Find Help

More Items From Ergsy search

-

How are the topics for the HMRC Employer Bulletin chosen?

Relevance: 100%

-

What is the HMRC Employer Bulletin?

Relevance: 89%

-

Is the HMRC Employer Bulletin free?

Relevance: 88%

-

Is feedback allowed on the HMRC Employer Bulletin?

Relevance: 84%

-

Does the HMRC Employer Bulletin cover changes in employment law?

Relevance: 83%

-

Where can I find the HMRC Employer Bulletin?

Relevance: 83%

-

Are there digital and print versions of the HMRC Employer Bulletin?

Relevance: 81%

-

Is the HMRC Employer Bulletin relevant for small businesses?

Relevance: 78%

-

How can I sign up to receive the HMRC Employer Bulletin?

Relevance: 78%

-

Can the HMRC Employer Bulletin help with payroll management?

Relevance: 77%

-

Can I access past issues of the HMRC Employer Bulletin?

Relevance: 76%

-

Does the HMRC Employer Bulletin provide guidance on compliance?

Relevance: 75%

-

Does the HMRC Employer Bulletin provide contact details for further inquiries?

Relevance: 72%

-

What topics does the HMRC Employer Bulletin cover?

Relevance: 67%

-

What is the main purpose of the HMRC Employer Bulletin?

Relevance: 57%

-

Who should read the HMRC Employer Bulletin?

Relevance: 56%

-

What should I do if I miss an issue of the HMRC Employer Bulletin?

Relevance: 55%

-

What should an employer do with the information from the HMRC Employer Bulletin?

Relevance: 53%

-

Does the HMRC Employer Bulletin include reminders for important deadlines?

Relevance: 30%

-

How to use topical steroids

Relevance: 29%

-

What are topical treatments for psoriasis?

Relevance: 29%

-

HMRC Tax Refund letters

Relevance: 27%

-

Why did I receive a tax refund letter from HMRC?

Relevance: 26%

-

Do I need to inform HMRC about the death?

Relevance: 26%

-

Steroid cream see Topical corticosteroids

Relevance: 26%

-

What happens if an employer pays below the National Living Wage?

Relevance: 25%

-

Can I get help from HMRC with my Self Assessment?

Relevance: 25%

-

How do I notify HMRC of someone’s death?

Relevance: 24%

-

How do I claim my tax refund from HMRC?

Relevance: 24%

-

What is an HMRC tax refund letter?

Relevance: 24%

-

What are HMRC Income Tax Changes in April 2026?

Relevance: 24%

-

Are employers legally required to pay the National Living Wage?

Relevance: 23%

-

Do I need to provide financial evidence to HMRC for the arrangement?

Relevance: 23%

-

Can I appeal against a penalty from HMRC?

Relevance: 23%

-

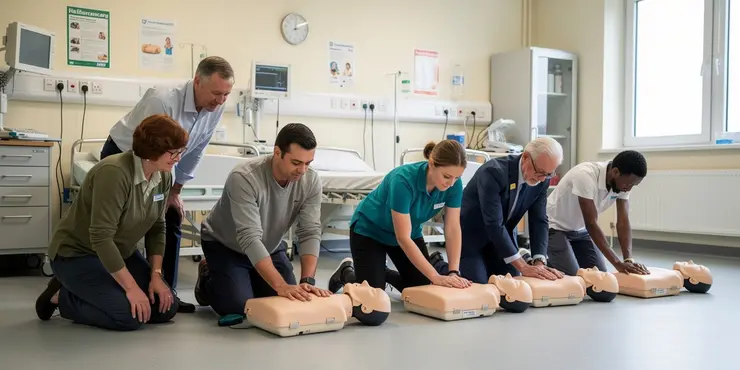

What topics are covered in a first aid course?

Relevance: 22%

-

How should employers manage the emotional impact of redundancy on employees?

Relevance: 22%

-

When will the new HMRC tax changes be officially confirmed?

Relevance: 22%

-

Will HMRC contact me via phone or email regarding my tax refund?

Relevance: 22%

-

What is the HMRC's new penalty point system?

Relevance: 22%

-

Who does the HMRC penalty point system apply to?

Relevance: 22%

Introduction to the HMRC Employer Bulletin

The HMRC Employer Bulletin is an essential resource for employers in the United Kingdom, providing updates and guidance on tax-related matters affecting businesses. It is a publication designed to ensure that employers stay informed about the latest regulations, policies, and best practices. The topics for the Employer Bulletin are carefully selected to address the most relevant and pressing issues that employers need to be aware of.

Sources for Topic Selection

The topics featured in the HMRC Employer Bulletin are chosen based on various criteria aimed at addressing the needs and concerns of employers. One of the primary sources for topic selection is recent legislative changes or upcoming changes in tax laws that have an impact on employers. HMRC monitors legislative developments closely to ensure that employers are well-prepared to comply with new requirements or take advantage of available opportunities.

Another source for topic selection is feedback and queries received from employers and industry stakeholders. HMRC ensures it has its finger on the pulse by engaging with businesses, trade associations, and professional bodies. This engagement helps HMRC to understand the challenges and uncertainties faced by employers, allowing them to choose topics that address the most common concerns and informational needs.

Analysing Data and Trends

HMRC also analyses data and trends to decide which topics to cover in the Employer Bulletin. This analysis involves looking at compliance data, identifying areas where employers may be struggling, and spotting patterns that suggest where additional guidance may be necessary. By understanding these trends, HMRC can proactively address issues before they become widespread problems.

Additionally, HMRC leverages its communication channels, such as webinars, workshops, and helplines, to gather information on the types of questions and issues that are most prevalent among employers. This information is invaluable for choosing topics that will have the greatest impact and reach.

Prioritisation of Topics

The process of choosing topics for the HMRC Employer Bulletin is not just about identifying potential ideas but also about prioritising them. This involves assessing which topics are time-sensitive and which ones are likely to have the most significant impact on employers. HMRC takes into account the tax calendar, ensuring that employers are given timely information that coincides with key dates and deadlines they need to be aware of.

Furthermore, HMRC aims to provide a balanced mix of topics in each edition of the Employer Bulletin. This balance ensures that there is something relevant for all employers, whether small businesses, medium enterprises, or large corporations. By carefully selecting and prioritising topics, HMRC ensures that the Employer Bulletin is an effective tool for staying informed and compliant with the latest tax obligations.

Introduction to the HMRC Employer Bulletin

The HMRC Employer Bulletin helps employers in the UK. It gives updates and advice about taxes for businesses. The Bulletin keeps employers up-to-date with new rules and helpful tips. The topics are chosen to help with the most important issues for employers.

Choosing Topics for the Bulletin

Topics in the Bulletin are picked because they matter to employers. HMRC looks at new tax laws to help businesses understand changes. They make sure employers know the rules and how to follow them.

HMRC also listens to questions and feedback from employers. They talk to businesses and groups to understand what help is needed. This way, they can pick topics that solve common problems.

Looking at Data and Trends

HMRC checks numbers and trends to decide on Bulletin topics. They find out where employers might need more help. By spotting patterns, HMRC can give advice before problems spread.

They also use webinars, workshops, and helplines to gather questions and issues from employers. This helps them choose topics that are important for many people.

Choosing the Most Important Topics

HMRC carefully picks the most helpful topics for the Bulletin. They think about which topics are urgent and which will help employers the most. They give information on time, especially before important tax dates.

HMRC wants to make sure there is something useful for everyone. They choose a mix of topics for small and large businesses. This makes the Employer Bulletin a great tool for staying up-to-date and following tax rules.

Frequently Asked Questions

How are the topics for the HMRC Employer Bulletin selected?

The topics for the HMRC Employer Bulletin are chosen based on legislative changes, feedback from employers, and current tax issues.

Who decides the content of the HMRC Employer Bulletin?

The content is decided by a team at HMRC that considers current employer needs and new policy initiatives.

Are external inputs considered in choosing topics for the bulletin?

Yes, HMRC considers feedback from employers and industry stakeholders in selecting topics.

Do the topics in the Employer Bulletin address recent changes in tax laws?

Yes, the bulletin often highlights recent and upcoming changes in tax laws that employers need to know.

How frequently is the HMRC Employer Bulletin published?

The HMRC Employer Bulletin is typically published every two months.

Does the bulletin cover specific issues faced by small businesses?

Yes, the bulletin includes guidance and information relevant to small businesses as well as larger organizations.

Can employers suggest topics for future editions of the bulletin?

Yes, employers can provide feedback and suggest topics through HMRC's official channels.

Is there a focus on specific sectors in the Employer Bulletin topics?

While the bulletin covers general employer guidance, it occasionally includes sector-specific information.

Does the Employer Bulletin include information on compliance deadlines?

Yes, the bulletin often includes reminders for important compliance deadlines.

Are there recurring topics in each edition of the Employer Bulletin?

Certain core topics, like PAYE and National Insurance, frequently appear, while others vary based on current issues.

How does HMRC ensure the relevance of the bulletin topics each edition?

HMRC reviews the current tax climate, employer feedback, and policy updates to ensure relevance.

Is feedback from previous bulletins used to shape future editions?

Yes, feedback from previous editions is carefully considered when planning future bulletins.

What role do government initiatives play in topic selection?

Government initiatives and budget announcements often influence the topics covered in the bulletin.

Does the bulletin cover digital transformation topics for employers?

Yes, topics related to digital transformation and digital tools for businesses are sometimes included.

How are urgent issues communicated in the bulletin?

Urgent issues are prioritized in the bulletin and sometimes addressed through special editions if needed.

Are there different editions of the bulletin for different regions within the UK?

The Employer Bulletin is generally unified, but regional issues may be highlighted when relevant.

How specific or detailed are the topics covered in the Employer Bulletin?

The level of detail varies; some topics are covered broadly while others are addressed in-depth.

Are employment law updates included in the bulletin?

Yes, relevant employment law updates that impact tax and payroll are included.

How are changes in international tax rules addressed in the bulletin?

Changes in international tax rules relevant to UK employers are highlighted when applicable.

Does the Employer Bulletin include case studies or examples?

While not common, some editions may include case studies or practical examples to illustrate specific points.

How do they pick topics for the HMRC Employer Bulletin?

The topics in the HMRC Employer Bulletin are picked because of new laws, ideas from employers, and current tax problems.

Who picks what is in the HMRC Employer Bulletin?

The people at HMRC choose what to include. They think about what bosses need now and any new rules.

Do other people help pick topics for the newsletter?

Yes, HMRC listens to feedback from bosses and people in different jobs when choosing topics.

Does the Employer Bulletin talk about new tax law changes?

If you need help, ask someone to explain the information.

Yes, the bulletin talks about new tax rules that bosses should know. It tells about what has happened and what will happen soon.

How often does the HMRC Employer Bulletin come out?

The HMRC Employer Bulletin is a newsletter. It comes out every few months. To help understand, you can set calendar reminders or ask someone to help you keep track of the dates it gets published.

The HMRC Employer Bulletin comes out every two months.

Does the bulletin talk about problems for small businesses?

This means: Does the bulletin talk about the problems that small businesses have?

Here's a tool to help: Use a dictionary to look up hard words.

Yes, the bulletin has help and information for small businesses and big companies too.

Can bosses ask for new ideas in the newsletter?

If you are a boss and you have ideas for the newsletter, you can tell us.

Here are some ways to share your ideas:

- Write your idea down.

- Use a voice recorder to say your idea out loud.

- Ask a friend to help you share your idea.

We want to hear from you!

Yes, bosses can give feedback and suggest ideas to HMRC. They can do this through official ways.

Does the Employer Bulletin talk about certain types of jobs?

The bulletin gives advice for bosses. Sometimes, it shares tips just for certain types of jobs.

Does the Employer Bulletin tell you about important dates to follow?

Yes, the bulletin often reminds us about important compliance deadlines.

Do the Employer Bulletins Talk About the Same Things Every Time?

Some things, like PAYE (Pay As You Earn) and National Insurance, are talked about a lot. Other things can change, depending on what's happening in the news.

How does HMRC choose the topics for each bulletin?

HMRC picks topics that are important right now. They talk to people to see what is needed. They look at questions people ask a lot.

HMRC uses tools and checks what is important. This helps them pick the best topics for the bulletin.

The HMRC looks at tax rules, listens to what employers say, and checks for new rules to keep everything up to date.

Do you use ideas from old newsletters to make new ones?

When people tell us what they liked or didn't like in newsletters, we use that to make the next one better. You can write to us or talk to us about what you think. We want to make sure you enjoy reading our newsletters!

Yes, we look at feedback from past bulletins to help us make the future ones better.

How does the government help choose topics?

What the government does with money can change what we talk about in the news.

Does the newsletter talk about digital change for bosses?

Yes, sometimes we talk about how businesses use computers and digital tools to change and grow.

How do we tell people about important news quickly?

Important problems are fixed first in the news, and sometimes we make special news if it is really important.

Are there different versions of the bulletin for different parts of the UK?

The Employer Bulletin is usually the same everywhere. But sometimes, it talks about special things happening in certain places if they are important.

What topics does the Employer Bulletin cover?

The Employer Bulletin talks about work stuff. It can be about big topics or little details. If you want to understand it better, you can:

- Ask someone to read it with you.

- Use a dictionary for hard words.

- Listen to audio versions if available.

Some parts talk about a lot of different things quickly. Other parts explain things with more details.

Are work rule updates in the bulletin?

We use bulletins to share news. If rules about work change, we tell you in the bulletin. Some tools or techniques to help understand bulletins better include:

- Reading with a friend or family member.

- Using a dictionary for hard words.

- Listening to audio versions if available.

Yes, we keep up with changes in job law that affect taxes and paychecks.

What Does the Bulletin Say About Changes to Tax Rules in Other Countries?

The bulletin talks about tax rule changes from other countries. It explains how they might affect people or businesses.

If the tax rules change, the bulletin will help explain what the new rules mean. It will also say what people might need to do differently.

Here are some tips to help understand:

- Read slowly and take your time.

- Use a dictionary to understand new words.

- Ask someone you trust if you have questions.

When there are changes to tax rules in other countries that UK employers need to know about, we will point them out.

Does the Employer Bulletin have stories or examples?

Sometimes, books have stories or examples to help explain things. This doesn’t happen a lot, but it can make the ideas easier to understand.

Useful Links

This website offers general information and is not a substitute for professional advice.

Always seek guidance from qualified professionals.

If you have any medical concerns or need urgent help, contact a healthcare professional or emergency services immediately.

Some of this content was generated with AI assistance. We’ve done our best to keep it accurate, helpful, and human-friendly.

- Ergsy carfully checks the information in the videos we provide here.

- Videos shown by Youtube after a video has completed, have NOT been reviewed by ERGSY.

- To view, click the arrow in centre of video.

- Most of the videos you find here will have subtitles and/or closed captions available.

- You may need to turn these on, and choose your preferred language.

- Go to the video you'd like to watch.

- If closed captions (CC) are available, settings will be visible on the bottom right of the video player.

- To turn on Captions, click settings .

- To turn off Captions, click settings again.

More Items From Ergsy search

-

How are the topics for the HMRC Employer Bulletin chosen?

Relevance: 100%

-

What is the HMRC Employer Bulletin?

Relevance: 89%

-

Is the HMRC Employer Bulletin free?

Relevance: 88%

-

Is feedback allowed on the HMRC Employer Bulletin?

Relevance: 84%

-

Does the HMRC Employer Bulletin cover changes in employment law?

Relevance: 83%

-

Where can I find the HMRC Employer Bulletin?

Relevance: 83%

-

Are there digital and print versions of the HMRC Employer Bulletin?

Relevance: 81%

-

Is the HMRC Employer Bulletin relevant for small businesses?

Relevance: 78%

-

How can I sign up to receive the HMRC Employer Bulletin?

Relevance: 78%

-

Can the HMRC Employer Bulletin help with payroll management?

Relevance: 77%

-

Can I access past issues of the HMRC Employer Bulletin?

Relevance: 76%

-

Does the HMRC Employer Bulletin provide guidance on compliance?

Relevance: 75%

-

Does the HMRC Employer Bulletin provide contact details for further inquiries?

Relevance: 72%

-

What topics does the HMRC Employer Bulletin cover?

Relevance: 67%

-

What is the main purpose of the HMRC Employer Bulletin?

Relevance: 57%

-

Who should read the HMRC Employer Bulletin?

Relevance: 56%

-

What should I do if I miss an issue of the HMRC Employer Bulletin?

Relevance: 55%

-

What should an employer do with the information from the HMRC Employer Bulletin?

Relevance: 53%

-

Does the HMRC Employer Bulletin include reminders for important deadlines?

Relevance: 30%

-

How to use topical steroids

Relevance: 29%

-

What are topical treatments for psoriasis?

Relevance: 29%

-

HMRC Tax Refund letters

Relevance: 27%

-

Why did I receive a tax refund letter from HMRC?

Relevance: 26%

-

Do I need to inform HMRC about the death?

Relevance: 26%

-

Steroid cream see Topical corticosteroids

Relevance: 26%

-

What happens if an employer pays below the National Living Wage?

Relevance: 25%

-

Can I get help from HMRC with my Self Assessment?

Relevance: 25%

-

How do I notify HMRC of someone’s death?

Relevance: 24%

-

How do I claim my tax refund from HMRC?

Relevance: 24%

-

What is an HMRC tax refund letter?

Relevance: 24%

-

What are HMRC Income Tax Changes in April 2026?

Relevance: 24%

-

Are employers legally required to pay the National Living Wage?

Relevance: 23%

-

Do I need to provide financial evidence to HMRC for the arrangement?

Relevance: 23%

-

Can I appeal against a penalty from HMRC?

Relevance: 23%

-

What topics are covered in a first aid course?

Relevance: 22%

-

How should employers manage the emotional impact of redundancy on employees?

Relevance: 22%

-

When will the new HMRC tax changes be officially confirmed?

Relevance: 22%

-

Will HMRC contact me via phone or email regarding my tax refund?

Relevance: 22%

-

What is the HMRC's new penalty point system?

Relevance: 22%

-

Who does the HMRC penalty point system apply to?

Relevance: 22%