Find Help

More Items From Ergsy search

-

What documents do I need to file my taxes online?

Relevance: 100%

-

Is it safe to file taxes online?

Relevance: 91%

-

Are there free options for filing taxes online?

Relevance: 91%

-

When is the deadline to file taxes online?

Relevance: 90%

-

Can I file taxes online after the deadline?

Relevance: 89%

-

Can I file my taxes online if I'm self-employed?

Relevance: 88%

-

How do I start filing my taxes online?

Relevance: 88%

-

Can I file my state taxes online as well?

Relevance: 86%

-

Can I get help while filing taxes online?

Relevance: 82%

-

What happens after I file my tax return online?

Relevance: 80%

-

What is an online tax return?

Relevance: 80%

-

Starting your online tax return

Relevance: 75%

-

Do I need to send anything by post when filing online?

Relevance: 74%

-

Can I amend an online tax return?

Relevance: 69%

-

Will I get a confirmation when I file online?

Relevance: 67%

-

Is it effective to file a complaint online?

Relevance: 67%

-

Do I need to print and mail my online tax return?

Relevance: 67%

-

How do I verify my identity when filing online?

Relevance: 66%

-

What if I don't have all my tax documents?

Relevance: 65%

-

Do online tax services help maximize my refund?

Relevance: 64%

-

Do I need an accountant to file a Self Assessment tax return?

Relevance: 61%

-

Who needs to file a Self Assessment tax return?

Relevance: 57%

-

What documents do I need to file my taxes online?

Relevance: 56%

-

How do I file VAT returns?

Relevance: 53%

-

What is a Self Assessment tax return?

Relevance: 52%

-

How can I check the status of my online tax return?

Relevance: 51%

-

How do I file a claim with travel insurance?

Relevance: 51%

-

What documents are needed for VAT registration?

Relevance: 48%

-

What if I've moved since the tax year ended?

Relevance: 48%

-

What should I do if I made a mistake on my tax return?

Relevance: 48%

-

When is the deadline to file taxes online?

Relevance: 48%

-

How do I complete my Self Assessment tax return?

Relevance: 47%

-

My first Self Assessment tax return

Relevance: 47%

-

Can I make a claim online?

Relevance: 46%

-

How long does it take to receive a tax refund from HMRC?

Relevance: 46%

-

Can I access my Council Tax payment history online?

Relevance: 45%

-

Do VAT rules apply to online sales?

Relevance: 45%

-

When is the deadline for submitting my Self Assessment tax return?

Relevance: 44%

-

Can I file taxes online after the deadline?

Relevance: 44%

-

Is it necessary to complete a final tax return for the deceased?

Relevance: 44%

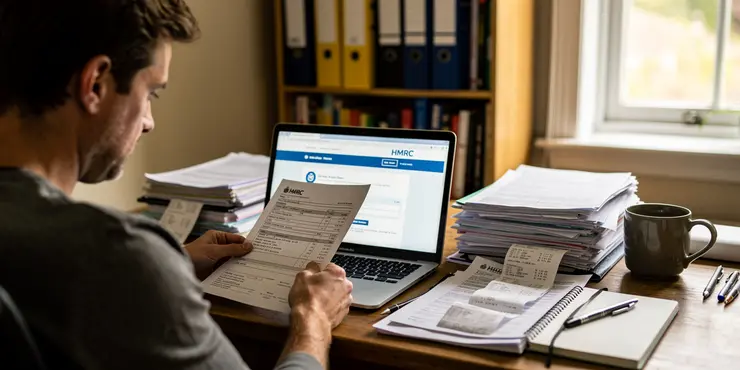

Personal Identification Documents

When filing your taxes online in the UK, you need to have your personal identification documents ready. This includes your National Insurance number, which is crucial for identifying your tax records.

You will also need a Government Gateway user ID and password. If you haven't set this up yet, you can register on the HMRC website.

Income Documents

Accurate income reporting is essential when filing your taxes. You should gather your P60 or P45 forms if you're employed, as these outline your earnings and tax paid during the year.

For those who are self-employed, a record of your business income and expenses is necessary. This might include invoices, bank statements, and any receipts related to business expenditures.

Bank Statements and Investment Information

Having detailed bank statements can help ensure that all income is reported correctly, especially for interest earned. This also aids in verifying any deductible expenses.

If you have investments, be sure to have documents related to dividends or interest from shares, bonds, or other investment products. This information ensures complete and accurate tax reporting.

Expense and Deduction Documentation

Various deductions can lower your taxable income, so having the right documents is key. For those with work-related expenses, receipts and records of these are crucial for claiming deductions.

Charitable donations can also be deducted, so keep any receipts or acknowledgment letters from charities. This can help reduce the amount of tax you owe.

Rental Income and Property Documents

If you earn income from renting out a property, you'll need detailed records of this. This includes rental agreements, income, and records of any related expenses.

For property-related tax relief, documents like mortgage statements and evidence of property improvements can also be useful. Ensure you have these ready before starting your tax filing process.

Summary of Required Documents

Filing your taxes online requires a variety of documents, covering personal identification, income, expenses, and investments. Having these ready simplifies the filing process and reduces errors.

Preparing these documents ahead of time helps you avoid last-minute stress. Ensure that each document is accurate to make your online filing process smooth and efficient.

Frequently Asked Questions

What documents do I need to file my taxes online?

You will need various documents, such as your W-2 forms, 1099 forms, receipts for deductions, and any other relevant financial documents.

Do I need my previous year's tax return to file online?

Yes, it can be helpful for reference, especially for information like your AGI.

Is a W-2 required to file taxes online?

Yes, a W-2 form is essential as it reports your annual wages and the taxes withheld.

Are 1099 forms necessary for online tax filing?

Yes, if you have received income aside from wages, a 1099 form is necessary to report this income.

Do I need receipts for deductions when filing taxes online?

Yes, having receipts for deductions can support claims and ensure accuracy.

Is my bank account information needed for online tax filing?

Yes, if you want a direct deposit for your refund or to make payments directly from your account.

Do I need information about my dependents to file taxes online?

Yes, any dependent’s information can impact tax credits and deductions.

Should I have proof of health insurance coverage when filing online?

Yes, you may need Form 1095 to report and verify your health insurance coverage.

Is it necessary to have my state-issued ID to file taxes online?

Sometimes, a state-issued ID may be required for identity verification when e-filing.

Will I need to provide information on my mortgage interest?

Yes, Form 1098 shows mortgage interest paid and can be used as a deduction.

Should I have records of any charitable donations?

Yes, records of charitable donations can be used for deductions if you itemize.

Do I need information about any education expenses?

Yes, Form 1098-T provides information on tuition payments for potential credits.

Is Social Security income documentation required for online filing?

Yes, if you receive Social Security income, you will need Form SSA-1099.

Are student loan interest deductions applicable when filing online?

Yes, Form 1098-E provides details about interest paid on student loans that may be deductible.

Do I need to report my IRA contributions?

Yes, contributions to IRAs might be deductible and should be reported.

Should I provide brokerage statements for stock sales?

Yes, 1099-B forms report capital gains or losses from stock sales.

Do I need unemployment income documents for online filing?

Yes, Form 1099-G documents any unemployment income received.

Should I gather records of alimony paid or received?

Yes, alimony payments can affect your taxable income and may be deductible.

Are business income records needed for filing online?

Yes, if you are self-employed, record keeping of business income and expenses is crucial.

Do I need to provide documents for any tax credits I'm claiming?

Yes, any documentation supporting claims for tax credits should be gathered for accuracy.

Useful Links

This website offers general information and is not a substitute for professional advice.

Always seek guidance from qualified professionals.

If you have any medical concerns or need urgent help, contact a healthcare professional or emergency services immediately.

Some of this content was generated with AI assistance. We’ve done our best to keep it accurate, helpful, and human-friendly.

- Ergsy carfully checks the information in the videos we provide here.

- Videos shown by Youtube after a video has completed, have NOT been reviewed by ERGSY.

- To view, click the arrow in centre of video.

- Most of the videos you find here will have subtitles and/or closed captions available.

- You may need to turn these on, and choose your preferred language.

- Go to the video you'd like to watch.

- If closed captions (CC) are available, settings will be visible on the bottom right of the video player.

- To turn on Captions, click settings .

- To turn off Captions, click settings again.

More Items From Ergsy search

-

What documents do I need to file my taxes online?

Relevance: 100%

-

Is it safe to file taxes online?

Relevance: 91%

-

Are there free options for filing taxes online?

Relevance: 91%

-

When is the deadline to file taxes online?

Relevance: 90%

-

Can I file taxes online after the deadline?

Relevance: 89%

-

Can I file my taxes online if I'm self-employed?

Relevance: 88%

-

How do I start filing my taxes online?

Relevance: 88%

-

Can I file my state taxes online as well?

Relevance: 86%

-

Can I get help while filing taxes online?

Relevance: 82%

-

What happens after I file my tax return online?

Relevance: 80%

-

What is an online tax return?

Relevance: 80%

-

Starting your online tax return

Relevance: 75%

-

Do I need to send anything by post when filing online?

Relevance: 74%

-

Can I amend an online tax return?

Relevance: 69%

-

Will I get a confirmation when I file online?

Relevance: 67%

-

Is it effective to file a complaint online?

Relevance: 67%

-

Do I need to print and mail my online tax return?

Relevance: 67%

-

How do I verify my identity when filing online?

Relevance: 66%

-

What if I don't have all my tax documents?

Relevance: 65%

-

Do online tax services help maximize my refund?

Relevance: 64%

-

Do I need an accountant to file a Self Assessment tax return?

Relevance: 61%

-

Who needs to file a Self Assessment tax return?

Relevance: 57%

-

What documents do I need to file my taxes online?

Relevance: 56%

-

How do I file VAT returns?

Relevance: 53%

-

What is a Self Assessment tax return?

Relevance: 52%

-

How can I check the status of my online tax return?

Relevance: 51%

-

How do I file a claim with travel insurance?

Relevance: 51%

-

What documents are needed for VAT registration?

Relevance: 48%

-

What if I've moved since the tax year ended?

Relevance: 48%

-

What should I do if I made a mistake on my tax return?

Relevance: 48%

-

When is the deadline to file taxes online?

Relevance: 48%

-

How do I complete my Self Assessment tax return?

Relevance: 47%

-

My first Self Assessment tax return

Relevance: 47%

-

Can I make a claim online?

Relevance: 46%

-

How long does it take to receive a tax refund from HMRC?

Relevance: 46%

-

Can I access my Council Tax payment history online?

Relevance: 45%

-

Do VAT rules apply to online sales?

Relevance: 45%

-

When is the deadline for submitting my Self Assessment tax return?

Relevance: 44%

-

Can I file taxes online after the deadline?

Relevance: 44%

-

Is it necessary to complete a final tax return for the deceased?

Relevance: 44%