Find Help

More Items From Ergsy search

-

What is an online tax return?

Relevance: 100%

-

What happens after I file my tax return online?

Relevance: 98%

-

When is the deadline to file taxes online?

Relevance: 94%

-

Starting your online tax return

Relevance: 94%

-

Are there free options for filing taxes online?

Relevance: 92%

-

Is it safe to file taxes online?

Relevance: 91%

-

Can I file taxes online after the deadline?

Relevance: 91%

-

Can I amend an online tax return?

Relevance: 90%

-

Can I file my state taxes online as well?

Relevance: 89%

-

Can I file my taxes online if I'm self-employed?

Relevance: 87%

-

Do I need to print and mail my online tax return?

Relevance: 87%

-

How do I start filing my taxes online?

Relevance: 86%

-

Do I need an accountant to file a Self Assessment tax return?

Relevance: 84%

-

Who needs to file a Self Assessment tax return?

Relevance: 83%

-

Can I get help while filing taxes online?

Relevance: 83%

-

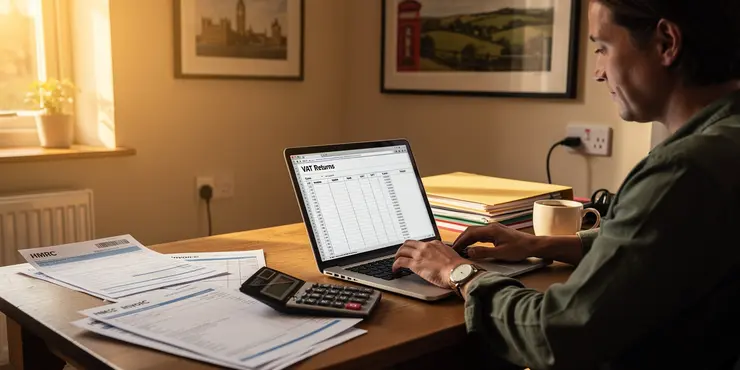

How do I file VAT returns?

Relevance: 81%

-

How can I check the status of my online tax return?

Relevance: 76%

-

What is a Self Assessment tax return?

Relevance: 76%

-

My first Self Assessment tax return

Relevance: 74%

-

What documents do I need to file my taxes online?

Relevance: 70%

-

Can I amend my tax return after submitting it?

Relevance: 68%

-

What should I do if I made a mistake on my tax return?

Relevance: 68%

-

How do I complete my Self Assessment tax return?

Relevance: 67%

-

Do online tax services help maximize my refund?

Relevance: 67%

-

When is the deadline for submitting my Self Assessment tax return?

Relevance: 66%

-

Is it necessary to complete a final tax return for the deceased?

Relevance: 65%

-

What if I make a mistake on my tax return?

Relevance: 64%

-

Is it effective to file a complaint online?

Relevance: 62%

-

Do I need to send anything by post when filing online?

Relevance: 62%

-

Will I get a confirmation when I file online?

Relevance: 60%

-

What information do I need to complete my Self Assessment tax return?

Relevance: 55%

-

How long does it take to receive a tax refund from HMRC?

Relevance: 54%

-

How do I verify my identity when filing online?

Relevance: 52%

-

Do I need to declare my ISA income on my tax return?

Relevance: 49%

-

Do VAT rules apply to online sales?

Relevance: 49%

-

What if I've moved since the tax year ended?

Relevance: 46%

-

What is the role of an executor in handling tax debts?

Relevance: 45%

-

When is the deadline to file taxes online?

Relevance: 45%

-

Do I need to report the Winter Fuel Payment on my tax return?

Relevance: 45%

-

What should I do if I need help managing the tax affairs of the deceased?

Relevance: 43%

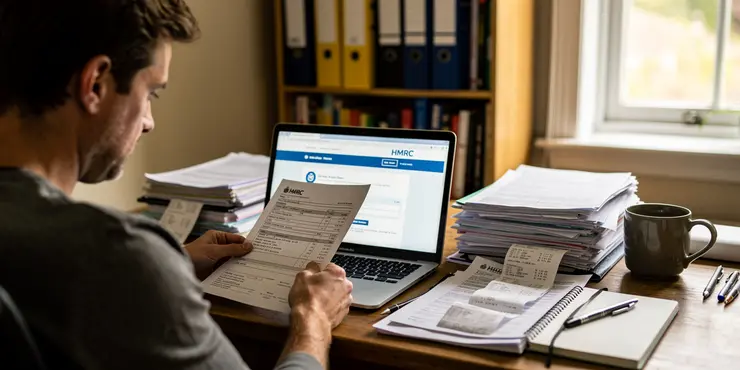

Acknowledgment of Submission

Once you file your tax return online with HM Revenue and Customs (HMRC), you'll receive an on-screen acknowledgment. This is confirmation that your return has been successfully submitted.

It's important to save or print this acknowledgment for your records. The document will contain a unique submission receipt reference number.

Processing of Your Tax Return

After submission, HMRC will review your tax return. This is an automated process for most straightforward cases.

If there are any discrepancies or additional checks required, HMRC may take longer to process your return. Generally, for simple returns, this process is completed quickly.

Receive Your Tax Calculation

Once the return is processed, HMRC will calculate your tax liability or refund. This will be based on the information you provided in your return.

If a refund is due, HMRC will notify you of how much you'll receive. Payments are usually made directly to your bank account if you provided details.

Handling Refunds and Payments

If you are owed a refund, HMRC aims to issue it within a few weeks. Ensure your bank details are correct to avoid delays.

If you owe additional tax, HMRC will inform you of the amount and the due date. It's crucial to pay promptly to avoid penalties and interest charges.

Corrections and Amendments

After filing, if you realize you've made a mistake, you have the option to amend your return. This can be done online via your HMRC account.

You have up to 12 months from the original filing deadline to make amendments to your tax return. Ensure all changes are accurate to prevent issues.

Communication from HMRC

You may receive communications from HMRC if they need further information. Always respond promptly to any queries or requests for additional documents.

Keep an eye on your mail and email for any correspondence. Responding quickly can prevent delays in processing your return or refund.

Final Steps and Record Keeping

Once everything is settled, HMRC will provide a final statement of account. This document shows your tax position for the year.

It is advisable to keep all records, such as your tax return, acknowledgment receipt, and any correspondence, for at least 22 months after the end of the tax year. Good record keeping ensures smooth filing in the future.

Frequently Asked Questions

What is the first step after filing my tax return online?

After you file your tax return online, you will receive a confirmation email from the IRS or your tax software provider acknowledging receipt of your return.

How can I check the status of my tax return?

You can check the status of your return through the 'Where's My Refund?' tool on the IRS website or by using the IRS2Go mobile app.

How long does it take for the IRS to process an e-filed tax return?

Typically, the IRS processes electronic returns within 21 days, but it may take longer during peak times or if your return requires additional review.

What happens if there is an error in my tax return?

If the IRS finds an error, they will correct it and send you a notification. They may contact you for more information if needed.

Will I get a refund after filing my tax return?

If you are eligible for a refund, it will be issued after your return is processed. You can choose to have it directly deposited into your bank account.

Can I make changes to my tax return after filing?

Yes, you can file an amended return using Form 1040-X to correct any errors or make changes to your original return.

What should I do if I owe additional taxes?

If you owe additional taxes, you should pay the amount due by the tax filing deadline to avoid penalties and interest.

How will I know if my tax return is selected for an audit?

The IRS will notify you by mail if your return is selected for an audit. They do not initiate audits through phone calls or emails.

How can I ensure my tax refund is not delayed?

Ensure all information is accurate and double-check for errors. Selecting direct deposit for your refund also speeds up the process.

What if my refund is lower than expected?

The IRS may have made adjustments to your return. You will receive a notice explaining any changes. You can contact the IRS if you believe there is an error.

Are there any security notifications I should expect?

You may receive emails from your tax software provider confirming the submission and status changes. Always verify the sender to avoid phishing scams.

What should I do if I don’t receive a confirmation email?

Check your spam or junk folders. If it seems like your return wasn't filed, confirm its status with your tax software or contact the IRS.

Is my electronic filing more secure than paper filing?

E-filing is generally considered more secure than paper filing due to encryption, but always ensure you use trustworthy and secure methods.

How do I know if my payment was successfully processed?

You can check the status of your payment through the payment confirmation page of your tax software or directly through an IRS payment portal.

Can I track the progress of my amended return?

Yes, use the 'Where's My Amended Return?' tool on the IRS website to track the status of an amended return.

What should I do if I forget to include an income source?

You should file an amended return as soon as possible to report the missing income and avoid penalties.

What if I accidentally filed my tax return twice?

Contact the IRS to explain the situation. They will ensure only one return is processed, but IRS systems typically block duplicate filings automatically.

Will I receive any notifications from the state tax authority?

If you filed a state tax return, you might receive a separate confirmation and communications regarding that return from your state tax authority.

How do I correct my bank information for a refund after filing?

If you realize you've entered incorrect bank information, contact the IRS immediately; they can guide you on the next steps.

What records should I keep after filing my online tax return?

Keep a copy of your filed tax return, confirmation emails, W-2s, 1099s, and any other supporting documents in case of future queries or audits.

Useful Links

This website offers general information and is not a substitute for professional advice.

Always seek guidance from qualified professionals.

If you have any medical concerns or need urgent help, contact a healthcare professional or emergency services immediately.

Some of this content was generated with AI assistance. We’ve done our best to keep it accurate, helpful, and human-friendly.

- Ergsy carfully checks the information in the videos we provide here.

- Videos shown by Youtube after a video has completed, have NOT been reviewed by ERGSY.

- To view, click the arrow in centre of video.

- Most of the videos you find here will have subtitles and/or closed captions available.

- You may need to turn these on, and choose your preferred language.

- Go to the video you'd like to watch.

- If closed captions (CC) are available, settings will be visible on the bottom right of the video player.

- To turn on Captions, click settings .

- To turn off Captions, click settings again.

More Items From Ergsy search

-

What is an online tax return?

Relevance: 100%

-

What happens after I file my tax return online?

Relevance: 98%

-

When is the deadline to file taxes online?

Relevance: 94%

-

Starting your online tax return

Relevance: 94%

-

Are there free options for filing taxes online?

Relevance: 92%

-

Is it safe to file taxes online?

Relevance: 91%

-

Can I file taxes online after the deadline?

Relevance: 91%

-

Can I amend an online tax return?

Relevance: 90%

-

Can I file my state taxes online as well?

Relevance: 89%

-

Can I file my taxes online if I'm self-employed?

Relevance: 87%

-

Do I need to print and mail my online tax return?

Relevance: 87%

-

How do I start filing my taxes online?

Relevance: 86%

-

Do I need an accountant to file a Self Assessment tax return?

Relevance: 84%

-

Who needs to file a Self Assessment tax return?

Relevance: 83%

-

Can I get help while filing taxes online?

Relevance: 83%

-

How do I file VAT returns?

Relevance: 81%

-

How can I check the status of my online tax return?

Relevance: 76%

-

What is a Self Assessment tax return?

Relevance: 76%

-

My first Self Assessment tax return

Relevance: 74%

-

What documents do I need to file my taxes online?

Relevance: 70%

-

Can I amend my tax return after submitting it?

Relevance: 68%

-

What should I do if I made a mistake on my tax return?

Relevance: 68%

-

How do I complete my Self Assessment tax return?

Relevance: 67%

-

Do online tax services help maximize my refund?

Relevance: 67%

-

When is the deadline for submitting my Self Assessment tax return?

Relevance: 66%

-

Is it necessary to complete a final tax return for the deceased?

Relevance: 65%

-

What if I make a mistake on my tax return?

Relevance: 64%

-

Is it effective to file a complaint online?

Relevance: 62%

-

Do I need to send anything by post when filing online?

Relevance: 62%

-

Will I get a confirmation when I file online?

Relevance: 60%

-

What information do I need to complete my Self Assessment tax return?

Relevance: 55%

-

How long does it take to receive a tax refund from HMRC?

Relevance: 54%

-

How do I verify my identity when filing online?

Relevance: 52%

-

Do I need to declare my ISA income on my tax return?

Relevance: 49%

-

Do VAT rules apply to online sales?

Relevance: 49%

-

What if I've moved since the tax year ended?

Relevance: 46%

-

What is the role of an executor in handling tax debts?

Relevance: 45%

-

When is the deadline to file taxes online?

Relevance: 45%

-

Do I need to report the Winter Fuel Payment on my tax return?

Relevance: 45%

-

What should I do if I need help managing the tax affairs of the deceased?

Relevance: 43%