Important Information On Using This Service

- Ergsy carefully checks the information in the videos we provide here.

- Videos shown by YouTube after a video has completed have NOT been reviewed by ERGSY.

- To view, click the arrow in the center of the video.

Using Subtitles and Closed Captions

- Most of the videos you find here will have subtitles and/or closed captions available.

- You may need to turn these on and choose your preferred language.

Turn Captions On or Off

- Go to the video you'd like to watch.

- If closed captions (CC) are available, settings will be visible on the bottom right of the video player.

- To turn on captions, click settings.

- To turn off captions, click settings again.

Find A Professional

More Items From Ergsy search

-

Should You Get Life Insurance UK | Life Insurance & Life Assurance

Relevance: 100%

-

Does life insurance cover funeral costs?

Relevance: 64%

-

Explaining Car insurance in the UK??

Relevance: 53%

-

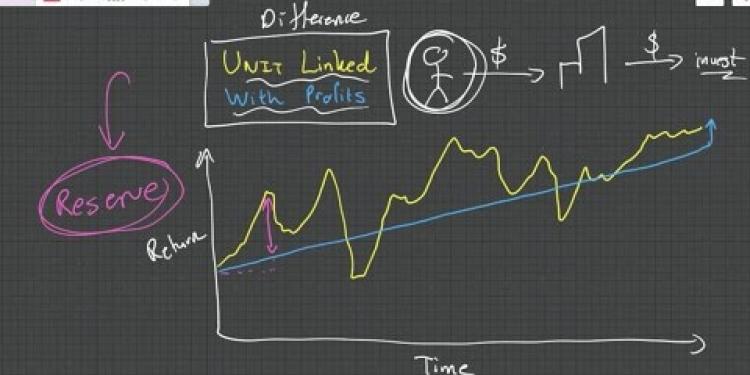

Life Insurance Difference between Unit Linked and With Profit Policies

Relevance: 49%

-

What is end of life care?

Relevance: 42%

-

Divorce - How To Rebuild Your Life After Losing Everything

Relevance: 35%

-

The Devious Car Insurance Scam Hidden In Your Policy! And How to Deal With it

Relevance: 32%

-

What treatments are available for obesity?

Relevance: 22%

-

Will a heart bypass make me live longer?

Relevance: 22%

-

State Pension UK | How much will I get? | WILL IT LAST FOREVER?!?

Relevance: 18%

-

Chronic kidney disease: What are the treatments?

Relevance: 15%

-

Incontinence | NHS

Relevance: 14%

-

Pam’s story - The NHS Diabetes Prevention Programme

Relevance: 14%

-

Tom's story (NHS Diabetes Prevention Programme)

Relevance: 14%

-

Will I qualify for the new state pension?

Relevance: 13%

-

Boost your Take Home Pay | Salary Sacrifice Explained UK

Relevance: 13%

-

Living with prostate cancer

Relevance: 13%

-

NHS Diabetes Prevention Programme; Preventing Type 2 and improving outcomes for people with diabetes

Relevance: 13%

-

Patient Stories - Having a kidney transplant

Relevance: 13%

-

Fibromyalgia: Suzanne's story | NHS

Relevance: 12%

-

Improving outcomes for people with diabetes

Relevance: 12%

-

Leg amputation and life afterwards

Relevance: 12%

-

Can genetics influence obesity?

Relevance: 12%

-

Myths about COPD

Relevance: 12%

-

Cataract surgery can resolve life long short-sightedness?!

Relevance: 12%

-

What causes Alzheimer's disease?

Relevance: 11%

-

Heart Attack Stories | NHS

Relevance: 11%

-

Treating generalised anxiety disorder (GAD)

Relevance: 11%

-

Living with Bipolar Disorder

Relevance: 11%

-

What are migraines and cluster headaches?

Relevance: 11%

-

Treating anxiety and depression - www.slam.nhs.uk

Relevance: 11%

-

What Is Buddhism? A Beginner’s Guide to Buddhist Beliefs

Relevance: 11%

-

What causes obesity?

Relevance: 11%

-

Talking menopause with your GP

Relevance: 10%

-

What Causes Erectile Dysfunction (ED) - Disease or Symptom - NHS A to Z - Dr Gill

Relevance: 10%

-

Osteoarthritis: Elaine's story | NHS

Relevance: 10%

-

Diagnosing irritable bowel syndrome (IBS)

Relevance: 10%

-

Osteoarthritis: Elaine's story | NHS

Relevance: 10%

-

Bernard's Story - Lung Transplant

Relevance: 10%

-

Liver transplant - Patient experience - Part 2 (Lynne)

Relevance: 10%

Should You Get Life Insurance in the UK?

Life insurance is an important consideration for many residents in the UK. It provides financial security to your loved ones in the event of your death. With a variety of policies and providers in the market, determining whether life insurance—or life assurance—is right for you is crucial.

What is Life Insurance?

Life insurance is a contract between you and an insurance provider. You pay regular premiums, and in return, the provider pays out a sum of money to your beneficiaries if you pass away during the term of the policy. This lump sum can help cover living expenses, mortgage payments, debts, and other financial obligations.

What is Life Assurance?

Life assurance, often referred to as "whole of life" insurance, differs from life insurance in that it provides coverage throughout your lifetime. As long as you keep paying the premiums, your beneficiaries are guaranteed a payout when you pass away, no matter when that occurs. This type of policy can also accumulate a cash value over time.

Benefits of Life Insurance

Life insurance can help provide peace of mind, knowing that your family will be financially supported if you are no longer around. It can cover funeral costs, mortgage payments, and help maintain your family's lifestyle. For business owners, life insurance can ensure that your company survives by offering funds to cover business debts or to buy out your share of the business.

Considerations Before Buying

Before purchasing life insurance, it's important to evaluate several factors such as your financial situation, dependents, and long-term financial goals. Assessing the type of policy that fits your needs—whether term life insurance or life assurance—is crucial. Additionally, comparing quotes from different providers and consulting with a financial advisor can help you make an informed decision.

Conclusion

Life insurance and life assurance are valuable financial tools that can provide security and peace of mind for your loved ones. In the UK, there are numerous options available, each designed to cater to different needs and circumstances. Carefully evaluating your personal situation and seeking professional advice can help you determine the best approach to protecting your family’s future.

Should You Get Life Insurance in the UK?

Life insurance is a way to protect your family with money if something happens to you. Many people in the UK think about getting it. There are different types of plans you can choose from.

What is Life Insurance?

Life insurance is an agreement between you and an insurance company. You pay money regularly. If you die while the insurance is active, the company gives money to your family. This money can help pay bills and other costs.

What is Life Assurance?

Life assurance is like life insurance but lasts your whole life. As long as you pay, your family will get money when you pass away. This plan can also grow in value over time.

Benefits of Life Insurance

Life insurance can help you feel better knowing that your family will have money if you're not there. It can pay for a funeral, house payments, or help keep your family living comfortably. If you have a business, it can help keep the business running.

Considerations Before Buying

Think about your money situation and what your family needs. Decide what kind of insurance is best. Look at different offers from companies and talk to a financial advisor for help making a good choice.

Conclusion

Life insurance and life assurance help keep your family safe with money in the future. In the UK, there are many choices. Look at what you need and talk to someone who knows about money to decide the best way to protect your family.

Frequently Asked Questions

What is life insurance?

Life insurance is a policy that pays out a sum of money either on the death of the insured person or after a set period.

Why should I get life insurance?

Life insurance can provide financial security for your family in the event of your death, helping to cover expenses like mortgage payments, children's education, and daily living costs.

What types of life insurance are available in the UK?

The main types of life insurance in the UK are term life insurance, whole life insurance, and over 50s life insurance plans.

How much life insurance cover do I need?

The amount of cover needed varies depending on individual circumstances such as mortgage liabilities, children's future needs, and daily living expenses. It's often recommended to have a policy that covers 10-15 times your annual income.

How does term life insurance work?

Term life insurance provides coverage for a specified period (the 'term'). If you die within this term, the policy pays out a lump sum to your beneficiaries. If you outlive the term, no payment is made.

What is whole life insurance?

Whole life insurance provides coverage for the lifetime of the insured person. It guarantees a payout no matter when the insured person dies, as long as premiums are kept up to date.

Who needs life insurance?

Life insurance is particularly important for anyone with dependents, such as a spouse, children, or a partner who relies on your income.

Can I have more than one life insurance policy?

Yes, you can hold multiple life insurance policies, though it's important to manage them carefully to avoid being over-insured.

How are life insurance premiums calculated?

Premiums are calculated based on factors such as age, health, lifestyle choices (e.g., smoking), amount of cover, term length, and type of policy.

What happens if I miss a premium payment?

Missing a premium payment could result in your life insurance policy being canceled. It's important to contact your insurer as soon as possible to discuss your options.

Is life insurance payout taxable in the UK?

In most cases, life insurance payouts are not subject to income tax in the UK. However, they could be liable for inheritance tax if the payout forms part of your estate unless the policy is written in trust.

Can I change my life insurance policy?

Yes, many providers allow you to review and adjust your policy to better suit your changing needs. Always check with your provider regarding specific terms and conditions.

What is critical illness cover?

Critical illness cover is an optional add-on to life insurance that pays out a lump sum if you are diagnosed with a specified critical illness, such as cancer or heart disease, during the policy term.

Do life insurance policies cover suicide?

Many life insurance policies have a suicide exclusion period, typically within the first 12-24 months of the policy. After this period, the policy may pay out on suicide, but terms vary between providers.

How do I make a claim on a life insurance policy?

To make a claim, you will need to contact the life insurance provider, fill out the necessary claim forms, and provide required documentation such as a death certificate and policy details.

What is life insurance?

Life insurance is a promise. If someone dies, the insurance company gives money to the people they choose.

This money can help pay for important things. For example, it can help with bills or school costs.

It's like a safety net for families.

Reading tips:

- Use simple words when talking about insurance.

- Ask someone if you have questions.

- Draw a picture to see how life insurance works.

- Take your time to understand.

Life insurance is a plan. It gives money when a person dies or after a certain time.

Why should I get life insurance?

Life insurance is a way to help your family if something happens to you. It gives them money to pay for things like food and bills. It helps them live well when you are not there to help. You can also think about it like a special kind of savings.

To help you understand more, you can:

- Ask an adult you trust to explain it to you.

- Look at simple pictures or videos about life insurance.

- Use apps that explain things in a clear way.

Life insurance gives money to your family if you pass away. This money can help pay for things like your house, your children's school, and everyday costs.

What kinds of life insurance can you get in the UK?

Here, we talk about the different types of life insurance you can have in the UK. Life insurance is for helping your family with money if you pass away.

Simple Tips:

- Use pictures or illustrations to learn more about this.

- Talk to someone you trust who understands life insurance.

- Use apps that read out loud to you.

There are three main kinds of life insurance in the UK:

1. **Term Life Insurance:** This type of insurance lasts for a set time. If you die during this time, it pays money to your family.

2. **Whole Life Insurance:** This insurance lasts your whole life. When you die, it pays money to your family.

3. **Over 50s Life Insurance Plans:** This is for people over 50. It pays money when you die, to help your family.

If you need help reading, you can use tools like text-to-speech apps. They can read this text out loud to you.

How much life insurance cover do I need?

How much money do I need to leave for my family if I die?

Here is a simple way to think about it:

- Think about your family's needs. This includes food, school, and bills.

- Think about any money you owe, like loans.

- Add up these costs to see how much money you need.

If you need help, you can:

- Ask a family member to help you.

- Use pictures or charts to understand better.

- Talk to a money expert for advice.

How much insurance you need depends on a few things. These include how much money you owe on your house, how much money your kids might need later, and how much you need for day-to-day costs. A good idea is to get insurance that is 10 to 15 times more than what you earn in a year.

What is term life insurance and how does it work?

Term life insurance is a kind of insurance. It helps if you pass away. It gives money to your family.

You need to pay for it every month. This is called a "premium".

The insurance is for a set time. This is called a "term". It might be 10 or 20 years.

If you pass away during this time, your family gets money. This is called a "payout".

If you do not pass away during this time, the insurance ends. You do not get any money back.

To help you understand, try using pictures or charts. You can also ask someone to explain it to you in person.

Term life insurance is a type of insurance that covers you for a certain amount of time. This time is called the 'term.' If you die while the insurance is active, the insurance company gives money to the people you choose, called beneficiaries. If you are still alive when the term ends, you or your family do not get any money.

What is whole life insurance?

Whole life insurance is a type of insurance that you have for your entire life. It helps to give money to your family or friends when you pass away.

Here’s how it works:

- You pay money every month or every year.

- If you pass away, the insurance gives money to the people you choose.

Tools to help understand better:

- Pictures: Use pictures to show how whole life insurance works.

- Videos: Watch simple videos about whole life insurance to learn more.

- Ask questions: It’s okay to ask someone to explain it to you!

Whole life insurance is a type of insurance that covers a person for their whole life. It pays out money when that person dies. You must keep paying for it to make sure it works.

Who should get life insurance?

Life insurance is money that helps your family if you die. It can pay for things your family needs.

You might need life insurance if:

- You have children who need money to live.

- Other people depend on your money, like your parents or partner.

- You want to make sure family can pay for things like the house or bills.

Tools that can help:

- Speak with an advisor: Talk to someone who knows a lot about life insurance. They can help you decide.

- Use a calculator: Find tools online to see how much insurance you might need.

Life insurance is important if people depend on you, like your husband, wife, kids, or partner who needs your money to live.

Can I have more than one life insurance policy?

You can have more than one life insurance policy. This means you can buy several plans to help protect your family if something happens to you. You can talk to a helpful person called an insurance agent to learn more. They can explain things in an easy way.

It can be helpful to ask questions like, "How much will this cost each month?" and "How does this plan help my family?" You can write down notes or use a calculator to help you understand numbers.

Don't be afraid to ask someone you trust to sit with you while you talk about life insurance. They can help you decide which plans are best for you.

Yes, you can have more than one life insurance policy. But you should be careful so you don't have too much insurance.

How do they decide how much you pay for life insurance?

How much you pay for insurance depends on things like how old you are, how healthy you are, whether you smoke or not, how much money you want covered, how long you want the insurance, and what kind of insurance it is.

What if I forget to pay?

If you forget to pay, don't worry. Here is what you can do:

- Check if there is a late fee. This is extra money you might need to pay.

- Find out how long you have to pay before your insurance stops. This is called a grace period.

- Use a calendar or phone reminder to help you remember next time.

- You can ask someone to remind you or help you pay on time.

If you are not sure, ask for help. You can call your insurance company and ask questions.

If you miss a payment for your life insurance, your policy might stop. It's important to call your insurance company quickly. Talk to them about what you can do next.

Do you have to pay tax on life insurance money in the UK?

When you get money from life insurance after someone dies, this money is usually not taxed. This means you do not have to pay extra money to the government.

If you need help, you can:

- Ask someone you trust to explain it to you.

- Use tools like a calculator to understand numbers better.

- Look for videos or guides online that explain life insurance in simple terms.

In most cases, the money you get from life insurance is not taxed in the UK. But, it could be taxed if it becomes part of your belongings and is not in a trust.

Can I change my life insurance plan?

Yes, many providers let you look at your policy and make changes if you need to. Always ask your provider about their rules.

What is critical illness cover?

Critical illness cover is a type of insurance. It gives you money if you get very sick. This money helps you pay for things when you cannot work because you are too ill.

For example, if you have a serious disease like cancer or have a heart attack, this insurance can help. The money can be used for doctor bills, medicines, or other costs.

You can also use the money for things you need, like food or rent. It's there to help you when you really need it.

If reading is hard, try asking someone to read with you. You can also use apps that read text out loud. It's okay to ask for help!

Critical illness cover is a special insurance you can add to life insurance. It gives you money if you get really sick, like with cancer or heart disease, while your insurance is active.

Does life insurance pay if someone dies by suicide?

Lots of life insurance plans have a rule about suicide. This rule is usually for the first 1 to 2 years of the plan. If someone dies from suicide during this time, the insurance might not pay money. After these years, the plan might pay, but it depends on the company.

How do I ask for money from a life insurance policy?

To get money from a life insurance policy, you need to call the insurance company. You must fill out some forms and give them important papers like the death certificate and policy details.

Useful Links

Have you found an error, or do you have a link or some information you would like to share? Please let us know using the form below.

- Ergsy carfully checks the information in the videos we provide here.

- Videos shown by Youtube after a video has completed, have NOT been reviewed by ERGSY.

- To view, click the arrow in centre of video.

- Most of the videos you find here will have subtitles and/or closed captions available.

- You may need to turn these on, and choose your preferred language.

- Go to the video you'd like to watch.

- If closed captions (CC) are available, settings will be visible on the bottom right of the video player.

- To turn on Captions, click settings .

- To turn off Captions, click settings again.