Find Help

More Items From Ergsy search

-

What is a Balance Transfer Credit Card?

Relevance: 100%

-

Can I transfer a balance to a card with no promotional offer?

Relevance: 97%

-

What are the benefits of a balance transfer credit card?

Relevance: 97%

-

How do I apply for a balance transfer card?

Relevance: 96%

-

Can I transfer balances from any credit card?

Relevance: 96%

-

Can I transfer a balance from a loan to a credit card?

Relevance: 95%

-

Can I use a balance transfer card for new purchases?

Relevance: 95%

-

What is a good credit score to qualify for a balance transfer card?

Relevance: 89%

-

Is a balance transfer the right choice for me?

Relevance: 86%

-

What is a balance transfer credit limit?

Relevance: 86%

-

How does a balance transfer work?

Relevance: 85%

-

Are there any fees associated with balance transfers?

Relevance: 85%

-

Do balance transfer offers apply to new purchases?

Relevance: 82%

-

Will transferring a balance affect my credit score?

Relevance: 81%

-

What is the typical duration of a promotional balance transfer offer?

Relevance: 81%

-

How long does a balance transfer take?

Relevance: 80%

-

Can I transfer cashback rewards to another credit card?

Relevance: 73%

-

Credit Cards for Beginners Explained UK | Do's and Don't | Type of Cards

Relevance: 64%

-

Credit Cards for Beginners Explained UK | Do's and Don't | Type of Cards

Relevance: 63%

-

How does a cashback credit card work?

Relevance: 50%

-

What happens when the introductory APR period ends?

Relevance: 49%

-

Is a cashback credit card right for me?

Relevance: 49%

-

What is a cashback credit card?

Relevance: 48%

-

Are there any drawbacks to using a cashback credit card?

Relevance: 44%

-

What should I look for in a cashback credit card?

Relevance: 44%

-

What fees should I avoid when choosing a new bank?

Relevance: 44%

-

How can I redeem my cashback rewards?

Relevance: 41%

-

What should I consider before doing a balance transfer?

Relevance: 41%

-

Will a cashback credit card help improve my credit score?

Relevance: 39%

-

What is credit card fraud?

Relevance: 39%

-

Is the physical card still valid after 2025?

Relevance: 38%

-

Can I transfer my ISA between providers?

Relevance: 37%

-

Do I earn cashback on all purchases?

Relevance: 37%

-

How are embryos transferred during IVF?

Relevance: 36%

-

What is the difference between flat-rate and tiered cashback cards?

Relevance: 36%

-

Is there a minimum transfer amount required?

Relevance: 36%

-

Are there any hidden fees with Monzo or Revolut?

Relevance: 36%

-

How many embryos are usually transferred in IVF?

Relevance: 35%

-

Can I use my EHIC card for medical treatment in the EU?

Relevance: 35%

-

What are some examples of hidden fees in banking?

Relevance: 34%

Understanding Balance Transfer Cards

A balance transfer card is a type of credit card that allows you to transfer existing debt from one or more cards to a new card with a lower interest rate. Often offering an introductory 0% interest period, these cards can help you manage debt more efficiently by reducing the amount you pay in interest.

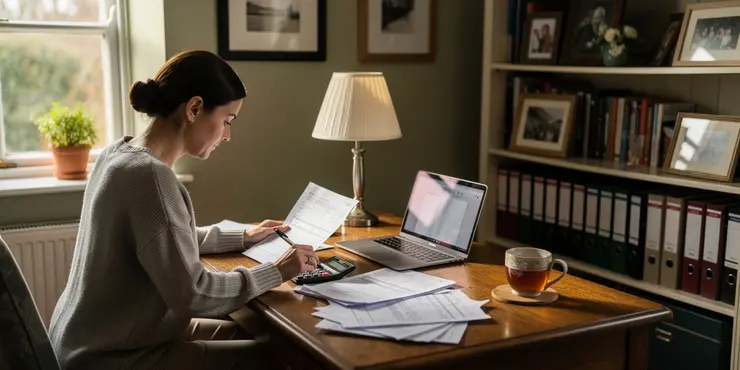

Assess Your Financial Situation

Before applying for a balance transfer card, it is crucial to assess your financial situation. Calculate your total existing credit card debt and determine how much you can realistically pay each month. This assessment will guide you in selecting a card with suitable terms and rates. Ensure that you have a clear plan to repay the debt within the promotional interest-free period to maximize savings.

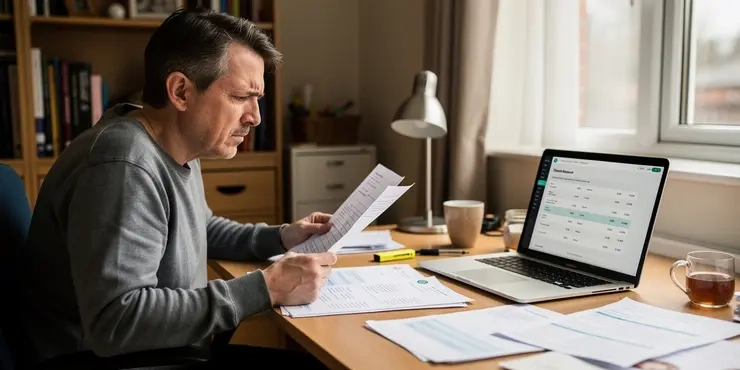

Research Card Options

There are numerous balance transfer cards available in the UK market, each offering different terms. Use online comparison tools and websites to research these options. Look for cards offering a lengthy 0% interest period, low or no balance transfer fees, and manageable revert rates once the promotional period ends. Carefully read the terms and conditions to ensure the card you choose aligns with your financial goals and repayment plan.

Check Eligibility Requirements

Balance transfer card providers have specific eligibility requirements. Typically, you need a good credit score, a stable income, and a residential address in the UK. Some providers also require you to be over 18 or even 21 years of age. Review these requirements to ensure you qualify before applying. Many providers offer eligibility checkers on their websites that allow you to check your chances of being approved without impacting your credit score.

Complete the Application Process

Once you have selected a suitable balance transfer card, proceed with the application. This can usually be done online through the card provider's website. Prepare personal information such as your name, address, employment details, and financial information. You may also need to specify the balances you wish to transfer and provide details of your existing credit cards. Submit your application and wait for a decision, which can sometimes be instantaneous or take a few days.

After Approval

If approved, your new card provider will manage the balance transfer. This process can take up to two weeks. Once completed, ensure you understand your new card’s terms, such as the length of the 0% interest period and any fees involved. Make at least the minimum monthly payment on time to avoid fees and potential loss of the promotional rate. It's also advisable to avoid making new purchases with the card to focus on repaying the transferred balance.

Frequently Asked Questions

What is a balance transfer card?

A balance transfer card allows you to transfer existing credit card debt to a new card with a lower interest rate.

How do I apply for a balance transfer card?

You can apply online through the card issuer's website or by visiting a bank branch. Ensure you meet the eligibility criteria and have necessary documents ready.

What details do I need to provide when applying?

You'll need to provide personal information, financial details, employment information, and details of the debt you want to transfer.

Do I need a good credit score to apply?

Generally, a good to excellent credit score improves your chances of approval for a balance transfer card with a low interest rate.

How soon will I know if my application is approved?

Most applications are processed within a few minutes to a few days. The issuer will notify you of their decision.

Can I transfer balances from multiple cards?

Yes, many balance transfer cards allow you to consolidate debt from multiple cards, up to your approved credit limit.

Is there a fee for balance transfers?

Most balance transfer cards charge a transfer fee, usually a percentage of the amount transferred, though some offer no-fee transfers.

What should I consider when choosing a balance transfer card?

Look at the introductory interest rate, duration of the low rate period, balance transfer fees, and any additional card benefits.

What is an introductory interest rate period?

An introductory interest rate period is a duration, often 6-21 months, during which the transferred balance incurs little or no interest.

Can I transfer balances to an existing card?

Balance transfers must usually be to a new credit card, but some issuers allow transfers to existing cards if they offer promotions.

What happens if I don't pay off the balance by the end of the introductory period?

The remaining balance will be subject to the card's regular interest rate, which can be considerably higher.

Can I use a balance transfer card for new purchases?

Yes, but new purchases may not benefit from the same low interest rate as balance transfers and may incur higher interest.

How much can I transfer to a balance transfer card?

You can transfer up to the card's credit limit, minus any applicable fees. Check the card issuer's terms for specifics.

Will applying for a balance transfer card impact my credit score?

A hard inquiry is typically made on your credit report when you apply, which might slightly lower your credit score temporarily.

Can I cancel a balance transfer request?

Once a balance transfer is processed, it usually cannot be cancelled. Contact the issuer immediately if there’s a mistake.

How long does a balance transfer take to complete?

A balance transfer typically takes 5-7 business days to complete but can sometimes take up to three weeks.

Are there any eligibility requirements for applying?

Eligibility depends on the issuer but generally includes minimum income thresholds and residency status requirements.

What is the typical interest rate after the introductory period?

After the introductory period, the interest rate often returns to the card’s standard APR, which is usually higher.

How can I increase my chances of approval?

Maintain a good credit score, ensure a low debt-to-income ratio, and check that you meet all the application requirements.

What should I do if my application is denied?

Contact the issuer to understand the reasons for the denial. Review your credit report and consider improving your credit before reapplying.

Useful Links

This website offers general information and is not a substitute for professional advice.

Always seek guidance from qualified professionals.

If you have any medical concerns or need urgent help, contact a healthcare professional or emergency services immediately.

Some of this content was generated with AI assistance. We’ve done our best to keep it accurate, helpful, and human-friendly.

- Ergsy carfully checks the information in the videos we provide here.

- Videos shown by Youtube after a video has completed, have NOT been reviewed by ERGSY.

- To view, click the arrow in centre of video.

- Most of the videos you find here will have subtitles and/or closed captions available.

- You may need to turn these on, and choose your preferred language.

- Go to the video you'd like to watch.

- If closed captions (CC) are available, settings will be visible on the bottom right of the video player.

- To turn on Captions, click settings .

- To turn off Captions, click settings again.

More Items From Ergsy search

-

What is a Balance Transfer Credit Card?

Relevance: 100%

-

Can I transfer a balance to a card with no promotional offer?

Relevance: 97%

-

What are the benefits of a balance transfer credit card?

Relevance: 97%

-

How do I apply for a balance transfer card?

Relevance: 96%

-

Can I transfer balances from any credit card?

Relevance: 96%

-

Can I transfer a balance from a loan to a credit card?

Relevance: 95%

-

Can I use a balance transfer card for new purchases?

Relevance: 95%

-

What is a good credit score to qualify for a balance transfer card?

Relevance: 89%

-

Is a balance transfer the right choice for me?

Relevance: 86%

-

What is a balance transfer credit limit?

Relevance: 86%

-

How does a balance transfer work?

Relevance: 85%

-

Are there any fees associated with balance transfers?

Relevance: 85%

-

Do balance transfer offers apply to new purchases?

Relevance: 82%

-

Will transferring a balance affect my credit score?

Relevance: 81%

-

What is the typical duration of a promotional balance transfer offer?

Relevance: 81%

-

How long does a balance transfer take?

Relevance: 80%

-

Can I transfer cashback rewards to another credit card?

Relevance: 73%

-

Credit Cards for Beginners Explained UK | Do's and Don't | Type of Cards

Relevance: 64%

-

Credit Cards for Beginners Explained UK | Do's and Don't | Type of Cards

Relevance: 63%

-

How does a cashback credit card work?

Relevance: 50%

-

What happens when the introductory APR period ends?

Relevance: 49%

-

Is a cashback credit card right for me?

Relevance: 49%

-

What is a cashback credit card?

Relevance: 48%

-

Are there any drawbacks to using a cashback credit card?

Relevance: 44%

-

What should I look for in a cashback credit card?

Relevance: 44%

-

What fees should I avoid when choosing a new bank?

Relevance: 44%

-

How can I redeem my cashback rewards?

Relevance: 41%

-

What should I consider before doing a balance transfer?

Relevance: 41%

-

Will a cashback credit card help improve my credit score?

Relevance: 39%

-

What is credit card fraud?

Relevance: 39%

-

Is the physical card still valid after 2025?

Relevance: 38%

-

Can I transfer my ISA between providers?

Relevance: 37%

-

Do I earn cashback on all purchases?

Relevance: 37%

-

How are embryos transferred during IVF?

Relevance: 36%

-

What is the difference between flat-rate and tiered cashback cards?

Relevance: 36%

-

Is there a minimum transfer amount required?

Relevance: 36%

-

Are there any hidden fees with Monzo or Revolut?

Relevance: 36%

-

How many embryos are usually transferred in IVF?

Relevance: 35%

-

Can I use my EHIC card for medical treatment in the EU?

Relevance: 35%

-

What are some examples of hidden fees in banking?

Relevance: 34%