Find Help

More Items From Ergsy search

-

Can a Time to Pay arrangement affect my credit score?

Relevance: 100%

-

Time to Pay arrangement for Self Assessment?

Relevance: 66%

-

Is there a penalty for setting up a Time to Pay arrangement?

Relevance: 65%

-

Is there any interest charged on a Time to Pay arrangement?

Relevance: 63%

-

What is a Time to Pay arrangement for Self Assessment?

Relevance: 62%

-

Who is eligible for a Time to Pay arrangement for Self Assessment?

Relevance: 61%

-

Will a cashback credit card help improve my credit score?

Relevance: 59%

-

What happens if I miss a payment under a Time to Pay arrangement?

Relevance: 58%

-

Will transferring a balance affect my credit score?

Relevance: 58%

-

Can I cancel a Time to Pay arrangement once it’s set up?

Relevance: 58%

-

Can I include previous year's tax debt in a new Time to Pay arrangement?

Relevance: 58%

-

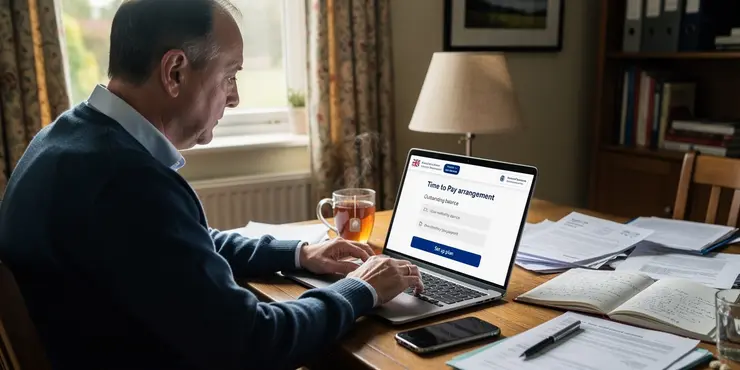

How to set up a Time to Pay arrangement online for Self Assessment

Relevance: 57%

-

Will penalty points affect my credit score?

Relevance: 57%

-

Can eviction affect my credit score?

Relevance: 57%

-

Will switching banks affect my credit score?

Relevance: 55%

-

What is a good credit score to qualify for a balance transfer card?

Relevance: 54%

-

How long can I spread my payments under a Time to Pay arrangement?

Relevance: 53%

-

Can a Time to Pay arrangement affect my credit score?

Relevance: 53%

-

What information do I need to set up a Time to Pay arrangement online?

Relevance: 53%

-

Will switching banks affect my credit score?

Relevance: 52%

-

How can I apply for a Time to Pay arrangement online for Self Assessment?

Relevance: 52%

-

How will I know if my Time to Pay arrangement is approved?

Relevance: 51%

-

What if I'm not comfortable applying online for a Time to Pay arrangement?

Relevance: 51%

-

Does applying for an income-driven repayment plan affect my credit score?

Relevance: 49%

-

Can mis-sold car finance affect my credit score?

Relevance: 48%

-

How does missing student loan payments affect my credit score?

Relevance: 47%

-

Credit Cards for Beginners Explained UK | Do's and Don't | Type of Cards

Relevance: 39%

-

What are the benefits of a balance transfer credit card?

Relevance: 38%

-

What if I can’t pay my tax bill on time?

Relevance: 38%

-

What is credit monitoring?

Relevance: 37%

-

How long does it take to set up a Time to Pay arrangement online?

Relevance: 37%

-

Credit Cards for Beginners Explained UK | Do's and Don't | Type of Cards

Relevance: 36%

-

What is a balance transfer credit limit?

Relevance: 35%

-

Is a cashback credit card right for me?

Relevance: 35%

-

Are there any drawbacks to using a cashback credit card?

Relevance: 35%

-

Is there a penalty for setting up a Time to Pay arrangement?

Relevance: 34%

-

What is a Balance Transfer Credit Card?

Relevance: 33%

-

What is a cashback credit card?

Relevance: 33%

-

How does a cashback credit card work?

Relevance: 32%

-

www.DebtMadeSimple.co.uk - Trust Deeds, Debt Arrangement Schemes, and Bankruptcy Services

Relevance: 31%

What Is a Time to Pay Arrangement?

A Time to Pay arrangement is an agreement with HMRC to pay your tax liabilities over an extended period. It is often used by individuals or businesses struggling to meet their tax obligations on time.

This arrangement can provide relief by allowing you to manage your cash flow more effectively. It's important to negotiate terms that are manageable and realistic to avoid further financial pressure.

Impact on Your Credit Score

Generally, a Time to Pay arrangement does not directly affect your credit score. The arrangement is an agreement between you and HMRC, and it is typically not reported to credit reference agencies.

However, if you fail to honour the arrangement and your debt is passed to collection agencies, your credit score could be affected. Ensuring timely payments under this arrangement is crucial to maintain your credit health.

Monitoring and Managing Your Credit Score

Even though a Time to Pay arrangement may not directly affect your credit score, it's wise to continually monitor your credit report. Doing so helps you stay informed about any potential issues.

Regular checks can also help you assess the impact of your overall financial behaviour. Consider using services that provide free access to your credit score and report.

Advantages of a Time to Pay Arrangement

Setting up a Time to Pay arrangement can prevent immediate financial strain. By spreading payments, you can avoid sudden, large outlays that could disrupt your budget.

Consistently making agreed payments can demonstrate your commitment to resolving debts, which may be beneficial if your financial conduct needs to be explained in future financial dealings.

Considerations Before Setting Up an Arrangement

Ensure that the payment plan is feasible within your budget. Unrealistic plans could lead to missed payments, potentially damaging your relationship with HMRC and risking further financial complications.

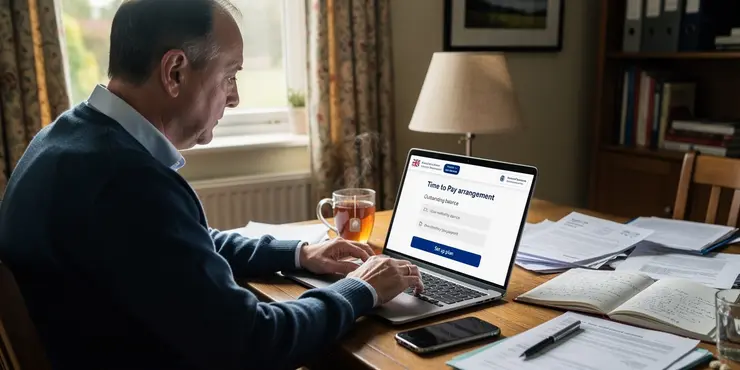

It's also important to communicate with HMRC proactively. If your financial situation changes, discuss possible adjustments to your payment plan to stay compliant.

Conclusion

While a Time to Pay arrangement itself does not directly affect your credit score, neglecting the terms of the agreement can lead to negative consequences. Responsible management and regular financial assessments are key.

Always strive to engage in sound financial practices to protect your credit standing while addressing your tax obligations. Consider professional financial advice if you encounter difficulties in managing your responsibilities.

Frequently Asked Questions

What is a Time to Pay arrangement?

A Time to Pay arrangement is a structured payment plan that allows individuals and businesses to pay off debts over an extended period.

Can a Time to Pay arrangement affect my credit score?

Yes, it can potentially affect your credit score if the arrangement is reported to credit bureaus or if you miss agreed-upon payments.

Is a Time to Pay arrangement considered a default?

Generally, a Time to Pay arrangement is not considered a default, but missing payments on the arrangement could be.

Will my creditors report the Time to Pay arrangement to credit bureaus?

This depends on the creditor's policies. Some may report the arrangement, while others may not.

How can I find out if my Time to Pay arrangement will be reported?

Contact your creditor or review the terms of the arrangement to determine if it will be reported to credit agencies.

Can entering into a Time to Pay arrangement improve my credit score?

While it may not directly improve your score, consistently making payments can demonstrate positive financial behavior.

What happens if I miss a payment on my Time to Pay arrangement?

Missing payments could lead to penalties, potential cancellation of the agreement, and negative impacts on your credit score.

Should I notify credit bureaus about a Time to Pay arrangement?

Typically, you don't need to notify credit bureaus; your creditors will handle reporting if applicable.

Does a Time to Pay arrangement show up on my credit report?

If reported by your creditor, the arrangement may appear as a repayment plan or noted in the remarks section.

How long will a Time to Pay arrangement impact my credit score?

The impact can last as long as the arrangement is active and possibly longer if there are missed payments reported.

Can a Time to Pay arrangement prevent debt collection actions?

It may postpone or prevent debt collection actions if you adhere to the payment schedule.

Will a Time to Pay arrangement affect my ability to get new credit?

Potentially, yes. Lenders might view ongoing arrangements as a sign of financial distress, which could affect new credit applications.

Are there alternatives to a Time to Pay arrangement that might not affect my credit?

Debt consolidation or seeking advice from a financial advisor might help manage your debts without impacting your credit.

How can I minimize the impact of a Time to Pay arrangement on my credit score?

Make timely payments, stay informed about any reporting, and communicate with creditors if issues arise.

Do all creditors offer Time to Pay arrangements?

Not all creditors offer these arrangements. It depends on their policies and your financial situation.

Are there fees associated with a Time to Pay arrangement?

Some creditors may charge fees or interest as part of the arrangement. It's important to review the terms carefully.

How is a Time to Pay arrangement different from a debt settlement?

A Time to Pay arrangement spreads out payments over time, whereas a debt settlement involves negotiating a reduced balance.

Do Time to Pay arrangements come with interest?

Some arrangements may include interest on the outstanding debt, which will be outlined in the agreement terms.

Can negotiating a Time to Pay arrangement affect my relationship with creditors?

It can demonstrate good faith in trying to repay debt, possibly improving your relationship if handled responsibly.

Who should I contact to set up a Time to Pay arrangement?

You should contact your creditor directly to discuss and set up a Time to Pay arrangement.

Useful Links

This website offers general information and is not a substitute for professional advice.

Always seek guidance from qualified professionals.

If you have any medical concerns or need urgent help, contact a healthcare professional or emergency services immediately.

Some of this content was generated with AI assistance. We’ve done our best to keep it accurate, helpful, and human-friendly.

- Ergsy carfully checks the information in the videos we provide here.

- Videos shown by Youtube after a video has completed, have NOT been reviewed by ERGSY.

- To view, click the arrow in centre of video.

- Most of the videos you find here will have subtitles and/or closed captions available.

- You may need to turn these on, and choose your preferred language.

- Go to the video you'd like to watch.

- If closed captions (CC) are available, settings will be visible on the bottom right of the video player.

- To turn on Captions, click settings .

- To turn off Captions, click settings again.

More Items From Ergsy search

-

Can a Time to Pay arrangement affect my credit score?

Relevance: 100%

-

Time to Pay arrangement for Self Assessment?

Relevance: 66%

-

Is there a penalty for setting up a Time to Pay arrangement?

Relevance: 65%

-

Is there any interest charged on a Time to Pay arrangement?

Relevance: 63%

-

What is a Time to Pay arrangement for Self Assessment?

Relevance: 62%

-

Who is eligible for a Time to Pay arrangement for Self Assessment?

Relevance: 61%

-

Will a cashback credit card help improve my credit score?

Relevance: 59%

-

What happens if I miss a payment under a Time to Pay arrangement?

Relevance: 58%

-

Will transferring a balance affect my credit score?

Relevance: 58%

-

Can I cancel a Time to Pay arrangement once it’s set up?

Relevance: 58%

-

Can I include previous year's tax debt in a new Time to Pay arrangement?

Relevance: 58%

-

How to set up a Time to Pay arrangement online for Self Assessment

Relevance: 57%

-

Will penalty points affect my credit score?

Relevance: 57%

-

Can eviction affect my credit score?

Relevance: 57%

-

Will switching banks affect my credit score?

Relevance: 55%

-

What is a good credit score to qualify for a balance transfer card?

Relevance: 54%

-

How long can I spread my payments under a Time to Pay arrangement?

Relevance: 53%

-

Can a Time to Pay arrangement affect my credit score?

Relevance: 53%

-

What information do I need to set up a Time to Pay arrangement online?

Relevance: 53%

-

Will switching banks affect my credit score?

Relevance: 52%

-

How can I apply for a Time to Pay arrangement online for Self Assessment?

Relevance: 52%

-

How will I know if my Time to Pay arrangement is approved?

Relevance: 51%

-

What if I'm not comfortable applying online for a Time to Pay arrangement?

Relevance: 51%

-

Does applying for an income-driven repayment plan affect my credit score?

Relevance: 49%

-

Can mis-sold car finance affect my credit score?

Relevance: 48%

-

How does missing student loan payments affect my credit score?

Relevance: 47%

-

Credit Cards for Beginners Explained UK | Do's and Don't | Type of Cards

Relevance: 39%

-

What are the benefits of a balance transfer credit card?

Relevance: 38%

-

What if I can’t pay my tax bill on time?

Relevance: 38%

-

What is credit monitoring?

Relevance: 37%

-

How long does it take to set up a Time to Pay arrangement online?

Relevance: 37%

-

Credit Cards for Beginners Explained UK | Do's and Don't | Type of Cards

Relevance: 36%

-

What is a balance transfer credit limit?

Relevance: 35%

-

Is a cashback credit card right for me?

Relevance: 35%

-

Are there any drawbacks to using a cashback credit card?

Relevance: 35%

-

Is there a penalty for setting up a Time to Pay arrangement?

Relevance: 34%

-

What is a Balance Transfer Credit Card?

Relevance: 33%

-

What is a cashback credit card?

Relevance: 33%

-

How does a cashback credit card work?

Relevance: 32%

-

www.DebtMadeSimple.co.uk - Trust Deeds, Debt Arrangement Schemes, and Bankruptcy Services

Relevance: 31%