Find Help

More Items From Ergsy search

-

How is redundancy pay calculated in the UK?

Relevance: 100%

-

What is redundancy pay and who is eligible for it?

Relevance: 72%

-

What is redundancy pay and who is eligible for it?

Relevance: 66%

-

What are the legal requirements for redundancy in the UK?

Relevance: 65%

-

What are the legal requirements for redundancy in the UK?

Relevance: 61%

-

Redundancy Coaching Couch 7: Redundancy and Judgement.MTS

Relevance: 57%

-

HOW A REDUNDANCY WORKS - General Information

Relevance: 56%

-

Redundancy Crusader and Annabel Kaye on the Current Model of Redundancy (1).MTS

Relevance: 54%

-

Redundancy Coaching Couch 4:Redundancy and Language

Relevance: 53%

-

Frequently asked questions about redundancy from ACAS

Relevance: 52%

-

Redundancy Coaching Couch 5: Redundancy and Feedback.MTS

Relevance: 52%

-

Redundancy Crusader and Annabel Kaye on scope and scale of redundancy (3).MTS

Relevance: 51%

-

Redundancy Coaching Couch 1: Redundancy and Presuppositions

Relevance: 51%

-

What support can employees expect during redundancy?

Relevance: 49%

-

What is the notice period for redundancy?

Relevance: 48%

-

Redundancy Crusader and Annabel Kaye on making redundancy a better experience (2).MTS

Relevance: 48%

-

Are there any protections for employees on maternity leave during redundancy?

Relevance: 47%

-

What happens if an employer does not follow the redundancy process?

Relevance: 46%

-

Redundancy Crusader and Annabel Kaye on communications in redundancy (5).MTS

Relevance: 45%

-

What is a fair selection process for redundancy?

Relevance: 45%

-

How is Stamp Duty calculated in the UK?

Relevance: 45%

-

Redundancy Coaching Couch 2: Redundancy and Passion

Relevance: 44%

-

How do I pay Stamp Duty in the UK?

Relevance: 43%

-

Who pays Stamp Duty in the UK?

Relevance: 41%

-

Can employees request voluntary redundancy?

Relevance: 41%

-

Redundancy Coaching Couch 3: States

Relevance: 41%

-

Can an employee appeal a redundancy decision?

Relevance: 41%

-

What is the role of trade unions in the redundancy process?

Relevance: 40%

-

What is the primary purpose of redundancy?

Relevance: 40%

-

What is the primary purpose of redundancy?

Relevance: 40%

-

How should companies consult employees about redundancy?

Relevance: 39%

-

What alternatives should be considered before redundancy?

Relevance: 39%

-

Boost your Take Home Pay | Salary Sacrifice Explained UK

Relevance: 36%

-

How should companies consult employees about redundancy?

Relevance: 35%

-

How is the National Living Wage calculated?

Relevance: 35%

-

How should employers manage the emotional impact of redundancy on employees?

Relevance: 35%

-

How is inheritance tax calculated?

Relevance: 34%

-

How can I calculate my new earnings based on the National Living Wage increase?

Relevance: 33%

-

Do I need to pay CGT if I gift a property?

Relevance: 33%

-

Three Debt Free Methods in 2023 | Free Debt Calculator Tracker

Relevance: 33%

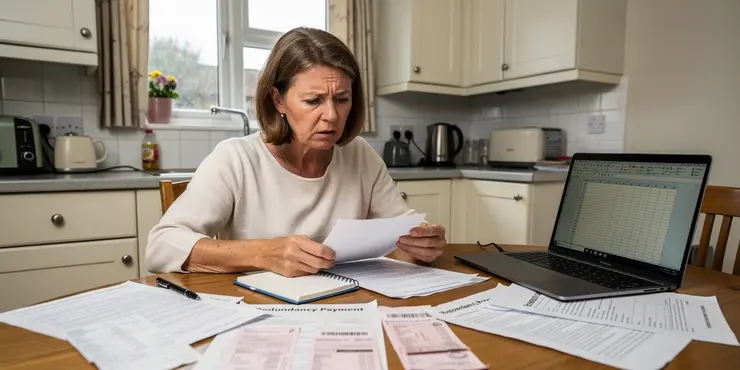

How is Redundancy Pay Calculated in the UK?

Redundancy pay in the UK is a form of compensation provided to employees who are dismissed from their jobs due to their position becoming unnecessary. This frequently arises from business restructuring, closures, or downsizing. Understanding how redundancy pay is calculated can help employees know what to expect should they face redundancy.

In the UK, statutory redundancy pay is calculated based on several factors: an employee's age, length of service, and weekly earnings, up to a statutory maximum amount. To qualify, an employee must have at least two years of continuous service with their employer.

The calculation is as follows: employees are entitled to receive:

- One and a half weeks’ pay for each full year of service when they are aged 41 or older.

- One week’s pay for each full year of service when they are aged 22 to 40.

- Half a week’s pay for each full year of service when they are aged under 22.

There is a cap on the weekly pay considered for redundancy calculations. As of the current financial year, the maximum weekly pay that can be used for these calculations is capped by the government (for example, £643 as of April 2023). This cap typically updates annually, so it is important to check the current cap when calculating redundancy pay.

The total number of service years an employee can claim redundancy for is capped at 20 years. Thus, the maximum possible redundancy payment is 20 years of service multiplied by the cap-adjusted weekly pay rate, calculated according to the above age brackets.

For example, consider an employee aged 45 who has worked for an employer for 15 years with a weekly pay (before any statutory cap) of £700. Their redundancy pay would be calculated as follows: for the 15 years of service, they receive 15 x 1.5 weeks of pay because they are over 41, totaling 22.5 weeks’ pay. Since the weekly pay cap applies, the calculation would use the capped rate, not the full £700. If the current cap is £643, the total redundancy payment would be 22.5 multiplied by £643, resulting in £14,467.50.

Employers may offer more generous terms than the statutory minimum, known as contractual redundancy pay, based on internal company policies or negotiated employment agreements. It's important for employees to check their employment contracts or consult their HR department for specific details.

Understanding the basics of redundancy pay calculation and keeping informed of any changes in government regulations ensures that both employers and employees can handle redundancy situations with clarity and fairness.

Frequently Asked Questions

What is redundancy pay?

Redundancy pay is a financial compensation provided to employees who are dismissed because their position is no longer needed.

Who is eligible for redundancy pay?

Employees must have worked continuously for at least 2 years for their employer and be dismissed due to redundancy to be eligible for redundancy pay.

How is statutory redundancy pay calculated?

Statutory redundancy pay is calculated based on age, weekly pay, and number of years worked, with specific multipliers for different age ranges.

What are the age multipliers for statutory redundancy pay?

The age multipliers are 0.5 weeks' pay for each year of employment under 22, 1 week for each year between 22 and 40, and 1.5 weeks for each year over 41.

What is considered 'a week's pay' for redundancy calculations?

A week's pay is generally the employee's average weekly gross (pre-tax) earnings over the 12 weeks prior to redundancy.

Is there a maximum cap on statutory redundancy pay?

Yes, as of 2023, the maximum weekly pay for statutory redundancy calculations is capped at £643.

What is the maximum number of years of service counted for redundancy pay?

Up to 20 years of service can be taken into account for statutory redundancy pay calculations.

Is redundancy pay taxed?

Statutory redundancy pay under £30,000 is generally tax-free in the UK.

Can enhanced redundancy pay be offered?

Employers can offer enhanced redundancy pay above the statutory amount as part of a contract or agreement.

Do notice periods affect redundancy pay?

Redundancy pay is separate from notice pay, but notice periods must be given unless replaced by pay in lieu.

How does part-time work affect redundancy pay?

Part-time workers are entitled to redundancy pay based on their average weekly earnings and years of service.

Are there exceptions to receiving redundancy pay?

Employees dismissed for misconduct, those on fixed-term contracts, and certain business transfers may not be eligible.

What happens if an employer cannot pay redundancy?

If an employer is insolvent, employees can apply to the Insolvency Service for statutory redundancy pay.

How long do I have to claim redundancy pay?

Employees have 6 months from the date of termination to claim statutory redundancy pay.

Does maternity or paternity leave affect redundancy pay?

Employees on maternity or paternity leave are entitled to redundancy pay based on their normal working conditions.

Is voluntary redundancy paid the same as compulsory redundancy?

The calculation of redundancy pay is the same, but voluntary redundancies may come with additional incentives.

What rights do employees have if made redundant?

Employees have rights to redundancy pay, a notice period, consultation, and to be considered for alternative positions.

Can I negotiate my redundancy pay?

It may be possible to negotiate redundancy pay beyond statutory requirements, especially in voluntary redundancy situations.

What role does accrued holiday pay play in redundancy?

Accrued but untaken holiday pay is usually paid out separately from redundancy pay upon termination.

How does probation affect redundancy pay?

Employees with less than 2 years of service, including probation, may not qualify for statutory redundancy pay.

Useful Links

This website offers general information and is not a substitute for professional advice.

Always seek guidance from qualified professionals.

If you have any medical concerns or need urgent help, contact a healthcare professional or emergency services immediately.

Some of this content was generated with AI assistance. We’ve done our best to keep it accurate, helpful, and human-friendly.

- Ergsy carfully checks the information in the videos we provide here.

- Videos shown by Youtube after a video has completed, have NOT been reviewed by ERGSY.

- To view, click the arrow in centre of video.

- Most of the videos you find here will have subtitles and/or closed captions available.

- You may need to turn these on, and choose your preferred language.

- Go to the video you'd like to watch.

- If closed captions (CC) are available, settings will be visible on the bottom right of the video player.

- To turn on Captions, click settings .

- To turn off Captions, click settings again.

More Items From Ergsy search

-

How is redundancy pay calculated in the UK?

Relevance: 100%

-

What is redundancy pay and who is eligible for it?

Relevance: 72%

-

What is redundancy pay and who is eligible for it?

Relevance: 66%

-

What are the legal requirements for redundancy in the UK?

Relevance: 65%

-

What are the legal requirements for redundancy in the UK?

Relevance: 61%

-

Redundancy Coaching Couch 7: Redundancy and Judgement.MTS

Relevance: 57%

-

HOW A REDUNDANCY WORKS - General Information

Relevance: 56%

-

Redundancy Crusader and Annabel Kaye on the Current Model of Redundancy (1).MTS

Relevance: 54%

-

Redundancy Coaching Couch 4:Redundancy and Language

Relevance: 53%

-

Frequently asked questions about redundancy from ACAS

Relevance: 52%

-

Redundancy Coaching Couch 5: Redundancy and Feedback.MTS

Relevance: 52%

-

Redundancy Crusader and Annabel Kaye on scope and scale of redundancy (3).MTS

Relevance: 51%

-

Redundancy Coaching Couch 1: Redundancy and Presuppositions

Relevance: 51%

-

What support can employees expect during redundancy?

Relevance: 49%

-

What is the notice period for redundancy?

Relevance: 48%

-

Redundancy Crusader and Annabel Kaye on making redundancy a better experience (2).MTS

Relevance: 48%

-

Are there any protections for employees on maternity leave during redundancy?

Relevance: 47%

-

What happens if an employer does not follow the redundancy process?

Relevance: 46%

-

Redundancy Crusader and Annabel Kaye on communications in redundancy (5).MTS

Relevance: 45%

-

What is a fair selection process for redundancy?

Relevance: 45%

-

How is Stamp Duty calculated in the UK?

Relevance: 45%

-

Redundancy Coaching Couch 2: Redundancy and Passion

Relevance: 44%

-

How do I pay Stamp Duty in the UK?

Relevance: 43%

-

Who pays Stamp Duty in the UK?

Relevance: 41%

-

Can employees request voluntary redundancy?

Relevance: 41%

-

Redundancy Coaching Couch 3: States

Relevance: 41%

-

Can an employee appeal a redundancy decision?

Relevance: 41%

-

What is the role of trade unions in the redundancy process?

Relevance: 40%

-

What is the primary purpose of redundancy?

Relevance: 40%

-

What is the primary purpose of redundancy?

Relevance: 40%

-

How should companies consult employees about redundancy?

Relevance: 39%

-

What alternatives should be considered before redundancy?

Relevance: 39%

-

Boost your Take Home Pay | Salary Sacrifice Explained UK

Relevance: 36%

-

How should companies consult employees about redundancy?

Relevance: 35%

-

How is the National Living Wage calculated?

Relevance: 35%

-

How should employers manage the emotional impact of redundancy on employees?

Relevance: 35%

-

How is inheritance tax calculated?

Relevance: 34%

-

How can I calculate my new earnings based on the National Living Wage increase?

Relevance: 33%

-

Do I need to pay CGT if I gift a property?

Relevance: 33%

-

Three Debt Free Methods in 2023 | Free Debt Calculator Tracker

Relevance: 33%