Find Help

More Items From Ergsy search

-

What are some common mistakes to avoid when switching banks?

Relevance: 100%

-

What are some common mistakes to avoid when switching banks?

Relevance: 99%

-

Are there any risks involved in switching banks?

Relevance: 71%

-

Can I save money by switching my bank?

Relevance: 71%

-

Are there any risks involved in switching banks?

Relevance: 67%

-

Is it worth switching banks for a sign-up bonus?

Relevance: 67%

-

How long does it take to switch banks?

Relevance: 66%

-

Can I save money by switching my bank?

Relevance: 66%

-

How long does it take to switch banks?

Relevance: 66%

-

Can I save money by switching my bank?

Relevance: 66%

-

Is it easy to switch banks to Monzo or Revolut?

Relevance: 65%

-

Is it worth switching banks for a sign-up bonus?

Relevance: 65%

-

Will switching banks affect my credit score?

Relevance: 65%

-

Can switching banks offer better loan options?

Relevance: 64%

-

Can switching banks help me budget better?

Relevance: 64%

-

Can switching banks offer better loan options?

Relevance: 63%

-

Can switching banks help me budget better?

Relevance: 63%

-

Will switching banks affect my credit score?

Relevance: 62%

-

What should I consider when switching banks to save money?

Relevance: 62%

-

What should I consider when switching banks to save money?

Relevance: 60%

-

What should I do with my automatic payments when switching banks?

Relevance: 59%

-

What should I do with my automatic payments when switching banks?

Relevance: 59%

-

What documents do I need to switch energy suppliers?

Relevance: 57%

-

Should I switch my savings account, checking account, or both?

Relevance: 54%

-

Should I switch my savings account, checking account, or both?

Relevance: 53%

-

How important is it to consider the bank's ATM network when switching?

Relevance: 51%

-

How important is it to consider the bank's ATM network when switching?

Relevance: 51%

-

What's the difference between switching to a credit union versus a bank?

Relevance: 48%

-

What are some common mistakes to avoid when writing a will?

Relevance: 46%

-

What if I made a mistake on my application?

Relevance: 46%

-

Do online banks have lower fees than traditional banks?

Relevance: 44%

-

Are online banks cheaper than traditional banks?

Relevance: 43%

-

Are online banks cheaper than traditional banks?

Relevance: 43%

-

Is a mistake always considered professional negligence?

Relevance: 43%

-

What feedback do customers give regarding banking fees?

Relevance: 42%

-

How can consumers protect themselves from hidden banking fees?

Relevance: 41%

-

What if I make a mistake on my tax return?

Relevance: 40%

-

Are online banks like Monzo and Revolut safe?

Relevance: 39%

-

How can I compare banks to find the best deal?

Relevance: 39%

-

What should I do if I made a mistake on my tax return?

Relevance: 39%

Not Researching the New Bank Thoroughly

It's essential to conduct comprehensive research before switching banks. Many people overlook comparing fees, interest rates, and services, leading to unpleasant surprises later.

Make sure to read customer reviews and understand the policies of the new bank. Knowing these details can help you make an informed decision that best suits your needs.

Ignoring the Benefits of Your Current Bank

While you may be eager to switch, don't forget to consider the benefits your current bank offers. Sometimes loyalty perks, such as higher interest rates or lower fees, can be more valuable over time.

Make a list of these benefits and weigh them against the new offerings. Evaluating both options ensures that you're making the right move financially.

Failing to Update Direct Debits and Standing Orders

One of the most common mistakes is not properly updating your direct debits and standing orders. Missing payments can lead to fees and damage your credit score.

Before closing your old account, ensure all regular payments are switched to the new one. Double-check this by examining your bank statements for at least a month.

Overlooking Hidden Fees and Charges

Many people get caught out by hidden fees when moving to a new bank. Make sure to scrutinize the terms and conditions for maintenance fees, ATM charges, or overdraft fees.

Ask the new bank for a detailed list of all fees. This way, you can avoid any unexpected costs that could impact your budget.

Closing the Old Account Too Soon

Closing your old bank account immediately after opening a new one can create issues. Wait until all transactions, including pending deposits or debits, are cleared.

Keeping the old account open for a few extra weeks provides a safety net, ensuring no payment is missed during the transition period.

Neglecting to Take Advantage of Switching Incentives

Many banks offer incentives to attract new customers, such as cash bonuses or interest-free overdrafts. Failing to meet the criteria for these offers means missing out on potential benefits.

Ensure you meet all the requirements specified by the bank to claim these incentives. This effort can reward you with added financial gains during the switch.

Frequently Asked Questions

What should I consider regarding my automatic payments when switching banks?

Make sure to update your automatic payments with your new bank account information to avoid missed payments.

How can I ensure a smooth transition of direct deposits when switching banks?

Inform your employer or any other source of direct deposit in advance and provide them with your new account details.

What is a common oversight regarding account fees when switching banks?

Neglecting to check for any early termination fees or new account fees can lead to unexpected expenses.

Why is it important to maintain a sufficient balance in your old account during the switch?

Keeping enough funds in your old account ensures that pending transactions clear without incurring overdraft fees.

What error do people often make with checks when switching banks?

Forgetting to stop using checks from the old account can lead to issues if those checks get cashed after the account is closed.

Why is it crucial to have a checklist when switching banks?

Having a checklist ensures you don't forget critical steps like updating payment information and notifying important contacts.

How can the timing of switching banks impact the process?

Switching banks right before bill payments or large transactions can disrupt the process; plan the switch when there is minimal financial activity.

What are potential issues with online banking during a switch?

Overlooking the need to download past statements and transaction histories from the old bank's online system can lead to lost financial records.

Why is it important to review your old bank's closure process?

Understanding the closure process can help you avoid charges or complications due to accounts not being closed properly.

How can account holds impact your banking transition?

Failing to account for holds when transferring large sums can cause temporary access issues to your money.

What is a common mistake related to credit products when switching banks?

Not transferring credit cards or loans to the new bank, if possible, can result in maintaining multiple bank relationships inadvertently.

Why is it important to read the terms and conditions when opening a new bank account?

Skipping the review of terms can lead to unanticipated charges or account restrictions that do not fit your financial needs.

What mistake do people make concerning their mobile banking app?

People often fail to delete their old bank’s app or forget to set up the new bank’s app, leading to confusion in managing their finances.

Should you close your old bank account immediately after opening a new one?

It's often best to keep the old account open for a few months to catch any transactions you may have missed updating.

What’s a frequent oversight when it comes to safety deposit boxes during a bank switch?

Forgetting to visit and empty a safety deposit box at the old bank can lead to missed valuables and added inconvenience.

Why might ignoring comparisons of interest rates be a mistake when switching banks?

Choosing a new bank without checking their interest rates for savings or loans vs. your current rates can result in less favorable financial outcomes.

What should you avoid doing with your old debit/credit cards immediately after opening a new account?

Don't cut up old cards until you are sure all your automated payments have been successfully redirected.

How can neglecting to double-check your new bank’s security measures be problematic?

Overlooking the security features offered by the new bank may expose you to higher risks of fraud or unauthorized access.

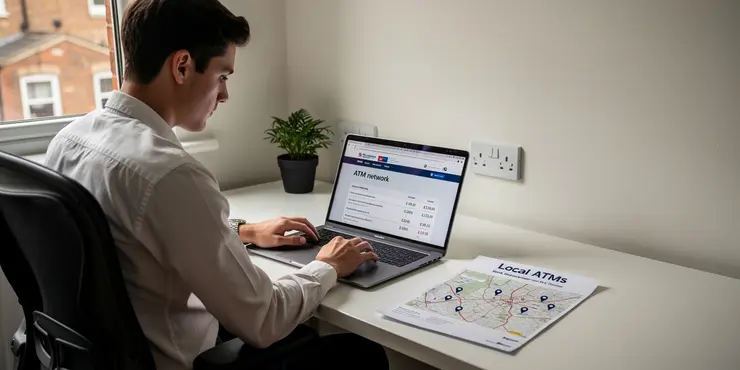

Why is it important to ensure the new bank's ATM network is convenient for you?

Switching without verifying the availability of ATMs can result in higher fees and inconvenience if the network doesn't meet your needs.

How can mismanaging leftover funds lead to problems when switching banks?

Failing to transfer or use all funds from your old account before closure can result in lost funds or difficulties in reclaiming them.

Useful Links

This website offers general information and is not a substitute for professional advice.

Always seek guidance from qualified professionals.

If you have any medical concerns or need urgent help, contact a healthcare professional or emergency services immediately.

Some of this content was generated with AI assistance. We’ve done our best to keep it accurate, helpful, and human-friendly.

- Ergsy carfully checks the information in the videos we provide here.

- Videos shown by Youtube after a video has completed, have NOT been reviewed by ERGSY.

- To view, click the arrow in centre of video.

- Most of the videos you find here will have subtitles and/or closed captions available.

- You may need to turn these on, and choose your preferred language.

- Go to the video you'd like to watch.

- If closed captions (CC) are available, settings will be visible on the bottom right of the video player.

- To turn on Captions, click settings .

- To turn off Captions, click settings again.

More Items From Ergsy search

-

What are some common mistakes to avoid when switching banks?

Relevance: 100%

-

What are some common mistakes to avoid when switching banks?

Relevance: 99%

-

Are there any risks involved in switching banks?

Relevance: 71%

-

Can I save money by switching my bank?

Relevance: 71%

-

Are there any risks involved in switching banks?

Relevance: 67%

-

Is it worth switching banks for a sign-up bonus?

Relevance: 67%

-

How long does it take to switch banks?

Relevance: 66%

-

Can I save money by switching my bank?

Relevance: 66%

-

How long does it take to switch banks?

Relevance: 66%

-

Can I save money by switching my bank?

Relevance: 66%

-

Is it easy to switch banks to Monzo or Revolut?

Relevance: 65%

-

Is it worth switching banks for a sign-up bonus?

Relevance: 65%

-

Will switching banks affect my credit score?

Relevance: 65%

-

Can switching banks offer better loan options?

Relevance: 64%

-

Can switching banks help me budget better?

Relevance: 64%

-

Can switching banks offer better loan options?

Relevance: 63%

-

Can switching banks help me budget better?

Relevance: 63%

-

Will switching banks affect my credit score?

Relevance: 62%

-

What should I consider when switching banks to save money?

Relevance: 62%

-

What should I consider when switching banks to save money?

Relevance: 60%

-

What should I do with my automatic payments when switching banks?

Relevance: 59%

-

What should I do with my automatic payments when switching banks?

Relevance: 59%

-

What documents do I need to switch energy suppliers?

Relevance: 57%

-

Should I switch my savings account, checking account, or both?

Relevance: 54%

-

Should I switch my savings account, checking account, or both?

Relevance: 53%

-

How important is it to consider the bank's ATM network when switching?

Relevance: 51%

-

How important is it to consider the bank's ATM network when switching?

Relevance: 51%

-

What's the difference between switching to a credit union versus a bank?

Relevance: 48%

-

What are some common mistakes to avoid when writing a will?

Relevance: 46%

-

What if I made a mistake on my application?

Relevance: 46%

-

Do online banks have lower fees than traditional banks?

Relevance: 44%

-

Are online banks cheaper than traditional banks?

Relevance: 43%

-

Are online banks cheaper than traditional banks?

Relevance: 43%

-

Is a mistake always considered professional negligence?

Relevance: 43%

-

What feedback do customers give regarding banking fees?

Relevance: 42%

-

How can consumers protect themselves from hidden banking fees?

Relevance: 41%

-

What if I make a mistake on my tax return?

Relevance: 40%

-

Are online banks like Monzo and Revolut safe?

Relevance: 39%

-

How can I compare banks to find the best deal?

Relevance: 39%

-

What should I do if I made a mistake on my tax return?

Relevance: 39%