Find Help

More Items From Ergsy search

-

Do all businesses need to charge VAT?

Relevance: 100%

-

What is reverse charge VAT?

Relevance: 86%

-

What is the VAT rate that I need to charge?

Relevance: 83%

-

Do I need to register my business for VAT?

Relevance: 81%

-

When should a business register for VAT?

Relevance: 80%

-

What is VAT?

Relevance: 65%

-

Who needs to register for VAT?

Relevance: 62%

-

Are there exemptions from registering for VAT?

Relevance: 62%

-

What is a VAT number?

Relevance: 62%

-

Are there grants for businesses to install charging points?

Relevance: 62%

-

What is the threshold for mandatory VAT registration?

Relevance: 62%

-

Can I register for VAT voluntarily?

Relevance: 61%

-

Can I reclaim VAT on purchases?

Relevance: 61%

-

How do I deregister for VAT?

Relevance: 60%

-

Do VAT rules apply to online sales?

Relevance: 59%

-

How long does it take to register for VAT?

Relevance: 59%

-

Can businesses be charged Stamp Duty?

Relevance: 58%

-

How do I file VAT returns?

Relevance: 57%

-

What documents are needed for VAT registration?

Relevance: 53%

-

What happens if I don't register for VAT when required?

Relevance: 53%

-

What records do I need to keep for VAT?

Relevance: 53%

-

Is there a software requirement for VAT submissions?

Relevance: 53%

-

What is input tax and output tax?

Relevance: 44%

-

How much does the Workplace Charging Scheme cover?

Relevance: 40%

-

Can businesses get grants for electric vehicles?

Relevance: 38%

-

What happens if my energy supplier charges above the price cap?

Relevance: 35%

-

Does the sugar tax apply to small businesses?

Relevance: 33%

-

Can businesses claim the EV grant?

Relevance: 32%

-

Is there any interest charged on a Time to Pay arrangement?

Relevance: 32%

-

NHS Dental Charges Explained

Relevance: 32%

-

What is the Workplace Charging Scheme?

Relevance: 32%

-

Why do energy companies charge different rates for their electricity?

Relevance: 32%

-

Can businesses be exempt from hosepipe bans?

Relevance: 31%

-

What is the Small Business Administration (SBA)?

Relevance: 31%

-

What is HMRC new penalty point system?

Relevance: 31%

-

Can I get tax benefits for my small business from the government?

Relevance: 31%

-

Is the HMRC Employer Bulletin relevant for small businesses?

Relevance: 31%

-

Are NHS dental charges different across the UK?

Relevance: 31%

-

Are there any extra charges for NHS dental treatments?

Relevance: 30%

-

Can minors be charged with drug offences?

Relevance: 30%

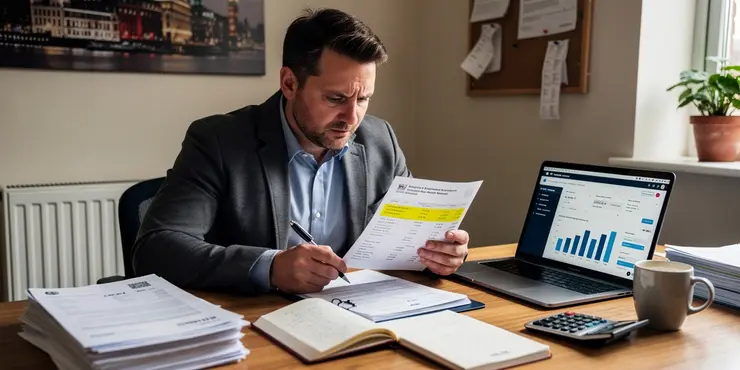

Understanding VAT in the UK

Value Added Tax (VAT) is a consumption tax levied on goods and services in the UK. It is applied at each stage of the production and distribution process. Businesses that are required to charge VAT act as tax collectors for the government.

VAT is important as it contributes significantly to the UK government’s revenue. However, not all businesses are required to register for or charge VAT. Certain criteria must be met before a business needs to consider VAT registration.

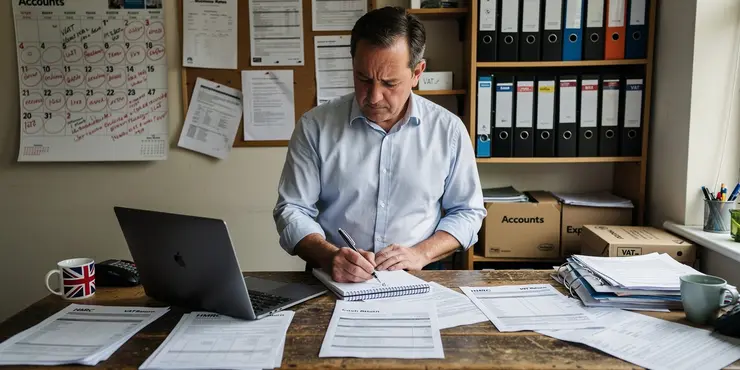

When VAT Registration Is Mandatory

A business must register for VAT if its taxable turnover exceeds the current threshold. As of 2023, the VAT threshold is set at £85,000. This is calculated based on the total value of VAT taxable goods and services sold over a 12-month period.

Even if a business does not exceed the threshold, voluntary registration could be beneficial. This may be the case for businesses anticipating future growth or those wishing to reclaim VAT on business expenses.

Exemptions from VAT

Certain goods and services are exempt from VAT. These include items like insurance, education, and certain healthcare services. Businesses dealing exclusively in these exempt services might not need to register for VAT.

It’s crucial to recognize the distinction between zero-rated and exempt goods. Zero-rated goods are taxable but at 0%, allowing businesses to reclaim VAT on expenses, unlike exempt goods.

Considerations for Small Businesses

Small businesses that do not exceed the VAT threshold might consider opting out of registration. This decision can simplify administrative tasks and avoid the complexities associated with VAT filing.

However, being VAT registered may enhance a small business’s credibility. Customers and clients might perceive the business as being more established and professional.

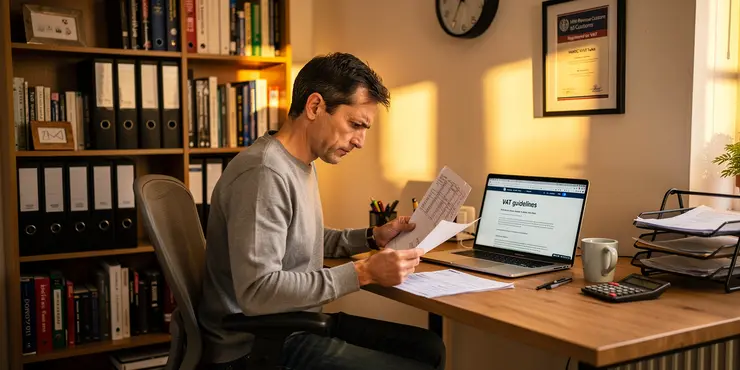

Voluntary VAT Registration

Some businesses choose to register for VAT voluntarily. This allows them to reclaim VAT on supplies and expenses, potentially reducing the net cost of doing business.

While voluntary registration can offer financial benefits, it also brings more administrative responsibilities. Businesses must weigh these aspects when deciding to register voluntarily.

Conclusion

Not all businesses in the UK are required to charge VAT. Small businesses should assess their taxable turnover and the nature of their goods and services to determine the necessity to register.

While mandatory for some, others may find strategic advantages in voluntary registration. It’s advisable for business owners to consult with tax professionals to make informed VAT-related decisions.

Frequently Asked Questions

What is VAT?

VAT, or Value Added Tax, is a type of indirect tax that is levied on the sale of goods and services at each stage of production or distribution.

Do all businesses need to charge VAT?

Not all businesses need to charge VAT. It depends on the country's regulations and the business's revenue surpassing a certain threshold.

What determines if a business should charge VAT?

In many regions, businesses must register for VAT if their annual taxable turnover exceeds a certain threshold set by the government.

Are small businesses exempt from charging VAT?

Yes, small businesses may be exempt from charging VAT if their taxable supplies are below the national VAT threshold.

Can businesses register for VAT voluntarily?

Yes, businesses can choose to register for VAT voluntarily even if their turnover is below the threshold. This can allow them to reclaim VAT on purchases.

What is the VAT threshold?

The VAT threshold is the amount of income a business can earn before it is required to register for VAT. This varies by country.

What happens if a business exceeds the VAT threshold?

If a business's taxable turnover exceeds the threshold, it's mandatory for them to register for VAT within a certain period to avoid penalties.

Can non-profit organizations be required to charge VAT?

Non-profit organizations may be required to charge VAT if they engage in taxable activities that exceed the VAT threshold.

Do businesses selling only VAT-exempt products need to register for VAT?

Businesses that sell only VAT-exempt goods and services typically do not need to register for VAT.

What are VAT-exempt goods and services?

VAT-exempt goods and services are those that are not subject to VAT, according to local tax laws. Examples may include financial services and education.

What is the difference between VAT-exempt and zero-rated supplies?

VAT-exempt supplies do not include VAT on sales and cannot reclaim input VAT, whereas zero-rated supplies do not include VAT on sales but can reclaim input VAT.

How do businesses register for VAT?

Businesses can typically register for VAT online or through the respective governmental tax authority in their country.

What are the consequences of not registering for VAT when required?

Failing to register for VAT when required can lead to penalties, fines, and a requirement to pay backdated VAT.

Are there different rates of VAT?

Yes, there can be different rates of VAT, such as standard rates, reduced rates, and zero rates, depending on the type of goods or services.

Can a business charge VAT before they have registered for it?

No, a business cannot legally charge VAT until they have registered and been issued a VAT number.

Can customer businesses reclaim VAT charged to them?

Yes, businesses that are registered for VAT can reclaim VAT on purchases as input tax, provided the expenses relate to taxable supplies.

How does VAT impact international trade for businesses?

VAT regulations for international trade can differ, with exports often zero-rated and imports subject to VAT, depending on local laws.

Do online businesses need to charge VAT?

Yes, online businesses may need to charge VAT if their sales meet certain criteria, especially with cross-border transactions within regions like the EU.

How frequently must VAT returns be filed?

The frequency of VAT return filing, which can be monthly, quarterly, or annually, varies by jurisdiction and depends on the turnover.

Can VAT regulations change, affecting existing businesses?

Yes, VAT regulations can change due to policy adjustments, requiring businesses to stay informed and comply with new laws.

Useful Links

This website offers general information and is not a substitute for professional advice.

Always seek guidance from qualified professionals.

If you have any medical concerns or need urgent help, contact a healthcare professional or emergency services immediately.

Some of this content was generated with AI assistance. We’ve done our best to keep it accurate, helpful, and human-friendly.

- Ergsy carfully checks the information in the videos we provide here.

- Videos shown by Youtube after a video has completed, have NOT been reviewed by ERGSY.

- To view, click the arrow in centre of video.

- Most of the videos you find here will have subtitles and/or closed captions available.

- You may need to turn these on, and choose your preferred language.

- Go to the video you'd like to watch.

- If closed captions (CC) are available, settings will be visible on the bottom right of the video player.

- To turn on Captions, click settings .

- To turn off Captions, click settings again.

More Items From Ergsy search

-

Do all businesses need to charge VAT?

Relevance: 100%

-

What is reverse charge VAT?

Relevance: 86%

-

What is the VAT rate that I need to charge?

Relevance: 83%

-

Do I need to register my business for VAT?

Relevance: 81%

-

When should a business register for VAT?

Relevance: 80%

-

What is VAT?

Relevance: 65%

-

Who needs to register for VAT?

Relevance: 62%

-

Are there exemptions from registering for VAT?

Relevance: 62%

-

What is a VAT number?

Relevance: 62%

-

Are there grants for businesses to install charging points?

Relevance: 62%

-

What is the threshold for mandatory VAT registration?

Relevance: 62%

-

Can I register for VAT voluntarily?

Relevance: 61%

-

Can I reclaim VAT on purchases?

Relevance: 61%

-

How do I deregister for VAT?

Relevance: 60%

-

Do VAT rules apply to online sales?

Relevance: 59%

-

How long does it take to register for VAT?

Relevance: 59%

-

Can businesses be charged Stamp Duty?

Relevance: 58%

-

How do I file VAT returns?

Relevance: 57%

-

What documents are needed for VAT registration?

Relevance: 53%

-

What happens if I don't register for VAT when required?

Relevance: 53%

-

What records do I need to keep for VAT?

Relevance: 53%

-

Is there a software requirement for VAT submissions?

Relevance: 53%

-

What is input tax and output tax?

Relevance: 44%

-

How much does the Workplace Charging Scheme cover?

Relevance: 40%

-

Can businesses get grants for electric vehicles?

Relevance: 38%

-

What happens if my energy supplier charges above the price cap?

Relevance: 35%

-

Does the sugar tax apply to small businesses?

Relevance: 33%

-

Can businesses claim the EV grant?

Relevance: 32%

-

Is there any interest charged on a Time to Pay arrangement?

Relevance: 32%

-

NHS Dental Charges Explained

Relevance: 32%

-

What is the Workplace Charging Scheme?

Relevance: 32%

-

Why do energy companies charge different rates for their electricity?

Relevance: 32%

-

Can businesses be exempt from hosepipe bans?

Relevance: 31%

-

What is the Small Business Administration (SBA)?

Relevance: 31%

-

What is HMRC new penalty point system?

Relevance: 31%

-

Can I get tax benefits for my small business from the government?

Relevance: 31%

-

Is the HMRC Employer Bulletin relevant for small businesses?

Relevance: 31%

-

Are NHS dental charges different across the UK?

Relevance: 31%

-

Are there any extra charges for NHS dental treatments?

Relevance: 30%

-

Can minors be charged with drug offences?

Relevance: 30%