Find Help

More Items From Ergsy search

-

UK House Prices Fall for Third Consecutive Month

Relevance: 100%

-

House Prices Soar: First-Time Buyers Share Their Stories

Relevance: 31%

-

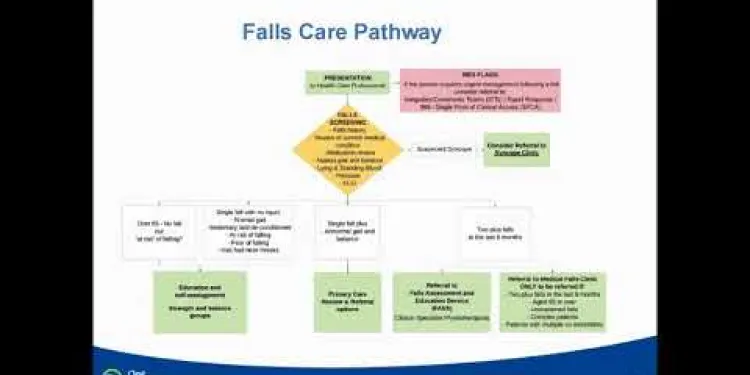

Falls and Falls Prevention

Relevance: 25%

-

Can bereavement leave be taken consecutively with other leaves?

Relevance: 24%

-

Impact of UK Housing Crisis on Local Communities

Relevance: 23%

-

How often is the energy price cap reviewed?

Relevance: 23%

-

Impact of Housing Shortage on Local Communities

Relevance: 23%

-

Rising Property Prices Fuel Concerns Over First-Time Buyer Accessibility

Relevance: 22%

-

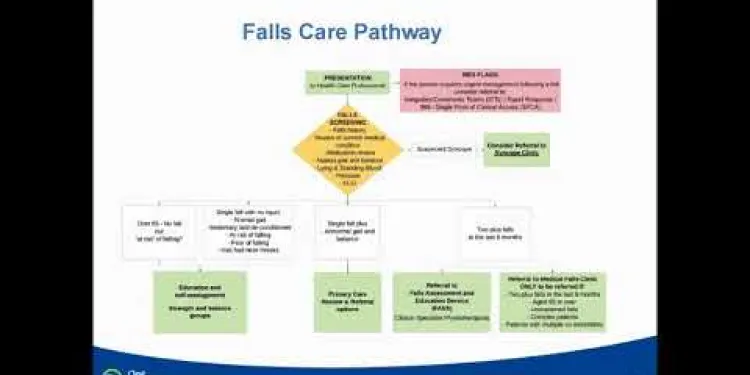

Falls Prevention Podcast

Relevance: 22%

-

How does inflation affect the situation with housing benefits and rents?

Relevance: 22%

-

Why do interest rates rise and fall?

Relevance: 21%

-

Addressing the Housing Crisis: Current Challenges and Solutions

Relevance: 21%

-

What measures are suggested to substitute the housing benefits?

Relevance: 21%

-

Dorothy's Story (Falls/Chest Infection)

Relevance: 20%

-

What is the relationship between rising rents and housing benefit cuts?

Relevance: 20%

-

What factors influence the rise and fall of energy bills in the UK?

Relevance: 20%

-

Are energy prices regulated in the UK?

Relevance: 20%

-

Is it possible to negotiate a better price on a lease?

Relevance: 20%

-

What is the UK's energy price cap?

Relevance: 19%

-

Can fixed-rate tariffs offer better price stability compared to variable tariffs?

Relevance: 19%

-

Falls Prevention - strength and balance exercises

Relevance: 19%

-

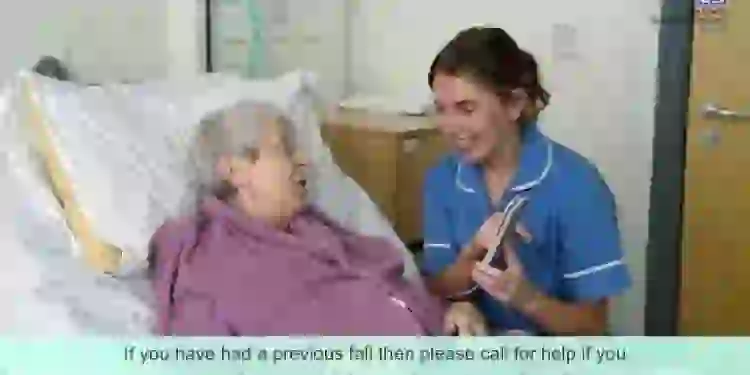

Falls Prevention video for patients attending hospital

Relevance: 19%

-

How is the energy price cap calculated?

Relevance: 19%

-

Can mosquitoes in the UK enter houses?

Relevance: 18%

-

What is the Energy Price Cap in the UK?

Relevance: 18%

-

What role do housing associations have amid these cuts?

Relevance: 18%

-

Have energy prices in the UK historically fluctuated?

Relevance: 18%

-

Who typically pays for the surveyor's report when buying a house?

Relevance: 18%

-

Fallsafe - Put the patient first. Preventing falls in Hospital.

Relevance: 18%

-

Amberwood House (Colten Care)

Relevance: 18%

-

Can the energy price cap go down as well as up?

Relevance: 18%

-

What is the main reason for the proposed cuts to housing benefits?

Relevance: 18%

-

Is a surveyor's report mandatory when buying a house?

Relevance: 18%

-

Is the energy price cap the same for everyone?

Relevance: 18%

-

How do I choose a surveyor for my house purchase?

Relevance: 18%

-

What are the potential long-term impacts of housing benefit cuts?

Relevance: 17%

-

How is the price of Bitcoin determined?

Relevance: 17%

-

What is a surveyor's report in the context of buying a house?

Relevance: 17%

-

What is the energy price cap?

Relevance: 17%

-

How often do energy companies review their electricity prices?

Relevance: 17%

Introduction

The UK housing market has recently witnessed a significant trend, with house prices falling for the third consecutive month. This decline marks a notable shift in the market dynamics, raising questions about the future trajectory of house prices and what it means for buyers, sellers, and investors alike. Several factors contribute to this trend, and understanding them is crucial for anyone involved in the UK property market.

Current Market Conditions

The Office for National Statistics reports that the average UK house price decreased by a significant margin over the past three months. This trend is seen across various regions, though some areas are affected more than others. The fall in house prices follows a period of substantial growth, during which the UK market experienced a boom due to historically low interest rates and increased demand following the COVID-19 lockdowns.

Factors Influencing the Decline

Several factors contribute to the current decline in UK house prices. Rising interest rates have had a profound impact, as the Bank of England has been increasing rates in an attempt to combat inflation. Higher interest rates have made mortgage borrowing more expensive, reducing affordability for potential buyers. Additionally, the cost-of-living crisis, driven by high inflation, is squeezing household budgets, further dampening demand for property.

Another factor is the end of government incentives such as the Stamp Duty holiday, which previously fueled market activity. With these incentives no longer in place, the urgency for buyers to purchase properties quickly has diminished, leading to a cooling in market activity.

Regional Variations

While house prices are falling nationwide, regional variations are evident. London, for instance, has seen sharper declines compared to other areas due to its previously inflated prices and greater exposure to international economic trends. Conversely, some regions in the north of England have seen more modest price reductions, reflecting their more stable economic conditions and affordability relative to the south.

Implications for Buyers and Sellers

The current market environment presents both challenges and opportunities. For buyers, the fall in house prices could represent an opportunity to enter the market at a more affordable level, particularly for first-time buyers. However, the increased cost of borrowing may offset some of these benefits. On the other hand, sellers might face longer selling periods and a need to adjust price expectations to attract buyers in a cooling market.

Future Outlook

Looking ahead, the trajectory of UK house prices will largely depend on economic factors such as interest rate changes, inflation, and overall economic growth. While some experts predict further price declines, others suggest that the market could stabilize in the medium term if economic conditions improve. Ultimately, the response of the housing market will be closely linked to broader economic policies and global economic trends.

Introduction

In the UK, house prices are going down. This means house prices have dropped for three months in a row. This is a big change. It makes people wonder what will happen next. This change affects people buying, selling, or investing in houses. There are reasons for this change, and it's important to know them if you care about houses in the UK.

Current Market Conditions

The Office for National Statistics says that the average UK house price has gone down a lot in the last three months. This is happening in many places, but some places are seeing bigger changes than others. Before this, house prices were going up fast. This was because interest rates were very low, and many people wanted to buy houses after COVID-19 lockdowns ended.

Factors Influencing the Decline

There are several reasons why house prices are going down now. Interest rates are going up because the Bank of England wants to stop prices from rising too fast (inflation). When interest rates are higher, borrowing money to buy a house costs more. This makes it harder for people to buy houses. Also, many people are spending more money on other things because of inflation, so they have less to spend on houses.

Another reason is the end of government help, like the Stamp Duty holiday, which made people want to buy houses quickly before. Now that this help is gone, people feel less rushed to buy houses.

Regional Variations

House prices are falling everywhere, but some places are seeing bigger changes. In London, prices are dropping more compared to other places because prices were really high there before. London is also more affected by changes in the world economy. In the north of England, prices are not falling as much. This is because prices were more stable and affordable there already.

Implications for Buyers and Sellers

For people who want to buy houses, the lower prices could be good news. It might be easier to buy a house for the first time. But borrowing money is more expensive, which is a challenge. For people who want to sell houses, it might take longer to find a buyer. They might have to lower their prices to sell in this cooling market.

Future Outlook

In the future, what happens to house prices will depend on things like interest rates, inflation, and how well the economy is doing. Some experts think prices might go down more. Others believe prices will stay the same if the economy gets better. The housing market will depend on what happens in the wider economy and the world.

Frequently Asked Questions

Why have UK house prices fallen for the third consecutive month?

UK house prices have fallen due to a combination of factors such as rising interest rates, reduced affordability, and economic uncertainties.

How much have UK house prices fallen in the last three months?

The exact percentage varies by region, but recent reports indicate an average decrease of around 1-2% over the past three months.

Are house prices expected to continue falling?

Experts have mixed opinions, but some predict further declines if current economic conditions persist, particularly if interest rates rise further.

What impact does a fall in house prices have on homeowners?

A fall in house prices can reduce the equity homeowners have in their property and may affect their ability to refinance or sell for a profit.

How do falling house prices affect first-time buyers?

Falling house prices can benefit first-time buyers by making homes more affordable, but higher interest rates may offset these gains.

Which regions in the UK are experiencing the most significant house price drops?

Regions such as London and the South East have seen more significant price drops compared to other areas, but it can vary.

What role do interest rates play in the housing market?

Rising interest rates increase mortgage costs, reducing affordability and demand, which can lead to falling house prices.

Are there any government measures in place to stabilize house prices?

The government has policies to support the housing market, but specific measures to stabilize prices currently are limited.

How has the economic outlook affected the housing market?

Economic uncertainties, such as inflation and recession fears, have led to cautious spending and investment, affecting the housing market.

What advice do experts have for homeowners during these times?

Experts often advise homeowners to avoid panic-selling and to hold on to their properties if possible, focusing on long-term value.

How are rental markets affected by falling house prices?

Rental markets might see increased demand as potential buyers delay purchasing homes, potentially leading to higher rents.

Is now a good time to buy a property in the UK?

It depends on individual circumstances, but falling prices can present opportunities for buyers with stable finances and good mortgage deals.

What historical trends suggest about the current fall in house prices?

Historically, house price corrections occur in cycles, often following periods of rapid growth, similar to the current situation.

How do house price trends in the UK compare with those in other countries?

House price trends can vary globally. Some countries are experiencing similar declines, while others see stable or rising prices.

Will falling house prices affect the construction industry?

A sustained decline can lead to reduced demand for new builds, impacting construction activity and related jobs.

How do house price declines impact mortgage lenders?

Lenders may face increased risk as property values fall, affecting the security of their loans and potentially leading to stricter lending criteria.

What should investors consider with the current house price trends?

Investors need to weigh potential risks and benefits, looking for undervalued assets and assessing long-term market stability.

Could the current fall in house prices lead to a housing market crash?

While some fear a crash, others believe regulatory measures and market fundamentals could prevent a severe downturn.

What is the impact of inflation on the housing market?

Inflation erodes purchasing power, affects interest rates, and can lead to higher costs for materials and construction.

How does public sentiment impact the housing market?

Public confidence influences buying and selling behaviors; negative sentiment can exacerbate price declines as people delay purchases.

Why Have UK House Prices Gone Down for Three Months?

UK house prices are going down. This is because of a few reasons:

- Interest rates are going up. This makes it more expensive to borrow money.

- People have less money to spend on houses.

- The economy is not stable. This makes people unsure about the future.

If you find reading hard, try using tools that read text out loud or explain hard words. These can help you understand better.

How much have UK house prices gone down in the last three months?

This question is asking about house prices in the UK. It wants to know how much they have dropped in the last three months.

Let's use simple words to think about this. 'House prices' mean how much people pay to buy houses. 'Gone down' means the prices are less than before.

If you find this hard to understand, you can use some tools to help you. You can ask someone to read it with you. You could also draw or write down what you think it means. These things can help you learn better.

The exact amount is different in each place, but new reports show it has gone down by about 1 to 2 percent over the last three months.

Will house prices keep going down?

Experts do not all agree. Some say prices may go down more if the economy stays the same, especially if the cost of borrowing money goes up.

What happens to homeowners when house prices drop?

When house prices go down, it affects people who own homes. Here is how it can change things for them:

- Their house might be worth less money than before.

- It could be harder to sell the house for a good price.

- If they borrowed money to buy the house, it might be tough if the house is worth less than the loan.

Here are some tools and ideas to help understand:

- Talk to a bank worker for advice.

- Use a simple calculator to see what money is needed.

- Ask a trusted friend or family member to help explain.

If house prices go down, people might not own as much of their house. This means it could be harder for them to borrow money using their house or sell it for more money than they paid.

What happens to first-time home buyers when house prices go down?

If houses cost less money, it can be good for people buying a house for the first time.

- They might be able to buy a house with less money.

- They could have lower loan payments each month.

- It might be easier to save up for a house deposit.

To help understand more, they can use tools like:

- A calculator to see how much they can afford.

- A guide that explains how to buy a house step by step.

When house prices go down, it can help people buying a home for the first time because the homes cost less money. But, the cost of borrowing money (interest) might go up, which can make homes cost more again.

Where are house prices going down the most in the UK?

In some places like London and the South East, house prices have gone down a lot. But in other places, prices might be different.

How do interest rates affect buying houses?

Interest rates are like extra money you pay when you borrow money. They make buying a house more expensive or cheaper.

If interest rates are low, it costs less extra money. More people can buy houses.

If interest rates are high, it costs more extra money. Fewer people can buy houses.

When you want to understand this better, use pictures or charts. They can help you see how interest rates change buying a house.

When interest rates go up, it costs more to pay for a home loan. This makes it harder for people to afford houses and fewer people want to buy. This can make house prices go down.

What is the government doing to keep house prices steady?

The government has some plans to help with housing, but they do not have many ways to keep house prices steady right now.

How is the money situation changing houses?

Money worries, like prices going up and fears of a weak economy, make people spend and invest less. This is affecting the housing market.

What tips do experts have for people who own homes right now?

- Experts are people who know a lot. - A homeowner is someone who owns a house. - Right now means today or these days. Here are some tips: - Keep some money saved just in case. - Make sure your house is safe and in good shape. - Ask for help if you have questions. You can also: - Use apps or tools to help with money. - Talk to someone who is good with houses, like a builder or a plumber. - Take notes so you remember things better.Experts say it's best not to rush and sell your house quickly. Try to keep your house if you can. It might be worth more later on.

What happens to renting when house prices go down?

More people might want to rent homes instead of buying them. This could make rents go up.

Is it a good time to buy a house in the UK now?

Are you thinking about buying a house in the UK?

Here are a few things to think about:

- How much money do you have saved?

- Do you have a stable job?

- Have you looked at house prices in the area?

It can help to talk to a family member or friend. You could also use tools that explain house prices and loans in simple language.

Prices going down can be good for people who want to buy. But it's best for those who have steady money and a good loan.

What can history tell us about house prices going down now?

House prices go up and down in cycles. This means they change in a pattern over time. After prices go up quickly, they often come down. This is happening now too.

Do house prices in the UK go up or down like they do in other countries?

Let's talk about how house prices in the UK change compared to other places.

Try using pictures or graphs to see these changes. This can make it easier to understand.

House prices are changing in different ways around the world. In some places, house prices are going down. In other places, they are staying the same or going up.

If it helps, you can use pictures or videos to understand this better. Talking to someone about what you read can also be useful.

Will Lower House Prices Change Building Work?

If house prices go down, will it change how many buildings get built? Let's think about it. When houses cost less money, it might be harder for builders to make money. So, builders might build fewer new houses.

Would you like to learn more? Try using pictures and videos to understand. Ask someone to explain it with simple words. You can also draw your ideas on paper.

If things keep going down, fewer people will want to build new homes. This can mean less work for builders and fewer jobs in construction.

What happens to banks when house prices go down?

Banks and people who lend money might worry if house prices go down. This is because their loans are not as safe when this happens. They might make it harder to borrow money.

Helpful Tip: If reading is difficult, try using tools like text-to-speech apps to have words read out loud.

What should people think about when buying or selling a house today?

Here are some simple ideas to help you:

- Watch Prices: Look at how house prices are changing. Are they going up or down?

- Talk to Experts: Speak to people who know a lot about houses. They can be real estate agents or financial advisors.

- Use Tools: Online tools like housing market reports can give you useful information.

- Think Long-Term: Consider if you want to keep the house for many years.

These tips can help you make smart choices with houses.

People who invest money should think about the good and bad things that can happen. They should look for things that are worth less than they should be and see if the market will stay steady for a long time.

Helpful tools:

- Use pictures or charts to understand better.

- Ask someone to explain if you're not sure.

Could falling house prices cause big problems?

House prices are going down. A lot of people are asking if this could make big problems in the housing market. Here are some things to think about:

- When house prices fall a lot, people might worry about buying or selling houses.

- If prices keep dropping, some people might owe more money on their house than it is worth.

- Some people might lose money if they need to sell their house when prices are low.

Talking to a grown-up or an expert can help you understand more about what is happening. You can also use websites or apps that help explain money and houses in simple words.

Some people are worried that the market might crash. But, others think rules and market health could stop a big problem.

How does rising prices affect houses people buy and sell?

When prices go up, money can buy less. This is called inflation. It can change how much you pay to borrow money and make things more expensive to build.

How do people's feelings change house prices?

People’s feelings can change house prices. If people feel good about buying houses, more people want to buy. This can make house prices go up.

If people feel worried or scared, fewer people buy houses. This can make house prices go down.

To understand more, you can:

- Ask someone to explain it to you.

- Look at pictures or videos about house prices and feelings.

What people think affects how they buy and sell things. If people feel bad about the market, they might wait to buy, and prices can go down more.

Useful Links

This website offers general information and is not a substitute for professional advice.

Always seek guidance from qualified professionals.

If you have any medical concerns or need urgent help, contact a healthcare professional or emergency services immediately.

Some of this content was generated with AI assistance. We’ve done our best to keep it accurate, helpful, and human-friendly.

- Ergsy carfully checks the information in the videos we provide here.

- Videos shown by Youtube after a video has completed, have NOT been reviewed by ERGSY.

- To view, click the arrow in centre of video.

- Most of the videos you find here will have subtitles and/or closed captions available.

- You may need to turn these on, and choose your preferred language.

- Go to the video you'd like to watch.

- If closed captions (CC) are available, settings will be visible on the bottom right of the video player.

- To turn on Captions, click settings .

- To turn off Captions, click settings again.

More Items From Ergsy search

-

UK House Prices Fall for Third Consecutive Month

Relevance: 100%

-

House Prices Soar: First-Time Buyers Share Their Stories

Relevance: 31%

-

Falls and Falls Prevention

Relevance: 25%

-

Can bereavement leave be taken consecutively with other leaves?

Relevance: 24%

-

Impact of UK Housing Crisis on Local Communities

Relevance: 23%

-

How often is the energy price cap reviewed?

Relevance: 23%

-

Impact of Housing Shortage on Local Communities

Relevance: 23%

-

Rising Property Prices Fuel Concerns Over First-Time Buyer Accessibility

Relevance: 22%

-

Falls Prevention Podcast

Relevance: 22%

-

How does inflation affect the situation with housing benefits and rents?

Relevance: 22%

-

Why do interest rates rise and fall?

Relevance: 21%

-

Addressing the Housing Crisis: Current Challenges and Solutions

Relevance: 21%

-

What measures are suggested to substitute the housing benefits?

Relevance: 21%

-

Dorothy's Story (Falls/Chest Infection)

Relevance: 20%

-

What is the relationship between rising rents and housing benefit cuts?

Relevance: 20%

-

What factors influence the rise and fall of energy bills in the UK?

Relevance: 20%

-

Are energy prices regulated in the UK?

Relevance: 20%

-

Is it possible to negotiate a better price on a lease?

Relevance: 20%

-

What is the UK's energy price cap?

Relevance: 19%

-

Can fixed-rate tariffs offer better price stability compared to variable tariffs?

Relevance: 19%

-

Falls Prevention - strength and balance exercises

Relevance: 19%

-

Falls Prevention video for patients attending hospital

Relevance: 19%

-

How is the energy price cap calculated?

Relevance: 19%

-

Can mosquitoes in the UK enter houses?

Relevance: 18%

-

What is the Energy Price Cap in the UK?

Relevance: 18%

-

What role do housing associations have amid these cuts?

Relevance: 18%

-

Have energy prices in the UK historically fluctuated?

Relevance: 18%

-

Who typically pays for the surveyor's report when buying a house?

Relevance: 18%

-

Fallsafe - Put the patient first. Preventing falls in Hospital.

Relevance: 18%

-

Amberwood House (Colten Care)

Relevance: 18%

-

Can the energy price cap go down as well as up?

Relevance: 18%

-

What is the main reason for the proposed cuts to housing benefits?

Relevance: 18%

-

Is a surveyor's report mandatory when buying a house?

Relevance: 18%

-

Is the energy price cap the same for everyone?

Relevance: 18%

-

How do I choose a surveyor for my house purchase?

Relevance: 18%

-

What are the potential long-term impacts of housing benefit cuts?

Relevance: 17%

-

How is the price of Bitcoin determined?

Relevance: 17%

-

What is a surveyor's report in the context of buying a house?

Relevance: 17%

-

What is the energy price cap?

Relevance: 17%

-

How often do energy companies review their electricity prices?

Relevance: 17%