Important Information On Using This Service

- Ergsy carefully checks the information in the videos we provide here.

- Videos shown by YouTube after a video has completed have NOT been reviewed by ERGSY.

- To view, click the arrow in the center of the video.

Using Subtitles and Closed Captions

- Most of the videos you find here will have subtitles and/or closed captions available.

- You may need to turn these on and choose your preferred language.

Turn Captions On or Off

- Go to the video you'd like to watch.

- If closed captions (CC) are available, settings will be visible on the bottom right of the video player.

- To turn on captions, click settings.

- To turn off captions, click settings again.

Find A Professional

Videos from Ergsy search

-

Diabetes Care - Preventing Amputations

-

NHS Acute Care Anaphylaxis

-

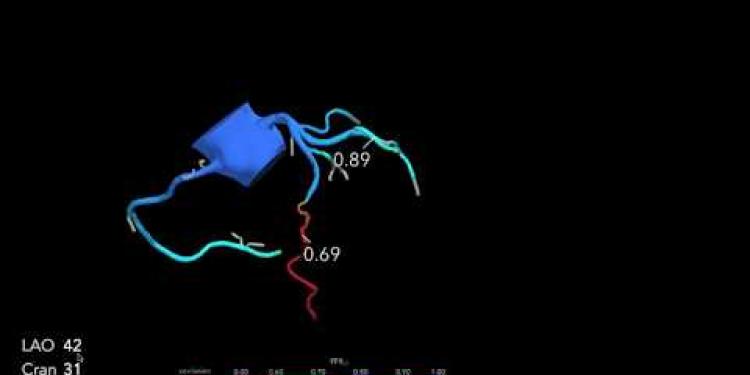

Cardiac Physiology Walkthrough

-

Genomics I: An overview of genomics in cancer care

-

Don't carry the worry of cancer with you | NHS

-

FFR-CT beat invasive conventional coronary angiography says a Cardiologist

-

Carpal Tunnel Syndrome

-

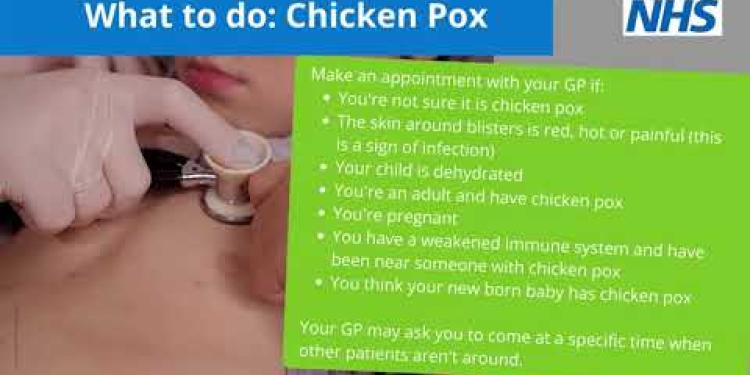

How to care for someone with chicken pox

-

Chiropractic Care on the NHS

-

Neck Care Exercises

-

Stoma Care

-

Sandwell and West Birmingham Hospitals NHS Trust – Faecal Incontinence and Constipation Healthcare

-

Cardiac Rehab

-

Heart attack care - Raigmore Hospital Inverness, NHS Highland

-

Having a CT Scan at Stoke Mandeville Hospital - Buckinghamshire Healthcare NHS Trust

-

Do not attempt cardiopulmonary resuscitation (DNACPR)

-

Self care: Treating ear infections

-

Patient Information Video - Leeds Stress Echocardiography Service

-

Join our echocardiography team

-

Caring for a child with fever | NHS

More Videos of Interestdiagnosis

How to Buy a Car in the UK: Pros and Cons of PCP, HP, and Leasing

Understanding Your Options

When purchasing a car in the UK, you'll typically encounter three main financing options: Personal Contract Purchase (PCP), Hire Purchase (HP), and Leasing. Understanding the intricacies of each can help you make an informed decision that suits your financial circumstances and personal preferences.

Personal Contract Purchase (PCP)

PCP allows you to make a deposit followed by a series of monthly payments. At the end of the contract, you have the option to either pay a final "balloon payment" to own the car, or return it to the dealer. The pros of PCP include lower monthly payments compared to HP, and flexibility at the end of the contract. However, it can be more expensive in the long run if you decide to purchase the vehicle, and there may be mileage restrictions and fees for wear and tear.

Hire Purchase (HP)

With HP, you make an initial deposit and then pay off the remainder of the car's value in monthly installments. Once all payments are completed, you own the car. The main advantage of HP is the straightforward path to ownership and no mileage restrictions. On the downside, monthly payments are typically higher than PCP, which might be less affordable for some buyers.

Car Leasing

Leasing involves renting a car for a fixed period, usually 2-4 years, with no option to own the vehicle at the end. This offers the benefit of driving a new car every few years with potentially lower monthly payments. However, it can be less cost-effective over time if continuous leasing, and you must adhere to mileage limits and return conditions.

Conclusion

The best option for purchasing a car in the UK will depend on your budget, driving needs, and long-term goals. PCP offers flexibility, HP provides a clear path to ownership, and leasing allows for driving new models regularly. Carefully consider each option's pros and cons in relation to your personal circumstances before making a decision.

Frequently Asked Questions

What is the difference between PCP and HP when buying a car in the UK?

PCP, or Personal Contract Purchase, involves lower monthly payments and an option to buy the car at the end of the term with a final 'balloon' payment. HP, or Hire Purchase, involves higher monthly payments, but you own the car outright after the final payment.

What are the main advantages of PCP over HP?

PCP offers lower monthly payments and flexibility at the end of the contract to either buy the car, return it, or trade it for a new one. It's ideal if you prefer upgrading your vehicle frequently.

When would HP be more beneficial than PCP?

HP is more beneficial if you intend to keep the car for a long time and want to own it outright at the end of the agreement without any large final payment.

What does leasing a car entail in the UK?

Leasing involves renting a car for an agreed period, typically 2-4 years, where you pay a fixed monthly fee. You return the car at the end of the lease without the option to purchase.

What are the pros and cons of leasing a car?

Pros: Lower monthly payments, maintenance often included, drive a new car every few years. Cons: You never own the car, may face mileage restrictions, and possible fees for damage.

What's typically included in a car lease agreement in the UK?

A car lease typically includes the rental of the vehicle, specified mileage limits, maintenance packages, breakdown cover, and potentially road tax. Insurance is usually not included.

How does leasing compare financially to financing a car?

Leasing generally offers lower monthly payments, but since you don't own the car, financing with PCP or HP may be more cost-effective in the long run if you plan to keep the car.

Is it possible to negotiate a better price on a lease?

Yes, you can often negotiate the initial rental cost, monthly payment, or additional services like maintenance packages, similar to negotiating a car purchase.

What happens if I exceed the mileage limit on a lease?

You will typically be charged an excess mileage fee as per the rate agreed in the lease contract. It's important to accurately estimate your mileage before signing the lease.

Can I end a lease agreement early?

Yes, but it might involve early termination fees. The cost depends on the terms outlined in your lease contract, which can be substantial.

What is a 'balloon payment' in a PCP deal?

A balloon payment is the final, larger payment at the end of a PCP contract required to purchase the car outright. This amount is agreed upon when the contract is drawn up.

Does buying a car with cash have advantages?

Yes, buying a car outright with cash eliminates the need for a finance agreement, reduces overall cost by avoiding interest, and leads to full ownership immediately.

How does interest rate affect my car finance agreement?

The interest rate determines the cost of borrowing. A lower rate means less interest paid over the term, reducing the total cost of financing the car.

Are there specific eligibility criteria for PCP or HP agreements?

Yes, criteria typically include being at least 18 years old, residing in the UK, and passing a credit check. Proof of income may also be required.

Can I modify a car I'm leasing or financing?

Modifications are generally not allowed on leased cars without permission. For financed cars, it's possible but may affect warranty or finance agreement terms. Always check with the provider.

Useful Links

More Videos of Interestdiagnosis

Have you found an error, or do you have a link or some information you would like to share? Please let us know using the form below.

- Ergsy carfully checks the information in the videos we provide here.

- Videos shown by Youtube after a video has completed, have NOT been reviewed by ERGSY.

- To view, click the arrow in centre of video.

- Most of the videos you find here will have subtitles and/or closed captions available.

- You may need to turn these on, and choose your preferred language.

- Go to the video you'd like to watch.

- If closed captions (CC) are available, settings will be visible on the bottom right of the video player.

- To turn on Captions, click settings .

- To turn off Captions, click settings again.