Find Help

More Items From Ergsy search

-

How are the topics for the HMRC Employer Bulletin chosen?

Relevance: 100%

-

What is the HMRC Employer Bulletin?

Relevance: 82%

-

Is the HMRC Employer Bulletin free?

Relevance: 80%

-

Does the HMRC Employer Bulletin cover changes in employment law?

Relevance: 78%

-

Is feedback allowed on the HMRC Employer Bulletin?

Relevance: 77%

-

Where can I find the HMRC Employer Bulletin?

Relevance: 76%

-

Are there digital and print versions of the HMRC Employer Bulletin?

Relevance: 74%

-

Is the HMRC Employer Bulletin relevant for small businesses?

Relevance: 71%

-

How can I sign up to receive the HMRC Employer Bulletin?

Relevance: 70%

-

Can the HMRC Employer Bulletin help with payroll management?

Relevance: 70%

-

Can I access past issues of the HMRC Employer Bulletin?

Relevance: 68%

-

Does the HMRC Employer Bulletin provide guidance on compliance?

Relevance: 68%

-

What topics does the HMRC Employer Bulletin cover?

Relevance: 67%

-

Does the HMRC Employer Bulletin provide contact details for further inquiries?

Relevance: 65%

-

What is the main purpose of the HMRC Employer Bulletin?

Relevance: 52%

-

Who should read the HMRC Employer Bulletin?

Relevance: 51%

-

What should I do if I miss an issue of the HMRC Employer Bulletin?

Relevance: 49%

-

What should an employer do with the information from the HMRC Employer Bulletin?

Relevance: 48%

-

How to use topical steroids

Relevance: 37%

-

What are topical treatments for psoriasis?

Relevance: 37%

-

Steroid cream see Topical corticosteroids

Relevance: 34%

-

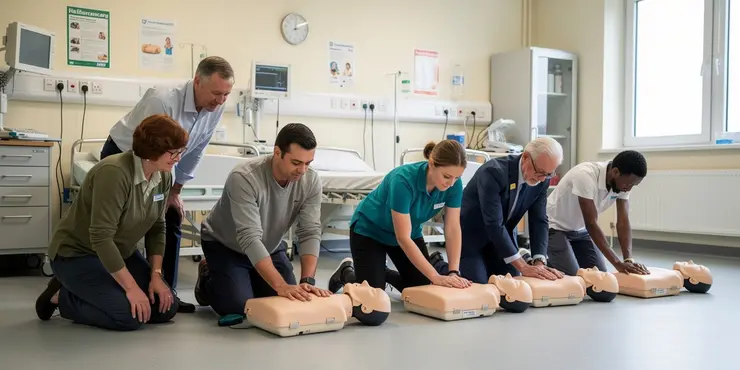

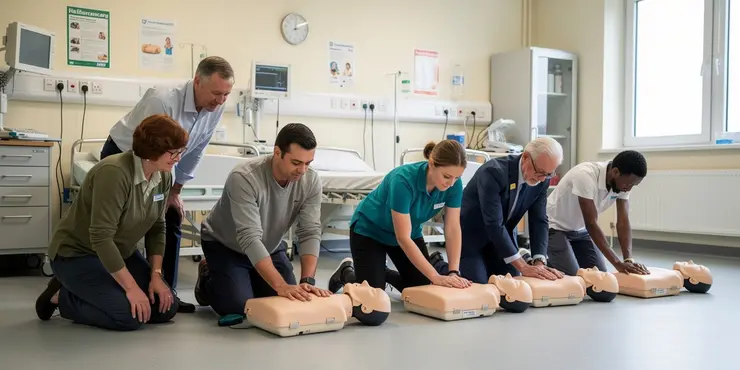

What topics are covered in a first aid course?

Relevance: 29%

-

Does the HMRC Employer Bulletin include reminders for important deadlines?

Relevance: 27%

-

Can my employer provide pension advice?

Relevance: 26%

-

What happens if an employer does not follow the redundancy process?

Relevance: 25%

-

Are employers legally required to pay the National Living Wage?

Relevance: 24%

-

What happens if an employer pays below the National Living Wage?

Relevance: 24%

-

How should employers manage the emotional impact of redundancy on employees?

Relevance: 23%

-

Employment Tribunal Cases Surge Amidst Gig Economy Debate

Relevance: 23%

-

Can my employer stop me from attending jury duty?

Relevance: 23%

-

Can my employer access my medical records without my consent?

Relevance: 22%

-

Workplace Pension UK | Pros and Cons | GET FREE MONEY FROM YOUR EMPLOYER!

Relevance: 21%

-

What happens to a deceased’s Income Tax if they were employed?

Relevance: 20%

-

How do senior employment programs assist older adults?

Relevance: 13%

-

Are zero-hour contract workers entitled to the National Living Wage?

Relevance: 12%

-

What treatment options are available for psoriasis?

Relevance: 12%

-

Are apprentices entitled to the National Living Wage?

Relevance: 12%

-

What treatments are available for eczema?

Relevance: 12%

-

How is impetigo treated?

Relevance: 12%

-

What forms does CBD come in?

Relevance: 11%

Introduction to HMRC Employer Bulletin

The HMRC Employer Bulletin is a valuable resource for employers in the UK, providing essential updates and information on tax, National Insurance, and administrative processes. Published periodically, the bulletin aims to keep employers informed of any legislative changes or new initiatives affecting their responsibilities.

Payroll Updates and Software

One core area covered in the HMRC Employer Bulletin is updates related to payroll. This includes changes to PAYE (Pay As You Earn) procedures, information on Real Time Information (RTI) submissions, and guidance on using payroll software efficiently. The bulletin also highlights any software modifications necessary to comply with new regulations, ensuring employers process payroll accurately and on time.

Tax Codes and Employment Allowance

The bulletin provides details on the issuance and management of tax codes, which are crucial for accurate tax deductions. Employers receive guidance on understanding and applying changes to tax code notices. Additionally, the bulletin informs employers about Employment Allowance updates, which can help reduce their National Insurance liability.

National Insurance Contributions

Updates on National Insurance Contributions (NICs) are a significant focus of the bulletin. Employers learn about changes to NIC rates, thresholds, and other pertinent details. Information is also provided on special categories, such as Class 1A contributions for benefits in kind, ensuring comprehensive compliance.

Benefits and Expenses

Employers need to manage employee benefits and expenses correctly. The HMRC Employer Bulletin covers regulations and reporting requirements for various benefits provided to employees. This includes company cars, travel and subsistence, and other non-cash benefits, along with necessary adjustments to avoid potential penalties.

Seasonal and Campaign-Specific Guidance

The bulletin often includes special sections tailored to seasonal changes or specific HMRC campaigns. For example, during the holiday season, there may be guidance on handling Christmas bonuses, work parties, or temporary hires. Additionally, employers may receive information on campaigns such as the introduction of new regulatory frameworks or compliance drives.

Digital Services and Online Support

The increasing reliance on digital platforms is mirrored in the bulletin’s emphasis on digital services. Employers are guided on utilizing HMRC's online tools for managing tax accounts, submitting returns, and accessing support. The bulletin lists new features or tips for overcoming common digital service hurdles.

Consultation and Feedback

Finally, the bulletin often encourages employer engagement through consultations and feedback opportunities. These sections outline active consultations where employers can provide input on impending legislative changes, fostering a collaborative approach between HMRC and businesses.

Welcome to the HMRC Employer Bulletin

The HMRC Employer Bulletin is a helpful guide for bosses in the UK. It tells them about important updates on tax, National Insurance, and other important tasks. This guide is sent out regularly to help bosses understand new rules and changes.

Pay Updates and Software

The bulletin talks about changes in how you pay your workers. It explains updates to PAYE (Pay As You Earn) and how to use software to pay workers. The bulletin tells bosses if they need to change their software to follow new rules.

Tax Codes and Employment Allowance

The bulletin explains how to manage tax codes. These codes help take the right amount of tax from pay. Bosses get advice on what to do when tax codes change. This section also talks about Employment Allowance, which can help bosses pay less National Insurance.

National Insurance Payments

The bulletin gives updates on National Insurance payments. It tells bosses the new rates and other important details. Sometimes, there are special rules for things like benefits given to workers.

Benefits and Expenses

Bosses need to handle benefits and expenses for their workers properly. The bulletin talks about the rules for things like company cars and travel costs. It tells bosses what they need to do to avoid mistakes.

Special Guides for Holidays and Campaigns

Sometimes, the bulletin has special guides for holidays or campaigns. For example, it might talk about Christmas bonuses or hiring workers for a short time. Bosses also get information on new rules or checks.

Online Tools and Help

The bulletin shows bosses how to use online tools to manage tax and get help. It talks about new features online and tips to solve common problems.

Have Your Say

The bulletin lets bosses share their thoughts on new laws or changes. Bosses can join talks to say what they think, helping HMRC and businesses work together.

Frequently Asked Questions

Useful Links

This website offers general information and is not a substitute for professional advice.

Always seek guidance from qualified professionals.

If you have any medical concerns or need urgent help, contact a healthcare professional or emergency services immediately.

Some of this content was generated with AI assistance. We’ve done our best to keep it accurate, helpful, and human-friendly.

- Ergsy carfully checks the information in the videos we provide here.

- Videos shown by Youtube after a video has completed, have NOT been reviewed by ERGSY.

- To view, click the arrow in centre of video.

- Most of the videos you find here will have subtitles and/or closed captions available.

- You may need to turn these on, and choose your preferred language.

- Go to the video you'd like to watch.

- If closed captions (CC) are available, settings will be visible on the bottom right of the video player.

- To turn on Captions, click settings .

- To turn off Captions, click settings again.

More Items From Ergsy search

-

How are the topics for the HMRC Employer Bulletin chosen?

Relevance: 100%

-

What is the HMRC Employer Bulletin?

Relevance: 82%

-

Is the HMRC Employer Bulletin free?

Relevance: 80%

-

Does the HMRC Employer Bulletin cover changes in employment law?

Relevance: 78%

-

Is feedback allowed on the HMRC Employer Bulletin?

Relevance: 77%

-

Where can I find the HMRC Employer Bulletin?

Relevance: 76%

-

Are there digital and print versions of the HMRC Employer Bulletin?

Relevance: 74%

-

Is the HMRC Employer Bulletin relevant for small businesses?

Relevance: 71%

-

How can I sign up to receive the HMRC Employer Bulletin?

Relevance: 70%

-

Can the HMRC Employer Bulletin help with payroll management?

Relevance: 70%

-

Can I access past issues of the HMRC Employer Bulletin?

Relevance: 68%

-

Does the HMRC Employer Bulletin provide guidance on compliance?

Relevance: 68%

-

What topics does the HMRC Employer Bulletin cover?

Relevance: 67%

-

Does the HMRC Employer Bulletin provide contact details for further inquiries?

Relevance: 65%

-

What is the main purpose of the HMRC Employer Bulletin?

Relevance: 52%

-

Who should read the HMRC Employer Bulletin?

Relevance: 51%

-

What should I do if I miss an issue of the HMRC Employer Bulletin?

Relevance: 49%

-

What should an employer do with the information from the HMRC Employer Bulletin?

Relevance: 48%

-

How to use topical steroids

Relevance: 37%

-

What are topical treatments for psoriasis?

Relevance: 37%

-

Steroid cream see Topical corticosteroids

Relevance: 34%

-

What topics are covered in a first aid course?

Relevance: 29%

-

Does the HMRC Employer Bulletin include reminders for important deadlines?

Relevance: 27%

-

Can my employer provide pension advice?

Relevance: 26%

-

What happens if an employer does not follow the redundancy process?

Relevance: 25%

-

Are employers legally required to pay the National Living Wage?

Relevance: 24%

-

What happens if an employer pays below the National Living Wage?

Relevance: 24%

-

How should employers manage the emotional impact of redundancy on employees?

Relevance: 23%

-

Employment Tribunal Cases Surge Amidst Gig Economy Debate

Relevance: 23%

-

Can my employer stop me from attending jury duty?

Relevance: 23%

-

Can my employer access my medical records without my consent?

Relevance: 22%

-

Workplace Pension UK | Pros and Cons | GET FREE MONEY FROM YOUR EMPLOYER!

Relevance: 21%

-

What happens to a deceased’s Income Tax if they were employed?

Relevance: 20%

-

How do senior employment programs assist older adults?

Relevance: 13%

-

Are zero-hour contract workers entitled to the National Living Wage?

Relevance: 12%

-

What treatment options are available for psoriasis?

Relevance: 12%

-

Are apprentices entitled to the National Living Wage?

Relevance: 12%

-

What treatments are available for eczema?

Relevance: 12%

-

How is impetigo treated?

Relevance: 12%

-

What forms does CBD come in?

Relevance: 11%