Find Help

More Items From Ergsy search

-

Are these grants taxable?

Relevance: 100%

-

Is the tax refund amount taxable?

Relevance: 53%

-

Are firefighter pension benefits taxable?

Relevance: 52%

-

Is the Winter Fuel Payment taxable?

Relevance: 51%

-

Is the £500 cost of living payment taxable?

Relevance: 51%

-

Are refunds for overpaid Council Tax taxable?

Relevance: 47%

-

Is the £500 cost of living payment taxable?

Relevance: 45%

-

How do I apply for the EV grant?

Relevance: 43%

-

What are Household & Cost-of-Living Support grants?

Relevance: 43%

-

What are Household & Cost-of-Living Support grants?

Relevance: 43%

-

Is the EV grant amount deducted from taxes?

Relevance: 42%

-

Are there any grants for purchasing electric bikes?

Relevance: 42%

-

What is the Sure Start Maternity Grant?

Relevance: 42%

-

How much is the Sure Start Maternity Grant?

Relevance: 40%

-

What is the eligibility criteria for government small business grants?

Relevance: 40%

-

Is there a grant for electric vans?

Relevance: 40%

-

Can businesses claim the EV grant?

Relevance: 39%

-

Are there grants specifically for individuals with disabilities?

Relevance: 38%

-

How much is the Plug-in Car Grant worth?

Relevance: 38%

-

Can businesses get grants for electric vehicles?

Relevance: 38%

-

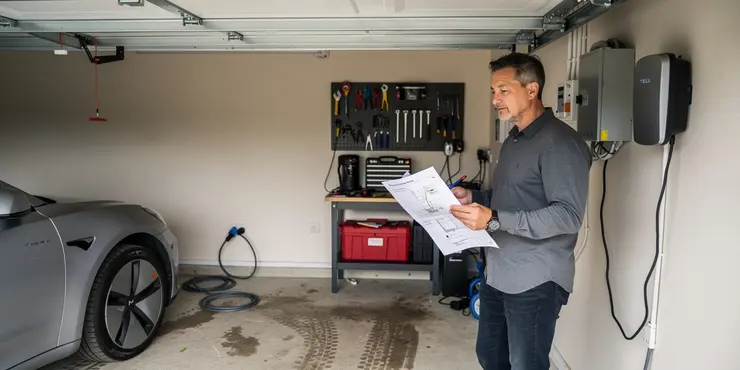

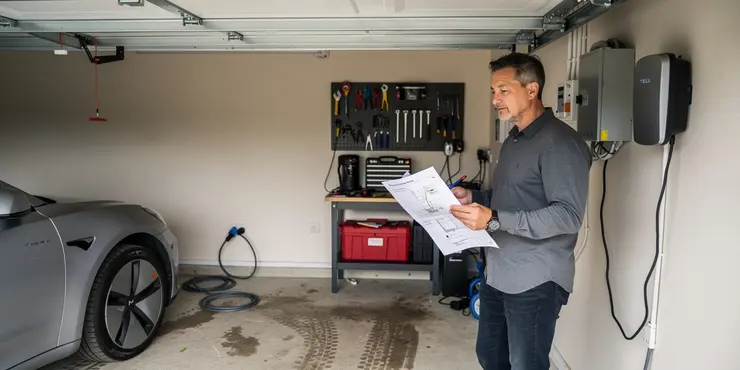

What is the value of the home charger installation grant?

Relevance: 38%

-

Is there a deadline for the Plug-in Car Grant?

Relevance: 38%

-

What is the Sure Start Grant?

Relevance: 38%

-

What should I consider when buying an electric car regarding grants?

Relevance: 38%

-

What is the Sure Start Grant?

Relevance: 38%

-

Do I need to pay back Household & Cost-of-Living grants?

Relevance: 37%

-

Are there support grants specifically for seniors?

Relevance: 37%

-

What is the UK Plug-in Car Grant?

Relevance: 37%

-

Do I need to repay the EV grant?

Relevance: 37%

-

Is the EV grant available for leased vehicles?

Relevance: 37%

-

Who is eligible for the EV grant in the UK?

Relevance: 37%

-

Is the EV grant available for electric vans?

Relevance: 37%

-

How much is the EV grant in the UK?

Relevance: 37%

-

Where can I apply for the EVHS grant?

Relevance: 37%

-

Does the EV grant apply to hybrids?

Relevance: 36%

-

Are there grants for installing an electric vehicle charger at home?

Relevance: 36%

-

What is the Sure Start Grant in the UK?

Relevance: 36%

-

What documents are needed to apply for these grants?

Relevance: 36%

-

Are there grants for converting petrol/diesel cars to electric?

Relevance: 36%

-

What is the Sure Start Maternity Grant?

Relevance: 36%

Understanding Grant Taxation in the UK

Grants are a crucial source of funding for individuals and organizations across various sectors in the UK. They can come from the government, charities, or private institutions. However, a common question that recipients often have is whether these grants are taxable. Understanding the taxation status of grants is important for financial planning and compliance purposes.

Types of Grants and Their Tax Implications

In the UK, the tax implications of a grant depend primarily on its purpose and the entity providing it. Generally, government grants provided to individuals for personal support—such as educational grants or certain welfare benefits—are non-taxable. An example is the Maintenance Loan for students in higher education, which typically does not count as taxable income.

Conversely, grants awarded to businesses or individuals for carrying out certain projects or business activities may be taxable. For instance, if a business receives a grant for research and development, that amount might be considered taxable income. It is crucial to examine the terms under which the grant is provided to determine its taxability.

Grants for Individuals

For individuals receiving grants, the tax treatment often depends on whether the grant represents a form of regular income, or if it serves a specific purpose. Educational grants and scholarships, for example, are mostly intended to cover study expenses and are not usually taxed. However, if an individual receives a grant that supplements their income, it could potentially be subject to tax.

Grants for Businesses

Businesses receiving grants should carefully assess the conditions and stipulations attached to the funding. While grants are often seen as a form of income to help offset the cost of business activities, they could increase the total taxable income unless specifically exempted. If a business uses a grant for capital expenditure—such as buying equipment—the tax implications could differ, and accountancies might be required to handle such transactions appropriately.

Charitable and Social Grants

In the UK, grants provided to charities are generally non-taxable, as charities benefit from several tax exemptions under UK law. This includes grants received from donation-based activities or government support. Still, charities must ensure compliance with the conditions of the grant and maintain proper documentation.

Conclusion

To navigate the complexities of grant taxation, recipients in the UK are encouraged to seek advice from tax professionals or consult HM Revenue and Customs (HMRC). Clear guidance from HMRC can provide specific details on the tax implications of different types of grants. Understanding these rules ensures compliance and helps avoid any unexpected tax liabilities.

Understanding Grant Taxation in the UK

Grants give money to people or groups in the UK. They can come from the government, charities, or private companies. A big question people have is if these grants are taxed. Knowing if a grant is taxed helps with money planning and following the rules.

Types of Grants and Their Tax Implications

In the UK, whether a grant is taxed depends on why you get it and who gives it. Grants from the government to help people, like for school or welfare, are usually not taxed. For example, students getting a Maintenance Loan for college don't pay tax on it.

But, if a business gets a grant for work projects, it might be taxed. For example, if a business gets a grant for research, it could count as income that is taxed. It's important to read the details of the grant to see if it's taxed.

Grants for Individuals

For people who get grants, whether it's taxed depends on what the money is for. Grants for education, like scholarships, usually pay for school costs and are not taxed. But if a grant adds to your regular income, it might be taxed.

Grants for Businesses

Businesses need to look at the rules of the grant money they get. Grants can help with work costs but might be taxed as income unless they are meant to be tax-free. If a business uses a grant to buy things, like equipment, the tax rules might be different. It's important to keep good records.

Charitable and Social Grants

In the UK, charities do not usually pay tax on grants because they get tax benefits. This is true for money they get from donations or the government. Charities must follow the grant rules and keep good records.

Conclusion

To understand grant taxes, people and businesses in the UK should ask tax experts or check with HM Revenue and Customs (HMRC). HMRC can give clear advice on different grants and their taxes. Understanding the rules helps to avoid surprise taxes.

Frequently Asked Questions

Are grants considered taxable income?

It depends on the type of grant. Some grants are considered taxable income, while others may not be. It's important to consult with a tax professional or the IRS guidelines for specific information.

Do I need to report grants on my tax return?

Yes, if the grant is considered taxable income, you must report it on your tax return. Check the specific guidelines for your type of grant.

Are scholarships and educational grants taxable?

Scholarships and educational grants are generally not taxable if they are used for tuition and required fees. However, amounts used for other expenses like room and board may be taxable.

Is a small business grant taxable?

Yes, grants for small businesses are generally considered taxable income and should be reported on your tax return.

Does a personal grant count as income?

A personal grant can be considered income depending on its source and purpose. Check with a tax advisor for specific situations.

Are COVID-19 related grants taxable?

Many COVID-19 relief grants, such as PPP loans forgiven, are not taxable, but others may be. Refer to specific guidelines issued at the time of the grant.

How do I determine if my grant is taxable?

Review the terms of the grant and consult IRS guidelines or a tax professional to determine if it is taxable.

What is the tax rate for taxable grants?

Taxable grants are taxed at your marginal tax rate, which is based on your overall income level.

Are grants for non-profit organizations taxable?

Grants to non-profit organizations are usually not taxable to the organization, but they must be used in accordance with tax-exempt purposes.

Do I pay state taxes on grants?

You may be required to pay state taxes on grants, depending on state tax laws. Check with your state's tax authority for guidance.

Are artist grants taxable?

Yes, grants received by artists are generally considered taxable income.

Can a grant be partially taxable?

Yes, if only a portion of the grant funds are used for non-taxable purposes, the rest may be considered taxable.

How do I report a taxable grant on my tax return?

You typically report taxable grants as income on your tax return. Follow the instructions for the specific form you are filing.

Are international grants taxable in the US?

International grants received while residing in the US may be considered taxable, depending on specific tax treaties and income rules.

What documentation do I need for a grant at tax time?

Keep all records related to the grant, including award letters and bank statements, as support for your tax return.

Do fellowship grants count as taxable income?

Fellowships used for living expenses and not for qualified educational expenses may be taxable.

Is a research grant award taxable?

Yes, research grants are typically considered taxable income.

Is a student grant taxable?

If student grants are used for non-qualified expenses, such as travel or optional equipment, they may be taxable.

Are housing grants taxable?

Housing grants might be taxable depending on the specific conditions and uses. Verify with a tax professional.

Will my grant affect my tax bracket?

Receiving a large grant could increase your total income and potentially push you into a higher tax bracket.

Do you have to pay tax on grants?

Grants are money you can get. Some grants can make you pay taxes, but some do not. To know more, you should ask a tax expert or check the IRS rules.

Do I need to tell the tax office about money I got from grants?

Yes, if the money from the grant is like income, you need to tell the tax people about it. Look at the rules for your kind of grant to be sure.

Do you have to pay tax on scholarships and grants for school?

Scholarships and money given for school are not taxed if you use them to pay for classes and school fees. But if you use them for living costs like room and board, you might have to pay tax on that money.

Do you have to pay tax on a small business grant?

Yes, money given to small businesses as grants is usually counted as money you need to pay tax on. This should be included when you do your taxes.

Does a personal grant count as income?

A personal grant is money given to you as a gift. It is not your regular pay from a job.

This money might be counted as income. "Income" means money you get.

To understand better, you can ask someone who knows about grants. This could be a friend, family, or a money helper.

You can use tools like a calculator to help you keep track of your money.

A personal grant is money that someone gives you. It might count as income, which is money you earn or receive. It depends on where the grant comes from and why you got it. Ask a tax advisor, who is someone that knows about taxes, to find out for sure in your case.

Do you have to pay tax on COVID-19 grants?

Some money help people got during COVID-19, like PPP loans that do not need to be paid back, do not require taxes. But some other money might need taxes. Check the rules that were given when you got the help.

Is my grant money taxed?

Check the rules of the grant. Ask the IRS or a tax expert if you need to pay tax on it.

What is the tax rate for grants you have to pay tax on?

Grants are money that people or businesses get. Sometimes, you have to pay tax on this money.

Tax rate means the amount of money you pay to the government from the grant. This is usually a percentage.

If you find it hard to understand, you can ask someone to help. You can also use a calculator to help you with numbers.

When you get money from taxable grants, you have to pay tax. The amount of tax you pay depends on how much money you make in total.

Do non-profit groups have to pay tax on grants?

A grant is money given to help non-profit groups. This money is not always taxed. It means the group might not have to pay tax on it.

To know if a grant is taxed, a non-profit group can:

- Ask a tax expert for help.

- Use online tools to learn more about taxes.

These steps can make it easier to understand tax rules.

Money given to non-profit groups does not usually have to be taxed. The money must be used for special reasons that do not involve making a profit.

Do I have to pay state taxes on grants?

A grant is money given to you for something special, like school or a project.

Sometimes you must pay state taxes on grants. It depends on where you live and what the grant is for.

For help, you can:

- Ask a tax expert.

- Use a tax software that explains things.

It's important to check the rules in your state!

You might have to pay state taxes on grants. This depends on the rules where you live. Ask your state’s tax office for help.

Do you have to pay taxes on money from artist grants?

Yes, money that artists get from grants usually counts as income that they need to pay taxes on.

Do you have to pay tax on part of a grant?

Yes. If you do not use all the grant money for things that are not taxed, the rest might have to be taxed.

How do I tell the tax office about money I got from a grant?

When you get grants that you have to pay taxes on, you need to tell the tax office about this money. You do this when you fill out your tax forms. Just follow the steps on the form to do it right.

Do you have to pay tax on grants from other countries in the US?

If you live in the US and get money from another country, you might have to pay taxes on it. It depends on the rules about money and taxes between the countries.

What papers do I need for a grant at tax time?

You need some papers when it's time to do taxes for your grant. Here is what you might need:

- Grant Letter: The paper that says you got the grant.

- Receipts: Papers that show what you bought with the grant money.

- Bank Statements: Papers from the bank that show money coming in and out.

- Forms: Any special tax forms that talk about the grant.

Here are some things you can do to make it easier:

- Use a folder to keep all your papers together.

- Make a list of what each paper is for.

- Ask someone to help you if you feel stuck.

Keep all your papers about the grant. This means letters saying you got the grant and bank papers. They help you with your taxes.

Do fellowship grants mean I have to pay taxes?

If you get money called a fellowship, you might have to pay tax on it if you use it for living costs, not school costs.

Do you have to pay tax on a research grant?

Yes, money from research grants usually counts as money you need to pay taxes on.

Do you have to pay tax on a student grant?

If students use their grant money for things like travel or extra equipment they don't need for school, they might have to pay taxes on it.

Do you have to pay taxes on housing grants?

Housing grants might mean you have to pay some tax. It depends on how you use the money and any special rules. It's a good idea to ask a tax expert to make sure.

Will my grant change how much tax I pay?

Getting a big grant means you might make more money. This could mean you have to pay more tax.

Useful Links

This website offers general information and is not a substitute for professional advice.

Always seek guidance from qualified professionals.

If you have any medical concerns or need urgent help, contact a healthcare professional or emergency services immediately.

Some of this content was generated with AI assistance. We’ve done our best to keep it accurate, helpful, and human-friendly.

- Ergsy carfully checks the information in the videos we provide here.

- Videos shown by Youtube after a video has completed, have NOT been reviewed by ERGSY.

- To view, click the arrow in centre of video.

- Most of the videos you find here will have subtitles and/or closed captions available.

- You may need to turn these on, and choose your preferred language.

- Go to the video you'd like to watch.

- If closed captions (CC) are available, settings will be visible on the bottom right of the video player.

- To turn on Captions, click settings .

- To turn off Captions, click settings again.

More Items From Ergsy search

-

Are these grants taxable?

Relevance: 100%

-

Is the tax refund amount taxable?

Relevance: 53%

-

Are firefighter pension benefits taxable?

Relevance: 52%

-

Is the Winter Fuel Payment taxable?

Relevance: 51%

-

Is the £500 cost of living payment taxable?

Relevance: 51%

-

Are refunds for overpaid Council Tax taxable?

Relevance: 47%

-

Is the £500 cost of living payment taxable?

Relevance: 45%

-

How do I apply for the EV grant?

Relevance: 43%

-

What are Household & Cost-of-Living Support grants?

Relevance: 43%

-

What are Household & Cost-of-Living Support grants?

Relevance: 43%

-

Is the EV grant amount deducted from taxes?

Relevance: 42%

-

Are there any grants for purchasing electric bikes?

Relevance: 42%

-

What is the Sure Start Maternity Grant?

Relevance: 42%

-

How much is the Sure Start Maternity Grant?

Relevance: 40%

-

What is the eligibility criteria for government small business grants?

Relevance: 40%

-

Is there a grant for electric vans?

Relevance: 40%

-

Can businesses claim the EV grant?

Relevance: 39%

-

Are there grants specifically for individuals with disabilities?

Relevance: 38%

-

How much is the Plug-in Car Grant worth?

Relevance: 38%

-

Can businesses get grants for electric vehicles?

Relevance: 38%

-

What is the value of the home charger installation grant?

Relevance: 38%

-

Is there a deadline for the Plug-in Car Grant?

Relevance: 38%

-

What is the Sure Start Grant?

Relevance: 38%

-

What should I consider when buying an electric car regarding grants?

Relevance: 38%

-

What is the Sure Start Grant?

Relevance: 38%

-

Do I need to pay back Household & Cost-of-Living grants?

Relevance: 37%

-

Are there support grants specifically for seniors?

Relevance: 37%

-

What is the UK Plug-in Car Grant?

Relevance: 37%

-

Do I need to repay the EV grant?

Relevance: 37%

-

Is the EV grant available for leased vehicles?

Relevance: 37%

-

Who is eligible for the EV grant in the UK?

Relevance: 37%

-

Is the EV grant available for electric vans?

Relevance: 37%

-

How much is the EV grant in the UK?

Relevance: 37%

-

Where can I apply for the EVHS grant?

Relevance: 37%

-

Does the EV grant apply to hybrids?

Relevance: 36%

-

Are there grants for installing an electric vehicle charger at home?

Relevance: 36%

-

What is the Sure Start Grant in the UK?

Relevance: 36%

-

What documents are needed to apply for these grants?

Relevance: 36%

-

Are there grants for converting petrol/diesel cars to electric?

Relevance: 36%

-

What is the Sure Start Maternity Grant?

Relevance: 36%