Find Help

More Items From Ergsy search

-

How does age affect holiday insurance policies?

Relevance: 100%

-

Are pre-existing medical conditions covered by holiday insurance policies?

Relevance: 79%

-

What is travel assistance in a holiday insurance policy?

Relevance: 78%

-

What are policy exclusions I should be aware of when buying holiday insurance?

Relevance: 75%

-

How do I choose good holiday insurance?

Relevance: 68%

-

Why is it important to compare holiday insurance providers?

Relevance: 66%

-

Is it necessary to have cancellation coverage in holiday insurance?

Relevance: 66%

-

What is the difference between single-trip and annual holiday insurance?

Relevance: 65%

-

How soon should I purchase holiday insurance before my trip?

Relevance: 62%

-

How can I determine the amount of coverage needed for my holiday insurance?

Relevance: 62%

-

What factors should I consider when choosing holiday insurance?

Relevance: 62%

-

Should I buy holiday insurance from a travel agent or search independently?

Relevance: 61%

-

Is it necessary to have holiday insurance if I have a credit card with travel benefits?

Relevance: 61%

-

How does the destination influence holiday insurance coverage?

Relevance: 60%

-

Does holiday insurance cover travel delays or missed connections?

Relevance: 60%

-

Can I purchase holiday insurance after I've started my trip?

Relevance: 56%

-

What should I do if my holiday insurance claim is denied?

Relevance: 55%

-

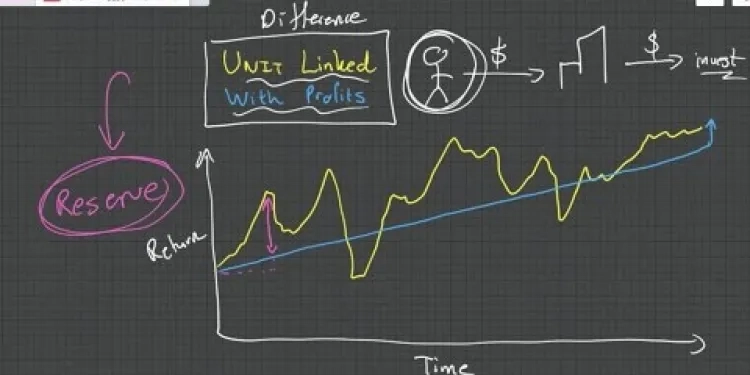

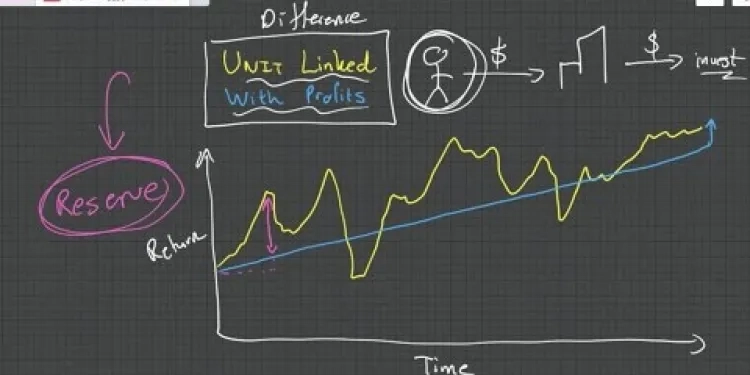

Life Insurance Difference between Unit Linked and With Profit Policies

Relevance: 50%

-

How does inheritance tax apply to life insurance policies?

Relevance: 48%

-

How does inheritance tax affect life insurance policies?

Relevance: 48%

-

The Devious Car Insurance Scam Hidden In Your Policy! And How to Deal With it

Relevance: 46%

-

What was the Stamp Duty holiday in the UK?

Relevance: 41%

-

Explaining Car insurance in the UK??

Relevance: 39%

-

Are live-in caregivers available on weekends and holidays?

Relevance: 39%

-

What is travel insurance?

Relevance: 39%

-

How long does travel insurance coverage last?

Relevance: 39%

-

Should You Get Life Insurance UK | Life Insurance & Life Assurance

Relevance: 38%

-

Is it necessary to have travel insurance for domestic trips?

Relevance: 37%

-

When should I buy travel insurance?

Relevance: 37%

-

Why is it important to buy travel insurance early?

Relevance: 37%

-

Do insurance rates increase for drivers over 70?

Relevance: 36%

-

Do UK citizens need travel insurance for Europe?

Relevance: 36%

-

Does travel insurance cover trip interruptions?

Relevance: 36%

-

What is a pre-existing condition waiver in travel insurance?

Relevance: 35%

-

Can I buy travel insurance after I've started my trip?

Relevance: 35%

-

Does life insurance cover funeral costs?

Relevance: 35%

-

Are professionals insured against negligence claims?

Relevance: 34%

-

Are life insurance payouts subject to Inheritance Tax?

Relevance: 34%

-

When should I buy travel insurance?

Relevance: 34%

-

Can travel insurance be refunded if my trip is canceled?

Relevance: 34%

Understanding the Basics of Holiday Insurance

Holiday insurance, also known as travel insurance, provides coverage for unexpected events while traveling. It typically covers medical emergencies, trip cancellations, and lost belongings.

Age is a significant factor that influences the terms and cost of holiday insurance policies. Insurers consider age when assessing risk, which impacts premium rates and coverage options.

Why Age Matters in Holiday Insurance

Age affects how insurers assess the likelihood of a claim. Older travelers are considered higher risk due to potential health issues, impacting policy conditions.

Younger travelers typically pay lower premiums, but age-based restrictions may apply, such as limited coverage for specific activities or higher excess amounts.

Premium Costs for Different Age Groups

Insurance premiums generally increase with age. Travelers over 65 can expect to pay more due to higher perceived risks, such as needing medical assistance abroad.

Younger travelers, especially those under 25, tend to receive more affordable rates, as they are less likely to file health-related claims. However, coverage options might be limited.

Impact of Age on Coverage Options

The coverage offered can differ based on age. For older travelers, certain pre-existing conditions may not be covered, or may require additional premiums.

Younger travelers might find coverage for adventurous activities included, while older age groups may face exclusions or require extra coverage for these activities.

Common Age-related Exclusions

Insurance policies often have age limits for specific benefits. For instance, adventure sports may have upper age limits, requiring additional cover if exceeded.

Older travelers may find exclusions on certain medical conditions, particularly if deemed pre-existing, impacting coverage availability.

Tips for Finding the Right Policy Based on Age

It's crucial to compare policies from multiple providers, as they cater differently to age groups. Look for policies specifically tailored for seniors or for those under 25.

Consider the level of coverage needed versus the cost. Ensure that medical coverage is sufficient, particularly for older travelers with health concerns.

Check the details regarding exclusions and limits, especially if engaging in activities that might be age-restricted.

Frequently Asked Questions

How does age impact holiday insurance premiums?

As you age, holiday insurance premiums typically increase due to the higher risk of health-related issues and higher chances of claims.

Are there age limits for purchasing holiday insurance?

Some insurers have age limits, often set at 65, 70, or sometimes 80 years, but there are policies specifically designed for older travelers.

Do older travelers need special holiday insurance policies?

Yes, older travelers might benefit from tailored policies that consider their unique health and travel needs, often called senior travel insurance.

Will pre-existing conditions affect my holiday insurance if I'm older?

Yes, pre-existing conditions can impact coverage and premiums, and it's crucial to declare them when purchasing insurance.

Does holiday insurance cover age-related medical emergencies?

Most holiday insurance policies cover medical emergencies, but coverage specifics can vary, especially for age-related conditions.

Can older adults get multi-trip holiday insurance?

Yes, older adults can get multi-trip insurance, but it may be more expensive and have more restrictions than single-trip insurance.

Does turning 65 significantly change my holiday insurance options?

At 65, some insurers may adjust premiums or options, but many policies are still available for those over 65.

What should older travelers look for in a holiday insurance policy?

Older travelers should look for comprehensive medical coverage, coverage for pre-existing conditions, and emergency support.

How can I find holiday insurance tailored for seniors?

Specialized providers and comparison websites can help find policies tailored for seniors with coverage for specific needs.

Are there any discounts available for older travelers on holiday insurance?

Discounts are less common for older travelers, but some insurers offer loyalty discounts or discounts for specific membership organizations.

Do holiday insurance policies get more expensive after age 75?

Yes, insurance policies typically become more expensive after age 75 due to increased health risks.

Can older travelers be denied holiday insurance coverage?

While age alone shouldn't deny coverage, some insurers may refuse coverage based on health risks or pre-existing conditions.

How does age affect coverage limits in holiday insurance?

Some insurers may impose lower coverage limits for older travelers, especially for medical expenses.

Does age impact the types of activities covered by holiday insurance?

Certain policies may exclude high-risk activities for older travelers, so it's important to review activity coverage carefully.

Are there specific claims older adults are more likely to file?

Older adults are more likely to claim for medical expenses and trip cancellations due to health issues.

Can older travelers extend their holiday insurance coverage while abroad?

Yes, many insurers allow extensions, but it's best to arrange this before departure or check conditions while purchasing the policy.

Is it more difficult for older travelers to find holiday insurance for long trips?

Long-term travel insurance can be more complex for older travelers, but there are policies that cater to extended stays.

How does age affect claims processing in holiday insurance?

Age itself typically doesn't affect processing, but claims involving medical issues may require more detailed documentation.

Can older travelers buy holiday insurance for destinations with high-risk levels?

Yes, but coverage might be limited or more expensive; consulting specialized providers is often necessary for high-risk destinations.

Do holiday insurance policies for older adults include repatriation coverage?

Most comprehensive policies, including those for seniors, include repatriation coverage, but checking the specifics is advisable.

Useful Links

This website offers general information and is not a substitute for professional advice.

Always seek guidance from qualified professionals.

If you have any medical concerns or need urgent help, contact a healthcare professional or emergency services immediately.

Some of this content was generated with AI assistance. We’ve done our best to keep it accurate, helpful, and human-friendly.

- Ergsy carfully checks the information in the videos we provide here.

- Videos shown by Youtube after a video has completed, have NOT been reviewed by ERGSY.

- To view, click the arrow in centre of video.

- Most of the videos you find here will have subtitles and/or closed captions available.

- You may need to turn these on, and choose your preferred language.

- Go to the video you'd like to watch.

- If closed captions (CC) are available, settings will be visible on the bottom right of the video player.

- To turn on Captions, click settings .

- To turn off Captions, click settings again.

More Items From Ergsy search

-

How does age affect holiday insurance policies?

Relevance: 100%

-

Are pre-existing medical conditions covered by holiday insurance policies?

Relevance: 79%

-

What is travel assistance in a holiday insurance policy?

Relevance: 78%

-

What are policy exclusions I should be aware of when buying holiday insurance?

Relevance: 75%

-

How do I choose good holiday insurance?

Relevance: 68%

-

Why is it important to compare holiday insurance providers?

Relevance: 66%

-

Is it necessary to have cancellation coverage in holiday insurance?

Relevance: 66%

-

What is the difference between single-trip and annual holiday insurance?

Relevance: 65%

-

How soon should I purchase holiday insurance before my trip?

Relevance: 62%

-

How can I determine the amount of coverage needed for my holiday insurance?

Relevance: 62%

-

What factors should I consider when choosing holiday insurance?

Relevance: 62%

-

Should I buy holiday insurance from a travel agent or search independently?

Relevance: 61%

-

Is it necessary to have holiday insurance if I have a credit card with travel benefits?

Relevance: 61%

-

How does the destination influence holiday insurance coverage?

Relevance: 60%

-

Does holiday insurance cover travel delays or missed connections?

Relevance: 60%

-

Can I purchase holiday insurance after I've started my trip?

Relevance: 56%

-

What should I do if my holiday insurance claim is denied?

Relevance: 55%

-

Life Insurance Difference between Unit Linked and With Profit Policies

Relevance: 50%

-

How does inheritance tax apply to life insurance policies?

Relevance: 48%

-

How does inheritance tax affect life insurance policies?

Relevance: 48%

-

The Devious Car Insurance Scam Hidden In Your Policy! And How to Deal With it

Relevance: 46%

-

What was the Stamp Duty holiday in the UK?

Relevance: 41%

-

Explaining Car insurance in the UK??

Relevance: 39%

-

Are live-in caregivers available on weekends and holidays?

Relevance: 39%

-

What is travel insurance?

Relevance: 39%

-

How long does travel insurance coverage last?

Relevance: 39%

-

Should You Get Life Insurance UK | Life Insurance & Life Assurance

Relevance: 38%

-

Is it necessary to have travel insurance for domestic trips?

Relevance: 37%

-

When should I buy travel insurance?

Relevance: 37%

-

Why is it important to buy travel insurance early?

Relevance: 37%

-

Do insurance rates increase for drivers over 70?

Relevance: 36%

-

Do UK citizens need travel insurance for Europe?

Relevance: 36%

-

Does travel insurance cover trip interruptions?

Relevance: 36%

-

What is a pre-existing condition waiver in travel insurance?

Relevance: 35%

-

Can I buy travel insurance after I've started my trip?

Relevance: 35%

-

Does life insurance cover funeral costs?

Relevance: 35%

-

Are professionals insured against negligence claims?

Relevance: 34%

-

Are life insurance payouts subject to Inheritance Tax?

Relevance: 34%

-

When should I buy travel insurance?

Relevance: 34%

-

Can travel insurance be refunded if my trip is canceled?

Relevance: 34%