Do I need to declare my ISA income on my tax return?

Relevance: 37%

-

How do I file VAT returns?

Relevance: 32%

-

How do I start filing my taxes online?

Relevance: 32%

-

How long does it take to receive a tax refund from HMRC?

Relevance: 32%

-

What if I owe more than £30,000 in Self Assessment tax?

Relevance: 31%

-

What is a P800 form and how does it relate to my tax refund?

Relevance: 29%

-

What is input tax and output tax?

Relevance: 29%

-

Self Harm

Relevance: 29%

-

How do I report a property disposal to the tax authorities?

Relevance: 29%