Find Help

More Items From Ergsy search

-

What is an income-driven repayment plan?

Relevance: 100%

-

Does applying for an income-driven repayment plan affect my credit score?

Relevance: 83%

-

What should I do if I can't afford to repay my student loan?

Relevance: 51%

-

Can I get my student loans forgiven if I can't repay them?

Relevance: 49%

-

What happens if i can not afford to repay my student loan?

Relevance: 44%

-

Are there implications for student loan repayments with 2026 changes?

Relevance: 40%

-

Student Finance: Should I pay more? | Plan 1 & Plan 2 | SF Explained

Relevance: 37%

-

How does loan consolidation help with repayment?

Relevance: 34%

-

Can my loan repayment terms be renegotiated?

Relevance: 33%

-

Do I need to repay the EV grant?

Relevance: 33%

-

What is loan rehabilitation?

Relevance: 28%

-

Do I have to repay the Winter Fuel Payment if my circumstances change after I've received it?

Relevance: 27%

-

Is bankruptcy an option for student loan discharge?

Relevance: 23%

-

What is deferment and how can it help?

Relevance: 23%

-

How do I qualify for public service loan forgiveness?

Relevance: 23%

-

What happens to my loans if I go back to school?

Relevance: 22%

-

Planning for your funeral

Relevance: 22%

-

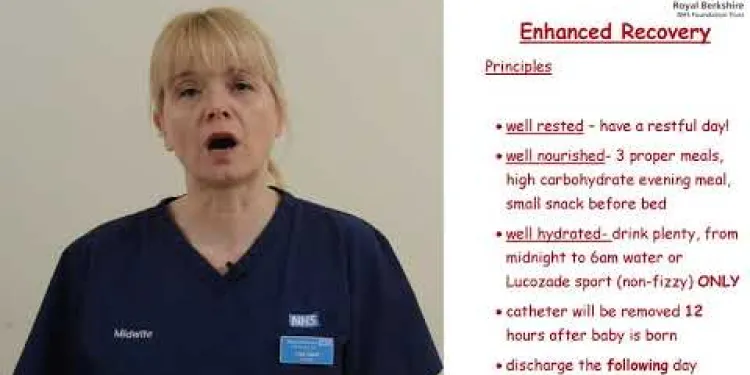

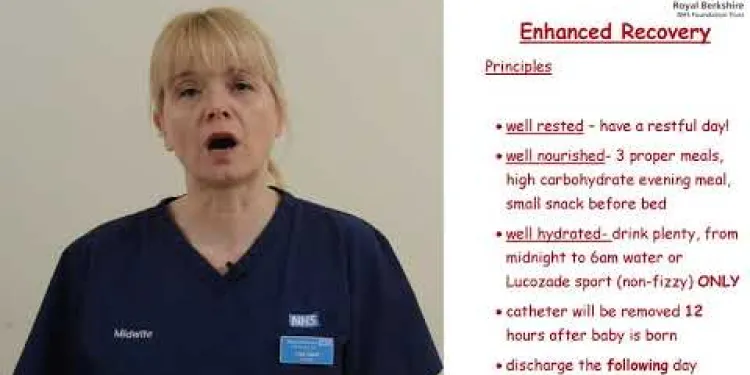

Planned caesarean section

Relevance: 21%

-

Could my payment plan affect how overpayments are handled?

Relevance: 21%

-

What is a pre-paid funeral plan?

Relevance: 21%

-

What is an asthma action plan?

Relevance: 21%

-

Having a planned caesarean section

Relevance: 20%

-

Can interest rates on student loans be reduced?

Relevance: 20%

-

How do I know if I am on the best energy plan?

Relevance: 20%

-

Are there professional advisors for inheritance tax planning?

Relevance: 19%

-

Can a robo-advisor help with pension planning?

Relevance: 19%

-

Can funeral directors offer payment plans?

Relevance: 19%

-

Do water companies have long-term infrastructure plans?

Relevance: 19%

-

Wills, Probate and Tax Planning in the UK

Relevance: 19%

-

How can I plan for future care needs?

Relevance: 18%

-

How often should I review my pension plan?

Relevance: 18%

-

What is the difference between fixed and variable rate plans?

Relevance: 18%

-

Pre operative Information for Planned Caesarean Birth

Relevance: 18%

-

How do renewable energy plans affect my choice of supplier?

Relevance: 18%

-

The NHS Long Term Plan for learning disability and autism

Relevance: 18%

-

Do insurance plans cover the cost of self-testing tools?

Relevance: 18%

-

What is the role of independent financial advisors in pension planning?

Relevance: 18%

-

What happens if I default on my student loan?

Relevance: 17%

-

How will the changes in pension age affect retirement planning?

Relevance: 17%

-

Planning Your Funeral in Advance? | Expert Tips from Celebrants

Relevance: 17%

Understanding Income-Driven Repayment Plans

An income-driven repayment plan is a type of student loan repayment strategy. It is designed to help borrowers manage their federal student debt more effectively. These plans calculate monthly payments based on your income and family size rather than your loan balance.

The objective is to ensure that payments remain affordable, especially for those with lower earnings. By linking payments to income, these plans aim to prevent financial strain. This approach can provide peace of mind for many borrowers.

Types of Income-Driven Repayment Plans

There are several types of income-driven repayment plans. In the US, these include plans like Income-Based Repayment (IBR) and Pay As You Earn (PAYE). Each plan has its own criteria and benefits.

Income-Contingent Repayment (ICR) is another option, providing flexibility. There’s also the Revised Pay As You Earn Plan (REPAYE), which opens opportunities to more borrowers. It's crucial to understand each plan’s specifics to choose the best fit for your situation.

Benefits of Income-Driven Repayment Plans

One significant advantage of these plans is payment reduction. By adjusting payment amounts, they alleviate financial pressure. This is beneficial for those with varying income levels or unexpected financial challenges.

These plans also offer potential loan forgiveness. After making qualifying payments for a set period, remaining balances may be forgiven. This provides a long-term solution for managing substantial debt burdens.

How to Apply for an Income-Driven Repayment Plan

Applying for an income-driven repayment plan involves providing proof of income. The application process usually requires completing specific forms and submitting them to your loan servicer. It’s important to keep documentation current to maintain eligibility.

Reviewing all available options before applying is recommended. Each plan has unique attributes, so understanding these details is vital. Consulting with a financial advisor or loan officer can offer valuable guidance.

Considerations for UK Borrowers

For UK students, similar repayment adjustments exist. However, it's essential to distinguish between UK and US systems. UK loans are often repaid through payroll deductions, tied to income thresholds.

Understanding how UK-based repayment works will ensure successful debt management. For those considering international education, knowing these differences can better prepare you financially. Always explore all avenues for income-contingent repayments to find the best strategy.

Frequently Asked Questions

What is an income-driven repayment plan?

An income-driven repayment plan is a type of federal student loan repayment plan that sets your monthly payment amount based on your income and family size.

What are the types of income-driven repayment plans available?

The types of income-driven repayment plans include Income-Based Repayment (IBR), Pay As You Earn (PAYE), Revised Pay As You Earn (REPAYE), and Income-Contingent Repayment (ICR) plans.

How does an income-driven repayment plan work?

An income-driven repayment plan reduces your monthly student loan payment to a percentage of your discretionary income, taking into account your income and family size.

Who is eligible for an income-driven repayment plan?

Most federal student loan borrowers are eligible for income-driven repayment plans, but specific eligibility criteria can vary by plan.

How do I apply for an income-driven repayment plan?

You can apply for an income-driven repayment plan through your loan servicer or by completing the application on the Federal Student Aid website.

What is considered discretionary income?

Discretionary income is the difference between your adjusted gross income and 150% of the poverty guideline for your family size and state of residence.

How often do I need to recertify my income and family size?

You must recertify your income and family size annually to remain on an income-driven repayment plan.

Can I switch from one income-driven repayment plan to another?

Yes, you can switch from one income-driven repayment plan to another if you qualify for the new plan.

How long can I remain on an income-driven repayment plan?

You can remain on an income-driven repayment plan as long as you continue to qualify, but each plan has a maximum repayment period—usually 20 or 25 years.

Will my payments change over time?

Yes, your payments may change annually based on your updated income and family size information.

What happens if I don't recertify my income on time?

If you don't recertify on time, your payment will revert to the standard repayment amount based on your remaining balance and time left, which may be higher.

Can I make extra payments on an income-driven repayment plan?

Yes, you can make extra payments without penalty, which may help reduce your loan balance and the total interest paid.

Are there disadvantages to an income-driven repayment plan?

One disadvantage is that you may pay more interest over time because payments are initially lower, possibly extending the loan term.

What happens to the remaining balance after the repayment period ends?

Any remaining loan balance may be forgiven after 20 or 25 years of qualifying payments, depending on the plan, but forgiven amounts may be taxable.

Do income-driven repayment plans affect my credit score?

Making on-time payments under an income-driven repayment plan can positively impact your credit score. However, missing payments could have a negative impact.

Are private student loans eligible for income-driven repayment plans?

No, income-driven repayment plans are only available for federal student loans, not private loans.

What is the difference between PAYE and REPAYE plans?

PAYE is only for newer borrowers and requires partial financial hardship, while REPAYE is available to all direct loan borrowers and does not require hardship.

Is interest subsidized under income-driven repayment plans?

Under some plans, like REPAYE, the government may pay a portion of the interest if payments don't cover it, especially for subsidized loans.

Can I qualify for Public Service Loan Forgiveness (PSLF) while on an income-driven repayment plan?

Yes, you can qualify for PSLF while on an income-driven repayment plan if you make qualifying payments while working in qualifying public service employment.

How do income-driven repayment plans affect loan forgiveness?

If you have a balance remaining after 20 or 25 years of qualifying payments under an income-driven repayment plan, that balance may be forgiven, subject to taxation.

Useful Links

This website offers general information and is not a substitute for professional advice.

Always seek guidance from qualified professionals.

If you have any medical concerns or need urgent help, contact a healthcare professional or emergency services immediately.

Some of this content was generated with AI assistance. We’ve done our best to keep it accurate, helpful, and human-friendly.

- Ergsy carfully checks the information in the videos we provide here.

- Videos shown by Youtube after a video has completed, have NOT been reviewed by ERGSY.

- To view, click the arrow in centre of video.

- Most of the videos you find here will have subtitles and/or closed captions available.

- You may need to turn these on, and choose your preferred language.

- Go to the video you'd like to watch.

- If closed captions (CC) are available, settings will be visible on the bottom right of the video player.

- To turn on Captions, click settings .

- To turn off Captions, click settings again.

More Items From Ergsy search

-

What is an income-driven repayment plan?

Relevance: 100%

-

Does applying for an income-driven repayment plan affect my credit score?

Relevance: 83%

-

What should I do if I can't afford to repay my student loan?

Relevance: 51%

-

Can I get my student loans forgiven if I can't repay them?

Relevance: 49%

-

What happens if i can not afford to repay my student loan?

Relevance: 44%

-

Are there implications for student loan repayments with 2026 changes?

Relevance: 40%

-

Student Finance: Should I pay more? | Plan 1 & Plan 2 | SF Explained

Relevance: 37%

-

How does loan consolidation help with repayment?

Relevance: 34%

-

Can my loan repayment terms be renegotiated?

Relevance: 33%

-

Do I need to repay the EV grant?

Relevance: 33%

-

What is loan rehabilitation?

Relevance: 28%

-

Do I have to repay the Winter Fuel Payment if my circumstances change after I've received it?

Relevance: 27%

-

Is bankruptcy an option for student loan discharge?

Relevance: 23%

-

What is deferment and how can it help?

Relevance: 23%

-

How do I qualify for public service loan forgiveness?

Relevance: 23%

-

What happens to my loans if I go back to school?

Relevance: 22%

-

Planning for your funeral

Relevance: 22%

-

Planned caesarean section

Relevance: 21%

-

Could my payment plan affect how overpayments are handled?

Relevance: 21%

-

What is a pre-paid funeral plan?

Relevance: 21%

-

What is an asthma action plan?

Relevance: 21%

-

Having a planned caesarean section

Relevance: 20%

-

Can interest rates on student loans be reduced?

Relevance: 20%

-

How do I know if I am on the best energy plan?

Relevance: 20%

-

Are there professional advisors for inheritance tax planning?

Relevance: 19%

-

Can a robo-advisor help with pension planning?

Relevance: 19%

-

Can funeral directors offer payment plans?

Relevance: 19%

-

Do water companies have long-term infrastructure plans?

Relevance: 19%

-

Wills, Probate and Tax Planning in the UK

Relevance: 19%

-

How can I plan for future care needs?

Relevance: 18%

-

How often should I review my pension plan?

Relevance: 18%

-

What is the difference between fixed and variable rate plans?

Relevance: 18%

-

Pre operative Information for Planned Caesarean Birth

Relevance: 18%

-

How do renewable energy plans affect my choice of supplier?

Relevance: 18%

-

The NHS Long Term Plan for learning disability and autism

Relevance: 18%

-

Do insurance plans cover the cost of self-testing tools?

Relevance: 18%

-

What is the role of independent financial advisors in pension planning?

Relevance: 18%

-

What happens if I default on my student loan?

Relevance: 17%

-

How will the changes in pension age affect retirement planning?

Relevance: 17%

-

Planning Your Funeral in Advance? | Expert Tips from Celebrants

Relevance: 17%