Find Help

More Items From Ergsy search

-

What is a realistic rate of return for an investment ISA?

Relevance: 100%

-

Can I invest in foreign stocks with an ISA?

Relevance: 54%

-

What types of ISAs can I use for investments?

Relevance: 53%

-

How much would I need in an ISA for a £2k monthly passive income?

Relevance: 47%

-

Do I need to declare my ISA income on my tax return?

Relevance: 46%

-

How much would I need in an ISA to generate £2,000 monthly?

Relevance: 43%

-

What Is An ISA UK (Should I have an ISA & Different Types Of ISAs)

Relevance: 42%

-

How does an ISA generate passive income?

Relevance: 40%

-

Saving for the Future: The Best ISAs to Consider Right Now

Relevance: 39%

-

What is an ISA?

Relevance: 38%

-

Are there fees associated with Stocks & Shares ISAs?

Relevance: 37%

-

Is my ISA protected if my provider goes bankrupt?

Relevance: 35%

-

Can I withdraw money from my ISA any time?

Relevance: 32%

-

Can I transfer my ISA between providers?

Relevance: 30%

-

What happens if I exceed the ISA contribution limit?

Relevance: 29%

-

Do online banks offer investment options?

Relevance: 28%

-

What are investment scams?

Relevance: 27%

-

How are dividends in an ISA taxed?

Relevance: 27%

-

Can I have multiple ISAs?

Relevance: 25%

-

How can I protect myself from rising interest rates?

Relevance: 23%

-

What information do I need to complete my Self Assessment tax return?

Relevance: 23%

-

What Happens To Investments and Pensions | Moving Abroad | Leaving the UK

Relevance: 22%

-

How do better interest rates help me save money?

Relevance: 22%

-

Crypto Scams Exposed - Protect Your Investments Now!

Relevance: 22%

-

Who needs to file a Self Assessment tax return?

Relevance: 21%

-

What is a Self Assessment tax return?

Relevance: 20%

-

Why do interest rates rise and fall?

Relevance: 20%

-

Major Banks Announce Changes in Interest Rates: Are You Affected?

Relevance: 20%

-

How do better interest rates help me save money?

Relevance: 19%

-

How will refunds affect investments towards improving water infrastructure?

Relevance: 19%

-

How soon can I return to work after a facelift?

Relevance: 19%

-

How do economic conditions influence interest rate changes?

Relevance: 19%

-

Are there any limits on how much I can invest in an ISA per year?

Relevance: 19%

-

What is the VAT rate that I need to charge?

Relevance: 18%

-

What is an online tax return?

Relevance: 18%

-

Do I need an accountant to file a Self Assessment tax return?

Relevance: 18%

-

Can I amend an online tax return?

Relevance: 17%

-

How do I file VAT returns?

Relevance: 17%

-

What are the success rates of Paillon treatment?

Relevance: 17%

-

Starting your online tax return

Relevance: 17%

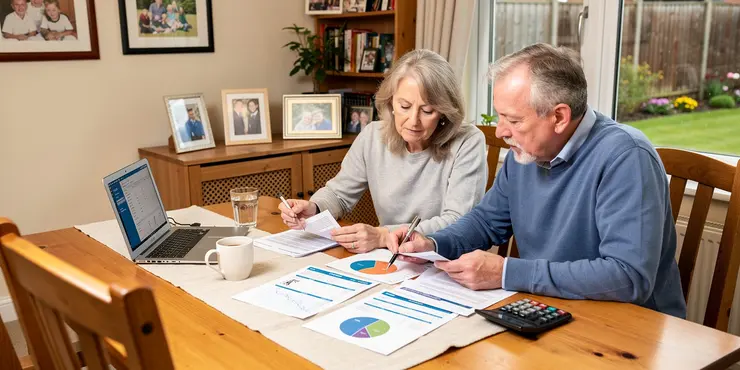

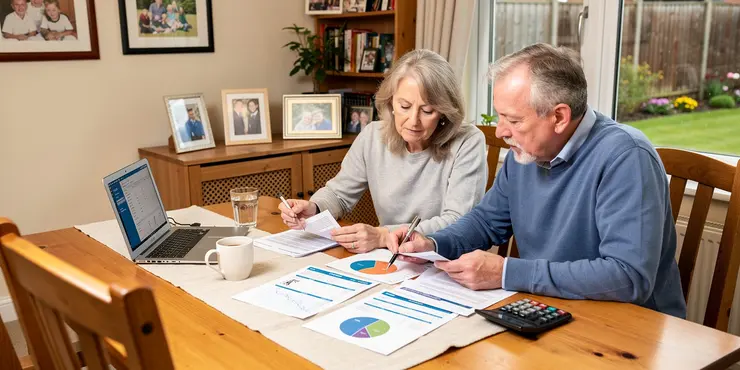

Understanding Investment ISAs

An Individual Savings Account (ISA) is a popular savings vehicle in the UK, known for its tax-efficient features. Among the different types of ISAs, Investment ISAs allow individuals to invest in a range of assets like stocks, bonds, and mutual funds. The key advantage is that any returns, whether through interest, dividends, or capital gains, are free from UK income and capital gains tax.

Factors Influencing Rates of Return

While looking at potential returns, it's crucial to remember that the performance of an Investment ISA varies significantly based on several factors. Market conditions, the chosen investment assets, the length of the investment period, and fees associated with managing the ISA can all influence returns. It’s important to note that past performance is not necessarily indicative of future results.

What Is a Realistic Rate of Return?

Determining a realistic rate of return for an Investment ISA often depends on the mixture of assets in the portfolio. Generally, stocks tend to offer higher potential returns over the long term compared to bonds or cash, but they also come with higher risk.

For a broadly diversified portfolio with a higher stock allocation, investors might expect an average annual return of around 5-7% over the long term. This estimate takes into account historical market performance, but it is crucial to understand that annual returns can fluctuate significantly year to year.

On the other hand, a more conservative portfolio, with greater allocations in bonds or fixed-income securities, might yield a lower return. Such portfolios might realistically achieve an average annual return of about 2-4%. This is because while bonds tend to be less volatile than stocks, they generally offer lower returns.

Inflation and Real Returns

While a nominal return gives an idea of the overall growth of the investment, it's essential to consider inflation, which can erode purchasing power over time. The real rate of return is the nominal return adjusted for inflation. For instance, if your investment has a 5% nominal return and inflation is at 2%, your real return is roughly 3%.

Conclusion

Investors should set realistic expectations for their Investment ISAs. Understanding that higher returns generally come with increased risk can assist in tailoring an investment strategy that aligns with one's financial goals and risk tolerance. Regular review and potential rebalancing of the ISA portfolio are recommended to optimise returns while managing risk effectively.

Consulting with a financial adviser can also provide personalized insights based on individual circumstances, helping set a clear investment path. Realistic expectations and sound financial planning are key to maximizing the benefits of an Investment ISA.

Understanding Investment ISAs

An Individual Savings Account, or ISA, is a special way to save money in the UK. It helps you save money without paying certain taxes. An Investment ISA lets you invest in things like stocks and bonds. The best part is you don’t pay UK tax on the money you make from these investments.

Things That Affect How Much Money You Make

How much money you make with an Investment ISA can change a lot. It depends on things like the market, what you invest in, how long you keep the investment, and any fees you have to pay. Remember, just because something made money in the past doesn't mean it will do so in the future.

What's a Good Amount of Money to Expect?

How much money you can make often depends on what you invest in. Stocks can make you more money over time, but they carry more risk. If you have more stocks, you might make about 5-7% each year over a long time. This can change every year.

If you invest more in bonds, which are safer than stocks, you might make 2-4% each year. Bonds are not as risky as stocks, but they don’t usually make as much money.

Inflation and Real Returns

When you make money from your investment, inflation can make it worth less over time. The real return is the money you make after taking away inflation. For example, if you earn 5% from your investment but inflation is 2%, your real money earned is about 3%.

Conclusion

You should have realistic hopes for your Investment ISA. Usually, more money means more risk. You need to plan your investments to match what you can handle. It’s good to look at your investment regularly and change it if needed to balance risk and returns.

Talking to a financial adviser can help you a lot. They can give advice that’s just for you. Plan wisely and have the right expectations to make the most out of your Investment ISA.

Frequently Asked Questions

What is a realistic rate of return for an investment ISA?

A realistic rate of return for an investment ISA can vary, but a common estimate is between 4% to 8% per year, depending on market conditions and the types of assets held.

How does market volatility affect the rate of return on an investment ISA?

Market volatility can cause the rate of return on an investment ISA to fluctuate, leading to higher gains during boom periods and potential losses during downturns.

Can an investment ISA guarantee a specific rate of return?

No, investment ISAs typically do not guarantee a specific rate of return, as they are subject to market risks and fluctuations.

What factors influence the rate of return on an investment ISA?

Factors such as asset allocation, investment type, market conditions, and management fees can influence the rate of return on an investment ISA.

Is it possible to achieve a high rate of return with an investment ISA?

While possible, achieving a high rate of return often involves higher risk. Diversification and a long-term investment strategy can help balance risks and returns.

How does the choice of investments within an ISA affect returns?

Choosing different asset classes, such as stocks, bonds, or funds, affects risk levels and potential returns, with equities often offering higher returns at higher risk.

What is the average historical return for investment ISAs?

Historically, the average return for investment ISAs has hovered around 5% to 7%, though past performance does not guarantee future results.

How do management fees impact the rate of return on an investment ISA?

Management fees reduce the overall return on an investment ISA, so it is important to consider these costs when evaluating potential returns.

What role does inflation play in the rate of return for an investment ISA?

Inflation can erode the real value of returns, meaning a higher nominal return is needed to maintain purchasing power over time.

How can diversification impact the rate of return for an investment ISA?

Diversification can lower risk and stabilize returns by spreading investments across various asset classes and sectors.

Should I adjust my investment strategy based on expected ISA returns?

Yes, strategic adjustments based on projected returns and personal financial goals can optimize portfolio performance in an ISA.

How often should I review the rate of return on my investment ISA?

Regularly reviewing your ISA, at least annually, ensures your investments align with your goals and risk tolerance.

Can a financial advisor help improve my ISA's rate of return?

A financial advisor can provide expertise and guidance, potentially improving your ISA's returns through strategic planning and market insights.

Is a higher risk tolerance necessary for a better ISA return?

Higher risk tolerance can lead to higher potential returns but comes with increased potential for losses; balance is key based on individual goals.

Are there tax benefits associated with the rate of return on an investment ISA?

Yes, returns on investment ISAs are tax-free, which can enhance effective yield compared to taxable investment accounts.

How does the time horizon affect the expected return on an ISA?

A longer time horizon allows for more aggressive strategies with higher potential returns, as there is more time to recover from market downturns.

What is the risk of losing money with an investment ISA?

While there's potential for growth, investment ISAs can also decrease in value, especially in the short term, due to market risk.

Can I switch investments within my ISA to improve returns?

Yes, frequently reviewing and adjusting investments based on performance and goals can enhance the returns of your ISA.

Do interest rates affect the return on an investment ISA?

Yes, interest rates can influence stock and bond prices, impacting the returns in an ISA; however, ISAs primarily invested in equities might be less directly affected.

How does rebalancing impact the rate of return on an investment ISA?

Regular rebalancing helps maintain your desired asset allocation, potentially enhancing returns and managing risk within your investment ISA.

How much money can you make from saving with an Investment ISA?

When you put money in an investment ISA, you can make more money from it. People think a good amount to earn is between 4% to 8% extra each year. But this can change because of how the market is doing and what you invest in.

How does market ups and downs change the money you make in an investment ISA?

Big changes in the market can make your investment ISA go up or down in value. This means the money you earn from it might change too. It's like a roller coaster ride for your money.

To help understand better, you can use pictures or graphs to see how your money changes over time.

Sometimes the market goes up and down a lot. This is called market volatility. When this happens, the money you earn from an investment ISA can change too. You might make more money when the market is doing well, but you could lose money when the market is doing badly.

Can an Investment ISA Promise a Certain Amount of Money Back?

An Investment ISA is a way to save money.

But, it does not promise a certain amount of money back.

The money you get back can be more or less than you expect.

If you want to learn more, you can:

- Ask someone you trust for help.

- Use apps that explain money simply.

- Look for videos that talk about saving money.

No, investment ISAs do not promise a fixed amount of money you will earn. The value goes up and down because of changes in the market.

Here are some things that can help:

- Use a calculator to see how your investment could change.

- Talk to someone who knows about investing, like a financial advisor.

- Look at websites that explain money and investing in simple words.

What things affect how much money you make with an investment ISA?

An investment ISA is a way to save money. It can help your money grow.

Here are things that can change how much money you make:

- Interest Rates: This is extra money you get for saving. It can go up or down.

- Fees: Sometimes, there are costs to have an ISA. This can take away some money you make.

- Stock Market: This is where companies sell parts of their business. If they do well, you can make more money.

- Time: The longer you save, the more chance your money has to grow.

Here are some tips to help:

- Ask someone for help if something is hard to understand.

- Use pictures or charts to see how your money can grow.

- Take your time and think about what works best for you.

Many things can change how much money you make from an investment ISA. These things include how you divide your money, what kind of investment you pick, how the market is doing, and any fees you have to pay for managing your money.

Can you make a lot of money with an Investment ISA?

Yes, it is possible to earn a lot, but it can be risky. You can spread out your money in different places and think long-term to help keep both risks and rewards balanced.

How do the investments you pick in an ISA change the money you make?

When you pick different types of investments like stocks, bonds, or funds, it changes how risky they are and how much money you might make. Stocks can make you more money, but they can also be riskier.

How much money do people usually make from investment ISAs?

In the past, people who saved money using investment ISAs usually got something back. This was often between 5% and 7%. But remember, just because it happened before doesn't mean it will happen again.

Tip: You can ask someone you trust to help explain hard words.

How do management fees affect how much money an investment ISA makes?

When you put money in an investment ISA, you want it to grow. But remember, some people manage the ISA, and they charge a fee. This fee is called a management fee.

If the fee is big, it can make your money grow slower. If the fee is small, your money can grow faster.

Always check the management fees before you pick an investment ISA. This way, you know how it will affect your money.

You can use tools like a calculator or ask someone you trust to help understand the fees better.

Management fees are costs you have to pay for someone to take care of your investment ISA. These fees can make the money you earn less. It is important to think about these costs when you are looking at how much money you might make.

How does inflation affect money you earn from an investment ISA?

Inflation means that prices go up over time. When you save or invest money, inflation can make the value of your money go down.

An Investment ISA is a special account where you can put your money and try to make it grow by investing.

If inflation is high, the money you earn from your ISA might not buy as much as it used to. Inflation can make your earnings from the investment ISA worth less.

To understand this better, you can use tools like online calculators to see how inflation affects your savings. You can also look at pictures or graphs that show how inflation changes over time.

Inflation makes things cost more. This means that your money buys less stuff over time. So, you need to make more money to keep buying the same things.

How does spreading out your money affect the money you earn in an ISA?

Here are some things that can help:

- Use pictures or charts to show how money grows.

- Make a list of places you can put your money (like different banks or stocks).

- Ask someone to explain new words.

- Use simple money apps or tools to help understand.

Diversification means not putting all your money in one place. It helps keep your money safe and steady. You spread your money into different types of things, like stocks, bonds, and other areas. This way, if one thing doesn't do well, the others can help balance it out.

Here's how you can make this easier:

- Use simple charts or images to show how spreading money works.

- Break information into small, clear steps.

- Use easy-to-understand examples, like a fruit basket. If one kind of fruit goes bad, you still have others that are good.

- Ask for help from a teacher or friend if something is hard to understand.

- Use apps or tools that read text out loud to you.

Should I change how I invest money because of ISA returns?

Think about if you need to change how you invest because of how much money you might make from your ISA (Individual Savings Account). Here are some tips to help you:

- Read slowly and carefully.

- Ask someone you trust if you need help.

- Use pictures or notes to help understand.

- Try reading with apps that read out loud.

Yes, you can make smart changes to your savings plan to help reach your money goals. This can make your ISA (Individual Savings Account) work better for you.

How often should I check how much money my investment ISA is making?

Check your investment ISA to see how much money you are making from it. You can do this every three months or every six months. This helps you know if you are doing well or if you need to change anything.

You can use a calculator to help you see the numbers clearly. Or, you can ask someone you trust to help you understand it better.

Check your ISA every year. This makes sure your money is doing what you want and it's safe for you.

Can a money helper make my ISA earn more?

A money helper is a person who knows a lot about saving and making money grow.

Your ISA is a special place where you keep your money safe and try to make more of it over time.

If you talk to a money helper, they can share good ideas to help your ISA grow faster.

Using pictures or diagrams can be helpful to understand better.

If it's hard to read, you can ask someone to read with you or use tools that read words out loud.

A financial advisor is someone who knows a lot about money. They can help you make more money from your ISA. They do this by using smart plans and sharing what they know about the market.

Do you need to take more risks to make more money with an ISA?

If you take more risks, you might make more money. But you might also lose more money. It is important to find a balance. Think about what you want to achieve.

Can you save money on taxes with an investment ISA return rate?

Yes, when you make money from an investment ISA, you don't have to pay tax on it. This means you can keep more of the money you earn compared to other types of investment accounts where you have to pay tax.

How does the time you save affect the money you make on an ISA?

An ISA is a special savings account that lets you save money without paying some types of tax.

The longer you leave your money in an ISA, the more money you might make. This is because your money has more time to grow.

If you save for a short time, you might not earn as much. But if you save for a long time, your money can grow bigger.

To help, you can:

- Use a calculator to see how much your money might grow.

- Talk to someone at the bank if you have questions.

When you plan for a long time, you can take bigger risks to try and make more money, because there's more time to fix things if the market goes down.

Can I lose money with an investment ISA?

When you put money in an investment ISA, there is a chance you might lose some money. This is because investments can go up or down in value.

Here are some things that can help you understand more and feel safer:

- Talk to a grown-up you trust about it.

- Read simple guides or use video explanations.

- Use apps that show you how your money is doing.

Remember, it's okay to ask for help if you're unsure.

Investment ISAs might grow and get bigger. But sometimes they can also go down in value because the market can change and be risky.

Can I change my ISA investments to make more money?

An ISA is a way to save or invest money without paying tax on it. You might want to change what you invest in to try and earn more money.

You can use these tools to help you:

- Ask a grown-up you trust.

- Use simple charts to compare investments.

- There are apps that help you understand investments better.

Looking at your savings often and changing them when you need to can help you get more money back.

Do interest rates change how much money you earn from an investment ISA?

Interest rates are like the cost of borrowing money or the money you earn from saving money. They can go up or down.

An investment ISA is a special place to keep your money safe and help it grow.

If interest rates go up, you might earn more money from your ISA. If they go down, you might earn less.

To help you understand, you can:

- Ask someone to explain words you don't know.

- Use a calculator to see how much money you might earn.

- Look at pictures or videos about interest rates and ISAs.

Yes, interest rates can change how much stocks and bonds cost. This can change how much money you get from an ISA. But, if your ISA is mostly in stocks, it might not change as much.

How does moving money around change how much you earn in an investment ISA?

Regularly checking and changing how your money is spread out helps keep your investments the way you want them. This can help grow your money and keep it safe in your investment account.

Useful Links

This website offers general information and is not a substitute for professional advice.

Always seek guidance from qualified professionals.

If you have any medical concerns or need urgent help, contact a healthcare professional or emergency services immediately.

Some of this content was generated with AI assistance. We’ve done our best to keep it accurate, helpful, and human-friendly.

- Ergsy carfully checks the information in the videos we provide here.

- Videos shown by Youtube after a video has completed, have NOT been reviewed by ERGSY.

- To view, click the arrow in centre of video.

- Most of the videos you find here will have subtitles and/or closed captions available.

- You may need to turn these on, and choose your preferred language.

- Go to the video you'd like to watch.

- If closed captions (CC) are available, settings will be visible on the bottom right of the video player.

- To turn on Captions, click settings .

- To turn off Captions, click settings again.

More Items From Ergsy search

-

What is a realistic rate of return for an investment ISA?

Relevance: 100%

-

Can I invest in foreign stocks with an ISA?

Relevance: 54%

-

What types of ISAs can I use for investments?

Relevance: 53%

-

How much would I need in an ISA for a £2k monthly passive income?

Relevance: 47%

-

Do I need to declare my ISA income on my tax return?

Relevance: 46%

-

How much would I need in an ISA to generate £2,000 monthly?

Relevance: 43%

-

What Is An ISA UK (Should I have an ISA & Different Types Of ISAs)

Relevance: 42%

-

How does an ISA generate passive income?

Relevance: 40%

-

Saving for the Future: The Best ISAs to Consider Right Now

Relevance: 39%

-

What is an ISA?

Relevance: 38%

-

Are there fees associated with Stocks & Shares ISAs?

Relevance: 37%

-

Is my ISA protected if my provider goes bankrupt?

Relevance: 35%

-

Can I withdraw money from my ISA any time?

Relevance: 32%

-

Can I transfer my ISA between providers?

Relevance: 30%

-

What happens if I exceed the ISA contribution limit?

Relevance: 29%

-

Do online banks offer investment options?

Relevance: 28%

-

What are investment scams?

Relevance: 27%

-

How are dividends in an ISA taxed?

Relevance: 27%

-

Can I have multiple ISAs?

Relevance: 25%

-

How can I protect myself from rising interest rates?

Relevance: 23%

-

What information do I need to complete my Self Assessment tax return?

Relevance: 23%

-

What Happens To Investments and Pensions | Moving Abroad | Leaving the UK

Relevance: 22%

-

How do better interest rates help me save money?

Relevance: 22%

-

Crypto Scams Exposed - Protect Your Investments Now!

Relevance: 22%

-

Who needs to file a Self Assessment tax return?

Relevance: 21%

-

What is a Self Assessment tax return?

Relevance: 20%

-

Why do interest rates rise and fall?

Relevance: 20%

-

Major Banks Announce Changes in Interest Rates: Are You Affected?

Relevance: 20%

-

How do better interest rates help me save money?

Relevance: 19%

-

How will refunds affect investments towards improving water infrastructure?

Relevance: 19%

-

How soon can I return to work after a facelift?

Relevance: 19%

-

How do economic conditions influence interest rate changes?

Relevance: 19%

-

Are there any limits on how much I can invest in an ISA per year?

Relevance: 19%

-

What is the VAT rate that I need to charge?

Relevance: 18%

-

What is an online tax return?

Relevance: 18%

-

Do I need an accountant to file a Self Assessment tax return?

Relevance: 18%

-

Can I amend an online tax return?

Relevance: 17%

-

How do I file VAT returns?

Relevance: 17%

-

What are the success rates of Paillon treatment?

Relevance: 17%

-

Starting your online tax return

Relevance: 17%