Find Help

More Items From Ergsy search

-

How do I pay my tax bill?

Relevance: 100%

-

What if I can’t pay my tax bill on time?

Relevance: 99%

-

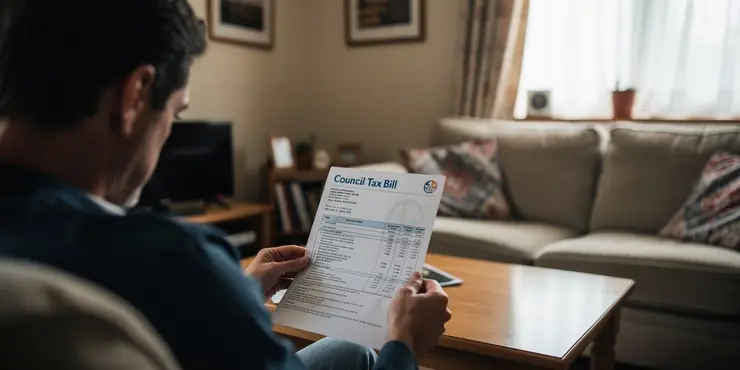

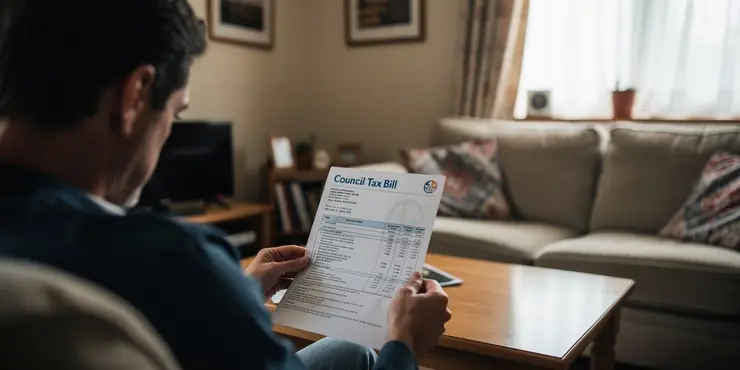

Where can I get a copy of my Council Tax bill?

Relevance: 92%

-

What should I do if I suspect an error in my Council Tax billing?

Relevance: 84%

-

Can an inheritance tax bill be challenged or appealed?

Relevance: 82%

-

How do I calculate my tax bill?

Relevance: 79%

-

How is the Inheritance Tax bill calculated?

Relevance: 77%

-

Is it possible to reduce the Inheritance Tax bill?

Relevance: 75%

-

Can I access my Council Tax payment history online?

Relevance: 75%

-

What is a payment on account?

Relevance: 75%

-

Do I need to pay tax on the £500 cost of living payment?

Relevance: 74%

-

Do I need to report the Winter Fuel Payment on my tax return?

Relevance: 72%

-

Does overpayment affect my Council Tax band?

Relevance: 66%

-

How does billing for live-in care work?

Relevance: 66%

-

Where can I get help in managing my household bills?

Relevance: 65%

-

How do can I find out if I have overpaid my UK Council Tax?

Relevance: 65%

-

Is the Winter Fuel Payment taxable?

Relevance: 65%

-

What if I owe more than £30,000 in Self Assessment tax?

Relevance: 62%

-

Are there government programs that help with utility bills?

Relevance: 60%

-

Is there a penalty for late payment of Stamp Duty in the UK?

Relevance: 60%

-

What is the £500 cost of living payment?

Relevance: 60%

-

Is it possible to delay menopause naturally?

Relevance: 59%

-

Why might a court date be delayed?

Relevance: 58%

-

Is the £500 cost of living payment taxable?

Relevance: 58%

-

When will I receive the £500 cost of living payment?

Relevance: 57%

-

Can seniors receive help with their energy bills?

Relevance: 57%

-

When will I receive the Winter Fuel Payment?

Relevance: 57%

-

What if I haven't received my payment by the expected date?

Relevance: 56%

-

What happens if Inheritance Tax is not paid on time?

Relevance: 56%

-

My first Self Assessment tax return

Relevance: 56%

-

Can my tax refund be applied to my future tax obligations?

Relevance: 56%

-

When will the £500 payment be distributed?

Relevance: 56%

-

What should I do if I think I'm eligible but haven't received the payment?

Relevance: 56%

-

Are refunds for overpaid Council Tax taxable?

Relevance: 55%

-

What is the £500 cost of living payment?

Relevance: 55%

-

how do I get the £500 cost of living payment before March deadline?

Relevance: 55%

-

Can I receive this payment alongside other cost of living payments?

Relevance: 55%

-

What should I do if my energy bill is unexpectedly high?

Relevance: 54%

-

Is the £500 cost of living payment taxable?

Relevance: 54%

-

How will I receive the £500 payment?

Relevance: 54%

Understanding Your Situation

If you find yourself unable to pay your tax bill on time, you're not alone. Many people face temporary financial hardships that make it difficult to meet tax obligations.

It's important to address the issue promptly. Ignoring the problem can lead to further complications, including additional interest and penalties.

Contact HM Revenue and Customs (HMRC)

Your first step should be to contact HMRC as soon as possible. They may be able to offer support or guidance for your specific situation.

HMRC appreciates proactive communication and may be more willing to agree to a payment plan if you reach out early.

Consider a Time to Pay Arrangement

HMRC offers a Time to Pay Arrangement, allowing you to pay your tax bill in instalments. This can be a good option if you need extra time to pay.

The arrangement is usually agreed upon based on your individual circumstances. You'll need to show that you're genuinely unable to pay in full.

Calculate Your Budget

Before discussing a payment plan with HMRC, evaluate your financial situation. Determine what you can realistically afford to pay each month.

A detailed budget will assist you in negotiating an installment plan that is sustainable and acceptable to HMRC.

Understand Potential Penalties

Delaying payment without contacting HMRC can lead to penalties and increased interest charges. This will escalate the amount you owe.

Being aware of these potential costs can motivate you to reach an agreement with HMRC promptly and minimise extra charges.

Seek Professional Advice

If you're struggling to understand your options, consider seeking advice from a tax professional. They can offer insights and assist with negotiations.

Professional advice can be especially valuable if your tax situation is complex or if you're facing significant financial difficulties.

Conclusion

Not paying your tax bill on time can be stressful, but there are solutions available. The key is to act quickly and communicate with HMRC.

By exploring your options and seeking help when needed, you can find a workable solution and avoid further financial strain.

Frequently Asked Questions

What should I do if I can't pay my tax bill on time?

Contact the IRS as soon as possible to discuss payment options and avoid penalties.

Will I incur penalties if I can't pay my tax bill by the due date?

Yes, the IRS typically imposes penalties and interest on unpaid tax bills starting from the due date.

Are there any payment plans available if I can't pay my tax bill in full?

Yes, the IRS offers payment plans such as installment agreements to help you pay your tax bill over time.

How can I apply for a payment plan with the IRS?

You can apply for a payment plan online at the IRS website, by phone, or by submitting Form 9465.

What is an installment agreement?

An installment agreement allows you to pay your tax debt in smaller, more manageable monthly payments.

How long do I have to pay back taxes with an installment agreement?

Installment agreements generally allow you to pay over a period of up to 72 months, depending on the amount owed.

What is the minimum payment requirement for an installment agreement?

The minimum payment is typically determined by dividing your total amount owed by the number of months in your agreement.

Are there fees associated with setting up an installment agreement?

Yes, there can be setup fees unless you qualify for lower-income options, which may offer reduced fees.

Can I use a credit card to pay my tax bill?

Yes, you can use a credit or debit card to pay your taxes, but additional convenience fees may apply.

What if my financial situation prevents me from making any payment?

You may qualify for an offer in compromise or be temporarily classified as 'Currently Not Collectible.'

What is an offer in compromise?

An offer in compromise allows you to settle your tax debt for less than the full amount owed if you qualify.

How can I apply for an offer in compromise?

You need to complete Form 656 and Form 433-A (OIC), including financial documentation, to apply.

What does 'Currently Not Collectible' mean?

If the IRS determines you can't pay any of your debt, they may temporarily delay collection activities.

Will being 'Currently Not Collectible' stop penalties and interest?

No, interest and penalties will continue to accrue even if collection is temporarily delayed.

Can I negotiate a lower amount to settle my tax debt?

Possibly, through an offer in compromise, but it requires meeting strict qualifications.

How do penalties and interest affect my unpaid taxes?

Penalties and interest will increase the total amount you owe over time.

Can penalties for late payment be waived?

Under certain circumstances, you can request a penalty abatement, but it is at the IRS's discretion.

What documentation do I need to provide if I cannot pay my taxes?

You may need to provide financial statements, pay stubs, and other documents for payment plans or offers.

Is interest charged on unpaid taxes?

Yes, interest is charged on any unpaid tax from the original due date until paid in full.

Can I get professional help if I can't pay my tax bill?

Yes, consider consulting a tax professional or advisor for guidance tailored to your situation.

Useful Links

This website offers general information and is not a substitute for professional advice.

Always seek guidance from qualified professionals.

If you have any medical concerns or need urgent help, contact a healthcare professional or emergency services immediately.

Some of this content was generated with AI assistance. We’ve done our best to keep it accurate, helpful, and human-friendly.

- Ergsy carfully checks the information in the videos we provide here.

- Videos shown by Youtube after a video has completed, have NOT been reviewed by ERGSY.

- To view, click the arrow in centre of video.

- Most of the videos you find here will have subtitles and/or closed captions available.

- You may need to turn these on, and choose your preferred language.

- Go to the video you'd like to watch.

- If closed captions (CC) are available, settings will be visible on the bottom right of the video player.

- To turn on Captions, click settings .

- To turn off Captions, click settings again.

More Items From Ergsy search

-

How do I pay my tax bill?

Relevance: 100%

-

What if I can’t pay my tax bill on time?

Relevance: 99%

-

Where can I get a copy of my Council Tax bill?

Relevance: 92%

-

What should I do if I suspect an error in my Council Tax billing?

Relevance: 84%

-

Can an inheritance tax bill be challenged or appealed?

Relevance: 82%

-

How do I calculate my tax bill?

Relevance: 79%

-

How is the Inheritance Tax bill calculated?

Relevance: 77%

-

Is it possible to reduce the Inheritance Tax bill?

Relevance: 75%

-

Can I access my Council Tax payment history online?

Relevance: 75%

-

What is a payment on account?

Relevance: 75%

-

Do I need to pay tax on the £500 cost of living payment?

Relevance: 74%

-

Do I need to report the Winter Fuel Payment on my tax return?

Relevance: 72%

-

Does overpayment affect my Council Tax band?

Relevance: 66%

-

How does billing for live-in care work?

Relevance: 66%

-

Where can I get help in managing my household bills?

Relevance: 65%

-

How do can I find out if I have overpaid my UK Council Tax?

Relevance: 65%

-

Is the Winter Fuel Payment taxable?

Relevance: 65%

-

What if I owe more than £30,000 in Self Assessment tax?

Relevance: 62%

-

Are there government programs that help with utility bills?

Relevance: 60%

-

Is there a penalty for late payment of Stamp Duty in the UK?

Relevance: 60%

-

What is the £500 cost of living payment?

Relevance: 60%

-

Is it possible to delay menopause naturally?

Relevance: 59%

-

Why might a court date be delayed?

Relevance: 58%

-

Is the £500 cost of living payment taxable?

Relevance: 58%

-

When will I receive the £500 cost of living payment?

Relevance: 57%

-

Can seniors receive help with their energy bills?

Relevance: 57%

-

When will I receive the Winter Fuel Payment?

Relevance: 57%

-

What if I haven't received my payment by the expected date?

Relevance: 56%

-

What happens if Inheritance Tax is not paid on time?

Relevance: 56%

-

My first Self Assessment tax return

Relevance: 56%

-

Can my tax refund be applied to my future tax obligations?

Relevance: 56%

-

When will the £500 payment be distributed?

Relevance: 56%

-

What should I do if I think I'm eligible but haven't received the payment?

Relevance: 56%

-

Are refunds for overpaid Council Tax taxable?

Relevance: 55%

-

What is the £500 cost of living payment?

Relevance: 55%

-

how do I get the £500 cost of living payment before March deadline?

Relevance: 55%

-

Can I receive this payment alongside other cost of living payments?

Relevance: 55%

-

What should I do if my energy bill is unexpectedly high?

Relevance: 54%

-

Is the £500 cost of living payment taxable?

Relevance: 54%

-

How will I receive the £500 payment?

Relevance: 54%