Find Help

More Items From Ergsy search

-

What if I'm self-employed and my income varies?

Relevance: 100%

-

Can I apply if I am self-employed?

Relevance: 60%

-

Can I apply for Universal Credit if I am self-employed?

Relevance: 59%

-

Can I file my taxes online if I'm self-employed?

Relevance: 51%

-

Can I get the basic State Pension if I’m self-employed?

Relevance: 49%

-

What is the minimum income floor for self-employed claimants?

Relevance: 40%

-

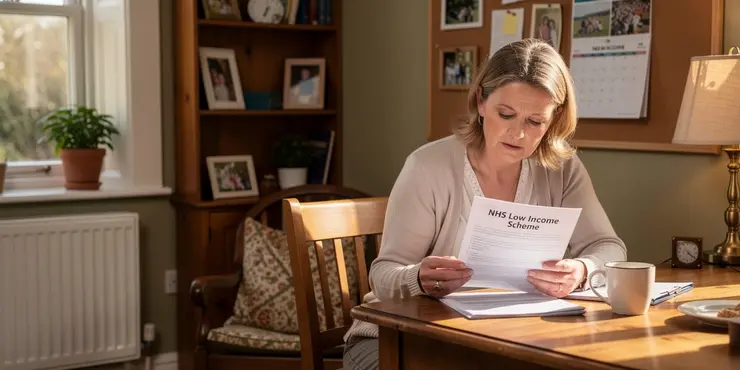

Who is eligible for the NHS Low Income Scheme?

Relevance: 37%

-

What are HMRC Income Tax Changes in April 2026?

Relevance: 37%

-

Using 100% of your Second Income for a Mortgage Application

Relevance: 36%

-

What are the HMRC income tax changes coming into effect in April 2026?

Relevance: 35%

-

What should business owners expect from income tax changes in 2026?

Relevance: 35%

-

What is NHS Low Income Scheme?

Relevance: 35%

-

Highest Income Multiple Mortgage Lenders Revealed - Good and Bad Points

Relevance: 35%

-

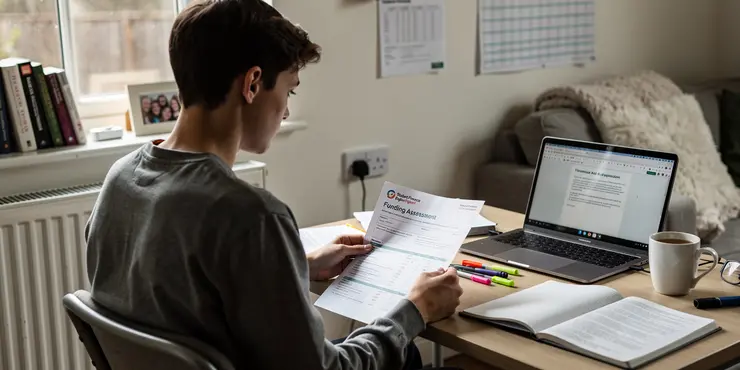

Is there an income threshold for students to qualify for the payment?

Relevance: 34%

-

Will income thresholds for tax reliefs be revised in 2026?

Relevance: 34%

-

What is the NHS Low Income Scheme?

Relevance: 33%

-

What is the NHS Low Income Scheme?

Relevance: 33%

-

UK Mortgage Rules Lenders Don't Talk About - Debt To Income Ratio

Relevance: 33%

-

How does an ISA generate passive income?

Relevance: 32%

-

Who is eligible for the NHS Low Income Scheme?

Relevance: 32%

-

How does a wealth tax differ from an income tax?

Relevance: 32%

-

Does inheritance tax vary by state or region?

Relevance: 31%

-

Could there be a reduction in the basic rate of income tax by 2026?

Relevance: 31%

-

How do I apply for the NHS Low Income Scheme?

Relevance: 30%

-

What happens to a deceased’s Income Tax if they were employed?

Relevance: 30%

-

Can heart attack symptoms vary by age?

Relevance: 30%

-

How do seniors qualify for Supplemental Security Income (SSI)?

Relevance: 29%

-

Do I need to declare my ISA income on my tax return?

Relevance: 29%

-

Who needs to file a Self Assessment tax return?

Relevance: 28%

-

Do electricity tariffs vary within the same energy company?

Relevance: 28%

-

How much would I need in an ISA for a £2k monthly passive income?

Relevance: 27%

-

What information do I need to complete my Self Assessment tax return?

Relevance: 26%

-

How do I calculate my tax bill?

Relevance: 25%

-

Do gig workers qualify for retirement benefits?

Relevance: 24%

-

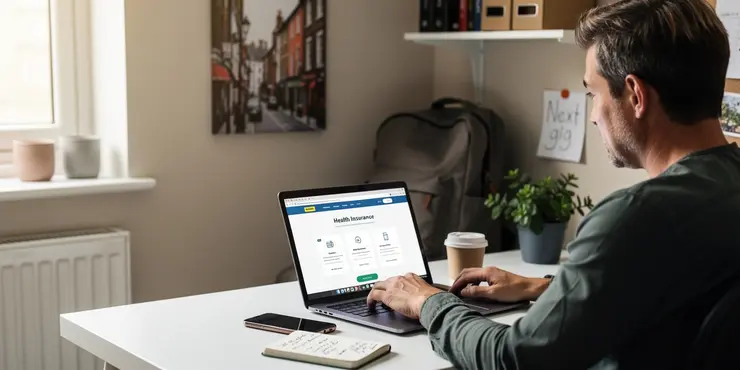

Can I receive health benefits as a gig worker?

Relevance: 24%

-

How do I complete my Self Assessment tax return?

Relevance: 24%

-

Do gig workers have access to unemployment benefits?

Relevance: 23%

-

Do I need an accountant to file a Self Assessment tax return?

Relevance: 23%

-

What is a Self Assessment tax return?

Relevance: 22%

-

What documents are required to apply for Universal Credit?

Relevance: 22%

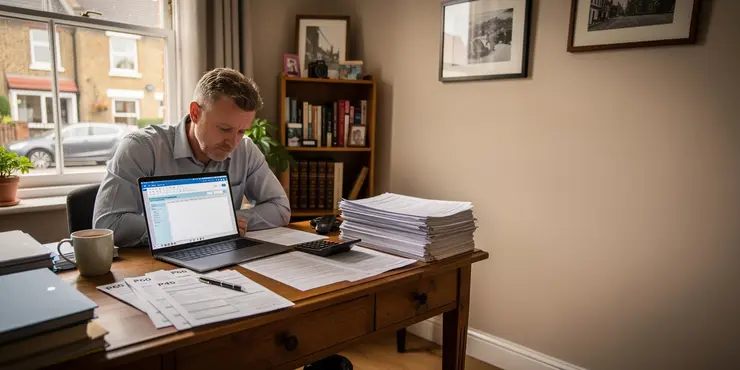

Understanding Variable Income

If you are self-employed in the UK, your income may not be consistent each month. This variability can make financial planning challenging.

One month you might have a high income, while the next month could be significantly lower. Understanding how to manage these fluctuations is crucial.

Having a grasp of your financial situation allows you to plan better for both lean and prosperous times. This can help maintain financial stability.

Budgeting for Fluctuations

Creating a flexible budget is essential when your income is not steady. Start by identifying your regular monthly expenses.

Make sure to account for essentials like rent or mortgage, utilities, and groceries. Also, add in any fixed business expenses you may have.

Next, allocate a portion of your variable income towards savings or an emergency fund. This reserve can be a financial cushion in low-income months.

Tax Considerations

As a self-employed individual, you'll need to handle your tax obligations. Make sure to set aside money regularly for tax payments.

HMRC requires self-employed individuals to pay taxes twice a year. Having savings ready can prevent payment issues.

Consider consulting an accountant to help estimate your tax contributions based on your fluctuating earnings.

Dealing with Inconsistent Cash Flow

Having an inconsistent cash flow can be stressful, but strategies can help manage it effectively. Try to negotiate longer payment terms with creditors if needed.

In contrast, shorter payment terms from your clients can help improve your cash flow. Regular invoicing helps maintain a steady influx of funds.

Furthermore, applying for a business overdraft or line of credit can also provide some buffer during down periods.

Financial Planning and Support

Financial planning is vital for self-employed individuals with variable incomes. Consider hiring a financial advisor to assist with long-term objectives.

Look into online tools and apps that can help track your finances, provide insights, and facilitate better budgeting.

Seeking advice and support can provide clarity and help alleviate some of the stress associated with income variability.

Frequently Asked Questions

How can I estimate my self-employment income if it varies each month?

To estimate your self-employment income, review past months' earnings, identify patterns or trends, and consider any upcoming contracts or work. Use an average from previous months to create a reasonable estimate.

How do I budget effectively with a fluctuating income?

Create a budget based on your lowest expected income, prioritize necessary expenses, and build an emergency fund to cushion months with lower income. Save surplus income during higher-earning months.

What percentage of my income should I set aside for taxes?

It is usually advisable to set aside 25-30% of your income for taxes, but this can vary based on your tax bracket and local tax laws. Consult a tax professional for personalized advice.

How can I manage cash flow when my income is irregular?

Track your income and expenses regularly, maintain a cash reserve to cover lean months, and invoice clients promptly to ensure steady cash flow.

Should I use a separate bank account for my self-employment income?

Yes, it's a good practice to separate your business and personal finances by using a dedicated business account. It simplifies tracking and management of your business finances.

How do I handle estimated tax payments with a variable income?

Estimate your annual income and divide it by four to make quarterly tax payments. Adjust payments based on your actual earnings. Consult a tax professional for guidance.

What tools can help me manage my variable income effectively?

Consider using accounting software like QuickBooks, FreshBooks, or free tools like Wave to track income and expenses, manage invoices, and create reports.

How can I ensure I'm paid on time by clients?

Set clear payment terms, invoice promptly, and follow up diligently. Consider offering incentives for early payments and charging late fees to encourage timely payments.

What are the recommended savings strategies for self-employed individuals?

Aim to save 10-15% of your income for emergencies and another portion for retirement. Use tax-advantaged accounts like IRAs or SEP IRAs for long-term savings.

How can I minimize the impact of lean months on my personal finances?

Build a robust emergency fund that covers at least three to six months of expenses. Tighten your budget and prioritize essential expenses during low-income periods.

What financial records should I keep as a self-employed individual?

Keep detailed records of all income and expenses, invoices, receipts, bank statements, and tax documents. Organize them for easy reference and tax reporting.

How do I calculate my net income if my gross income fluctuates?

Subtract all business-related expenses from your gross income to calculate your net income. This includes costs for materials, travel, insurance, and any other business expenses.

How should I handle business expenses with a variable income?

Regularly review and categorize your expenses. Cut non-essential costs during lean months and plan for necessary large expenses during higher-income periods.

What can I do to stabilize my income as a self-employed individual?

Diversify your client base and income streams, offer retainer or recurring billing agreements, and continuously market your services to reduce income volatility.

Can I claim deductions for business-related travel and meals?

Yes, you can typically deduct reasonable business-related travel and meal expenses. Maintain detailed records and adhere to IRS guidelines to ensure proper deductions.

How do I report fluctuating income on my tax return?

Use Schedule C to report your self-employment income and expenses. Accurately track all income and deductible expenses to report your net earnings on your tax return.

Should I consider hiring an accountant if my income varies?

If managing your finances and taxes feels overwhelming, hiring an accountant can be beneficial. They can offer financial advice, tax planning, and ensure compliance with tax laws.

What should I do if my clients do not pay on time?

Implement follow-up procedures, send reminders, and consider setting up a late payment policy. If necessary, seek legal advice or hire a collection agency.

How can I prepare for retirement with a variable income?

Contribute consistently to retirement accounts like IRAs or SEP IRAs, and increase contributions during higher-income periods. Consider consulting a financial advisor for tailored advice.

How can I improve my creditworthiness with an irregular income?

Maintain a positive credit history by paying bills on time, reducing debt levels, and monitoring your credit report. Building an emergency fund can also help stabilize your financial profile.

Useful Links

This website offers general information and is not a substitute for professional advice.

Always seek guidance from qualified professionals.

If you have any medical concerns or need urgent help, contact a healthcare professional or emergency services immediately.

Some of this content was generated with AI assistance. We’ve done our best to keep it accurate, helpful, and human-friendly.

- Ergsy carfully checks the information in the videos we provide here.

- Videos shown by Youtube after a video has completed, have NOT been reviewed by ERGSY.

- To view, click the arrow in centre of video.

- Most of the videos you find here will have subtitles and/or closed captions available.

- You may need to turn these on, and choose your preferred language.

- Go to the video you'd like to watch.

- If closed captions (CC) are available, settings will be visible on the bottom right of the video player.

- To turn on Captions, click settings .

- To turn off Captions, click settings again.

More Items From Ergsy search

-

What if I'm self-employed and my income varies?

Relevance: 100%

-

Can I apply if I am self-employed?

Relevance: 60%

-

Can I apply for Universal Credit if I am self-employed?

Relevance: 59%

-

Can I file my taxes online if I'm self-employed?

Relevance: 51%

-

Can I get the basic State Pension if I’m self-employed?

Relevance: 49%

-

What is the minimum income floor for self-employed claimants?

Relevance: 40%

-

Who is eligible for the NHS Low Income Scheme?

Relevance: 37%

-

What are HMRC Income Tax Changes in April 2026?

Relevance: 37%

-

Using 100% of your Second Income for a Mortgage Application

Relevance: 36%

-

What are the HMRC income tax changes coming into effect in April 2026?

Relevance: 35%

-

What should business owners expect from income tax changes in 2026?

Relevance: 35%

-

What is NHS Low Income Scheme?

Relevance: 35%

-

Highest Income Multiple Mortgage Lenders Revealed - Good and Bad Points

Relevance: 35%

-

Is there an income threshold for students to qualify for the payment?

Relevance: 34%

-

Will income thresholds for tax reliefs be revised in 2026?

Relevance: 34%

-

What is the NHS Low Income Scheme?

Relevance: 33%

-

What is the NHS Low Income Scheme?

Relevance: 33%

-

UK Mortgage Rules Lenders Don't Talk About - Debt To Income Ratio

Relevance: 33%

-

How does an ISA generate passive income?

Relevance: 32%

-

Who is eligible for the NHS Low Income Scheme?

Relevance: 32%

-

How does a wealth tax differ from an income tax?

Relevance: 32%

-

Does inheritance tax vary by state or region?

Relevance: 31%

-

Could there be a reduction in the basic rate of income tax by 2026?

Relevance: 31%

-

How do I apply for the NHS Low Income Scheme?

Relevance: 30%

-

What happens to a deceased’s Income Tax if they were employed?

Relevance: 30%

-

Can heart attack symptoms vary by age?

Relevance: 30%

-

How do seniors qualify for Supplemental Security Income (SSI)?

Relevance: 29%

-

Do I need to declare my ISA income on my tax return?

Relevance: 29%

-

Who needs to file a Self Assessment tax return?

Relevance: 28%

-

Do electricity tariffs vary within the same energy company?

Relevance: 28%

-

How much would I need in an ISA for a £2k monthly passive income?

Relevance: 27%

-

What information do I need to complete my Self Assessment tax return?

Relevance: 26%

-

How do I calculate my tax bill?

Relevance: 25%

-

Do gig workers qualify for retirement benefits?

Relevance: 24%

-

Can I receive health benefits as a gig worker?

Relevance: 24%

-

How do I complete my Self Assessment tax return?

Relevance: 24%

-

Do gig workers have access to unemployment benefits?

Relevance: 23%

-

Do I need an accountant to file a Self Assessment tax return?

Relevance: 23%

-

What is a Self Assessment tax return?

Relevance: 22%

-

What documents are required to apply for Universal Credit?

Relevance: 22%