Find Help

More Items From Ergsy search

-

Can switching banks offer better loan options?

Relevance: 100%

-

Can switching banks offer better loan options?

Relevance: 99%

-

Can I save money by switching my bank?

Relevance: 69%

-

Can I save money by switching my bank?

Relevance: 67%

-

Will switching banks affect my credit score?

Relevance: 65%

-

Can I save money by switching my bank?

Relevance: 65%

-

Are there any risks involved in switching banks?

Relevance: 63%

-

Will switching banks affect my credit score?

Relevance: 61%

-

Are there any risks involved in switching banks?

Relevance: 59%

-

Can switching banks help me budget better?

Relevance: 57%

-

Is it worth switching banks for a sign-up bonus?

Relevance: 56%

-

Can switching banks help me budget better?

Relevance: 56%

-

How long does it take to switch banks?

Relevance: 56%

-

What are some common mistakes to avoid when switching banks?

Relevance: 56%

-

How long does it take to switch banks?

Relevance: 55%

-

What are some common mistakes to avoid when switching banks?

Relevance: 55%

-

What should I consider when switching banks to save money?

Relevance: 54%

-

Is it easy to switch banks to Monzo or Revolut?

Relevance: 54%

-

What's the difference between switching to a credit union versus a bank?

Relevance: 54%

-

Is it worth switching banks for a sign-up bonus?

Relevance: 53%

-

What should I consider when switching banks to save money?

Relevance: 53%

-

What should I do with my automatic payments when switching banks?

Relevance: 52%

-

Do online banks offer investment options?

Relevance: 51%

-

Should I switch my savings account, checking account, or both?

Relevance: 50%

-

What should I do with my automatic payments when switching banks?

Relevance: 50%

-

Major Banks Announce Changes in Interest Rates: Are You Affected?

Relevance: 48%

-

How can I compare banks to find the best deal?

Relevance: 48%

-

Is bankruptcy an option for student loan discharge?

Relevance: 46%

-

What's the difference between switching to a credit union versus a bank?

Relevance: 46%

-

Should I switch my savings account, checking account, or both?

Relevance: 46%

-

Are online banks cheaper than traditional banks?

Relevance: 45%

-

Is it possible to switch my mortgage type if interest rates become unfavourable?

Relevance: 44%

-

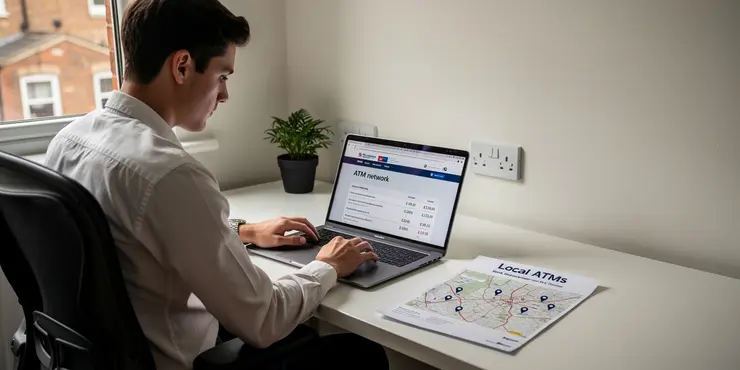

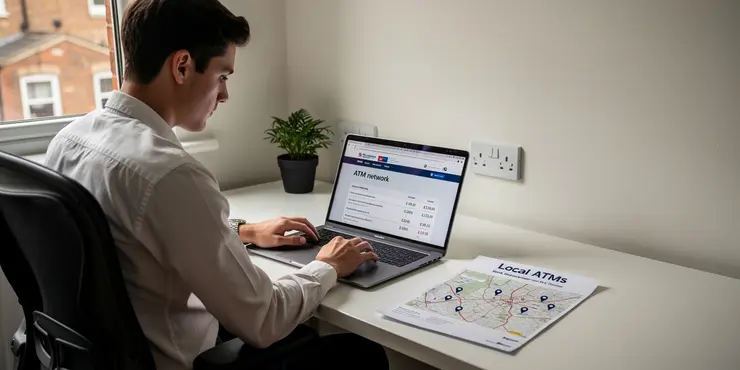

How important is it to consider the bank's ATM network when switching?

Relevance: 43%

-

How important is it to consider the bank's ATM network when switching?

Relevance: 43%

-

Do online banks have lower fees than traditional banks?

Relevance: 42%

-

Are online banks cheaper than traditional banks?

Relevance: 42%

-

Are there benefits to having multiple bank accounts at different banks?

Relevance: 42%

-

Can I get a loan to cover funeral costs?

Relevance: 41%

-

What happens to my loans if I go back to school?

Relevance: 40%

-

How do I apply for a small business loan through a government program?

Relevance: 39%

Introduction to Switching Banks

Switching banks can seem daunting, but it’s a straightforward process in the UK. Many people switch banks in search of better services and lower fees. One of the key reasons customers consider switching is to access better loan options.

With varying interest rates and services, moving to a new bank might offer significant financial benefits. If you're considering a major purchase or trying to consolidate existing loans, exploring different banks could be advantageous.

Comparing Loan Offerings

Banks often compete fiercely to attract new customers with competitive loan packages. New customers can sometimes secure better rates or terms than existing ones. Switching banks may open up more favourable interest rates for personal loans, mortgages, or other financial products.

When comparing loan options, look at the Annual Percentage Rate (APR), which factors in fees to reflect the true cost of borrowing. It’s essential to compare offers from several banks to determine the most cost-effective option for your situation.

Loyalty vs. Introductory Rates

While loyalty to your current bank might feel rewarding, it doesn’t always translate into the best financial benefits. Banks often reserve their best rates for new customers. These introductory rates can significantly lower the cost of a loan, especially in the initial years.

However, it's important to examine the terms carefully. Introductory rates might rise after a certain period, which could increase your overall repayment costs. Make sure you understand the long-term implications before making a switch solely for these rates.

Considerations Before Switching

Before deciding to switch banks, consider the wider financial implications. Examine any hidden fees, early repayment penalties, and the overall loan terms. It's crucial to ensure that the benefits of switching outweigh any potential downsides.

Consider the customer service reputation of the new bank. Having a bank that is responsive and easy to deal with can be just as important as the loan terms themselves. Make sure the switch aligns with your broader financial goals.

Steps to Switch Banks

If you decide to switch, the process is quite simple in the UK with the Current Account Switch Service. This service is designed to help customers move their accounts within seven days. It's worth noting that this service also covers direct debits and standing orders.

Gather all necessary documentation and be prepared to provide proof of income and identity. Be sure to fully research and plan the switch to avoid any disruption in your financial arrangements.

Frequently Asked Questions

Can switching banks lead to better loan options?

Yes, switching banks can sometimes offer better loan terms, such as lower interest rates or more favorable repayment conditions.

Do all banks offer the same loan options?

No, different banks may have different loan products, interest rates, and terms, so it's worth comparing options across multiple banks.

What should I consider before switching banks for a loan?

Consider the interest rates, loan terms, fees, and customer service of the new bank. It's also important to check if switching banks could impact your credit score.

How can I compare loan options across different banks?

You can compare loans by reviewing online loan calculators, checking bank websites for their loan offerings, or speaking with a financial advisor.

Is it possible for a new bank to offer lower interest rates?

Yes, some banks might offer promotional rates to new customers or have generally lower rates compared to your current bank.

Will switching banks for a better loan affect my credit score?

Applying for a loan with a new bank can result in a hard credit inquiry, which may temporarily lower your credit score. However, the impact is typically minor.

Can a bank offer better repayment terms than my current bank?

Yes, some banks might offer longer repayment periods, lower monthly payments, or other flexible options that may be better for your financial situation.

What are the risks of switching banks for a loan?

Risks include potential impacts on your credit score, fees associated with changing banks, and the possibility that the new bank might not meet all your needs.

Can loyalty to my current bank prevent me from accessing better loans?

While loyalty may lead to better offers from your current bank, it can also limit your exposure to potentially better offers from other banks.

Should I always switch banks if I find better loan terms elsewhere?

Not necessarily. It's important to weigh the benefits against any potential downsides, such as fees, impact on credit, or other inconveniences.

How do banks determine loan interest rates?

Banks consider factors such as the applicant’s credit score, prevailing market interest rates, the type of loan, and competitive factors when setting interest rates.

What incentives might a bank offer to switch my loan to them?

Banks may offer lower interest rates, reduced fees, longer repayment periods, or cash bonuses to incentivize customers to switch loans.

How long does it take to switch banks for a loan?

The time to switch can vary, but the process typically takes a few weeks, depending on the complexity of the loan and the speed of each bank's processing capabilities.

Can I negotiate better loan terms with my current bank if I threaten to switch?

Possibly. If your bank values you as a customer, they may be willing to negotiate better terms to keep your business.

Are refinancing and switching banks the same thing?

Refinancing involves taking out a new loan to pay off an existing one and can be done with the same bank or a new one. Switching banks may sometimes involve refinancing.

Can different banks have different eligibility criteria for loans?

Yes, banks may have varying credit score requirements, income levels, and documentation needed, which can affect your eligibility for a loan.

Is it better to switch banks online or visit a branch in person?

Both methods have advantages. Online applications are convenient and fast, while visiting a branch allows for face-to-face discussions and personalized advice.

What documentation do I need to switch banks for a loan?

Typically, you'll need proof of income, identification, existing loan details, and your credit history, but requirements can vary by bank.

Do credit unions offer better loan terms than traditional banks?

Credit unions often offer competitive loan terms compared to traditional banks, especially in terms of interest rates and fees.

Can switching banks for a loan lead to hidden costs?

It's possible. Always read the fine print to understand all fees and penalties associated with the new loan terms before making a switch.

Useful Links

This website offers general information and is not a substitute for professional advice.

Always seek guidance from qualified professionals.

If you have any medical concerns or need urgent help, contact a healthcare professional or emergency services immediately.

Some of this content was generated with AI assistance. We’ve done our best to keep it accurate, helpful, and human-friendly.

- Ergsy carfully checks the information in the videos we provide here.

- Videos shown by Youtube after a video has completed, have NOT been reviewed by ERGSY.

- To view, click the arrow in centre of video.

- Most of the videos you find here will have subtitles and/or closed captions available.

- You may need to turn these on, and choose your preferred language.

- Go to the video you'd like to watch.

- If closed captions (CC) are available, settings will be visible on the bottom right of the video player.

- To turn on Captions, click settings .

- To turn off Captions, click settings again.

More Items From Ergsy search

-

Can switching banks offer better loan options?

Relevance: 100%

-

Can switching banks offer better loan options?

Relevance: 99%

-

Can I save money by switching my bank?

Relevance: 69%

-

Can I save money by switching my bank?

Relevance: 67%

-

Will switching banks affect my credit score?

Relevance: 65%

-

Can I save money by switching my bank?

Relevance: 65%

-

Are there any risks involved in switching banks?

Relevance: 63%

-

Will switching banks affect my credit score?

Relevance: 61%

-

Are there any risks involved in switching banks?

Relevance: 59%

-

Can switching banks help me budget better?

Relevance: 57%

-

Is it worth switching banks for a sign-up bonus?

Relevance: 56%

-

Can switching banks help me budget better?

Relevance: 56%

-

How long does it take to switch banks?

Relevance: 56%

-

What are some common mistakes to avoid when switching banks?

Relevance: 56%

-

How long does it take to switch banks?

Relevance: 55%

-

What are some common mistakes to avoid when switching banks?

Relevance: 55%

-

What should I consider when switching banks to save money?

Relevance: 54%

-

Is it easy to switch banks to Monzo or Revolut?

Relevance: 54%

-

What's the difference between switching to a credit union versus a bank?

Relevance: 54%

-

Is it worth switching banks for a sign-up bonus?

Relevance: 53%

-

What should I consider when switching banks to save money?

Relevance: 53%

-

What should I do with my automatic payments when switching banks?

Relevance: 52%

-

Do online banks offer investment options?

Relevance: 51%

-

Should I switch my savings account, checking account, or both?

Relevance: 50%

-

What should I do with my automatic payments when switching banks?

Relevance: 50%

-

Major Banks Announce Changes in Interest Rates: Are You Affected?

Relevance: 48%

-

How can I compare banks to find the best deal?

Relevance: 48%

-

Is bankruptcy an option for student loan discharge?

Relevance: 46%

-

What's the difference between switching to a credit union versus a bank?

Relevance: 46%

-

Should I switch my savings account, checking account, or both?

Relevance: 46%

-

Are online banks cheaper than traditional banks?

Relevance: 45%

-

Is it possible to switch my mortgage type if interest rates become unfavourable?

Relevance: 44%

-

How important is it to consider the bank's ATM network when switching?

Relevance: 43%

-

How important is it to consider the bank's ATM network when switching?

Relevance: 43%

-

Do online banks have lower fees than traditional banks?

Relevance: 42%

-

Are online banks cheaper than traditional banks?

Relevance: 42%

-

Are there benefits to having multiple bank accounts at different banks?

Relevance: 42%

-

Can I get a loan to cover funeral costs?

Relevance: 41%

-

What happens to my loans if I go back to school?

Relevance: 40%

-

How do I apply for a small business loan through a government program?

Relevance: 39%