Find Help

More Items From Ergsy search

-

Can the executor use the deceased's assets to pay tax debts?

Relevance: 100%

-

Who is responsible for paying the deceased’s tax debts?

Relevance: 79%

-

What is the role of an executor in handling tax debts?

Relevance: 78%

-

What Happens to Tax Debt After Death? (UK Laws)

Relevance: 63%

-

What if the estate does not have enough assets to pay all tax debts?

Relevance: 60%

-

What is the role of an executor?

Relevance: 59%

-

Are beneficiaries responsible for the deceased's tax debts?

Relevance: 56%

-

Do unpaid tax debts affect Inheritance Tax calculations?

Relevance: 53%

-

What happens to a deceased’s Income Tax if they were employed?

Relevance: 47%

-

Is it necessary to complete a final tax return for the deceased?

Relevance: 47%

-

What should I do if I need help managing the tax affairs of the deceased?

Relevance: 46%

-

What assets are subject to inheritance tax?

Relevance: 45%

-

What taxes need to be paid from the deceased’s estate?

Relevance: 45%

-

Who is responsible for paying Inheritance Tax?

Relevance: 40%

-

Is there any relief for business assets in Inheritance Tax?

Relevance: 39%

-

What is the process for paying inheritance tax?

Relevance: 38%

-

What is probate?

Relevance: 38%

-

Would a wealth tax apply to foreign assets?

Relevance: 37%

-

How is inheritance tax calculated?

Relevance: 36%

-

What is Inheritance Tax?

Relevance: 36%

-

Wills, Probate and Tax Planning in the UK

Relevance: 36%

-

Who pays the inheritance tax?

Relevance: 36%

-

How is the Inheritance Tax bill calculated?

Relevance: 34%

-

How do I value the estate for Inheritance Tax purposes?

Relevance: 34%

-

How is Inheritance Tax (IHT) dealt with after death?

Relevance: 34%

-

Can I include previous year's tax debt in a new Time to Pay arrangement?

Relevance: 33%

-

How and when do I pay Inheritance Tax when someone has died?

Relevance: 33%

-

What is Inheritance Tax?

Relevance: 32%

-

When is inheritance tax due to be paid?

Relevance: 32%

-

What happens if inheritance tax is not paid?

Relevance: 31%

-

When is inheritance tax due?

Relevance: 31%

-

What is inheritance tax in the UK?

Relevance: 30%

-

What to do when someone dies

Relevance: 29%

-

What is inheritance tax?

Relevance: 29%

-

Will and Probate Solicitor Bath

Relevance: 29%

-

Is there a difference between inheritance tax and estate tax?

Relevance: 29%

-

What forms do I need to complete for Inheritance Tax?

Relevance: 28%

-

Do I need a solicitor to apply for probate?

Relevance: 28%

-

How do I notify HMRC of someone’s death?

Relevance: 28%

-

How is a wealth tax typically calculated?

Relevance: 28%

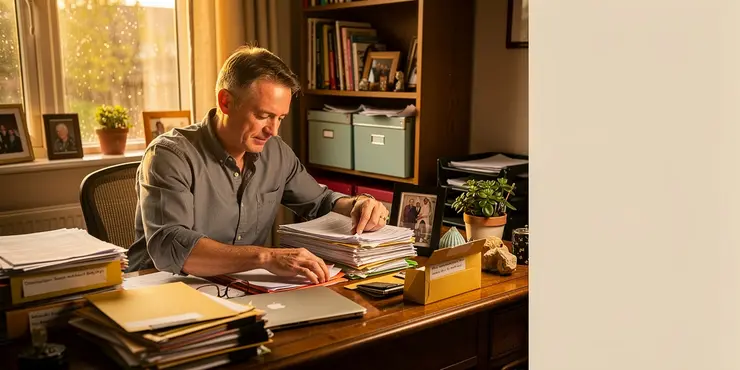

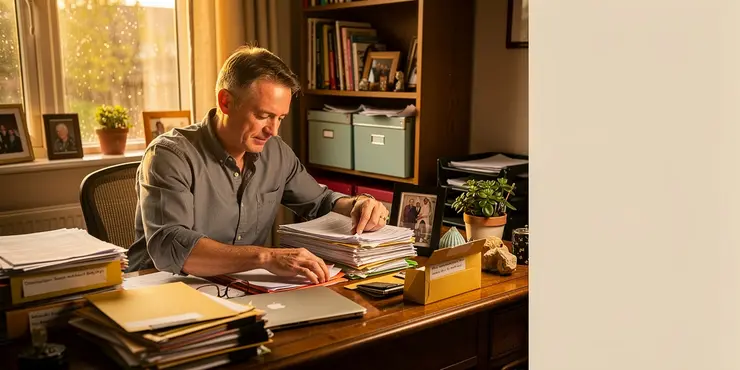

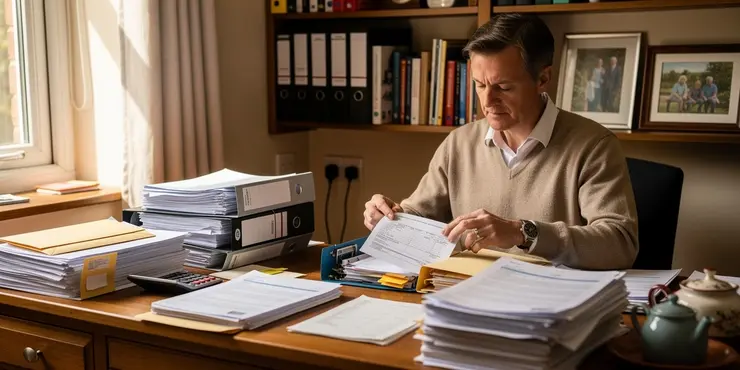

Understanding the Executor's Role in Paying Tax Debts

In the United Kingdom, when a person passes away, their estate, which includes all their assets, must be used to settle any outstanding debts, including tax liabilities. The person responsible for managing this process is known as the executor, if there is a will, or an administrator if there isn't one. One of the executor's primary responsibilities is to ensure that the deceased's taxes are paid before any distribution to the beneficiaries.

Assets of the Deceased Estate

The assets of the deceased include money in bank accounts, property, stocks, personal belongings, and any other items of value. These assets collectively form the estate. The executor must first take stock of all these assets and assess their value. This assessment is crucial because it determines how debts, including tax debts, will be paid.

Paying Outstanding Tax Debts

It is the executor's duty to use the estate's assets to pay any outstanding tax debts of the deceased. This includes income tax, capital gains tax, inheritance tax, or any other tax obligations that the deceased may have had at the time of death. The executor must submit tax returns on behalf of the deceased, ensuring that any unpaid taxes are accurately calculated.

Priority of Debt Payments

Tax debts typically take high priority over payments to beneficiaries. This means that before distributing the estate to family or other heirs, the executor must ensure that all tax and other liabilities are settled. This could involve liquidating certain assets to raise the necessary funds to pay off the debts. Executors are advised to be thorough in this process to avoid personal liability for unpaid taxes.

Executor's Liability

If the executor fails to pay the deceased's taxes before distributing the assets, they could be held personally liable for the unpaid debts. This is why it is crucial for the executor to understand the full extent of the deceased's tax obligations and settle them promptly using the estate's resources. Executors should keep detailed records of all financial transactions to provide transparency and accountability.

Seeking Professional Help

Given the complexity involved in settling a deceased person's tax debts, executors often seek professional advice from accountants or solicitors familiar with estate law. Professional advisors can provide valuable guidance and ensure compliance with all legal requirements, helping executors to navigate the process smoothly and avoid potential pitfalls.

Conclusion

In summary, the executor can and must use the deceased's assets to pay any tax debts. This process is an integral part of estate administration in the UK. Executors should approach this task with diligence, ensuring that all tax liabilities are addressed to prevent future complications and preserve the integrity of the estate administration process.

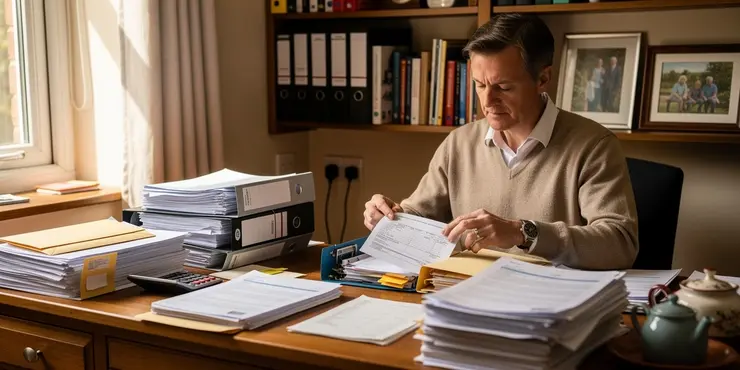

Understanding the Executor's Job in Paying Tax Debts

In the UK, when someone dies, all the things they own are called their "estate." This estate must be used to pay off any money they owe, like taxes. The person who handles this is called the executor if there is a will, or an administrator if there isn't. An important job for the executor is to make sure the dead person's taxes are paid before giving out anything to family or friends.

What is in the Estate?

The estate includes things like money in the bank, houses, stocks, personal items, and anything else that is valuable. The executor has to make a list of all these things and find out how much they are worth. This is important to know how much money is needed to pay debts like taxes.

Paying Tax Debts

The executor must use the estate to pay any taxes that the person who died owed. This could be income tax, capital gains tax, inheritance tax, or other taxes they owed when they died. The executor files the tax return for the person, making sure all taxes are paid correctly.

Which Debts to Pay First?

Tax debts usually have to be paid before giving out the estate to family or others. The executor must make sure taxes and other debts are paid first. Sometimes, they may need to sell things from the estate to get money to pay these debts. Executors must be careful to avoid being personally responsible for unpaid taxes.

Executor's Responsibility

If the executor doesn’t pay the taxes first before sharing the estate, they might have to pay these debts themselves. That makes it important to know and pay all the taxes the person owed. Executors should keep good records of all money transactions to show what they did.

Getting Help from Professionals

Because dealing with taxes can be tricky, executors often ask accountants or lawyers for help. These professionals know estate rules and can guide executors, helping them meet all the legal rules and avoid problems.

Conclusion

In short, the executor must use what the dead person owned to pay any tax debts. This is a key part of handling an estate in the UK. Executors need to be careful and make sure all taxes are dealt with to avoid issues later and keep the estate process fair and clear.

Frequently Asked Questions

Can the executor use the deceased's assets to pay tax debts?

Yes, the executor can use the deceased's assets to pay any tax debts as part of settling the estate.

What types of tax debts must an executor pay from the deceased's assets?

The executor must pay any outstanding income taxes, estate taxes, and other taxes owed by the deceased using the estate's assets.

Is the executor personally liable for the deceased's tax debts?

No, the executor is not personally liable for the deceased's tax debts, but they must use the estate's assets to pay these debts.

Are there any priority rules for paying debts from the deceased's estate?

Yes, tax debts generally have a high priority, so they should be paid before distributing any assets to beneficiaries.

What happens if the estate does not have enough assets to pay tax debts?

If the estate does not have enough assets, the tax debts will go unpaid, but the executor must show that estate assets were insufficient.

Can the executor sell estate assets to pay tax debts?

Yes, the executor can sell estate assets to generate funds to pay any outstanding tax debts.

What should the executor do if they find unfiled tax returns from the deceased?

The executor should file any unfiled tax returns on behalf of the deceased and pay any taxes due using the estate's assets.

Are tax debts of a deceased individual discharged after their death?

No, tax debts are not discharged upon death and must be settled by the estate.

Who is responsible for filing the deceased's final tax return?

The executor is responsible for filing the deceased's final tax return and any necessary estate tax returns.

What is the executor's role in handling the deceased's unpaid taxes?

The executor must identify, file, and pay any unpaid taxes using the estate's assets.

Can beneficiaries receive assets if the estate has outstanding tax debts?

Beneficiaries typically cannot receive their share of assets until all tax debts and other obligations of the estate are paid.

How does the executor determine what tax debts are owed?

The executor should review the deceased's financial records and consult with tax professionals to determine any owed tax debts.

Can the executor be held accountable for not paying tax debts?

An executor who fails to pay tax debts may be held accountable for mismanaging the estate.

What happens if the executor overpays a tax debt from the estate?

If the executor overpays a tax debt, they can request a refund from the taxing authority, which will be added back to the estate.

Can the IRS claim assets from the deceased's estate for unpaid taxes?

Yes, the IRS can place a claim against the estate to recover unpaid taxes.

What is an estate tax return and why might it be necessary?

An estate tax return reports the estate's value; it's necessary if the estate exceeds certain thresholds or has significant tax obligations.

Are all debts, including taxes, considered before distribution of assets?

Yes, all debts including taxes must be settled before any distribution to beneficiaries occurs.

How does an executor access the deceased's financial records for tax purposes?

The executor can access the deceased's financial records through bank statements, investment reports, and tax documents found among their personal files.

Can the executor hire professionals to help with the estate's tax issues?

Yes, the executor can hire accountants, tax advisors, or attorneys to assist with managing and resolving tax issues related to the estate.

What documentation is necessary for paying tax debts from the estate?

Documentation such as death certificates, estate tax ID numbers, and tax return filings would be needed to manage and pay tax debts from the estate.

Can the person in charge use the dead person's money to pay tax money owed?

Yes, the person in charge of the will can use the person's money or things to pay any taxes they owe when sorting out what happens to their stuff after they have died.

What tax bills does an executor need to pay with the money and things from someone who has died?

The person in charge has to pay any money owed to the government by the person who died. This includes taxes on money they earned and on their property. They use the money and things left behind by the person who died to do this.

Does the person managing the will have to pay taxes owed by someone who died?

No, the person in charge (executor) does not have to pay the dead person's tax money from their own pocket. But they must use the dead person's money and things (estate assets) to pay what is owed.

If you need help understanding this, you can ask someone you trust to explain it to you. You can also use websites with easy words, like a dictionary for kids, to help you learn.

What are the important rules for paying money owed by someone who has died?

Yes, you must pay tax debts first because they are very important. Do this before giving anything to family or friends.

What if there is not enough money or things to pay tax debts?

If there isn't enough money or things of value in the estate, the tax bills won't be paid. The person in charge, called the executor, has to prove that there wasn't enough stuff to pay the taxes.

Can the person in charge sell things to pay taxes?

Yes, the person in charge of the will can sell things from the estate to get money to pay any taxes owed.

What to do if you find unpaid taxes for someone who has died?

If you find out that someone who passed away did not pay their taxes, here's what you can do:

1. **Ask for Help:** Talk to a tax expert or someone who knows about taxes.

2. **Get Tax Papers:** Find all the papers you need to pay the unpaid taxes.

3. **Send the Papers:** Once the papers are ready, send them to the tax office.

4. **Pay the Taxes:** Make sure the taxes get paid. You can use money from the person's estate (the things they owned).

Remember, asking for help is okay! You can use tools like calculators or guides to make things easier.

The person who looks after the will should fill out any tax forms that the person who died still needs to do. They should use the money from the person's things (the estate) to pay any taxes owed.

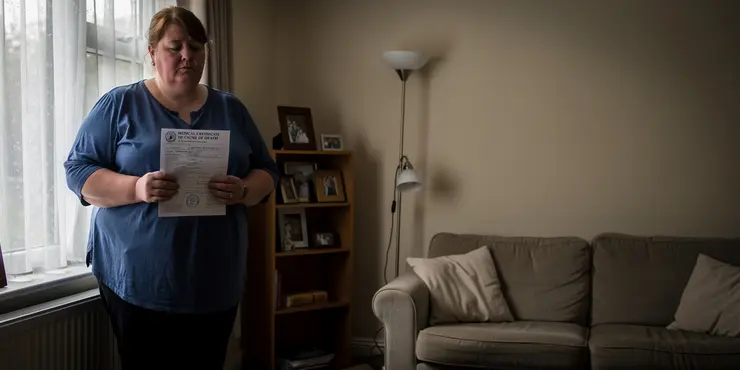

Do tax debts go away after a person dies?

When a person dies, they might still owe tax money. This money does not just go away. It is like a bill that still needs to be paid.

Here is a simple way to think about it:

- If the person who died left money or things, that money might be used to pay the tax debt.

- Sometimes, the family has to help sort out these debts.

- It is a good idea to ask someone who knows about money and taxes for help.

Tools to help you:

- Ask an adult for help to understand more.

- Talk to a money expert called an accountant.

No, tax debts do not go away when someone dies. They must be paid from the person's money and property after they pass away.

Who must do the last tax form for someone who has died?

The executor is the person who helps when someone dies. They must do the taxes for the person who died. They also need to do taxes for the things the person owned.

What does an executor do about the taxes of someone who has died?

An executor is a person who helps after someone has died. They have to look after the person's things and money. One big job is to sort out any taxes the person still owes.

Here is what an executor does for taxes:

- They see if the person owed any taxes when they died.

- They might need to fill out forms and send them to the tax office.

- They help pay any taxes that are still due using the person's money.

If you are an executor, it can be helpful to get help from a trusted adult or a tax expert. They can help you understand what to do.

The person in charge must find out about any taxes that still need to be paid. They have to use the money and things from the estate to pay these taxes.

Can people get money or things from someone who passed away if there are unpaid taxes?

Family or friends who are getting money or things from someone who passed away must wait. They have to wait until all taxes and bills are paid from the person's money and things.

How does the person in charge know what taxes need to be paid?

The person who handles money and bills when someone dies is called an "executor." They need to find out what taxes the person who died still has to pay.

Here are some steps they can use to help:

- Look at old tax papers and bills to see what was paid before.

- Talk to a tax expert or go to a tax office for help.

- Use special software that helps add up money and taxes.

These steps can help the person in charge know what taxes need paying.

The person in charge should look at the money papers of the person who died. They should also talk to tax experts to find out if there are any taxes that still need to be paid.

Can the person in charge be in trouble for not paying taxes owed?

If the person in charge of a will does not pay the taxes, they can get in trouble for not doing their job properly.

What if the person in charge pays too much tax from an estate?

When someone passes away, a special person called an "executor" takes care of their money and belongings. Sometimes, they might pay too much tax. If this happens, don't worry.

The executor can ask for the extra money back. This is called a "refund." They should keep all the receipts and papers to show how much they paid.

If you need help, you can use a calculator or ask a friend. There are people who know a lot about taxes who can also help.

If the person who manages the money pays too much tax, they can ask for the extra money back. This money will go back to the person's things.

Can the IRS take things from someone who has died to pay for taxes they owe?

Yes, the IRS can ask for money from the estate if there are taxes owed.

What is an estate tax return and why might it be needed?

An estate tax return is a form that tells the government how much a person owned when they died. This might be things like money, houses, or cars.

The law sometimes asks for this form so the government can see if there's any tax to pay.

Helpful tools: You might try asking a family member or friend for help. You can also use a calculator to add things up.

An estate tax return is a report that tells how much an estate is worth. You need to do this if the estate is very big or owes a lot of taxes.

Do we check all bills, like taxes, before sharing out the money and things?

When someone passes away, we need to check all the bills they owed, like taxes and other debts. This is important before we can give out their money and things to others. People can use tools like calculators or get help from a trusted friend or adult to make sure they understand and do this correctly.

Yes, all money owed, like taxes, must be paid before anything is given to those who inherit it.

How can an executor get the money records of someone who has died for taxes?

The person who takes care of someone's things after they pass away is called the executor. This person can look at the person's money papers. These papers can be things like bank records, reports on investments, and tax papers. They usually find these papers in the person's things.

Can the helper get experts to help with money and tax problems?

Yes, the person in charge can get help from accountants, tax experts, or lawyers to fix any tax problems with the estate.

What papers do you need to pay tax debts from someone’s estate?

To help someone understand this question better, you could try these tips: - Break the sentence into smaller parts. - Use pictures or diagrams to explain what an "estate" is. - Use simple words like "money owed" instead of "debts." - Show examples of the papers needed, like tax forms or bills. - Encourage using a dictionary for difficult words.When someone passes away, there are a few important papers that help take care of their things:

- A death certificate is needed. It says the person has died.

- There is something called an estate tax ID number. It's like a special number for the person's things after they pass away.

- Tax return papers also need to be filled out. These papers show how much tax needs to be paid.

These papers help make sure all taxes and debts are paid properly.

Using tools like picture guides or apps that read text out loud can be very helpful.

Useful Links

This website offers general information and is not a substitute for professional advice.

Always seek guidance from qualified professionals.

If you have any medical concerns or need urgent help, contact a healthcare professional or emergency services immediately.

Some of this content was generated with AI assistance. We’ve done our best to keep it accurate, helpful, and human-friendly.

- Ergsy carfully checks the information in the videos we provide here.

- Videos shown by Youtube after a video has completed, have NOT been reviewed by ERGSY.

- To view, click the arrow in centre of video.

- Most of the videos you find here will have subtitles and/or closed captions available.

- You may need to turn these on, and choose your preferred language.

- Go to the video you'd like to watch.

- If closed captions (CC) are available, settings will be visible on the bottom right of the video player.

- To turn on Captions, click settings .

- To turn off Captions, click settings again.

More Items From Ergsy search

-

Can the executor use the deceased's assets to pay tax debts?

Relevance: 100%

-

Who is responsible for paying the deceased’s tax debts?

Relevance: 79%

-

What is the role of an executor in handling tax debts?

Relevance: 78%

-

What Happens to Tax Debt After Death? (UK Laws)

Relevance: 63%

-

What if the estate does not have enough assets to pay all tax debts?

Relevance: 60%

-

What is the role of an executor?

Relevance: 59%

-

Are beneficiaries responsible for the deceased's tax debts?

Relevance: 56%

-

Do unpaid tax debts affect Inheritance Tax calculations?

Relevance: 53%

-

What happens to a deceased’s Income Tax if they were employed?

Relevance: 47%

-

Is it necessary to complete a final tax return for the deceased?

Relevance: 47%

-

What should I do if I need help managing the tax affairs of the deceased?

Relevance: 46%

-

What assets are subject to inheritance tax?

Relevance: 45%

-

What taxes need to be paid from the deceased’s estate?

Relevance: 45%

-

Who is responsible for paying Inheritance Tax?

Relevance: 40%

-

Is there any relief for business assets in Inheritance Tax?

Relevance: 39%

-

What is the process for paying inheritance tax?

Relevance: 38%

-

What is probate?

Relevance: 38%

-

Would a wealth tax apply to foreign assets?

Relevance: 37%

-

How is inheritance tax calculated?

Relevance: 36%

-

What is Inheritance Tax?

Relevance: 36%

-

Wills, Probate and Tax Planning in the UK

Relevance: 36%

-

Who pays the inheritance tax?

Relevance: 36%

-

How is the Inheritance Tax bill calculated?

Relevance: 34%

-

How do I value the estate for Inheritance Tax purposes?

Relevance: 34%

-

How is Inheritance Tax (IHT) dealt with after death?

Relevance: 34%

-

Can I include previous year's tax debt in a new Time to Pay arrangement?

Relevance: 33%

-

How and when do I pay Inheritance Tax when someone has died?

Relevance: 33%

-

What is Inheritance Tax?

Relevance: 32%

-

When is inheritance tax due to be paid?

Relevance: 32%

-

What happens if inheritance tax is not paid?

Relevance: 31%

-

When is inheritance tax due?

Relevance: 31%

-

What is inheritance tax in the UK?

Relevance: 30%

-

What to do when someone dies

Relevance: 29%

-

What is inheritance tax?

Relevance: 29%

-

Will and Probate Solicitor Bath

Relevance: 29%

-

Is there a difference between inheritance tax and estate tax?

Relevance: 29%

-

What forms do I need to complete for Inheritance Tax?

Relevance: 28%

-

Do I need a solicitor to apply for probate?

Relevance: 28%

-

How do I notify HMRC of someone’s death?

Relevance: 28%

-

How is a wealth tax typically calculated?

Relevance: 28%