Find Help

More Items From Ergsy search

-

How does an ISA generate passive income?

Relevance: 100%

-

How much would I need in an ISA for a £2k monthly passive income?

Relevance: 73%

-

How much would I need in an ISA to generate £2,000 monthly?

Relevance: 49%

-

Do I need to declare my ISA income on my tax return?

Relevance: 44%

-

What Is An ISA UK (Should I have an ISA & Different Types Of ISAs)

Relevance: 36%

-

What is an ISA?

Relevance: 32%

-

Are there fees associated with Stocks & Shares ISAs?

Relevance: 31%

-

What happens if I exceed the ISA contribution limit?

Relevance: 30%

-

Can I invest in foreign stocks with an ISA?

Relevance: 30%

-

What types of ISAs can I use for investments?

Relevance: 30%

-

What is a realistic rate of return for an investment ISA?

Relevance: 28%

-

Can I transfer my ISA between providers?

Relevance: 27%

-

Saving for the Future: The Best ISAs to Consider Right Now

Relevance: 26%

-

Is my ISA protected if my provider goes bankrupt?

Relevance: 25%

-

Can I withdraw money from my ISA any time?

Relevance: 25%

-

How are dividends in an ISA taxed?

Relevance: 23%

-

Can I have multiple ISAs?

Relevance: 22%

-

How much revenue has the sugar tax generated?

Relevance: 22%

-

How does a wealth tax differ from an income tax?

Relevance: 20%

-

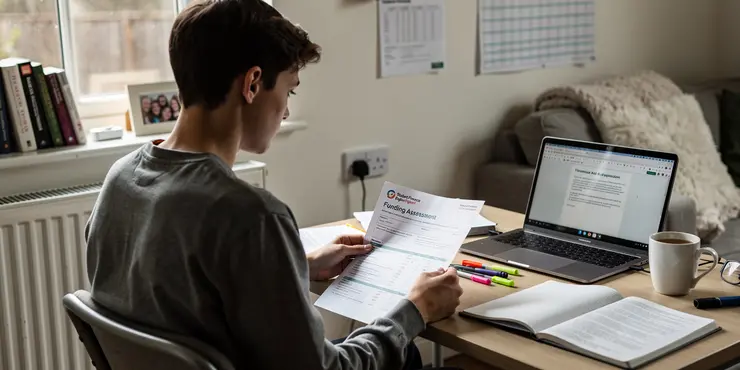

Using 100% of your Second Income for a Mortgage Application

Relevance: 20%

-

Is there an income threshold for students to qualify for the payment?

Relevance: 19%

-

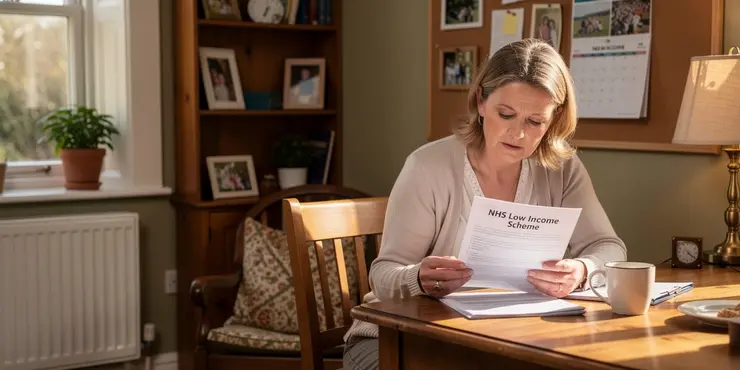

What is the NHS Low Income Scheme?

Relevance: 18%

-

What is the NHS Low Income Scheme?

Relevance: 18%

-

What is NHS Low Income Scheme?

Relevance: 18%

-

UK Mortgage Rules Lenders Don't Talk About - Debt To Income Ratio

Relevance: 18%

-

Who is eligible for the NHS Low Income Scheme?

Relevance: 18%

-

Who is eligible for the NHS Low Income Scheme?

Relevance: 18%

-

Will income thresholds for tax reliefs be revised in 2026?

Relevance: 18%

-

What if I'm self-employed and my income varies?

Relevance: 18%

-

How do I apply for the NHS Low Income Scheme?

Relevance: 17%

-

Could there be a reduction in the basic rate of income tax by 2026?

Relevance: 17%

-

What happens to a deceased’s Income Tax if they were employed?

Relevance: 17%

-

What are HMRC Income Tax Changes in April 2026?

Relevance: 16%

-

Highest Income Multiple Mortgage Lenders Revealed - Good and Bad Points

Relevance: 16%

-

How do seniors qualify for Supplemental Security Income (SSI)?

Relevance: 16%

-

What are the HMRC income tax changes coming into effect in April 2026?

Relevance: 15%

-

What are common arguments in favor of a wealth tax?

Relevance: 14%

-

What should business owners expect from income tax changes in 2026?

Relevance: 14%

-

Higher Income Tax - How to Claim Pension Tax Relief | Extra 20% Boost

Relevance: 12%

-

Would a wealth tax replace other taxes in the UK?

Relevance: 12%

Understanding Individual Savings Accounts (ISAs)

Individual Savings Accounts, known as ISAs, are a popular tax-efficient way for UK residents to save and invest their money. By placing funds into an ISA, any interest, dividends, or capital gains earned are sheltered from UK tax. This can be particularly advantageous when aiming to generate passive income, as the profits from your investments can grow without the need to pay tax.

Types of ISAs

There are several types of ISAs available in the UK, each offering unique ways to generate passive income:

1. Cash ISA: A Cash ISA operates similarly to a regular savings account, yet the interest accrued is tax-free. Although interest rates may currently be modest, this option provides a safe and accessible means to earn passive income.

2. Stocks and Shares ISA: This type of ISA allows for investment in stocks, bonds, or funds. It comes with higher risk but has the potential for greater returns. Any dividends or capital gains made are tax-free, offering a substantial avenue for passive income through investment growth.

3. Innovative Finance ISA: Innovative Finance ISAs permit investment in peer-to-peer lending platforms. The interest earned from these loans is tax-free, providing an alternative way to derive passive income by lending money to individuals or businesses.

4. Lifetime ISA: Aimed at those under 40, Lifetime ISAs support saving for retirement or a first home, offering a 25% government bonus on contributions. While primary access is limited, they offer potential growth in investment returns or interest as an avenue for future passive income.

Generating Passive Income with ISAs

The key to generating passive income from ISAs lies in understanding their unique benefits and using them effectively:

Invest Strategically: By selecting a diversified mix of assets within a Stocks and Shares ISA, investors can efficiently spread risk and harness income through dividends and growth.

Utilize Compound Interest: Over time, interest earned within Cash ISAs can benefit from compounding, gradually increasing passive income. Even modest contributions consistently compounded can accumulate considerable value.

Take Advantage of Tax-Free Growth: The tax-free status of ISAs means more money remains in an account to be reinvested or used for living expenses, without the erosion of tax liabilities.

Maximizing ISA Contributions

The annual ISA allowance for the 2023/24 tax year is £20,000. To maximize passive income potential, individuals should aim to fully utilize this allowance if possible, spreading investments across different ISA types to match personal financial goals and risk tolerance.

Conclusion

ISAs serve as a valuable tool for creating a stream of passive income in a tax-efficient manner. By understanding the different ISA options and crafting a well-thought-out investment strategy, UK residents can take advantage of the benefits of these savings accounts to build their financial future. Always consult with a financial advisor to tailor strategies to your individual needs and circumstances.

Understanding Individual Savings Accounts (ISAs)

ISAs, or Individual Savings Accounts, are a way for people in the UK to save and invest money without paying tax on the earnings. This means that any money you make from an ISA does not need to be taxed. ISAs can help your money grow without losing any of it to taxes. This is good if you want to earn money without having to do extra work.

Types of ISAs

There are different kinds of ISAs you can choose from. Each one helps you earn money in different ways:

1. Cash ISA: This is like a regular savings account, but the interest you earn is tax-free. Even if the interest is small, it is a safe place to keep your money and earn a little extra.

2. Stocks and Shares ISA: With this ISA, you can buy stocks or bonds. It has a higher risk but could earn more money. Any profit you make is tax-free, so it is a good way to make your money grow.

3. Innovative Finance ISA: This type lets you lend money to others through a peer-to-peer platform. The interest you earn is tax-free, which is another way to earn money.

4. Lifetime ISA: This ISA is for people under 40. You can use it to save for retirement or to buy your first home. The government adds extra money to your savings, offering more growth over time.

Generating Passive Income with ISAs

You can earn passive income - money you don't have to work for - with ISAs if you use them smartly:

Invest Smartly: By choosing a mix of stocks and shares in your Stocks and Shares ISA, you can spread out the risk and earn money from what you invest.

Make Use of Compound Interest: Money in Cash ISAs can grow over time if you leave it there. The interest you earn gets added to your savings, which then earns more interest. This helps your money grow faster.

Enjoy Tax-Free Growth: Since ISAs are tax-free, the money you make stays with you. You don't have to pay any of it to the tax office.

Maximizing ISA Contributions

In the 2023/24 tax year, you can put up to £20,000 into ISAs. To make the most out of your savings, try to put in as much as you can. Use different types of ISAs that fit what you want to do with your money and how much risk you are willing to take.

Conclusion

ISAs are a good way to save and earn money without paying taxes. By learning about the different ISAs and planning your saving methods, you can use ISAs to build a strong financial future. Always talk to a financial advisor to get advice that fits your personal needs and situation.

Frequently Asked Questions

What is an ISA?

An ISA, or Individual Savings Account, is a type of savings account available in the UK that offers tax advantages on the interest or returns generated from your investments.

How can an ISA help generate passive income?

An ISA can generate passive income by investing in assets such as stocks, bonds, or funds that produce returns over time, which can include interest payments, dividends, or capital gains.

What types of ISAs are available for generating passive income?

The main types of ISAs for generating passive income are Cash ISAs and Stocks and Shares ISAs. Cash ISAs earn interest, while Stocks and Shares ISAs can generate income through dividends and capital growth.

How does a Cash ISA generate passive income?

A Cash ISA generates passive income by accruing interest on the deposited funds, which is tax-free.

How does a Stocks and Shares ISA generate passive income?

A Stocks and Shares ISA generates passive income through dividends from shares and interest from bonds, and it can also benefit from capital gains as the value of the investments grows.

Are the returns from an ISA tax-free?

Yes, the returns generated within an ISA, whether from interest, dividends, or capital gains, are typically tax-free for UK residents.

What is the annual contribution limit for an ISA?

As of the current rules, the annual contribution limit for an ISA is £20,000. This amount can be split between different types of ISAs.

Can I withdraw money from my ISA any time?

Yes, most ISAs allow you to withdraw money at any time, but the terms can vary, especially for fixed-rate or notice ISAs.

What are dividend-paying stocks within a Stocks and Shares ISA?

Dividend-paying stocks are shares of companies that pay out a portion of their earnings to shareholders on a regular basis, providing a source of passive income.

Can I reinvest the income generated in an ISA?

Yes, any income generated within an ISA can be reinvested without losing the tax advantages, allowing for compound growth over time.

Is it possible to transfer money between different ISAs?

Yes, you can transfer funds between different ISAs, but ensure that you follow the ISA transfer process to maintain the tax advantages.

Are there any risks associated with a Stocks and Shares ISA?

Yes, investments in a Stocks and Shares ISA can go down as well as up in value, and there is a risk of losing money since it's subject to market fluctuations.

How does inflation affect the income from a Cash ISA?

Inflation can erode the purchasing power of the interest earned on a Cash ISA if the inflation rate is higher than the interest rate.

Can I open multiple ISAs in the same tax year?

Yes, you can open multiple types of ISAs in the same tax year, but you cannot pay into more than one of the same type of ISA per tax year.

What is the impact of ISA fees on passive income?

Fees can reduce the overall returns of a Stocks and Shares ISA, so it's important to be aware of management fees, transaction charges, and other costs that can impact passive income.

What is the ISA allowance carry-forward rule?

There is no carry-forward rule for ISAs. You cannot carry over any unused ISA allowance to future tax years.

Are there alternatives to ISAs for generating passive income?

Yes, apart from ISAs, other options include pensions, regular investment accounts, and property investment, although they may not offer the same tax benefits as ISAs.

How do bond funds within a Stocks and Shares ISA generate income?

Bond funds invest in bonds that pay interest, which is distributed to investors as income, contributing to passive income in a Stocks and Shares ISA.

What is a Lifetime ISA and can it generate passive income?

A Lifetime ISA is designed to help save for a first home or retirement. It can generate passive income if invested in stocks and shares, but it has restrictions on when you can access the funds without penalties.

How does investment diversification in a Stocks and Shares ISA help with passive income?

Diversification spreads risk across different investments, potentially reducing volatility and helping to maintain a steady stream of passive income from various sources.

What is an ISA?

An ISA is a type of bank account. It helps you save money.

The money you put in an ISA can grow. You don't pay tax on it.

If you want help learning about ISAs, you can:

- Ask someone to explain it to you.

- Watch a video about ISAs.

- Use a picture guide.

An ISA is a special savings account in the UK. It helps you save or invest money. With an ISA, you don’t have to pay tax on the money you earn from it. This can help your savings grow faster.

How can an ISA help you make money while you do nothing?

An ISA is a way to save money.

You can put your money into an ISA. The ISA keeps your money safe and helps it grow.

Your money can make more money, even if you don't do anything. This is called passive income.

Here are some tips to help understand ISAs:

- Ask someone you trust to explain it.

- Look for videos or books made for kids about saving money.

- Use simple drawing or charts to show how money grows.

An ISA is a special account that helps you make money without working. You can put your money into things like stocks and bonds. Over time, these can make you more money, like getting extra money from interest, sharing in company profits, or selling something for more than you paid.

What ISAs can help you earn money without much work?

The two main ISAs that help you make money while you do nothing are Cash ISAs and Stocks and Shares ISAs.

With Cash ISAs, the money you put in earns more money called interest.

With Stocks and Shares ISAs, you can make money in two ways: through dividends, which is like getting a little payment, and through capital growth, which means your investment can become worth more over time.

How does a Cash ISA help you make money?

A Cash ISA is like a special savings account. You can put money in it and leave it to grow. It helps you make money without doing anything!

Here is how it works:

- You save some money in your Cash ISA.

- The bank adds a little extra money to your savings. This is called interest.

- Over time, your savings get bigger because of the interest.

Tools you can use:

- A calculator can help you see how your money grows.

- A bank app can show you your savings anytime.

A Cash ISA is a special savings account. It helps you make money without doing any work. This is called passive income. The money you put in the Cash ISA earns extra money called interest. Best of all, you don't have to pay tax on this extra money.

How can a Stocks and Shares ISA make money for you without work?

A Stocks and Shares ISA can help you make money in a few ways. You can get money called 'dividends' from shares. You might also get some 'interest' from bonds. If the value of your investments goes up, you might make extra money too.

Helpful Tip: Use tools like picture charts or simple graphs to see how your money is growing. This can make it easier to understand!

Is the money you earn from an ISA free from tax?

Yes, if you live in the UK, the money you earn in an ISA is usually tax-free. This includes money from interest, dividends, or selling things for more than you paid (capital gains).

How much money can I put in an ISA each year?

Right now, you can put up to £20,000 in an ISA account each year. You can divide this money between different ISA accounts if you want.

Can I take money from my ISA any time?

Yes, you can take out money from most ISAs whenever you want. But, the rules might be different for ISAs with fixed rates or ones that need notice first.

What are stocks that pay money in a Stocks and Shares ISA?

Some companies give extra money to people who own their stocks. This extra money is called a "dividend." When you buy these stocks in a Stocks and Shares ISA, you can keep the extra money. You do not have to pay taxes on it.

Helpful Tips:

- You can use drawings or charts to understand better how stocks work.

- Ask a family member or friend to explain if you find something hard.

- Use a calculator to help with numbers if needed.

Some companies pay money to people who own their shares. This money is called a dividend. Getting this money is like having an easy way to earn some extra cash regularly.

Can I put the money I earn back into my ISA?

Yes, you can put any money you earn inside an ISA back into it. This helps your money grow because you don’t have to pay tax on it. Over time, your money can grow more and more.

If you find reading hard, you can try these tips:

- Use a finger or ruler to follow the words.

- Read out loud and say the words slowly.

- Break big words into smaller parts.

- Ask someone to help explain parts that are tricky.

Remember, it's okay to ask for help if you need it!

Can I move money between different ISAs?

Yes, you can move money between different ISAs. "ISAs" are special savings accounts. To know how to do this, you can:

- Ask a grown-up to help you.

- Call your bank; they can tell you what to do.

- Check your bank's website; it might have easy steps to follow.

Yes, you can move money between different ISAs. Just make sure you follow the ISA transfer steps to keep getting tax benefits.

Can a Stocks and Shares ISA be risky?

Yes, there can be risks. When you put your money into a Stocks and Shares ISA, the value can go up or down.

- You might make money.

- You might lose money.

It's important to learn and ask questions so you understand the risks. You could use tools like videos or simple books to help you learn more.

Yes, when you put money in a Stocks and Shares ISA, the value can go up or down. This means you might lose money because the stock market changes.

What happens to your money in a Cash ISA when prices go up?

Inflation can make your money worth less over time. If the cost of things goes up faster than the money you earn from a Cash ISA, you might not be able to buy as much with your savings.

Can I have more than one ISA in a year?

This means: Can you open different ISAs in the same year? Here's a tip: You can only put money into one of each type of ISA each year.

You can have different kinds of ISAs in one tax year. But you can't put money into more than one of the same kind of ISA in a tax year.

Here are some tips to help:

- Use a calendar to track your ISA payments.

- Ask someone you trust if you need help or have questions.

How do ISA fees affect the money you make from savings?

If you save money in an ISA, you might have to pay fees. These fees can change how much money you earn. Let's see how.

- Fees are costs: These are small amounts of money you pay for the account.

- Less money earned: When you pay fees, you have less money left over.

- Compare fees: Check different ISAs to see which ones have lower fees.

You can ask a parent or a teacher to explain it to you, or use a calculator to see how fees take away some of the money you earn.

Fees can make the money you earn from a Stocks and Shares ISA smaller. It is important to know about management fees, charges for buying and selling, and other costs. These fees can change how much money you make.

Can I save more money in my ISA next year?

You can't save any leftover ISA money for next year. If you don't use your full ISA amount this year, it doesn't roll over to the next year.

Can you earn money without working using different plans instead of ISAs?

Yes, there are other ways to save money. You can use pensions or regular investment accounts. You can also buy property. These might not have the same tax benefits as ISAs (Individual Savings Accounts).

How do bond funds in a Stocks and Shares ISA make money?

A Stocks and Shares ISA is a way to save or invest your money. Bond funds are one type of investment you can put in an ISA. Here's how bond funds make money:

1. **Understanding Bond Funds:** Bond funds are like a group of loans. Companies or governments borrow money, and they pay it back with extra money called 'interest'.

2. **Making Money from Interest:** Bond funds make money by getting this interest. It's like getting a little extra money for letting someone use your money.

3. **Buying and Selling Bonds:** Sometimes, bond funds buy bonds at a low price and sell them at a higher price. This also makes money.

If you're learning about this for the first time, you might use these tools to help:

- **Pictures or Videos:** Look for simple pictures or videos online that explain how bond funds work.

- **Ask Someone:** Talk to a family member or friend who knows about saving and investing.

- **Simple Books or Guides:** Find books or guides that explain money in an easy way.

Bond funds use money to buy bonds. Bonds give interest, which is like a small payment, to the owner. This money is shared with people who invest in the bond fund. This helps make extra money, called passive income, in a Stocks and Shares ISA.

What is a Lifetime ISA and can it help you earn money without working?

A Lifetime ISA is a special savings account. You can use it to save money for when you are older or to help buy your first home.

It can help you earn money without working because the government adds extra money to your savings. This extra money is called a bonus.

Here are some helpful tools:

- Ask a family member or friend to explain it to you.

- Use simple apps or websites to learn more about saving money.

A Lifetime ISA is a special account to help you save money. You can use it to buy your first home or for retirement. You can also invest the money in stocks to make more money. But, there are rules about when you can take out the money. If you take it out early, you might have to pay a fee.

How can having different investments in a Stocks and Shares ISA help you make money without working?

Making money this way is called "passive income." Here are some ways to understand it better:

- Diversification: This means putting your money in different places. Imagine not putting all your eggs in one basket. If one thing doesn't make money, others might.

- Stocks and Shares ISA: This is a special account where you can put your money in things like company shares. You don't have to pay tax on the money you make.

- Passive income: This is money you make without working all the time. It's like getting pocket money because your investments are doing well.

Here are some tools and techniques that can help:

- Ask someone who is good with money questions to explain things simply.

- Use apps or websites that explain investing in a simple way.

- Watch videos that have easy words and pictures to explain investing.

Diversification means putting your money into different things. This helps spread risk. It can make your money grow more smoothly and help you keep earning money from different places.

If you find reading hard, there are tools that can help. Reading apps can read the text out loud. You can also use colored overlays to make reading easier. Asking someone to explain it can also help you understand better.

Useful Links

This website offers general information and is not a substitute for professional advice.

Always seek guidance from qualified professionals.

If you have any medical concerns or need urgent help, contact a healthcare professional or emergency services immediately.

Some of this content was generated with AI assistance. We’ve done our best to keep it accurate, helpful, and human-friendly.

- Ergsy carfully checks the information in the videos we provide here.

- Videos shown by Youtube after a video has completed, have NOT been reviewed by ERGSY.

- To view, click the arrow in centre of video.

- Most of the videos you find here will have subtitles and/or closed captions available.

- You may need to turn these on, and choose your preferred language.

- Go to the video you'd like to watch.

- If closed captions (CC) are available, settings will be visible on the bottom right of the video player.

- To turn on Captions, click settings .

- To turn off Captions, click settings again.

More Items From Ergsy search

-

How does an ISA generate passive income?

Relevance: 100%

-

How much would I need in an ISA for a £2k monthly passive income?

Relevance: 73%

-

How much would I need in an ISA to generate £2,000 monthly?

Relevance: 49%

-

Do I need to declare my ISA income on my tax return?

Relevance: 44%

-

What Is An ISA UK (Should I have an ISA & Different Types Of ISAs)

Relevance: 36%

-

What is an ISA?

Relevance: 32%

-

Are there fees associated with Stocks & Shares ISAs?

Relevance: 31%

-

What happens if I exceed the ISA contribution limit?

Relevance: 30%

-

Can I invest in foreign stocks with an ISA?

Relevance: 30%

-

What types of ISAs can I use for investments?

Relevance: 30%

-

What is a realistic rate of return for an investment ISA?

Relevance: 28%

-

Can I transfer my ISA between providers?

Relevance: 27%

-

Saving for the Future: The Best ISAs to Consider Right Now

Relevance: 26%

-

Is my ISA protected if my provider goes bankrupt?

Relevance: 25%

-

Can I withdraw money from my ISA any time?

Relevance: 25%

-

How are dividends in an ISA taxed?

Relevance: 23%

-

Can I have multiple ISAs?

Relevance: 22%

-

How much revenue has the sugar tax generated?

Relevance: 22%

-

How does a wealth tax differ from an income tax?

Relevance: 20%

-

Using 100% of your Second Income for a Mortgage Application

Relevance: 20%

-

Is there an income threshold for students to qualify for the payment?

Relevance: 19%

-

What is the NHS Low Income Scheme?

Relevance: 18%

-

What is the NHS Low Income Scheme?

Relevance: 18%

-

What is NHS Low Income Scheme?

Relevance: 18%

-

UK Mortgage Rules Lenders Don't Talk About - Debt To Income Ratio

Relevance: 18%

-

Who is eligible for the NHS Low Income Scheme?

Relevance: 18%

-

Who is eligible for the NHS Low Income Scheme?

Relevance: 18%

-

Will income thresholds for tax reliefs be revised in 2026?

Relevance: 18%

-

What if I'm self-employed and my income varies?

Relevance: 18%

-

How do I apply for the NHS Low Income Scheme?

Relevance: 17%

-

Could there be a reduction in the basic rate of income tax by 2026?

Relevance: 17%

-

What happens to a deceased’s Income Tax if they were employed?

Relevance: 17%

-

What are HMRC Income Tax Changes in April 2026?

Relevance: 16%

-

Highest Income Multiple Mortgage Lenders Revealed - Good and Bad Points

Relevance: 16%

-

How do seniors qualify for Supplemental Security Income (SSI)?

Relevance: 16%

-

What are the HMRC income tax changes coming into effect in April 2026?

Relevance: 15%

-

What are common arguments in favor of a wealth tax?

Relevance: 14%

-

What should business owners expect from income tax changes in 2026?

Relevance: 14%

-

Higher Income Tax - How to Claim Pension Tax Relief | Extra 20% Boost

Relevance: 12%

-

Would a wealth tax replace other taxes in the UK?

Relevance: 12%