Find Help

More Items From Ergsy search

-

Are there benefits to having multiple bank accounts at different banks?

Relevance: 100%

-

Are there benefits to having multiple bank accounts at different banks?

Relevance: 98%

-

Is it worth switching banks for a sign-up bonus?

Relevance: 57%

-

Will students receive the payment directly into their bank accounts?

Relevance: 57%

-

Are online banks cheaper than traditional banks?

Relevance: 55%

-

Can I save money by switching my bank?

Relevance: 55%

-

Can I save money by switching my bank?

Relevance: 55%

-

What's the difference between switching to a credit union versus a bank?

Relevance: 54%

-

How can I compare banks to find the best deal?

Relevance: 54%

-

Are online banks cheaper than traditional banks?

Relevance: 54%

-

What should I consider when switching banks to save money?

Relevance: 54%

-

Do all banks have the same fee structures?

Relevance: 53%

-

Can I use Monzo or Revolut for everyday banking?

Relevance: 53%

-

What's the difference between switching to a credit union versus a bank?

Relevance: 53%

-

Should I switch my savings account, checking account, or both?

Relevance: 53%

-

Are there any risks involved in switching banks?

Relevance: 53%

-

What should I consider when switching banks to save money?

Relevance: 53%

-

Can I receive my tax refund directly into my bank account?

Relevance: 52%

-

Do online banks have lower fees than traditional banks?

Relevance: 52%

-

Are there any risks involved in switching banks?

Relevance: 52%

-

Should I switch my savings account, checking account, or both?

Relevance: 51%

-

Is it easy to switch banks to Monzo or Revolut?

Relevance: 51%

-

How can I compare banks to find the best deal?

Relevance: 51%

-

How do banking fees impact financial inclusion?

Relevance: 51%

-

Do online banks offer investment options?

Relevance: 49%

-

Can switching banks offer better loan options?

Relevance: 49%

-

Are online banks like Monzo and Revolut safe?

Relevance: 49%

-

Is it worth switching banks for a sign-up bonus?

Relevance: 49%

-

Can I save money by switching my bank?

Relevance: 49%

-

Can switching banks help me budget better?

Relevance: 49%

-

What are some common mistakes to avoid when switching banks?

Relevance: 48%

-

How long does it take to switch banks?

Relevance: 48%

-

What fees should I avoid when choosing a new bank?

Relevance: 48%

-

Can customers dispute unexpected banking fees?

Relevance: 48%

-

What feedback do customers give regarding banking fees?

Relevance: 48%

-

How long does it take to switch banks?

Relevance: 48%

-

What are some common mistakes to avoid when switching banks?

Relevance: 48%

-

Why are some banking fees unexpectedly high?

Relevance: 48%

-

Digital Banking: A Surge in Adoption Amongst All Age Groups

Relevance: 48%

-

How do I know if a bank is insured and secure?

Relevance: 47%

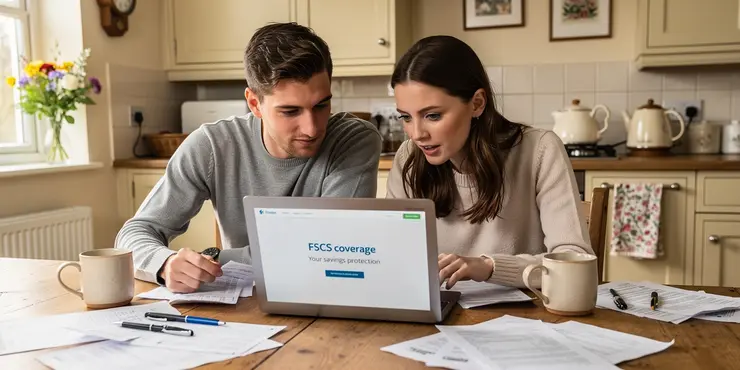

Diversification of Financial Risk

Having accounts at multiple banks can help spread your money across different institutions. This diversification can protect your assets should one bank face financial difficulties.

In the UK, the Financial Services Compensation Scheme (FSCS) protects deposits up to £85,000 per person, per bank. Splitting your funds ensures you remain within this safe limit.

Access to Varied Financial Products

Different banks often offer unique financial products and incentives. For example, one bank may have a high-interest savings account, while another has a rewards-based credit card.

By using multiple banks, you can cherry-pick the best products that suit your financial needs and goals.

Improved Money Management

Splitting your finances across several accounts can aid in budgeting. You can designate specific accounts for purposes like bills, savings, or leisure.

This separation makes it easier to track expenses and avoid overspending. It can significantly enhance your financial discipline.

Increased Convenience and Access

Having accounts with multiple banks means more ATM and branch access. This is particularly useful if you travel frequently or live in a rural area.

Different banks may offer varying online banking features, providing you with options that best match your tech preferences.

Enhanced Security and Fraud Prevention

Using various banks can also increase your financial security. If one account is compromised, the rest of your funds remain unaffected.

Multiple accounts can also help you monitor transactions more effectively, spotting any unusual activity quickly.

Potential Downsides to Consider

While having multiple accounts offers many advantages, managing them can be complex. You need to keep track of various login credentials and account activities.

Also, ensure you meet any account requirements to avoid fees, as minimum balance regulations may apply across different banks.

Frequently Asked Questions

What are the benefits of having multiple bank accounts at different banks?

Having accounts at different banks can provide benefits such as diversification of risk, access to different banking products, and the ability to take advantage of various fee structures and interest rates.

How does having multiple bank accounts help with diversification of risk?

By spreading your funds across multiple banks, you reduce the risk of losing access to all your money in case one bank faces financial difficulties or technical issues.

Can having accounts at different banks help me save on fees?

Yes, different banks offer varying fee structures, so you can choose accounts with the lowest fees for certain transactions or features that you use most.

Do different banks offer different interest rates on savings accounts?

Yes, interest rates can vary significantly between banks, so having multiple accounts allows you to take advantage of the best rates available.

How can multiple bank accounts assist with budgeting?

You can use different accounts for different purposes, such as one for bills, another for savings, and a third for discretionary spending, which can help you manage and track your expenses more effectively.

Is it easier to manage financial goals with multiple bank accounts?

Yes, by setting up separate accounts to save for specific goals, you can more easily track your progress and stay motivated.

Can having multiple bank accounts improve my financial flexibility?

Yes, having access to multiple accounts can provide greater flexibility in managing your finances, such as accessing funds quickly if needed and using various account features tailored to your needs.

How does account security benefit from having multiple bank accounts?

Spreading your funds across different banks can enhance security by reducing the impact of potential fraud or identity theft at any single institution.

What are the advantages of having checking and savings accounts at different banks?

This setup can help you manage funds between short-term spending and long-term savings while benefiting from each bank's specific offerings.

Is it possible to take advantage of special offers and promotions with multiple bank accounts?

Yes, having accounts at different banks can allow you to take advantage of promotional rates, cash bonuses, and rewards programs offered by various institutions.

Can having multiple bank accounts at different banks affect my credit score?

Simply opening multiple bank accounts usually does not affect your credit score, as they are not credit accounts. However, be careful with any overdraft facilities, which may impact your credit if not managed properly.

How does having accounts at different banks help if one bank experiences downtime?

If one bank faces technical issues or routine maintenance, having accounts at another institution ensures you still have access to your money.

Does having multiple accounts aid in achieving financial independence?

Yes, by effectively managing and differentiating your funds, you can navigate your financial landscape more strategically and build toward independence.

Can I use multiple accounts to separate personal and business finances?

Yes, having separate accounts for personal and business transactions helps maintain clear records and simplify accounting and tax filing.

Are there any tax advantages to having multiple bank accounts?

While there are no direct tax advantages, separate accounts can simplify tracking of income and deductible expenses, making tax preparation easier.

Does having multiple bank accounts help with managing automatic payments?

Yes, you can set up automatic payments from specific accounts to ensure that funds are dedicated to covering recurring expenses separate from other funds.

How can having multiple accounts help avoid overdraft fees?

By maintaining higher balances across accounts, you reduce the risk of overdrawing any single account, helping to avoid associated fees.

Will multiple bank accounts assist with currency management?

Yes, if you need access to accounts in multiple currencies, having relationships with different banks can provide more options.

Can spreading my money across several banks help with FDIC insurance limits?

Yes, keeping your money in different banks can help you stay within the FDIC insurance limits at each, ensuring your funds are protected.

Are there any drawbacks to maintaining multiple bank accounts?

Some drawbacks include the potential complexity of managing multiple accounts and the need to keep track of different fees, terms, and login credentials.

Useful Links

This website offers general information and is not a substitute for professional advice.

Always seek guidance from qualified professionals.

If you have any medical concerns or need urgent help, contact a healthcare professional or emergency services immediately.

Some of this content was generated with AI assistance. We’ve done our best to keep it accurate, helpful, and human-friendly.

- Ergsy carfully checks the information in the videos we provide here.

- Videos shown by Youtube after a video has completed, have NOT been reviewed by ERGSY.

- To view, click the arrow in centre of video.

- Most of the videos you find here will have subtitles and/or closed captions available.

- You may need to turn these on, and choose your preferred language.

- Go to the video you'd like to watch.

- If closed captions (CC) are available, settings will be visible on the bottom right of the video player.

- To turn on Captions, click settings .

- To turn off Captions, click settings again.

More Items From Ergsy search

-

Are there benefits to having multiple bank accounts at different banks?

Relevance: 100%

-

Are there benefits to having multiple bank accounts at different banks?

Relevance: 98%

-

Is it worth switching banks for a sign-up bonus?

Relevance: 57%

-

Will students receive the payment directly into their bank accounts?

Relevance: 57%

-

Are online banks cheaper than traditional banks?

Relevance: 55%

-

Can I save money by switching my bank?

Relevance: 55%

-

Can I save money by switching my bank?

Relevance: 55%

-

What's the difference between switching to a credit union versus a bank?

Relevance: 54%

-

How can I compare banks to find the best deal?

Relevance: 54%

-

Are online banks cheaper than traditional banks?

Relevance: 54%

-

What should I consider when switching banks to save money?

Relevance: 54%

-

Do all banks have the same fee structures?

Relevance: 53%

-

Can I use Monzo or Revolut for everyday banking?

Relevance: 53%

-

What's the difference between switching to a credit union versus a bank?

Relevance: 53%

-

Should I switch my savings account, checking account, or both?

Relevance: 53%

-

Are there any risks involved in switching banks?

Relevance: 53%

-

What should I consider when switching banks to save money?

Relevance: 53%

-

Can I receive my tax refund directly into my bank account?

Relevance: 52%

-

Do online banks have lower fees than traditional banks?

Relevance: 52%

-

Are there any risks involved in switching banks?

Relevance: 52%

-

Should I switch my savings account, checking account, or both?

Relevance: 51%

-

Is it easy to switch banks to Monzo or Revolut?

Relevance: 51%

-

How can I compare banks to find the best deal?

Relevance: 51%

-

How do banking fees impact financial inclusion?

Relevance: 51%

-

Do online banks offer investment options?

Relevance: 49%

-

Can switching banks offer better loan options?

Relevance: 49%

-

Are online banks like Monzo and Revolut safe?

Relevance: 49%

-

Is it worth switching banks for a sign-up bonus?

Relevance: 49%

-

Can I save money by switching my bank?

Relevance: 49%

-

Can switching banks help me budget better?

Relevance: 49%

-

What are some common mistakes to avoid when switching banks?

Relevance: 48%

-

How long does it take to switch banks?

Relevance: 48%

-

What fees should I avoid when choosing a new bank?

Relevance: 48%

-

Can customers dispute unexpected banking fees?

Relevance: 48%

-

What feedback do customers give regarding banking fees?

Relevance: 48%

-

How long does it take to switch banks?

Relevance: 48%

-

What are some common mistakes to avoid when switching banks?

Relevance: 48%

-

Why are some banking fees unexpectedly high?

Relevance: 48%

-

Digital Banking: A Surge in Adoption Amongst All Age Groups

Relevance: 48%

-

How do I know if a bank is insured and secure?

Relevance: 47%